“Exergy, Work and Economic Growth – Past and Future” Keynote

“Exergy, Work and Economic Growth – Past and

Future”

Keynote address

Third Global Conference on Global Warming

Lisbon, July 10-14, 2011.

Robert U. Ayres

INSEAD

Abstract

Conventional economic growth theory assumes that technological progress is exogenous, that resources are “produced” by capital and labor and that resource consumption is a consequence, not a cause, of economic growth. It also assumes that growth will continue regardless of energy availability. Economists who have considered the costs of global warming and the benefits of abatement start from this position. It seems to follow that the costs will be felt primarily in the agricultural sector, also a comparatively small fraction (in the OECD countries) and some damage from coastal storms and sea-level rise. Abatement is thought of in terms of cutting GHG emissions by improved energy efficiency, and supplementary investment in carbon capture and storage (CCS). The costs, based on this calculus, appear to be one or two percent of global GDP. The reality is rather different and more complex because cutting GHG emissions means drastically cutting energy consumption

(at least the fossil fuel component) which will necessitate drastic increases in energy prices.

In fact, energy is more important to the economy than the neoclassical theory admits, and the consequences of radical supply decreases and price increases due to abatement, not to mention the coincidental advent of “peak oil”, will be to sharply cut global growth. – with huge social and political implications.

Energy and production

It is obvious today that energy is essential to all economic activity, and specifically to the production of material goods and services. For hundreds of years, sunlight, wind, and flowing water were free gifts of nature. The fact that the essence of all of these natural phenomena is what we now call ‘useful energy’ was not understood, even by physical scientists, until the last years of the 19th century. The word A energy @ was more widely used in a literary or metaphorical sense, not in the physical sense as the fundamental A stuff @ of the universe, as physicists and cosmologists now understand it to be. When Albert Einstein first stated the identity between mass and energy it was headline news and, of course, the first clue to the possibility of nuclear weapons and nuclear power.

But meanwhile, it has become clear that what really drives every action, every motion and every physical or chemical process is useful energy in some form. It is traditional to characterize energy as thermal (heat), kinetic (motion), chemical or electrical . Heat from nuclear reactions might be added. Capital equipment, such as tools and machines, without

energy to activate them are inert mass. Passive forms of capital, such as buildings and roads, produce nothing in and of themselves, however important they may be to support other productive activity. More important, when economists speak of “labor productivity”, what they mean is economic output (GDP) in dollars, divided by the quantity of human labor

(usually man-hours). The false implication is that rising productivity is due to better training or better organization. The truth is that most of the past and current gains in productivity have been and still are due to the substitution of machines (including ICT) for human and animal muscles. More recently, machines also begin to replace human brains. The machines are driven by cheap energy, mostly from fossil fuels, water power or nuclear reactors.

Not all energy is potentially useful. The ocean contains a lot of heat, compared to outer space, but it is not useful or potentially useful to us. Steam is potentially useful because it is a lot hotter than the ocean, whence there is a temperature difference. From a technical thermodynamic perspective, work means exerting force to overcome inertia or some kind of of resistance. It may be lifting a weight, winding a spring, pumping a fluid through a pipe, propelling a projectile (or a vehicle) through air or water, driving an endothermic chemical reaction or driving an electric current against a voltage.

The difference between work, in the technical sense, and useful work , arises from the existence of human intention and control. The expansion of the universe constitutes work against the force of gravity. Similarly, the evaporation of water from the oceans, the eruption of volcanoes, the rise of mountains and the carving of valleys are other examples of work done by natural forces. But those forms of work are not A useful @ in the economic sense.

Work is useful to us humans only insofar as it is productive – which economists take to mean contributing to GDP -- and contributes to human utility or welfare.

To extract useful work (or any kind of work) from a reservoir of some energy carrier

(e.g. fuel) energy there must also be a disequilibrium that can be exploited, because natural forces always act in such a way as to approach thermodynamic equilibrium. The existence of disequilibrium is usually marked by a gradient of temperature, pressure, voltage, chemical composition or gravitational field. The potentially useful component of energy is called exergy while the non-useful component is called anergy

Energy per se is conserved in every process. That is the First Law of thermodynamics.

