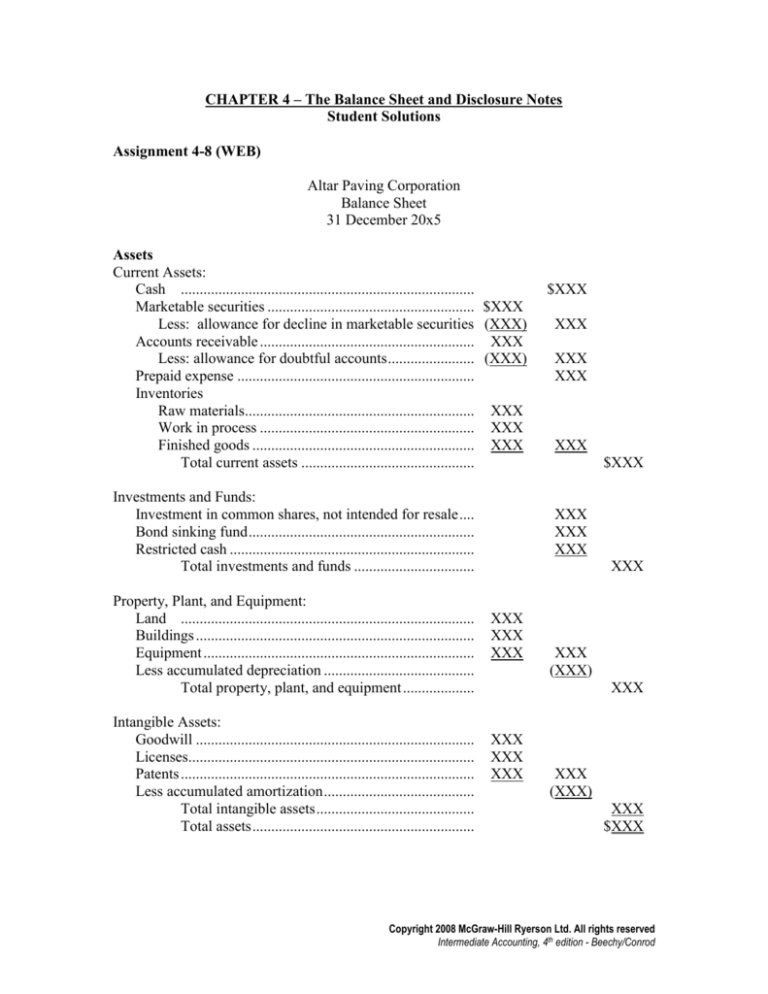

CHAPTER 4 – The Balance Sheet and Disclosure Notes

Student Solutions

Assignment 4-8 (WEB)

Altar Paving Corporation

Balance Sheet

31 December 20x5

Assets

Current Assets:

Cash ..............................................................................

Marketable securities ....................................................... $XXX

Less: allowance for decline in marketable securities (XXX)

Accounts receivable ......................................................... XXX

Less: allowance for doubtful accounts ....................... (XXX)

Prepaid expense ...............................................................

Inventories

Raw materials............................................................. XXX

Work in process ......................................................... XXX

Finished goods ........................................................... XXX

Total current assets ..............................................

Investments and Funds:

Investment in common shares, not intended for resale ....

Bond sinking fund ............................................................

Restricted cash .................................................................

Total investments and funds ................................

Property, Plant, and Equipment:

Land ..............................................................................

Buildings ..........................................................................

Equipment ........................................................................

Less accumulated depreciation ........................................

Total property, plant, and equipment ...................

Intangible Assets:

Goodwill ..........................................................................

Licenses............................................................................

Patents ..............................................................................

Less accumulated amortization ........................................

Total intangible assets ..........................................

Total assets ...........................................................

$XXX

XXX

XXX

XXX

XXX

$XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

(XXX)

XXX

XXX

XXX

XXX

XXX

(XXX)

