English version - Academic Resources at Missouri Western

advertisement

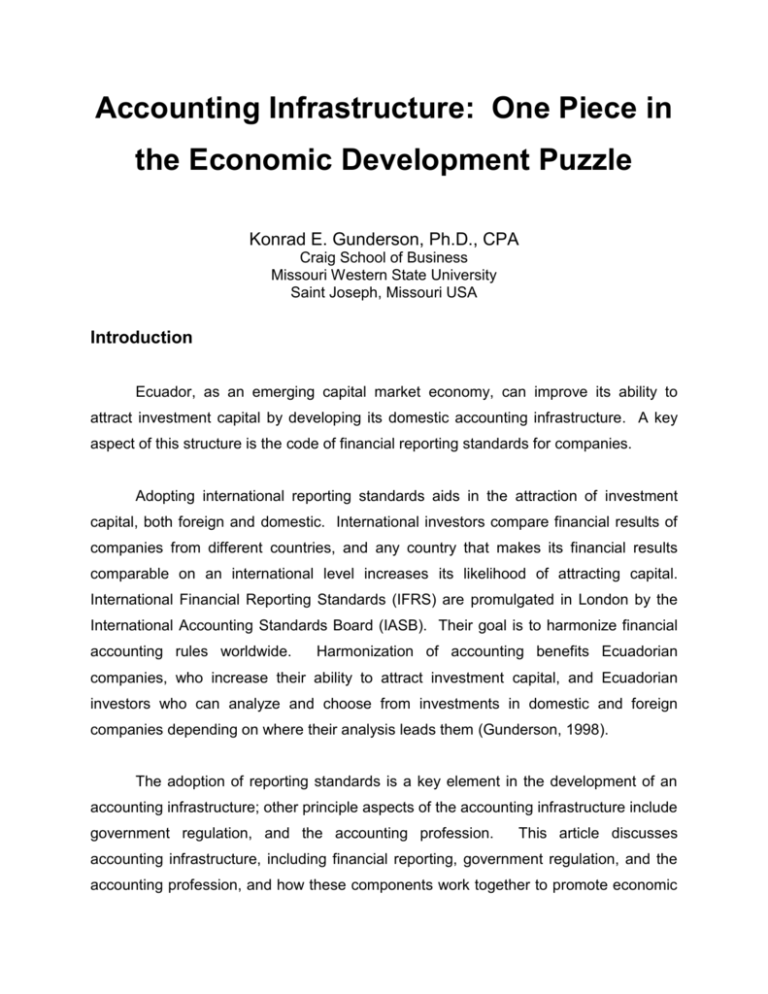

Accounting Infrastructure: One Piece in the Economic Development Puzzle Konrad E. Gunderson, Ph.D., CPA Craig School of Business Missouri Western State University Saint Joseph, Missouri USA Introduction Ecuador, as an emerging capital market economy, can improve its ability to attract investment capital by developing its domestic accounting infrastructure. A key aspect of this structure is the code of financial reporting standards for companies. Adopting international reporting standards aids in the attraction of investment capital, both foreign and domestic. International investors compare financial results of companies from different countries, and any country that makes its financial results comparable on an international level increases its likelihood of attracting capital. International Financial Reporting Standards (IFRS) are promulgated in London by the International Accounting Standards Board (IASB). Their goal is to harmonize financial accounting rules worldwide. Harmonization of accounting benefits Ecuadorian companies, who increase their ability to attract investment capital, and Ecuadorian investors who can analyze and choose from investments in domestic and foreign companies depending on where their analysis leads them (Gunderson, 1998). The adoption of reporting standards is a key element in the development of an accounting infrastructure; other principle aspects of the accounting infrastructure include government regulation, and the accounting profession. This article discusses accounting infrastructure, including financial reporting, government regulation, and the accounting profession, and how these components work together to promote economic development. Accounting infrastructure is part of the entire legal and regulatory system designed to secure property rights, enforce contracts, and provide financial information; this system, sometimes referred to as “investor protection,” is vital to development of emerging stock markets such as Ecuador has. International Financial Reporting Standards As mentioned above, adoption of International Financial Reporting Standards (IFRS) is a goal being pursued by many countries around the world. International consulting firm Deloitte Touche Tohmatsu estimate that today more than one hundred countries worldwide require or allow IFRS in some form (Deloitte Touche Tohmatsu, 2008) . In 1999 and 2000 Ecuador adopted Normas Ecuatorianas de Contabilidad ADOPTION OF IFRS FOR DOMESTIC LISTED COMPANIES BY SOUTH AMERICAN COUNTRIES1 IFRS Not Adopted Argentina IFRS Allowed IFRS Required X X Bolivia Brazil X (beginning 2010) Chile X (beginning 2009) Colombia X X (beginning 2008) Ecuador X Paraguay X Peru Uruguay2 X X Venezuela 1 Source: Deloitte Touche Tohmatsu IAS-Plus web site, 2008. Note that the adoption of IFRS is for listed companies only, meaning those that have shares traded on a stock exchange. 2 Uruguayan companies follow IFRS existing at 19 May 2004, but auditors’ reports refer to conformity with Uruguayan accounting principles 2 (NEC) which represents a step toward convergence with IFRS. NEC is largely based on IFRS, but some IFRS rulings have been excluded. Taking a gradual approach toward adoption of IFRS is a sensible approach for Ecuador. In reality, very few countries have adopted all IFRS rules at once, including the European Union countries. In the 2004-2006 time period a project was undertaken to fully adopt IFRS in Ecuador with the support of the Inter-American Development Bank and the Multilateral Investment Fund (MIF) and, as indicated in the above table, Ecuador is on track to fully adopt IFRS in 2008 according to data from Deloitte Touche Tohmatsu. After the initial adoption of IFRS there is the ongoing need for interpretation, implementation, and updating of the standards. Each country adopting IFRS must support an independent domestic technical body to help national accountants interpret and apply the standards, as well as to adopt new standards as they are issued by the IASB. Retaining such technical expertise within the country aids economic development by allowing high quality financial reporting to take place at a wide range of companies, including those not yet listed. This allows successful smaller and intermediate sized companies to eventually offer their shares on stock exchanges, which