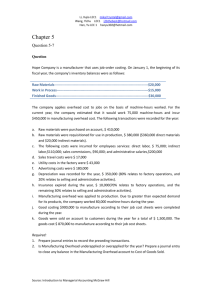

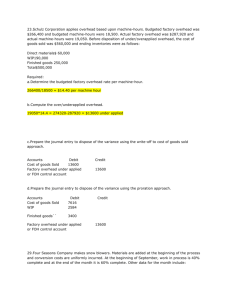

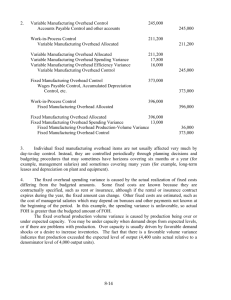

Flexible Budgets and Overhead Analysis

advertisement