XXX

$XXX

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

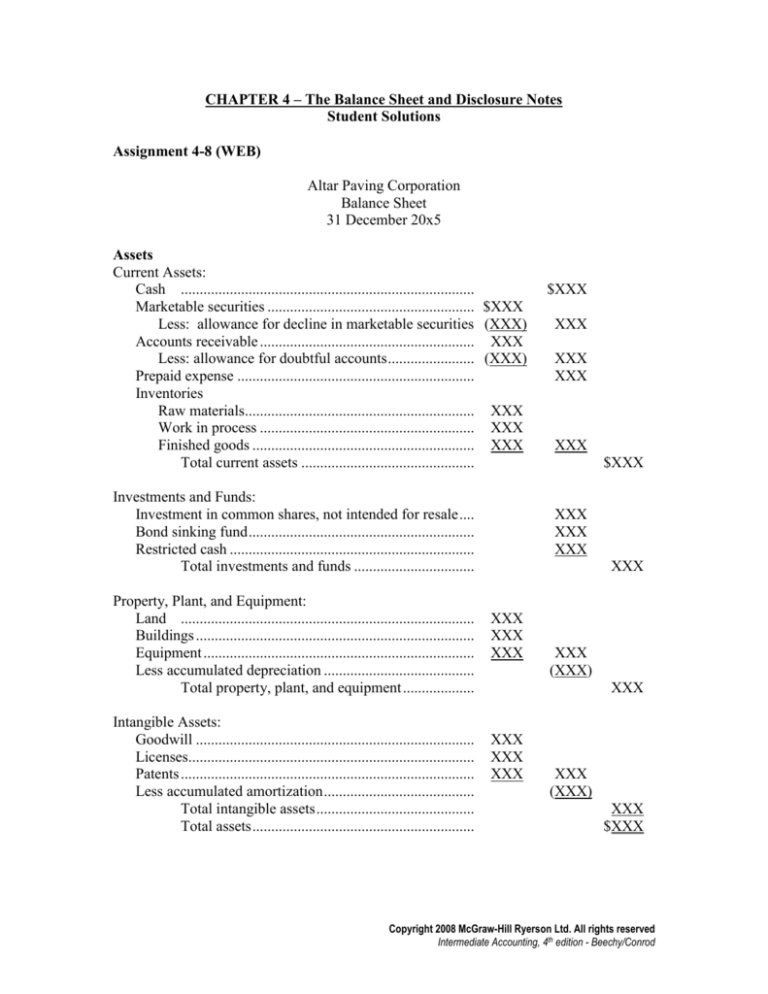

Liabilities and Shareholders’ Equity

Current Liabilities:

Accounts payable .............................................................

Accrued expenses.............................................................

Income tax payable ..........................................................

Interest payable ................................................................

Dividends payable ............................................................

Wages payable .................................................................

Total current liabilities ...............................................

$XXX

XXX

XXX

XXX

XXX

XXX

$XXX

Long-term Liabilities:

Bonds payable .................................................................. $XXX

Less: discount on bonds payable..................................... (XXX)

Future income tax liability ...............................................

Total long-term liabilities ................................................

Total liabilities ...........................................................

Shareholders’ Equity

Contributed Capital:

Common shares ................................................................ $XXX

Contributed capital from share retirement ....................... XXX

Total contributed capital ............................................

Retained earnings .............................................................

Total shareholders’ equity..........................................

Total liabilities and shareholders’ equity .........................

XXX

XXX

XXX

XXX

XXX

XXX

XXX

$XXX

Note: Other variations are permissible. The instructor will need to use judgement.

Assignment 4-9 (WEB)

Requirement 1

a)

b)

c)

d)

e)

$9,648

$6,261

$377,919

$156,782

$8,319

f)

g)

h)

i)

j)

k)

$46,203

$314,106

$14,281

$126,916

$141,197

$661,774

Requirement 2

Account title:

Cash & cash equivalents

Marketable securities

Accounts receivable

i

Type of note disclosure

ii

iii

iv

v

vi

X

X

X

X

X*

X*

X

X

X

X

X

X

vii

X

X

X

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

Inventories

X

X

Prepaids

Capital assets (all)

X

X(amortization, etc.)

Investments

X

X*

X*

X*

X

X(revenue rec.)

Other assets

X

X*

Accounts & notes payable X

X*

X

Other current liabilities

X

Long-term debt

X

X

X

X

X

Future income tax

X

Non-controlling interest

X(cons. policy)

Share capital

X

X

Retained earnings

X

*if applicable; note that marketable securities should be valued at market value

Note disclosures:

i. Financial instruments; disclosure of terms and conditions.

ii. Financial instruments; disclosure of interest rates, including effective rate.

iii. Financial instruments; disclosure of credit risk.

iv. Financial instruments; disclosure of fair value by class.

v. Breakdown of accounts aggregated to arrive at a balance sheet total.

vi. Disclosure of accounting policy.

vii. Details of changes during the period.

Assignment 4-13 (WEB)

Requirement 1

Vantage Electronics Corporation

Balance Sheet

31 December 20x5

Assets

Current assets:

Cash..........................................................................

Accounts receivable (trade) .....................................

$12,400

Less: Allowance for doubtful accounts

($12,400 × 5%) ................................................

620

Merchandise inventory ($17,000 – $1,000 – $500) .

Office supplies inventory .........................................

Total current assets ................................

Investments and funds:

Advance on purchase of land ...................................

Capital assets:

Land ($6,400 – $1,000) ............................................

5,400

Equipment ($22,400 4 = $5,600) × 10 .................. $56,000

Less: Accumulated amortization

($56,000 × 6/10) .............................................. 33,600 22,400

Building ($7,600 19 = $400) × 25 ........................ 10,000

Less: Accumulated amortization

$15,000

11,780

15,500

500

42,780

1,000

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

($10,000 × 6/25) ..............................................

Total capital assets .................................

Deferred charges ............................................................

Other assets:

Due from officers ($15,000 – $12,400) ...................

Total assets .............................................

2,400

7,600

35,400

1,100

2,600

$82,880

Liabilities

Current liabilities:

Accounts payable (trade) .........................................

Interest payable ($8,000 × 10% × 9/12) ..................

Notes payable, 10% interest .....................................

Total current liabilities ...........................

Shareholders’ Equity

Contributed capital:

Common shares, no-par, 2,500 shares outstanding..