promotes economic growth by attracting a wider array of investors. Technical assistance is currently provided by the Instituto de Investigaciones Contables del Ecuador (IICE); however, the IICE should be made independent of its sponsoring organization, the Federacion Nacional de Contadores del Ecuador (FNCE). The exact structure of Global financial reporting is a dynamic process. The International Accounting Standards Board (IASB) provides some technical support and implementation guidance. Also regional bodies such as the Inter-American Accounting Association may assist member countries with implementation issues. Nevertheless, Ecuador should make a commitment of resources to allow the IICE, or a newly formed national accounting standards board, to operate independently. The alternative would be to place too much reliance on outside parties; such an imbalance would not be a positive sign for a developing economy. 3 Governmental Regulation The development of an independent technical body relieves governmental regulators of the task of adopting standards through legal processes, allowing them to concentrate on enforcement issues such as sanctioning companies whose financial statements do not conform to standards, or disciplining auditors who do not carry out their work with due care. Enforcement has been a challenge in Ecuador. In fact, Ecuador, without adoption of additional IFRS standards, could immediately improve investor protection by simply enforcing an existing rule, that of required disclosure of related party transactions. A transaction between a corporate insider and a related party must be disclosed in notes accompanying the financial statements because of the possibility that the transaction may not reflect that which would occur in an “arms-length” transaction, or between disinterested parties. The problem is of immediate concern from an accounting standpoint because transaction prices determine amounts reported in the financial statements. If a corporate official WORLD BANK INVESTOR PROTECTION INDEX FOR SELECTED SOUTH AMERICAN COUNTRIES Country Investor Protection Index Argentina 4.7 Bolivia 4.0 Brazil 5.3 Ecuador 4.0 Peru 6.7 Venezuela 2.7 INDEX = 10 HIGH (BEST PRACTICES) INDEX = 1 LOW (POOR PRACTICES) Source: World Bank, Doing Business Report (2008) 4 directs that equipment be purchased from a friend or family member at an inflated price, this amount is incorporated into the financial records and assets are over-stated on the corporate balance sheet, as is depreciation expense on the income statement. This scenario is precisely the one used by the World Bank to evaluate investor protection for its “Doing Business” reports. World Bank evaluates each country’s investor protection environment based on what mechanisms are in place to prevent or detect such an insider transaction. The basic accounting principle concerning related party transactions, if enforced, provides investor protection because disclosure deters corporate officials from engaging in self-dealing. Thus, while Ecuador has moved ahead with the adoption of IFRS, there are still problems with enforcement. Adoption of new accounting standards will be of no benefit if there is not effective enforcement of those standards and, as indicated by the World Bank report, Ecuador has not had effective enforcement in the area of investor protection. A structure with an independent technical body to adopt and interpret standards, and separate governmental enforcement of those standards, should help improve compliance and allow the benefits of IFRS to be realized. The Accounting Profession Companies in emerging markets rely on professional accountants to prepare financial reports in accordance with standards such as IFRS, and independent professional accountants audit these reports to assure investors of their truthfulness. The financial reporting system is reliant upon an adequately trained pool of professional accountants. Not only is this important for the large listed companies, but equally for those medium sized companies which will grow to a point where they begin to have their shares traded in the stock markets. In the period of transition it will be particularly 5 important to have accountants and auditors who can adapt to the increased reporting and disclosure regulations that are required by the stock exchanges. One way a country can improve the average quality of expertise across its