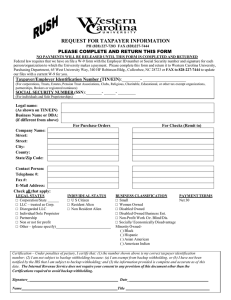

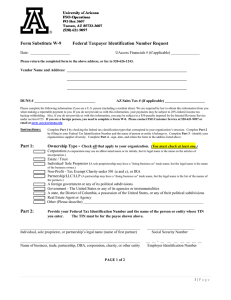

Substitute W-9 : Taxpayer Identification Number Request

advertisement

Substitute W-9 : Taxpayer Identification Number Request Please complete the following information. We are required by law to obtain this information from you when making a reportable payment to you. Section 3406 of the Internal Revenue Code requires that we withhold a predetermined percent in tax (28%), called backup withholding, when you do not give us your correct Name/Tin combination. Payments that are subject to backup withholding include interest, dividends, broker and barter exchange transactions, rents, royalties, non-employee pay, and certain other payments. Real estate transactions are not subject to backup withholding. If you fail to furnish your correct TIN, you may be subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect. Your TIN is required whether or not you are required to file a tax return. Use this form only if you are a U.S. person (including U.S. resident alien). If you are a foreign person, use the appropriate Form W-8. Part 1 – Tax Status Complete only one of the sections below. Individual’s Name (Last, first, middle) Individual - OR - Individual’s Social Security Number A dba (doing business as) may be used in the Business or Trade Name, but should NOT be in Owner’s Name. Owner’s Name (Last, first, middle) -EITHER- Owner’s Social Security Number Sole Proprietor (also, LLC Business or Trade Name -OR- Federal Employer ID Number Partnership (also, LLP, LLC Partnership’s or Entities Legal Name on IRS Records (see IRS Mailing Label) Federal Employer ID Number with multiple owners, other non-exempt companies and entities) Business or Trade Name (if different from Legal Name) with single owner) - OR - - OR - □ Exempt Entities [C/S Corporation, Government…] *a box must be checked to be classified as exempt Corporation , Subchapter C or S –or– LLC granted corporation status (No Exemption for medical, healthcare and legal service payments) □ Tax Exempt Entity under 501(a), 501(c)(3) or IRA □ The United States or any of its agencies or instrumentali ties Legal Name of Corporation or Entity (see Articles of Incorporation) A state, the District of a possession □ □ ofColumbia, the United States, or any of their political subdivisions or agencies A foreign government or any of its political subdivisions or an international organization in which the United States participates under a treaty or Act of Congress Federal Employer ID Number Business or Trade Name (if different from Legal Name) Part 2 – Address Tax Correspondence Address Part 3 - Certification Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. person (including a U.S. resident alien). Print Name Phone Sign Signature of US Person Here ► Date Return Certified Forms to: Fax: (803)777-2032 Mail: University of South Carolina Purchasing 1600 Hampton St. Columbia, SC 29208 UNIVERSITY OF SOUTH CAROLINA CONTROLLER’S OFFICE COLUMBIA, SOUTH CAROLINA 29208 803/777-2602 FAX 803/777-9586