Information Every Business Needs to Know HR & Benefits Advisor

advertisement

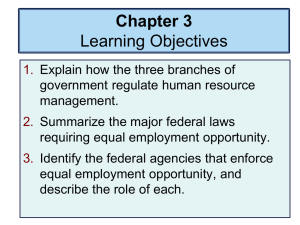

Information Every Business Needs to Know HR & Benefits Advisor December 2010 Brought to you by: Fiduciary Intermediary LTD In this Issue Change Health Insurance Issuers without Losing Grandfather Status Online Poster Advisor Independent Contractors versus Employees Employee Safety and Your Company Medical Loss Ratio Requirements Clarification of GINA Title II Provisions Updated Model CHIP Notice Group Health Plans May Change Health Insurance Issuers without Losing Grandfather Status Employers can offer the same level of coverage through a new issuer and remain grandfathered but be sure to adhere to the other grandfather rules. The Departments of Health and Human Services (HHS), Labor, and the Treasury have issued an amendment to the interim final regulations on grandfathered plans (health coverage in place on March 23, 2010), which include rules for determining when changes to a health plan cause the plan to lose its grandfathered status. Medical Loss Ratio The amendment permits a group health plan to change health insurance Requirements under the coverage (that is, to enter into a new policy, certificate, or contract of insurance) without losing the grandfathered status of the health plan, so Affordable Care Act long as it has not made any other changes that would revoke its status under paragraph (g)(1) of the interim final regulations. What does the amendment change? Previously, one of the ways a group health plan could lose its grandfather status was if the employer changed issuers – switching from one insurance company to another. The original interim final regulations only allowed selffunded plans to change third-party administrators without necessarily losing their grandfathered plan status. The amendment allows employers to offer the same level of coverage through a new issuer and remain grandfathered, as long as the change in issuer does not result in: Significant cost increases, A reduction in benefits, or Other changes described in the original grandfather rule. New regulations issued by the U.S. Department of Health and Human Services (HHS) require What types of plans does this affect? health insurers to spend 80 to 85 percent of consumers’ The amendment affects insured group health plans. premiums (depending on the A change of issuers in the individual market would still result in the size of the insurance market) loss of grandfathered status. on direct care for patients and efforts to improve care quality. This regulation, known as the "medical loss ratio" provision of the Affordable Care Act, will make the insurance marketplace more transparent and make it easier for consumers to purchase plans that provide better value for their money, according to HHS. - Beginning in 2011, the law requires that insurance companies publicly report how they spend premium dollars, providing meaningful information to consumers. - Also beginning in 2011, insurers are required to spend at least 80 percent (generally, 85 percent in the large group market and 80 percent in the small group or individual market) of the premium dollars they collect on medical care and quality improvement activities, rather than on administrative costs. What documentation does the amendment require for a change in coverage? To maintain status as a grandfathered health plan, a group health plan that enters into a new policy, certificate, or contract of insurance must provide to the new health insurance issuer (and the new health insurance issuer must require) documentation of plan terms (including benefits, cost sharing, employer contributions, and annual limits) under the prior health coverage sufficient to determine whether any change described in paragraph (g)(1) of the original interim final rules is being made. This documentation may include a copy of the policy or summary plan description. What is the effective date of the amendment? The amendment to the interim final regulations is effective on November 15, 2010. Does the amendment apply retroactively? The amendment applies to such changes to group health insurance coverage that are effective on or after November 15, 2010; the amendment does not apply retroactively to such changes to group health insurance coverage that were effective before this date. For this purpose, the date the new coverage becomes effective is the operative date, not the date a contract for a new policy, certificate or contract of insurance is entered into. For example, if a plan enters into an agreement with an issuer on September 28, 2010 for a new policy to be effective on January 1, 2011, then January 1, 2011 is the date the new policy is effective and, therefore, the relevant date for purposes of determining the application of the amendment to the interim final regulations. If, however, the plan entered into an agreement with an issuer on July 1, 2010 for a new policy to be effective on September 1, 2010, then the amendment would not apply and the plan would cease to be a grandfathered health plan. - Insurance companies that are not meeting the medical loss ratio standard will be required to provide rebates to their Why did HHS, Labor and Treasury make this change? consumers. The Departments adopted this amendment in response to comments received concerning the section of the interim final rules that provides that a - Insurers will be required to group health plan will relinquish grandfather status if it changes issuers or make the