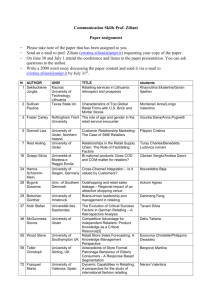

An empirical study on consumer preferences while

advertisement