File - Michelle Hwang

advertisement

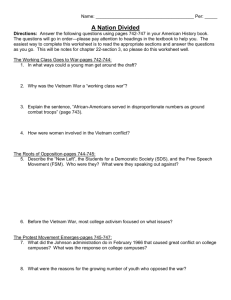

2.2 Vietnamese market 2.2.1 Vietnamese economic review Following the progression of its 2006 entry into the WTO, Vietnam’s economy continues to perform high growth and therefore, has been considered as the second fastest growing economy in Asia, just behind China. Foreign direct ivestment is still burgeoning here with the reach to over US$13 billion in 2007, and a continuous raise of 8.3% since 2006, which is US$1 billion higher than earlier expected. In the manufacturing sector, Vietnam has many Industrial Zones which provides streamlined investment In the manufacturing sector, Vietnam has many Industrial Zones which offer streamlined investment procedures and attractive tax incentives with a vast number of Open Economic Zones being introduced. Vietnamese workers are well- known as hard working, skillful, and the level of wage is still low. In addition, Vietnam has one of the highest literacy rates in the world, with Vietnamese Romanized alphabet allows the people to learn English quickly, which is often cited by investors as an advantage in Vietnam. Vietnam has major ports in the north (Hai Phong), central region (Danang) and the south (Ho Chi Minh City) and streamlined export procedures. All of these factors lead to an environment where manufacturing activities can thrive. In recent years, the garment industry in Vietnam has seen explosive growth, and clothes from Vietnam can be found at most retail clothing stores in the United States. Vietnam’s retail sector is coveted by the world wide retail distributors and companies dealing in consumer goods, as well as by foreign media and entertainment conglomerates. The reason lies in a population of 84 million consumers (which stands as the 12th most populous country in the world), half of whom are under the age of 25 that have more and more expendable income due to the improving economy. Luxury goods brands such as Louis Vuitton or ESPRIT have opened up stores in many major cities, and fast food giants such as Kentucky Fried Chicken and Pizza Hut are quickly expanding in Vietnam. Supermarket projects are among some of the most successful projects in these recent years, with the appearances of Metro and Big C/Bourbon constructing and operating very successful big box stores in major cities. In the tourism and property development sector, Vietnam is always known as “The Pearl of the Orient”. Major hotel projects and condominium/villa construction projects are going forward in all major cities and in many vacation spots along the coast, such as in Nha Trang, Vung Tau, Danang and Hoi An. Hilton and Sheraton own and/or operate major hotels in the country. The strength of the tourism industry and economy is apparent in the fact that hotel and airline reservations are often difficult to make unless made well in advance. Office projects and serviced apartment projects are also seeing significant investment due to the 99% occupancy rates in Hanoi and Ho Chi Minh City which has led to high rental prices of US$30-US$40 per square meter for prime space. Mid-level prices check in at US$17-US$25 per square meter. VOV News Looking briefly at the Vietnamese economy, few notable statistic number could be seen. With the strong FDI flow at approximately US$58.3 billion of registered capital YTD, banks loosening credit tie for construction loands and individuals , lending rate at 15% decreasing from 21%, deposit rate at 14% decreasing from peak 20% and the base rate 12% down from peak 14%, the current situation of Vietnam economy pointed out the decreasing in CPI during the last few months. The reason for this situation is from the impacts of global economy crisis, together with stock market fluctuation and diversification, spreading risks, global unemployment and MNCs headcounts under review. In the other hand, the shift of potential capital from developed markets to developing markets and opportunities offered by international investors lead to a higher FDI flow at around US$60 billion. Bill US FDI PROJECTS LICENSED IN 1988-2008 In macro, Vietnamese market has significant changes from planning to market system, such as the change from state dominance towards multi- players as state, private, foreign… and opening to the world market, together with increasing trend of industrialization and urbanization, steep increase in income and consumption from US$200 annually in the early 90s to US$500 in 2004. Economic growth rate (%) 2.2.2 Vietnamese retail market The rapid growth in Vietnam's retail market in the recent past has made the country an attractive destination for multinational retailers. Vietnam has continued its dominance in the top 10 emerging retail markets across the globe, as per Global Retail