OIL AND GROWTH - Cardiff Business School

advertisement

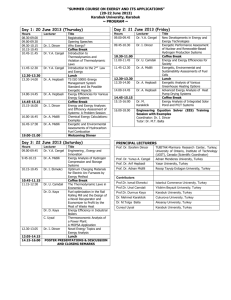

ECONOMICS AT THE END OF THE END OF HISTORY: NAVIGATING THE ENERGY TRANSITION PROF CALVIN JONES CARDIFF BUSINESS SCHOOL FRIDAY WORKSHOP 02.11.02012 USUAL CAVEAT No paper, sorry, very much a work in progress. HYPOTHESIS (1) Global growth may be slowing due to attainment of a Solow steady state of percapita-income driven by diminishing returns to energy-generating fossilised natural capital (2) Transition to non-exhaustible energy inputs will (especially in the West) be sub-optimal Maddison quoted in Van de Berg, 4 LONG RUN GDP GROWTH SKETCHED MODEL: EXTENDED SOLOW Solow (1956) growth model posits 2 factors, L , K with constant returns to scale and diminishing returns to any one factor Growth is series of ‘one-offs’ achieved only via: • labour augmenting improvements to capital stock (Arrow, Romer, Lucas et al) • increase in savings ratio • Reduction in depreciation rate of capital SOLOW GROWTH EQUILIBRIUM To right of k*, δk > s hence amount of capital per worker diminishes to k* y δk To left of δk < s hence capital accumulates to k* y’ k*, e.g. decrease in depreciation δk increases PCY to y’ y* δk’ s = σβ(k) α k k1 k* k2 k’ 6 There is a stable equilibrium capital stock and income per worker level at k* y* y = β(k) α EXTENDED SOLOW* Consider extension of Solow with new factor of production E representing exergy – amount of energy available for useful work Cobb-Douglas; Y = KαLφ where α+φ=1 becomes: Extended Cobb-Douglas; Y = KαLφEψ where α+φ+ψ=1 Allow K & L to be infinitely extendable in tandem and hence collapse term to y y = β(kl) αφ y = β(kl) αφ kl *n.b. I depreciate Hotelling/Hartwick/Solow papers that equate rents on exhaustible resources to stock values due to informational & other imperfections discussed later; see Krautkraemer, 1998 EXTENDED SOLOW* Implication that growth will experience diminishing returns to increasing inputs of K and L if available system energy, E is fixed Notes: • We do not distinguish here between fossil and renewably generated energy • Energy efficiency developments increase exergy hence shift function up – but themselves y experience diminishing returns y = β(kl) αφ kl DIMINISHING RETURNS TO ENERGY EFFICIENCY EXERGY LEVELS? Response to this analysis might contend exergy sufficiently available such that does not constitute a drag on economic growth – hence increasing factor accumulation + technical progress sufficient to allow (but not ensure) growth Abundant energy sources waiting to be tapped when price justifies exploitation (see work of Maugeri & Yergin especially) Any signals here? EVIDENCE SUPPLY CONSTRAINTS? NEXT? Fatih Birol, Chief Economist of the International Energy Agency, September 2010 interviewed on BBC One Planet "It is definitely depressing, more than depressing, I would say alarming, which is what we try to do, to alarm the governments. … even if we were to assume the next 20 years global oil demand growth was flat, no growth at all, in order to compensate the decline in the existing fields we have to increase the production about 45m bpd just to stay where we are in 20 years, which means to find and develop four new Saudi Arabias, and this is a major challenge. INTIMATIONS? Lack of positive supply response from conventional oil since 2005 suggests limitation in annually available exergy from that source – for technical/cost of production reasons Substitution effects – nuclear, unconventional oil (tar sands), biofuels, wind… and in short term gas All are an order of magnitude more expensive than ‘easy’ Saudi oil at $8 - $12 at barrelhead (Simmons, 2006) and with little prospect of scale economies to to techniques of extraction – cheapest is boiling Western Canada @ $80/ba (see Nelder) NOT JUST PRICE ISSUE - EROEI Energy Return on Energy Invested – technical coefficient dividing energy generated by energy used in discovery, production & distribution processes over life cycle OIL AND GROWTH Even if global exergy can be increased EROEI implies far higher cost of energy This either in terms of $ - e.g. OECD, 2012 