But exergy is not conserved; in fact, exergy is destroyed in every action or process. Yet, when we speak of “energy” in everyday language B as in the context of heating a house or driving a car, it is really exergy that we are talking about. The chemical energy embodied in a fuel such as natural gas mostly exergy, while the heat energy in the ocean is mostly anergy.

Unfortunately energy, exergy, anergy and work are all measured in the same units as energy

(e.g. joules) and it is easy to confuse energy in the form of useful work with primary energy in the form of wind, water or fuel.

Since inert structures and inactive muscles produce nothing, it is a short step to realize that all economic production is really comprised of products made from materials transformed by useful work, plus services generated by those products. This is even true of information production, processing and transmission. Moreover, useful work is an essential input to every economic activity, just as capital (in some form) and labor (in some form) are thought to be essential. It can be argued that useful work is obtained from A raw @ or primary energy by the application of capital and labor, but useful energy (exergy) is also essential for that purpose. There is no way to produce useful work from inert capital and inactive labor alone.

It follows that exergy or useful work should be regarded as A factors of production @ in the economic sense, along with traditional capital and labor. Yet it is a fact that most economic models today still consider only capital and labor as factors of production, even though the increasing productivity of labor is largely due to inputs of energy (exergy) that

drive the machines that continue to replace human labor. Yet in traditional economics the benefits of increasing productivity are nevertheless allocated to labor. Traditional economics still regards energy (or useful work) as an intermediate product of the application of capital and labor. This tradition continues, even though capital and labor, without activating energy, can produce nothing.

Energy/GDP relationship

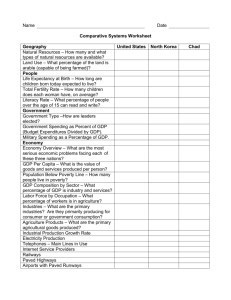

As long as time series data has been available (since 1850) there has been a very close correlation between global primary energy consumption and global GDP in purchasing power parities (PPP).See Figure 1 {Bourdaire, 2003 #7087}. Up to 1973 the relationship was essentially linear. But after 1973, there has been a slight decoupling, possibly triggered by the succession of oil price shocks, starting in 1973, each of which has triggered a recession. The latest example of an oil shock (not shown in the graph) was 2007-8 when the price briefly reached $150/bbl and was followed by the global financial collapse in 2008 from which the western countries, especially the US, have not yet fully recovered.

In view of the usual assumption that energy is not a factor of production, the high correlation between primary energy consumption and GDP suggests (to most economists) that global energy production is simply driven by global demand, which is driven by global

GDP. In other words, it is convenient to assume that there are no supply constraints. For purposes of forecasting future energy needs, it follows that a GDP growth forecast, together with a forecast of price and income elasticities, should be sufficient. This is exactly the methodology employed by the IEA, the OECD, the US IEA and the IMF.

As it happens, the most commonly used production function of capital and labor takes the form shown below:

Y = A(t) K(t) a

L(t) b

where Y is output, K is the stock of capital and L is the stock of labor, while a and b are constants, where a + b = 1 (to assure constant returns to scale). This form was suggested by Charles Cobb and

Paul Douglas back in 1927. It has the convenient mathematical property that output elasticities

(logarithmic derivatives) of the two factors are just the constants a and b.

A theorem called the A income allocation theorem @ , also dating from a century ago, states that, in a simple economy consisting of many small ( A price taking @ ) competing firms producing a single product from rented capital and labor (which are assumed to be freely substitutable), the equilibrium B or profit maximization B condition requires that total labor requirements must be determined by the marginal productivity of labor, which is the wage rate. Hence the total payments to labor must be equal to the wage rate times the quantity of labor employed and the total payments to capital must be determined by the marginal productivity of capital (the profit rate), times the quantity of capital employed. It can be shown that, in this ultra-simple case, the output elasticity of each factor must be equal to its cost share in the GDP (which is equal to the sum total of wages and profits, respectively.)

As it happens the cost shares of capital and labor, as defined above, have been relatively constant over the years, which seems to fit the requirements of the Cobb-Douglas production function,

In 1956 and 1957, Robert Solow noted that increasing capital per worker but keeping the cost shares constant did not explain US economic growth from 1909 to 1949 (the years he analyzed). But instead of introducing a third factor of production he attributed most of the unexplained historical growth to the residual multiplier A(t) that he characterized as A technical progress @ . Now it is called A total factor productivity @ or TFP.

An enormous amount of effort has been expended on trying to eliminate the unexplained residual by introducing A quality adjustments @ to labor and capital, while continuing to treat labor productivity as the ratio between total output and labor input. Certainly education and increasing literacy (and numeracy) would be a quality adjustment for labor, while technical performance improvements should also be taken into account for capital. Unfortunately none of the proposed adjustments are accurately quantifiable. Hence the usual approach is to assume a convenient exponential form for A(t), with a constant annual growth rate, around 2 percent per annum. I repeat: economic growth is assumed to continue, as in the past, with or without energy.

But even the standard theory cannot escape the implications for energy. The IMF has recently forecast global economic growth of more than 4.5% p.a. for the years 2011 through 2016 (actually accelerating from 4.4 % in 2011 to 4.7% in 2016). It assumes constant prices – hence no price effect -- and an average income elasticity of 0.685, which means that 1 % increase in global GDP calls forth a new supply of 0.685 %, whence a global growth rate of 4.5% implies an increase in global oil supply of about 3% p.a. In terms of cumulative totals, this implies an increased global output of 17 mbd by 2016, whereas there has been very little increase (3-4 mbd) since 2004 despite much higher prices. Where will this new oil come from?

A recent post by blogger Stuart Stanisford {Stanisford, 2011 #7088} has pointed out that if the constant price assumption is relaxed, and prices are allowed to increase just enough to cut consumption growth from 3% p.a. to 2 % p.a. using the IMFs assumed price elasticity (-0.019) total new supply of

“only” 11 mbd will be needed in 2016. But, that, in turn, implies an annual price increase of 53% for the next 5 years. This will not happen, of course, because a much smaller increase would stop economic growth and bring on another recession or depression. If Stanisford (or the IMF) slipped a decimal point and the price elasticity is -0.19% (much more likely) the annual oil price increase would still have to be

5.3%, and to keep global oil consumption constant (no increase) the annual price increase would (will) have to be several times higher still – and the economic consequences would be severe.

It is also likely – in fact, certain – that the income and price elasticities will change over time.

(There is no theoretical reason why they should be regarded as constants.) The income elasticity will probably decrease – by an unknown amount, to be sure – and the price elasticity must increase considerably as the prices rise and as people (and firms0 learn how to find and use less energyintensive ways of doing things.

But the fundamental problem with the IMF’s economic model (and all the others) is the assumption that energy is not a factor of production in the first place. If that assumption is modified, one has a production function of three variables, rather than two. The third factor could be primary energy E or (my preference) useful work U. Useful work is the product of E times energy (exergy) efficiency f, viz..

U = fE

However, to eliminate the exogenous multiplier by including a third factor of production that is not perfectly substitutable for the others, creates a problem. Perfect substitutability of capital or labor for useful work would allow for the possibility of producing output from capital alone (and no labor or useful work), or from labor alone with no capital or useful work, or from useful work alone, with no labor or capital.

Clearly, none of the factors is a perfect substitute for either of the others. In fact, some substitution is possible at the margin but the extent of substitutability is limited, and those limits can be expressed as mathematical constraints on the profit maximization (equilibrium) condition. Euler-

Lagrange optimization in the presence of a mathematical constraint on the possible relationships among the factors introduces A Lagrange multipliers @ that are interpreted as A shadow prices @ of the constraints.

If the constraints are not binding, the shadow prices will be zero, but what if substitutability is much more limited than most economists assume? From this one can argue (as we have in the past) that the output elasticity of energy (work) is much larger than the cost share.