Development Index. However, Vietnam has moved down five places to sixth position in 2009 index from the topmost slot in 2008, but despite this Vietnam remains attractive destination for retail investment due to its strong GDP growth, changes in the country's regulatory structure favoring foreign investors, and increasing consumer demand for modern retail concepts, says 'Vietnam Retail Analysis (20082012)', a research report. The retail sector market in Vietnam is much smaller as compared to other developing economies in Asia, but it has shown strong fundamentals and buoyant expansion in comparison of its neighbors like India and China. The value of retail sales in Vietnam has expanded rapidly over the past few years. It reached nearly US$ 39 Billion in 2008 from around US$ 23.7 Billion in 2005 on account of rising consumer expenditure and changing market dynamics. Government support and favorable consumer confidence will result in positive outlook for retailers in Vietnam. Traditional retail channels will continue to dominate the market, but government decision to allow 100% entry to foreign retailers under WTO commitment will lead modern retail to realize unrealistic growth. With such strong fundamentals, we anticipate the retail industry to surpass US$ 85 Billion in revenues by 2012. Modern retail channels are expected to play crucial role in the future growth of the industry, improving their position in the market. Retail Statistics Total retail sales of goods & services: US$42.5 billion > US$ 45 billion retail sales in 2007 and growing around 20% annually � Consumer spending expected to hit > US$ 60 billion in 2010 2.1 Conclusion International retailers have not altered their long term growth strategy in Asia and are aiming to further penetrate markets across the region particularly in emerging economies such as China, India and Vietnam. However such companies are expected to be highly prudent when it comes to choosing locations and will budget rental expenditure with great caution. The research conducted by PricewaterhouseCoopers LLP(PwC) , published in the UK’s Economic Outlook magazine in an article named “Which are the largest city economies in the world and how this might change by 2025”, provided estimates for the growth of GDP in the world’s major city economies from 2008 to 2025. It covered 151 cities around the world, including Vietnam’s two biggest cities, namely Hanoi and Ho Chi Minh City. It also ranks the growth of GDP by taking into account the impact of the current economic downturn and a potential de-globalisation scenario. According to PwC’s estimates, the GDP of the world’s 100 largest cities accounted for approximately 30 percent of global GDP in 2008, while the top 30 cities alone accounted for around 18 percent of the world’s GDP. Tokyo in Japan, New York, Los Angeles and Chicago in the US and London in the UK came top of the list. PwC projected that by 2025 the fastest climbers within the top 30 largest urban economies would be Shanghai in China , moving into the top 10 from being 25th in 2008 to 9th in 2025. Mumbai in India is also expected to make a significant jump from being 29th in 2008 to 11th in 2025. Both Hanoi and HCM City will be two of the more notable climbers in the 2025 list. HCM City is expected to leap into 64th position from 95th and Hanoi from 116th in 2008 to 82nd in 2025. Vietnam’s two major economic hubs, Hanoi and Ho Chi Minh City, will lead the global list of fastest growing GDP in 2008-2025, according to a recent study by the U.K.’s PricewaterhouseCoopers (PwC In terms of economic growth during the 2008-2025 period, Hanoi and HCM City will come first and second in the top 30 fastest growing cities with an annual average GDP growth rate of 7 percent over that period. There are no advanced city economies represented in this list, when compared to Vietnam’s two top cities and 12 will be Indian and nine Chinese. This clearly shows that global economic power is shifting towards emerging markets. “At present, the mega-cities of the major developed economies continue to lead the global GDP rankings,” said the General Director of PwC Vietnam, Ian S. Lydall, “Only seven emerging economy cities are currently in the top 30 but our illustrative projections suggest that they will all move up the GDP rankings by 2025 and enter the top 30”. He added: “We expect large emerging market cities such as Hanoi and HCM City to grow at a faster rate, between 6-7 percent per annum, than the cities in advanced economies, 2 percent, leading to cumulative growth of up to almost 200 percent over the 2008-2025 period. This is in contrast to cities from advanced economies whose cumulative growth will be only around 35 percent.”