Retained earnings* .........................................................

Total shareholders’ equity............................

Total liabilities and shareholders’ equity.

$ 5,500

600

8,000

14,100

$38,500

30,280

68,780

$82,880

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

* Computation of retained earnings:

$32,500

(1,000)

(620)

(600)

$30,280

balance given

reduction for inventory overstatement

reduction for bad debt expense (allowance for doubtful accounts)

reduction for interest expense

corrected balance

Requirement 2

The balance sheet would have a total for assets minus liabilities if the net asset approach

were used: $82,880 – $14,100 = $68,780. This amount represents the net assets of the

company, or the shareholders’ equity.

The balance sheet would list assets on the left and liabilities and equities on the right if it

were an account form balance sheet.

Assignment 4-17 (WEB)

Requirement 1

1. The date in the heading should be “(At) 31 December 20x5”.

2. The caption “Current” should be “Current assets”.

3. The allowance for doubtful accounts should be shown as a deduction from accounts

receivable, rather than as a liability.

4. “Merchandise” should be “Merchandise inventory”.

5. “Supplies” should be “Supplies inventory”.

6. Shares of an investee company should be reported under the caption “investments

and funds”unless held as short-term investments.

7. There should be a caption “Total current assets”.

8. The “Loan to shareholder” is an investment or an “other asset.”

9. The caption “Tangible” should be “Land, building and equipment,” “Capital assets”

or “Property, plant and equipment.”

10. Because land is not subject to depreciation, it should be reported separately.

11. “Reserve for depreciation” should be titled “Accumulated amortization”.

12. Prepaid expenses are not deferred charges. Prepaid expenses are a current asset.

13. The caption should be “Total assets” rather than “Total”.

14. The major equity captions should be “Liabilities and Shareholders’ Equity”; not

“Debt and Capital”.

15. The caption “Current” should be “Current liabilities”.

16. “Reserve for future, deferred income tax” should be “Future (deferred) income tax

liability”. It is a liability.

17. “Customers’ accounts with credit balances” can be included in accounts receivable

(net) only because the amount ($100) is immaterial.

18. “Fixed” should be “Long-term liabilities”. Do not need to include that interest was

paid at year’s end.

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

19. Maturity date for mortgage note payable should be shown.

20. “Mortgage” is an inadequate title; it should be “Mortgage note payable”.

21. Reserve for bad debts should be called “Allowance for doubtful accounts”. Also see

3. above; Allowance for doubtful accounts is a contra to accounts receivable.

22. “Total liabilities” (caption and amount) should be shown. A caption “Shareholders’

Equity” is needed instead of “Capital”.

23. The caption “Contributed capital” should be used.

24. Preferred shares represent an obligation to pay out cash; they should be shown as a

long-term liability.

25. The number of common shares authorized, issued, and outstanding should be shown.

26. Donated capital should be titled “Contributed capital” and should be included in the

contributed capital section of shareholders’ equity.

27. “Total contributed capital” (caption and amount) should be shown.

28. “Earned surplus” should be “Retained earnings”.

29. A final caption is needed for “Total liabilities and shareholders’ equity”.

Requirement 2

Blackstone Tire Corporation

Balance Sheet

31 December 20x5

Assets

Current assets:

Cash..............................................................................................

$ 23,000

Short-term investments ................................................................

10,000

Accounts receivable (trade)* ....................................................... $14,900

Less: Allowance for doubtful accounts.................................

900

14,000

Merchandise inventory.................................................................

31,000

Supplies inventory .......................................................................

5,000

Prepaid expenses ..........................................................................

5,000

Total current assets ................................................................

88,000

Investments and funds:

Shares of Wilmont Company, at cost ..........................................

17,000

Capital assets:

Land ............................................................................................. 10,000

Building...................................................................... $76,000

Less: Accumulated amortization......................... 40,000

36,000

Equipment .................................................................. 20,000

Less: Accumulated amortization......................... 15,000

5,000

Total land, building, and equipment ...............................

51,000

Other assets:

Loan to shareholder......................................................................

82,500

Total assets .............................................................................

$238,500

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

Liabilities

Current liabilities:

Accounts payable (trade) .............................................................

Long-term liabilities:

Bonds payable, due 20x9, 8.5% ...................................................

Mortgage note payable, due date**, 11% ....................................

Preferred shares with guaranteed redemption date, 20x9.

Authorized and outstanding, 6,000 shares. ............................

Future income tax liability ...........................................................

Total liabilities .............................................................................

Shareholders’ Equity

Contributed capital:

Common shares, no-par, authorized 10,000 shares,

xxx ** shares issued................................................................

Contributed capital – donated capital .......................................

Total contributed capital .....................................................

Retained earnings ......................................................................

Total shareholders’ equity...................................................

Total liabilities and shareholders’ equity ......................

$ 16,000

45,000

12,000

50,000

17,000

140,000

67,000

9,000

76,000

22,500

98,500

$238,500

*$15,000 less customer accounts with credit balances of $100. The $100 may also be

disclosed as accounts payable.

**Unknown, must be disclosed.

Some students may also point out that the current portion of long-term liabilities, if any,

must be reclassified.

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod