accounting and finance - Bannerman High School

advertisement

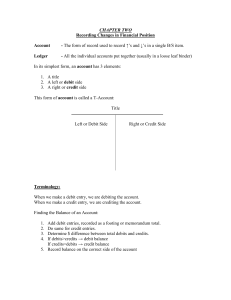

ACCOUNTING AND FINANCE ESSENTIAL STUDY GUIDE CONTAINING UNIT 4 REVISION NOTES 1 ACCOUNTING AND FINANCE Partnership UNIT 4A REVISION NOTES RATIO ANALYSIS - THE USE OF RATIOS TO ANALYSE PERFORMANCE We can assess how well a business or club is doing by calculating 5 ratios, using information from the final accounts. This process lets us compare: one year with another one business with another the performance of the business with the industry average Comparisons can be made on the basis of profitability, activity and liquidity (the ability of the business to pay its creditors on time). The Profitability ratios are: Formula What the result means Gross Profit Percentage = Gross Profit X 100 Net Sales What percentage of each pound of net sales is gross profit Net Profit Percentage Net Profit X 100 Net Sales What percentage of each pound of net sales is net profit Net Profit X 100 Capital at start What percentage investors get back on each pound invested Cost of Goods Sold Average Stock How many times average stock is replaced Current Assets Current Liabilities How many times current liabilities can be paid by with current assets = Return on Capital Invested = An Activity ratio is: Rate of Stock Turnover = A Liquidity ratio is: The Current Ratio/ Working Capital Ratio = As a generalisation, the higher the results of these ratios the better the organisation is doing, except for the Current Ratio which should be as close to 2:1 as possible. Lower indicates possible liquidity problems ie inability to pay creditors when due, higher, indicates that funds could be better used by purchasing/renewing equipment. The results of these ratios allow conclusions to be drawn about the strengths and weaknesses in the performance of the organisation and suggestions can be made as to how and where improvements can be achieved. This is usually done in a report. 2 ACCOUNTING AND FINANCE Partnership UNIT 4B REVISION NOTES Sole Trader businesses often struggle to compete with larger firms. The limited amount of capital they are able to raise prevents them growing big enough to compete with much larger firms. One solution to this problem is for the sole trader to form a Partnership with others who are willing to invest (contribute) capital in return for a share of profits. Advantages and Disadvantages to the Sole Trader of forming a Partnership Advantages: Disadvantages: More capital becomes available More expertise to run the business Can share the workload Need to share profits with other partners Need to consult other partners Need to have common goals PARTNERSHIP PARTNERSHIP AGREEMENT CAPITAL ACCOUNT APPROPRIATION ACCOUNT CURRENT ACCOUNT RESIDUAL PROFIT A business partnership is usually between 2 and 20 people, bound by a legal agreement, all working with the common aim of making profit. This legal agreement should cover any areas which could cause disagreements. The Partnership Agreement (Deed) is the legal document setting out: the name the partnership will trade under how much capital each partner is contributing what role each partner will play (what expertise they will specialise in eg accountant, legal matters, sales) the ratio in which profits and losses will be shared if any interest will be paid on Capital contributed if any interest will be charged on Drawings any salaries paid to partners – to whom and how much 3 ACCOUNTING AND FINANCE Partnership UNIT 4B REVISION NOTES HOW PARTNERSHIP STATUS AFFECTS THE ACCOUNTS 1 The Trading and Profit and Loss Account is followed by an Appropriation Account which shows how net profit is shared out between the partners. Here is an example of an Appropriation Account: PETERS AND CONNORS – LEGAL PARTNERS Appropriation Account for year ended 30 June £ £ Net Profit 98,000 Less Partnership Salary – Connors 5,000 Residual Profit 93,000 Share of Profit: Peters (3/5 x 93,000) 55,800 Connors (2/5 x 93,000) 37,200 93,000 Partnership salaries (as stated in the Partnership Agreement) are paid out of Net Profit first. This leaves Residual Profit which is divided according to the Partnership Agreement and is often in the same proportion as the Capital put in by the partners. 