Vendor Questionnaire - Chugach Alaska Corporation

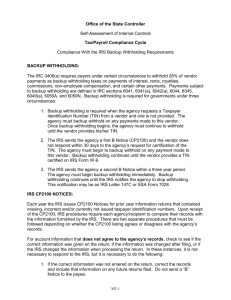

advertisement

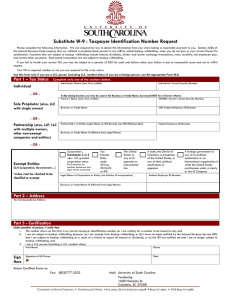

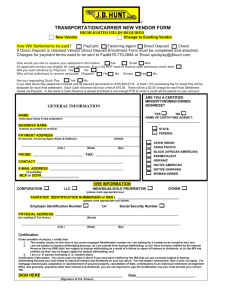

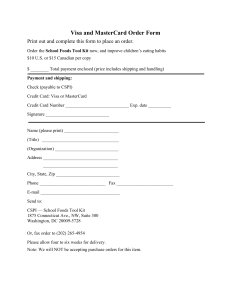

*Chugach Co. Name: *Location: *Phone: Are you a: Chugach Employee (only fill-in those areas with an asterisk ( * ). Vendor (fill-out all portions of the form) or a VENDOR'S QUESTIONNAIRE FORM *Company Name (as shown on your income tax return): *Doing Business As (name as shown on your invoice): Business name/disregarded entity name, if different from above Company Name *Remit Address: *City: Ordering Address: *State: City: *Telephone #: *Zip Code: State: Zip Code: Fax #: E-Mail Address: Contact Name: Payment Method & Terms: CHECK MASTERCARD/EPAYABLES * NET 30 2% NET 20 5% Net 15 Other NET 25 2% NET 20 5% Net 15 Other (see below) Our MasterCard/EPayable program provides expedited cash receipts for vendors. Vendors will receive a remittance advice via email with authorization to charge the MasterCard number provided. *If choosing MASTERCARD/EPAYABLES, please fill out the additional enrollment form attached and return with VQ form. Federal Tax Identification # (TIN): – *Social Security #: – CAGE Code: – 9 digits: xx-xxxxxxx 9 digits: xxx-xx-xxxx or DUNS No + 4: Supplier/Subcontractor General Product Line or Service: NAICS Code(s): - North American Industry Classification System (NAICS): See http://osha.gov/oshstats/naics-manual.html Business Type: (check appropriate box for federal tax) Sole Proprietorship OWNER’S LEGAL NAME: Corporation C-Corp Government Agency City State Federal Disregarded Entity OWNER’S LEGAL NAME: Partnership OWNER’S LEGAL NAME: LLC (Limited Liability Co.) Enter Tax Classification C = C corporation C S P CAC-FIN-J010 / Rev. 11 / 12-13-12 Not for Profit Organization (please also check business type) 501(c)3 Corporation (Non-Profit) S = S corporation P = partnership Other Entities: See Note below Foreign Owned 1 of 3 S-Corp 1099 Type: N/A Medical Rental Misc Service Legal Business Size: (check ALL that apply) See http://www.sba.gov/size/indexguide.html for size standards. Large Small Woman Owned Minority Business Veteran-Owned SB CAC Shareholder 8(a) SBA HUBZone SB Service-Disabled Veteran SB Historically Black Colleges & Universities Small Disadvantaged African American Hispanic American Asian American Subcontinent Asian American Native American Pacific Islander Other _________________________________________________________ COMPANY REPRESENTATIVE CERTIFICATION *Job Title: *Printed Name: *Signature: *Date: ACCTS. PAYABLE USE ONLY Spoke With: Contact Date: A/P Tech: Vendor #: Certification: Under Penalties of Perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. citizen or other U.S. person (defined on IRS Form W-9) Certification Instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See IRS Form W-9 instructions on page 4. Notice: Under 15 U.S.C. 645(D), any person who misrepresents a firm's status as a Small Business Concern in order to obtain a contract to be awarded under the preference programs established pursuant to Sections 8(a), 8(d), 9 or 15 of the Small Business Act or any other provision of Federal Law that specifically references Section 8(d) for a definition of program eligibility, shall (1) Be punished by imposition of fine, imprisonment, or both; (2) Be subject to administrative remedies, including suspension and debarment; and (3) Be ineligible of participation in programs conducted under the authority of the Act. The small business size standard for a concern which submits an offer in its own name, other than on a construction or service contract, but which proposes to furnish a product which it did not itself manufacture, is 500 employees. The size standard for products which it did manufacture and for all services, the size standard is determined by NAICS Code. Note: Other Entities: Enter your business name as shown on required federal tax documents on the “Name” line. This name should match the name shown on the charter or other legal document creating the entity. You may enter any business, trade, or DBA name on the “Business name” line. CAC-FIN-J010 / Rev. 11 / 12-13-12 2 of 3 Credit Card Acceptance Form When you sign up, Chugach Alaska Corporation and its subsidiaries will provide you with a MasterCard payment each time your invoices are due. To: Vendor Enrollment Fax number: 877-474-8066 Email: VendorSetup@chugach-ak.com Enroll Us Now! Enrollment Instructions: To begin participating in our MasterCard payment program, please email the information as requested below and include all fields in the body of the email. You can also complete and return this form by fax to the contact listed above or call 1-907-563-8866 and ask for the Accounts Payable Department VMC Program. Please print the information below. Company Name: Accounts Receivable Contact Information: Name and Title: Phone Number: Remittance Email Address*: *An e-mail address is required for the payment notification. We recommend a central email address, such as accountsreceivable@vendorname.com. We value your input! If you are not enrolling in our MasterCard Payment Program, please let us know why: Do not currently accept MasterCard Other (please explain below) __________________________________________________________________________ ___________________________________________________________________ CAC-FIN-J010 / Rev. 11 / 12-13-12 3 of 3