But if that were true, it follows that energy is really more productive than its price suggests, whence the optimum (profit-maximizing) consumption of energy (work) in the economy is actually larger than current consumption. Can this possibly be true? Most economists will say “no”, whence the traditional cost-share assumption may be OK.

In fact, there is plenty of evidence (a) that firms use too much – not too little – energy, The evidence is plentiful that firms consistently neglect cost-saving investments in energy conservation, with very high returns, in favor of investments in marketing, new products or capacity expansion.

Governments and consumers behave in roughly the same way, preferring to spend on current consumption goods or services rather than investment in future cost savings. (The health-care dispute is a good example.) What that means is that the profit-maximizing or cost-minimizing optimum energy consumption level is actually considerably lower than the current level, as a number of studies have indicated.

Does this mean that energy or work can be neglected as factors of production, as most models have assumed? If so, continued economic growth can safely be assumed and higher energy prices don’t really matter much after all. I don’t believe it. But I don’t know how to explain the associated implication that, if energy is a more important factor of production than current theory says, we should be using more of it, not less. .

Setting this question aside, we can now postulate specific functional forms for the output elasticities, with appropriate asymptotic behavior, such that realistic physical constraint requirements, plus the constant returns to scale condition are satisfied. This was done some years ago by Kuemmel et al (1986). Without going more deeply into mathematics, one of the simplest functional forms that meets

this requirement, with U as the third factor, is known as the LINEX (Linear-Exponential) function, which looks like this:

Y(t) = U exp{a(2-b) - a(L-U)/K + ab(L/U)}

Here U refers to useful work and Y, U, K and L are functions of time, while a and b are constants. In principle, we have time series for U, K and L and the constants a and b have to be determined econometrically, i.e. by finding the best fit between Y as calculated and actual historical output (GDP).

In practice, K and L are available from official sources, but U is not, and it must be estimated. For the

US this has been done, approximately, for the years 1900-1998 by Ayres et al (2003) and subsequently updated and extended to several other countries.

Figure 3 shows the results of comparing the best fit with a three-factor Cobb-Douglas production function, assuming constant output elasticities, vs the best LINEX fit with variable output elasticities. The LINEX fit is obviously better. Moreover, it does not require an exogenous multiplier

A(t) to explain past growth. However, it must be acknowledged that the fit is not very good after the

1980’s. There are several possible explanations. One explanation, due to Bourdaire is that the US GDP was artificially inflated during the 1990s, due to a series of unseasonably warm winters, the use of

“hedonic” pricing for computers or higher margins based on cheap imports – attributable to the everincreasing trade deficit with China {Bourdaire, 2003 #7087}. In effect the US was, and still is, consuming goods that are produced elsewhere with borrowed money.

However, we think the rapid introduction if new information and communications technology

(ICT) may be the missing link. It suggests a modified production function in which capital is split into

“normal” and ICT components. Results are shown below.

During recent decades information, computer and telecommunications (ICT) technologies have vastly increased in importance. To reflect this shift, we have subdivided capital stock into two components,

‘physical capital’ and ICT capital. Since ICT capital was essentially negligible before 1975 we can also assume that the impact on GDP was also negligible before 1975, but has since become increasingly important. Let δ stand for ICT capital, whence K - δ refers to ordinary physical capital. It is plausible that information technology effectively increases the productivity of human labour, while correspondingly reducing the productivity of other exergy services. We postulate a modified form of the LINEX function, as follows: y

q

0 exp 2

a

u k

l

ab l u

c

l

(11)

It is evident that the modified form reduces to the original form in the limit as δ approaches zero. This suggests the possibility of using a functional version of the familiar Taylor expansion, viz. y

y ( 0 )

y

2 y

y ( 0 )

q

0 u exp f

a

k l

ab l u y

a k u

y

y

a u

k

2 l

l

2 c l

l c

(12)

Giving the 1st order approximation as, y

y

1

a u

l k

2

c l

This production function will be referred to as the ICT adjusted LINEX.

(13)