estimate real price of oil doubles to 2020 (accounting for new discovery & substitution) Or in terms of opportunity cost – ever larger proportion of productive factors dedicated to chasing ever more marginal energy sources Additional problem here – exergy is also an input for application of K and L – it is an ‘ur-commodity’ see Schumacher) OIL AND GROWTH oil comprises around a third of global primary energy use, and 95% of global transport. Oil-derived products, including plastics are central inputs to wide range of non energy products Dependence of global agriculture on oil for mechanised production, pesticides, inorganic fertilisers and distribution means in US & Europe, one calorie of food requires 7-10 calories of fossil fuel to produce Heller and. Keoleian (2000) Manufacture of a passenger vehicle cf. 22-29 Gj of energy, cf. 3.75-5 barrels of oil (Weiss et al 2003, MIT) Hence ↑ energy cost implies ↓ in productivity of inputs (opportunity cost of exergy) OIL AND GROWTH Increasing production cost (exergy terms) & substitution to energy sector cuts factor levels in productive sector Hence leftward shift in kl and downward pressure on PCY y y = β(kl) αφ kl Can we hope for offsetting improvements in energy or non-energy technology? ‘… the Stone Age ended, not because we ran out of stones. It’s ideas, it’s innovation, it’s technology that will end the Age of Oil before we run out of oil.’ Sears, 2010; see also Deutsche Bank http://www.ted.com/talks/lang/en/richard_sears_planning_for_the_end_of_oil. html PROBLEMS & SUB-OPTIMAL TRANSITIONS Formal (western) economics not used to explaining transitions to ‘worse’ factors! Newcomen’s Coal engine 1712. Adam Smith born 1723 Batteries must improve carrying capacity by a factor of 50 to match oil – but fundamental chemical constraints & DMR NETWORK/SUNK COSTS e.g. transportation: - electrification: battery cars. smart 2-way grid. high power charging points. 2 x generating capacity (MacKay 2009)? - hydrogen: fuel cell cars. storage tanks & tankers or pipelines. - gas: LPG / CNG cars. below ground (?) pressurised storage (but not hydrogensubstitutable). definite shelf life. AND OF COURSE IN EXPERIMENTAL TRANSITION, DEPRECIATION RATES LIKELY TO INCREASE? δk’ y δk y = β(k) α y* ↓ s = σβ(k) α y’ k k* 22 k’ k1 MORAL HAZARD / PRINCIPAL AGENT incentives to stifle information flow on reserves (or overstate) from within industry / producer-nations to shore up demand & lock-in (see Lewis, 2010 for case study of US finance)? NON-ECONOMIC (OR JUST NON-) DISTRIBUTION OF EXERGY Sino-supplier joint ventures (nascent) hint at future geo-political not price based distribution? (Not that the West will afford it anyway!) EQUITY & GEOGRAPHY 160.0 2.50 140.0 2.00 120.0 100.0 1.50 80.0 1.00 60.0 Residence Based GVA/Head 20061 40.0 0.50 Total final energy consumption (kWh)/ £GVA 20.0 0.0 0.00 Greater London South East East of England South West Scotland East West North Midlands Midlands West Yorkshire North and the East Humber Wales FINAL THOUGHTS: ENERGY CAPTURE 14,000BC – 2000AD Morris (2010) Why the West Rules: For Now ENERGY CAPTURE: 14,000BC – 2000AD Morris (2010) Why the West Rules: For Now ENERGY CAPTURE: 14,000BC – 2000AD Morris (2010) Why the West Rules: For Now CONCLUSIONS Issue at hand is not oil ‘running out’ But rather extent to which limitations in supply growth of fuels (& technically driven increased marginal cost) will influence extent of economic growth – or indeed force the continuation of de-growth (in West) Very imperfect competition in energy markets unlikely to help smooth transition to non-exhaustible fuels Significant social tensions evident (Mexico city food riots, fuel strike, real-wage effects of increased commuting cost, fuel poverty) suggest socio-political resilience may be more important than economic/factor price considerations in driving transition THANKS FOR LISTENING. “It might be said that energy is for the mechanical world what consciousness is for the human world. If energy fails, everything fails.” e.f. schumacher small is beautiful p99 Prof. Calvin Jones Cardiff Business School jonesc24@cf.ac.uk