annual report

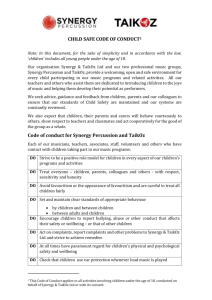

advertisement