first round of rebates policies. Those concerns included the following: to consumers in 2012. The medical loss ratio regulation outlines: - disclosure and reporting requirements, - how insurance companies will calculate their medical loss ratio and provide rebates, and - how adjustments could be There are circumstances where a group health plan may need to make administrative changes that don’t affect the benefits or costs of a plan. For example, an insurer may stop offering coverage in a market. Or a company may change hands. In those cases, the employer can maintain grandfathered status for their employee’s plan under this amendment. Comments expressed concern that the original provision could have the inadvertent effect of interfering with health care cost containment. If an employer has to stay with the same insurance company to keep the benefits of having a grandfathered plan, the insurance company has undue and unfair leverage in negotiating the price of coverage renewals. Allowing employers to shop around can help keep costs down while ensuring individuals can keep the made to the medical loss ratio standard to guard against market destabilization. The interim final regulation is effective January 1, 2011. For more information regarding the medical loss ratio, please click here. To view the interim final regulations, please click here. You may also read the press release by clicking here. coverage they have. Some employers buy coverage from insurance companies; others “self-insure,” meaning that they pay claims themselves but usually hire a third-party administrator (TPA) to handle the paperwork. Usually only large companies can self-insure. Before this amendment, self-insured plans could change the company hired to handle the paperwork without losing grandfathered status as long as the benefits and costs of the plan stayed the same, while an employer that just changed insurance companies while maintaining the same benefits under their plan could not do so. Under this amendment, all employers have the flexibility to keep their grandfathered plan but change insurance company or third-party administrator. Where can I find more information on this amendment? Final Regulations Provide Clarification of GINA Title II Provisions For more information on the amendment, please see this Fact Sheet. To read the amendment in its entirety, please click here. Poster Advisor Helps Employers Comply with DOL Poster Requirements Whether your company is small or large, the U.S. Department of Labor (DOL) requires that you display a number of different posters at your workplace. The DOL administers a number of different laws, which require employers to display official DOL posters where employees can easily observe them. The Equal Employment Opportunity Commission (EEOC) has issued a final rule to implement Title II of the Genetic Information Nondiscrimination Act of 2008 (GINA). Title II of GINA, which took effect on November 21, 2009, prohibits the use of genetic information in the employment context, restricts employers and other entities covered by Title II from requesting, requiring, or purchasing genetic information, and strictly limits such entities from disclosing genetic information. According Online Poster Advisor Will Guide You The DOL provides an online, interactive tool called Poster Advisor to help you though the process of identifying the required posters for your business. The Poster Advisor provides short descriptions of DOL poster requirements, as well as links to printable posters, at no cost to employers. The Poster Advisor only provides information relating to federal DOL poster requirements. Employers are encouraged to contact their State Department of Labor to identify other applicable state law requirements. For downloadable state posters, please go to the HR & Benefits Essentials State Employment Laws section, select your state and click on “Posters” in the left-hand navigation. To access the Poster Advisor, please click here. to the EEOC, the purpose of the final regulations is to implement the various provisions of Title II consistent with Congress's intent, to provide some additional clarification of those provisions, and to explain more fully those sections where Congress incorporated by reference provisions from other statutes. The final rule is effective January 10, 2011. To view the regulations, please click here. FAQs for small businesses related to Title II of GINA and the EEOC’s final rule can be found by clicking here. Additional information on GINA is available on the HR & Benefits Essentials website here. Tips for Classifying Independent Contractors versus Employees from the IRS As we are approaching a new year, it is a good time to review important tips for classifying employees. The IRS has provided some very useful guidelines for determining the difference between an independent contractor versus an employee. This will affect how much you pay in taxes, whether you need to withhold from your workers' paychecks and what tax documents you need to file. The IRS has provided information on seven key issues every business should know about concerning hiring people as independent contractors versus hiring them as employees. 1. The IRS uses three characteristics to determine the relationship Updated Model CHIP Notice Now Available 2. 3. 4. 5. 