domestic accounting profession is to implement a uniform written examination for all candidates entering the profession. Professional accounting exams, while relatively new to developing countries, are common in developed economies such as the United States and Great Britain. South American countries all require a university academic background for professional accountants, and professional exams are beginning to emerge. Brazil and Peru have taken the lead by requiring uniform examinations for licensure as a professional accountant, and Chile is considering a similar move (International Federation of Accountants, 2008). Ecuador certainly has universities whose graduates would exceed the level required in professional exams. And a uniform exam broadens the base of well prepared accountants from which companies can draw to staff their accounting departments. This improves financial reporting by these companies, and, on a personal level, enhances the careers of licensed accountants who enjoy a recognized credential of uniform quality. Conclusion A thriving economy needs physical infrastructure such as transportation and communications systems. Equally important is a country’s accounting infrastructure, which includes the system for adoption of financial reporting standards, the system of governmental regulation, and the system for education and certification of professionals. In this regard, Ecuador’s development of an independent institute of accounting standards, governmental regulation focused on enforcement, and adoption of a uniform professional examination, should be part of any economic development plan for Ecuador. These measures promote investor protection which increases the flow of capital from domestic and foreign sources. 6 References Deloitte Touche Tohmatsu. 2008. IASPLUS website, accessed March, 2008: www.iasplus.com. Gunderson, K. 1998. Accounting Standards: Key to Attracting Investment. Ekos Economia Empresa, Volume 53, No. 6 (June, 1998) 62-63. International Federation of Accountants (IFAC). 2008. IFAC website, accessed February, 2008: www.ifac.org. World Bank. 2008. Doing Business 2008 – Ecuador: Comparing Regulation in 178 Economies. World Bank: Washington, DC. 7 Bibliographical References Askary, S. Accounting Professionalism – A Cultural Perspective in Developing Countries. Managerial Auditing Journal, Volume 21, No. 1, 102-111. Baydoun, N., and R. Willet. 1995. Cultural Relevance of Western Accounting Systems to Developing Countries. ABACUS, Volume 31, No. 1. 67-92. Blair, Richard, CPA, Chief Financial Officer, HCJB VOZ ANDES World Radio, Quito, Ecuador. Interview concerning implementation of International Financial Reporting Standards (March, 2008). Fortin, Henry, Senior Analyst, Latin American Region, World Bank. 2008. Interview concerning Ecuador’s response to World Bank’s Report on the Observance of Standards and Codes (2004). Hooper, V., and R. Morris. 2004. Washington Consensus, Emerging Economies and Company Financial Reporting: An Appraisal. Research in Accounting in Emerging and Transitional Economies, Supplement No. 2, 93-116. Kirsch, R., K. Laird, and T. Evans. 2000. The Entry of International CPA Firms into Emerging Markets: Motivational Factors and Growth Strategies. The International Journal of Accounting, Volume 35, No. 1 99-119. Pazos, Jenny De Burbano, CPA, Internal Auditor, HCJB VOZ ANDES World Radio, Quito, Ecuador. Interview concerning education and certification of Ecuadorian CPAs (March, 1998). Pozo, Felipe Alban, Attorney, Superintendencia De Companias, Quito, Ecuador. Interview concerning formation of Ecuadorian accounting law (March, 1998). 8 Saudagaran, S., and J. Diga. 1997. Financial Reporting in Emerging Capital Markets: Characteristics and Policy Issues. Accounting Horizons, Volume 11, No. 2, 41-64. World Bank. 2004. Report on the Observance of Standards and Codes – Ecuador (Accounting and Auditing). World Bank: Washington, DC. 9 Acknowledgements Thanks to Monica Rojas, Professor of Economics, University of San Fransisco-Quito, and former economist, Central Bank of Ecuador, for editorial and translation assistance. Thanks to the staff at the Ecuadorian-American Chamber of Commerce, Guayaquil, for their assistance and communication during the editorial review process. Thanks to Missouri Western State University for Applied Learning travel funding which allowed me to be on the ground in Ecuador in February-March, 2008. 10