/. MPI At this time, more established banking network with facilities or modern point of sales appear, which helps retailers expand to be more accessible with each district in Hanoi and Hochiminh city are easy to host a large hypermarket and department store, helping consumers to save travelling time for their shopping needs. Also the traditional retail formats like street stalls, shop houses are still being highly prominent in developing countriest including China, Indonesia, Philippines and Vietnam. Those are the factors that make the potential for modern retail format’s growth being considered as high. In order to have a more specific view of the emergence of Vietnamese retail market, a brief detail of Hanoi retail market, as the leading retail market of the country, is being provided below. GROWING RETAIL SALES – Hanoi Hanoi Income per capita reaches approximately US$1,900 , increasing 23% year on year 2008 Also for a future prediction, Hanoi’s population shall increase to 3% at growth rate in 2011. Also by 2011, the visitor arrivals number is predicted to reach 11 million. About the Hanoi retail stock, the total stock reaches approximately 100,000sm GLA within 13 shopping centres and department stores at this moment, which are mostly located in the centre areas such as Hoan Kiem district or Hai Ba Trung district. The occupancy rate rise to around 90% with the centre located shopping centres are fully occupied, only the rental centres in inferior locations encounter vacancies. The rental rate in Hanoi reach to US$25US$60/sqm/month in non centred locations and US$65- US$130/sqm/month for centre locations renting, which then lead to an affordable and sustainable rental cost ratio to sales for most retailers. For future prediction, the considerable number of approximately 41,496sqm is given for 2010 and 330,251sqm retail space is given for 2011. Most of the future retail centers are being located around My Dinh area. The future complexes and shopping malls are predicted to have larger size with the average size at around 28,633sqm and the largest shopping mall is believed to be Ciputra shopping mall with 120,000sqm which will be finished in 2011. Ongoing shortage of modern, quality retail space will continue to sustain retailers’ demand for shop houses with those ones in central location can be as high as US$110/sqm/month Both local and international retailers will continue to strengthen their presence to increase market share. Due to A.T. Kearney’s Annual list of emerging report, Vietnam scores the highest mark for country risk and time pressure, lowest mark for market attractiveness and the second highest for market saturation, which brought Vietnam to the top of this list with the changing rate at +3 while the other emerge markets’ changing rates are mostly at -1. This is because of the rapidly growing per capita income, the drastic opening up of regulations for new entry, the absence of competition, the strong GDP growth rate and the young population with increased spending power of Vietnam. About the ranking of Vietnam, chosen by the Asia Retail Journal through voting by readers and supply chain industries, based on the primary criteria of overall sales turnover and sales turnover per sqm, Vietnam again get a good position as being in the top 500 retailers for the year, top 10 retailers in each market, top 10 retailers in each of several retail formats, “best of best”- added criteria in shop design and layout, staff training, merchandising, customer satisfaction, etc. About the Vietnamese food retail market, there is an increasing number of stake- holders in food retail sector from state dominance to multi- players, with the new actors as the private sector is on the rise such as the case of Trung Nguyen coffee or Future generation tea, the entering of foreign corporations like Metro and the standardization process of quality and price. Vietnamese food retail market is a complex market with both traditional and modern methods existing at the same time. There are 9000 traditional markets, 160 supermarkets and 32 trade centers take part at the moment with various scale from small to large, using techonological methods like PC, storing, refrigerator systems, etc. together with big differences in price and quality. Also the management models are different between family and company, and the safeness problems is the biggest problem for this complex market as the quality control in farming activities and sale are uncontrolled, for example, in Hochiminh City around 80% processed food in traditional market is unsafe. However, the modern food retail sector is believed to increase with a rapid pace with 45 supermarkets in Hochiminh City and 25 supermarkets in Hanoi.

![vietnam[1].](http://s2.studylib.net/store/data/005329784_1-42b2e9fc4f7c73463c31fd4de82c4fa3-300x300.png)