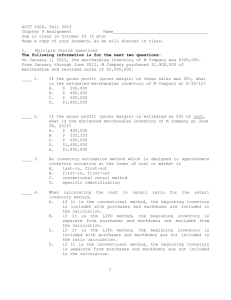

The following information is for the next two questions

ACCT 3304, Spring 2013

Chapter 9 Assignment (5 pts)

Due in class on April 5th

Name______________________________________

Section: 11am_____ Noon_____

Keep a copy of your answers, as we will discuss in class.

I. Multiple choice questions

The following information is for the next two questions:

On January 1, 2012, the merchandise inventory of M Company was $300,000.

From January through June 2012, M Company purchased $1,900,000 of merchandise and recorded sales of $2,000,000.

____ 1. If the gross profit (gross margin) on these sales was 20%, what is the estimated merchandise inventory of M Company at 6/30/12?

A. $ 200,000

B. $ 400,000

C. $ 600,000

D. $1,600,000

____ 2. If the gross profit (gross margin) is estimated as 20% of cost, what is the estimated merchandise inventory of M Company at June

30, 2012?

A. $ 400,000

B $ 533,333

C. $ 600,000

D. $1,600,000

E. $1,800,000

____ 3. An inventory estimation method which is designed to approximate inventory valuation at the lower of cost or market is

A. last-in, first-out

B. first-in, first-out

C. conventional retail method

D. specific identification

____ 4. When calculating the cost to retail ratio for the retail inventory method,

A. if it is the conventional method, the beginning inventory is included with purchases and markdowns are included in the calculation.

B. if it is the LIFO method, the beginning inventory is separate from purchases and markdowns are excluded from the calculation.

C. if it is the LIFO method, the beginning inventory is included with purchases and markdowns are not included in the ratio calculation.

D. if it is the conventional method, the beginning inventory is separate from purchases and markdowns are not included in the calculation.

E. None of the above is correct.

1

____ 5. The following relates to an inventory item held by the

Poore Sales Co. at the balance sheet date:

Cost

Estimated selling price

Estimated selling costs

Normal profit margin

Replacement cost

$64

72

2

12

55

The amount that should be reported for this inventory item according to the lower-of-cost-or-market rule is

A. $70.

B. $64.

C. $58.

D. $55.

E. none of the above, the answer is $_______________.

II. Retail estimating techniques

The following information was available from the records of

Johnson's Department Store for the year ended December 31, 2012.

At Cost

Merchandise Inventory, 1/1/12 $ 90,000

Purchases 330,000

Markups (net)

Markdowns (net)

Sales

At Retail

$130,000

460,000

10,000

40,000

380,000

Ending inventory at retail? $________

CARRY ALL RATIOS TO 4 DECIMAL PLACES. You do NOT have to reconstruct the full schedule as we did in class, but you should show the numerator and denominator calculation(s) of the cost-toretail ratio(s) for partial credit.

A. Estimate ending inventory using the average retail method: $_________________

B. Given the cost information in the top section of this page, and the calculated ending inventory from Part A, prepare the adjusting journal entry for the periodic method to recognize ending inventory and cost of goods sold:

2

C. Estimate ending inventory using the conventional retail method: $_________________

D. Estimate ending inventory using the LIFO retail method: $_________________

E. Estimate ending inventory using the dollar value LIFO retail method: $_________________

(assume the price index at 1/1/12 was 100 and at 12/31/12 it was 104)

3