- Vermont Legislature

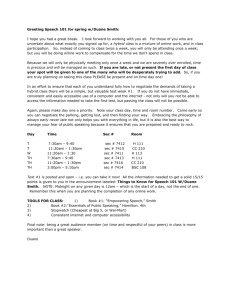

advertisement