2 The Ledger contains a Capital Account and a Current Account for each partner. Each partner’s Capital Account is credited with the amount invested and debited with any capital the partner takes out eg on retirement. Here is a partner's capital account: CAPITAL ACCOUNT – CONNORS Date Details 2005 1 July Debit Credit Balance £ £ £ Balance 60,000 Cr Each partner’s Current Account is credited with anything the business is giving to the partner eg salary, share of profit, interest on capital and debited with drawings the partner takes during for year, interest paid on those drawings and share of any losses. Here is a partner's current account: CURRENT ACCOUNT - CONNORS Date Details Debit 2005 1 July £ Credit £ Balance b/f Balance £ 6,000 Cr 2006 30 June Salary 30 June Share of Profit 30 June Drawings 5,000 4 5,000 11,000 Cr 37,200 48,200 Cr 43,200 Cr ACCOUNTING AND FINANCE Partnership UNIT 4B REVISION NOTES A final credit balance on the Current Account represents value the partner is able to take out of the business at the end of the year. Partners sometimes leave all or part of the credit balance as additional finance for the business and this is carried forward to the following year. When a Current Account has a debit balance it is because the partner has taken out more than entitled to and represents what the partner owes the business. The credit balances on all the partners' capital and current accounts represent investment in the business and are therefore transferred to the 'Financed by' section of the Balance Sheet at the end of the accounting year. 3 The Balance Sheet for a Partnership PETERS AND CONNORS - LEGAL PARTNERS BALANCE SHEET AS AT 30 JUNE Fixed Assets: £000s £000s Premises Machinery Current Assets: Stock Debtors less Provision (15,000-1,000) Cash Less Current Liabilities: Bank Overdraft Accruals Creditors 3 1 7 20 14 4 38 11 Financed By: Capital Account Balances: Peters Connors Current Account Balances: Peters Connors 90 60 5 43 5 £000s 120 50 170 28 198 150 48 198 Money columns are often headed up 'thousands of pounds' to save entering all the zeroes in large amounts These are the closing balances on the individual Capital and Current Accounts from the ledger ACCOUNTING AND FINANCE Partnership UNIT 4B REVISION NOTES CORRECTION OF ERRORS Errors can be grouped into 2 main categories – those not revealed by the Trial Balance and those revealed by the Trial Balance. ERRORS NOT REVEALED BY THE TRIAL BALANCE These are mistakes made in the ledger accounts that affect both a debit and a credit balance, so the columns in the Trial Balance agree but each mistake discovered should be corrected by means of a double entry in the appropriate ledger accounts. These types of errors can be errors of: Omission – where a document/transaction has been missed out completely Commission – where the debit and credit is correct but in the wrong person's account Principle - where the wrong class of account has been used eg an asset account instead of an expense account Original Entry – where an error has been made reading the amount from the source document A Compensating Error – when 2 separate errors for the same amount cancel each other out A Complete Reversal of Entry – where the correct amounts have been entered in the correct accounts but round the wrong way. You need to 'double up' the amount to correct this kind of error. Here is an example of an error of commission and how to correct it. Remember this error would not have shown up when doing the Trial Balance. £300 paid to us by J Smith (a debtor), has been credited to T Smith account. (We must assume the bank account part of the double entry is correct but the wrong debtor’s account has been credited). To correct this error, in the ledger: Debit T Smith - to take out the £300 wrongly credited and Credit J Smith - to correctly record the payment made as it should have been done in the first place 6 ACCOUNTING AND FINANCE Partnership UNIT 4C REVISION NOTES ERRORS REVEALED BY THE TRIAL BALANCE Errors in the ledger which cause the Trial Balance columns not to agree, are errors which affect only one account involved in the double entry. Here is an extract from a Trial Balance which fails to balance and the process to correct it. Trial Balance of E Bunyan as at 31 December Debit £ (Totals after all accounts have been listed) 189,000 Suspense Account 3,000 192,000 Credit £ 192,000 ______ 192,000 E Bunyan’s Ledger Date Details Suspense Account 31 Dec Balance Debit Credit Balance £ 3,000 £ £ 3,000 Dr The Trial Balance is made to agree by making an entry called 'Suspense Account' with a value sufficient to balance the 2 columns a Suspense A/c is opened in the ledger with a balance to that value The following errors are then discovered: The Sales Account has been underadded by £1,000 A cheque paid to a creditor, Adams, was entered correctly in the Bank A/c for £2,000 but in Adams' account as £200 Purchase of a second hand van on credit for £3,500 was entered in the creditor's account but not entry was made in the Motor Vehicle account A payment for £1,300 Rent was entered in the Rent account but no entry had been made in the Bank account E Bunyan’s Ledger To correct these 'single account errors', use the Suspense A/c to complete the double entry as follows: Credit Sales A/c Debit Adams A/c Debit M.Veh A/c Credit Bank A/c Date Details Suspense Account 31 Dec Balance 31 Dec Sales 31 Dec Adams 31 Dec Motor Vehicle 31 Dec Bank 7 Debit Credit Balance £ 3,000 1,000 £ £ 3,000 Dr 4,000 Dr 2,200 Dr 1,300 Cr ----- 1,800 3,500 1,300 8 9