6. The U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) has posted on its website an updated version of the Model Employer Children’s Health 7. between businesses and workers: o Behavioral Control covers facts that show whether the business has a right to direct or control how the work is done through instructions, training or other means. o Financial Control covers facts that show whether the business has a right to direct or control the financial and business aspects of the worker's job. o Type of Relationship relates to how the workers and the business owner perceive their relationship. If you have the right to control or direct not only what is to be done, but also how it is to be done, then your workers are most likely employees. If you can direct or control only the result of the work done -- and not the means and methods of accomplishing the result -- then your workers are probably independent contractors. Employers who misclassify workers as independent contractors can end up with substantial tax bills. Additionally, they can face penalties for failing to pay employment taxes and for failing to file required tax forms. Workers can avoid higher tax bills and lost benefits if they know their proper status. Both employers and workers can ask the IRS to make a determination on whether a specific individual is an independent contractor or an employee by filing a Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, with the IRS. You can learn more about the critical determination of a worker’s status as an Independent Contractor or Employee at IRS.gov by selecting the Small Business link. Additional resources are listed Insurance Program (CHIP) Notice, which employers may use to inform employees of their potential eligibility for premium assistance under state Medicaid or a CHIP. The Children's Health Insurance Program Reauthorization Act of 2009 (CHIPRA) requires that an employer maintaining a group health plan in a state that provides premium assistance for the purchase of coverage under Medicaid or a state CHIP notify each employee of the opportunity for the assistance of employees and dependents. The Model Notice includes information on how employees can contact their state for additional information and how to apply for premium assistance. - To view the Model Notice in English, please click here. - To view the Spanish version of the Model Notice, please click here. To view the HR & Benefits Essentials CHIPRA page, please click here. below and are available on the IRS website or by calling the IRS at 800-829-3676 (800-TAX-FORM). For Additional Information: Publication 15-A, Employer's Supplemental Tax Guide Publication 1779, Independent Contractor or Employee Publication 1976, Do You Qualify for Relief under Section 530 Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding Employee Safety and Your Company With the Occupational Safety and Health Act of 1970, Congress created the Occupational Safety and Health Administration (OSHA) to ensure safe and healthful working conditions for working men and women by setting and enforcing standards and by providing training, outreach, education and assistance. Under OSHA, employers have the responsibility to provide a safe workplace. Employers must provide their employees with a workplace that does not have serious hazards and follow all OSHA safety and health standards. OSHA Coverage Most employees in the nation come under OSHA's jurisdiction. OSHA covers private sector employers and employees in all 50 states, the District of Columbia, and other U.S. jurisdictions either directly through Federal OSHA or through an OSHA-approved state program. State run health and safety programs must be at least as effective as the Federal OSHA program. To find the contact information for the OSHA Federal or State Program office nearest you, see the Regional and Area Offices map. OSHA Resources for Small Business OSHA’s On-site Consultation Program offers free and confidential advice to small and medium-sized businesses in all states across the country, with priority given to high-hazard worksites. On-site consultation services are separate from enforcement and do not result in penalties or citations. Consultants from state agencies or universities work with employers to identify workplace hazards, provide advice on compliance with OSHA standards, and assist in establishing safety and health management systems. Read more about OSHA’s free On-site Consultation Program. Compliance Assistance Specialists Each OSHA Area Office in states under federal jurisdiction has a Compliance Assistance Specialist. These staffers respond to requests for help from a variety of groups, including small businesses. Compliance Assistance Specialists put on seminars and workshops for small businesses and other groups. They promote OSHA’s cooperative programs, OSHA’s training resources, and the OSHA web site. To read more about Compliance Assistance Specialists and find a directory in your area, click here. OSHA Publications & Posters The following are a number of resources, posters and guides that will provide important OSHA-related requirements and programs. All About OSHA English Spanish This OSHA handbook provides an overview of the Agency, its regulatory responsibilities, policies, procedures and programs Employee Workplace Rights Employer Rights and Responsibilities Following an OSHA Inspection It's The Law - Job Safety and Health Poster English Spanish This poster informs employers and employees of their rights and responsibilities for a safe and healthful workplace. OSHA Small Business Handbook Newsletter provided by: HR and Benefits Essentials 400 Main Street, Suite 410, Stamford, CT 06901 (203) 977-8100 www.HRandBenefits.com