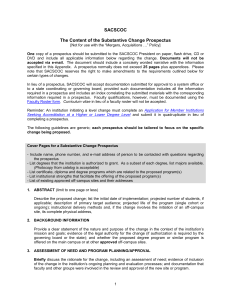

Full Press Release in relation to the issue of the Guidelines

advertisement

SFC PRESS RELEASE 21 February 2003 TO THE BUSINESS EDITOR FOR IMMEDIATE RELEASE Guidelines to Facilitate Offers of Shares and Debentures The SFC announces the gazettal today of three sets of guidelines facilitating offers of shares and debentures. The guidelines are made in response to market requests after taking into account investor protection considerations. They have been developed in close consultation with members of the Working Group on Debt Market and the Securities Offering Issues sub-group of the Government’s Financial Market Development Task Force (Note 1) and other securities market practitioners. The guidelines constitute a facilitative interpretation of particular provisions of the current prospectus regime and make adjustments to current market practices and procedural requirements in order to facilitate the conduct of a public offering of shares or debentures. No legislative changes are required for their implementation. The SFC will continue to work with market participants to identify and remove restrictions and bottlenecks under the existing statutory and regulatory regimes in respect of securities offerings. The three guidelines, which have become effective immediately, are described below. 1. Guidelines on use of offer awareness and summary disclosure materials in offerings of shares and debentures under the Companies Ordinance These guidelines relate to the content and manner of publication of certain publicity and disclosure materials that may be issued to the public in Hong Kong in connection with an offer of shares or debentures made by a prospectus. The guidelines clarify the SFC’s view regarding the treatment of such materials. Offer awareness materials The SFC considers that certain publicity materials that are issued by the issuer of a prospectus and designed only to raise investor awareness of a public offer of shares or debentures will not constitute a prospectus or an extract from or abridged version of a prospectus within sections 2 and 38B, respectively, of the Companies Ordinance (CO), or a prohibited advertisement within section 4(1) of the Protection of Investors Ordinance. SFC Website: http://www.hksfc.org.hk Electronic Investor Resources Centre: http://www.hkeirc.org Such materials may assist the issuer in the efficient conduct of the offer and facilitate greater retail investor participation. Potential investors would have more time to arrange their financial and other affairs in order to participate in an offer. In the guidelines, the SFC specifies requirements concerning the form and manner of publication for such publicity materials. They must be strictly limited to giving procedural and administrative information regarding the offer, and should not promote the issuer or the offer. Certain legends clarifying that the publicity material does not constitute an offer and warning potential investors to read the prospectus for detailed information before making an investment decision will be required. The guidelines recommend that publicity of this kind should not be issued earlier than 14 days before the launch of an offer. Materials that comply with the prescribed requirements will constitute “offer awareness materials” for the purposes of the guidelines. The SFC does not intend to pre-vet such materials. Summary disclosure materials The SFC also considers that disclosure materials issued by the issuer of a prospectus that summarise or highlight key information concerning a public offer should be encouraged. These materials, commonly described as mini-prospectuses or fact sheets, are likely to help investors understand the information contained in the prospectus. The SFC considers that these documents will normally amount to an extract from or abridged version of a prospectus, rather than a full prospectus. They therefore will not need to be registered with the Registrar of Companies. However, such documents must be expressly authorised by the SFC prior to issue. In the guidelines, the SFC specifies requirements concerning the form and manner of publication for summary disclosure materials. The guidelines provide, among other things, that summary disclosure materials should not include any substantive information not contained in the full prospectus and should contain a clear statement as to whether they contain a fair summary of the prospectus information. Certain legends clarifying that the disclosure material does not constitute an offer and warning potential investors to read the prospectus will be required. SFC Website: http://www.hksfc.org.hk Electronic Investor Resources Centre: http://www.hkeirc.org The guidelines would allow mini-prospectuses and fact sheets to be made available or distributed from the time of issue of the prospectus. 2. Guidelines on using a “dual prospectus” structure to conduct programme offers of shares or debentures requiring a prospectus under the Companies Ordinance (Cap. 32) The guidelines outline the SFC’s regulatory approach with respect to offers of shares or debentures on a “repeat” or “programme” basis using separately registered programme and issue prospectuses. The CO does not expressly provide for repeat or programme offering structures which enable offers to be made on a continuous basis or through successive tranches. It makes no concession for offers where prospectuses may be issued frequently or in the ordinary course of a company’s business (and in particular by the financial industry). It does not expressly contemplate the filing of an offer-specific “issue” section of a prospectus, which updates a document (namely, the “programme” section of the prospectus containing, among other things, financial and other generic information on the issuer, the mechanics of the programme and risk factors) that was previously registered. The guidelines describe a “dual prospectus” structure which allows registration of the programme section and issue section as separate prospectuses, referred to as the “programme prospectus” and the “issue prospectus”. The structure will facilitate continuous offerings of shares and debentures, by removing the need to re-register the document containing the programme information. This reduces administrative hurdles, such as the need to obtain a fresh copy of an expert’s consent to a report appearing in a programme prospectus. The guidelines include a number of investor protection safeguards to ensure investors receive all necessary information relating to an offer. For example, they provide that each issue prospectus and application form must draw attention to the existence of the programme prospectus and indicate where a copy may be obtained. Issuers of prospectuses must also make adequate arrangements to ensure potential investors have convenient and timely access to all constituent prospectuses, free of charge, and that application instructions are not accepted without investors’ confirmation that they have read or had access to all constituent prospectuses. SFC Website: http://www.hksfc.org.hk Electronic Investor Resources Centre: http://www.hkeirc.org 3. Guidelines on applying for a relaxation from procedural formalities to be fulfilled upon registration of a prospectus under the Companies Ordinance (Cap. 32) The CO provides that for the purpose of authorising registration, a prospectus must be printed on A4 paper of a certain thickness and weight. Consent to the issue of the prospectus from any person as an expert is also required. The current practice is to submit to the SFC (or the Stock Exchange, in the case of listed offerings) the definitive prospectus (being the version that is distributed to the public) satisfying these requirements together with the original of any expert’s consent letter. Market practitioners have commented in some cases that, because of their particular arrangements for printing the definitive prospectus or the use of overseas-based experts, the requirements introduce an additional level of complexity into the process. The guidelines aim to address these concerns. The guidelines set out relaxations which will apply if the issuer or its adviser satisfies the SFC that administrative difficulties will otherwise unjustifiably result. In such cases, faxed copies of experts’ consent letters and a bulk print proof (being the version approved by the issuer for bulk printing) of the prospectus may be accepted for registration under the CO. The relaxation will assist those issuers that encounter timing difficulties at the stage immediately preceding registration of a prospectus. All three Guidelines are available at the SFC office and can be downloaded from the SFC website. Ends Notes to Editor: 1. The Working Group on Debt Market was established in December 2001 to pursue initiatives for the development of the retail debt market and reports to the Financial Market Development Task Force, which is chaired by the Secretary for Financial Services and the Treasury. The Securities Offering Issues sub-group was set up under the Securities and Futures Market Development Working Group of the Task Force. 2. For enquiries, please contact C K Chan at 2842 7624 or Ernest Lau at 2840 9470. CC\03PR28 SFC Website: http://www.hksfc.org.hk Electronic Investor Resources Centre: http://www.hkeirc.org