CHAPTER TWO NOTES

CHAPTER TWO

Recording Changes in Financial Position

- The form of record used to record

↑ ’s and ↓

’s in a single B/S item.

Account

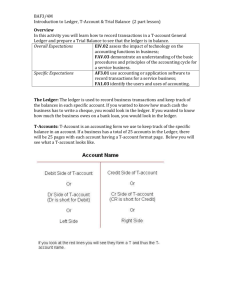

Ledger - All the individual accounts put together (usually in a loose leaf binder)

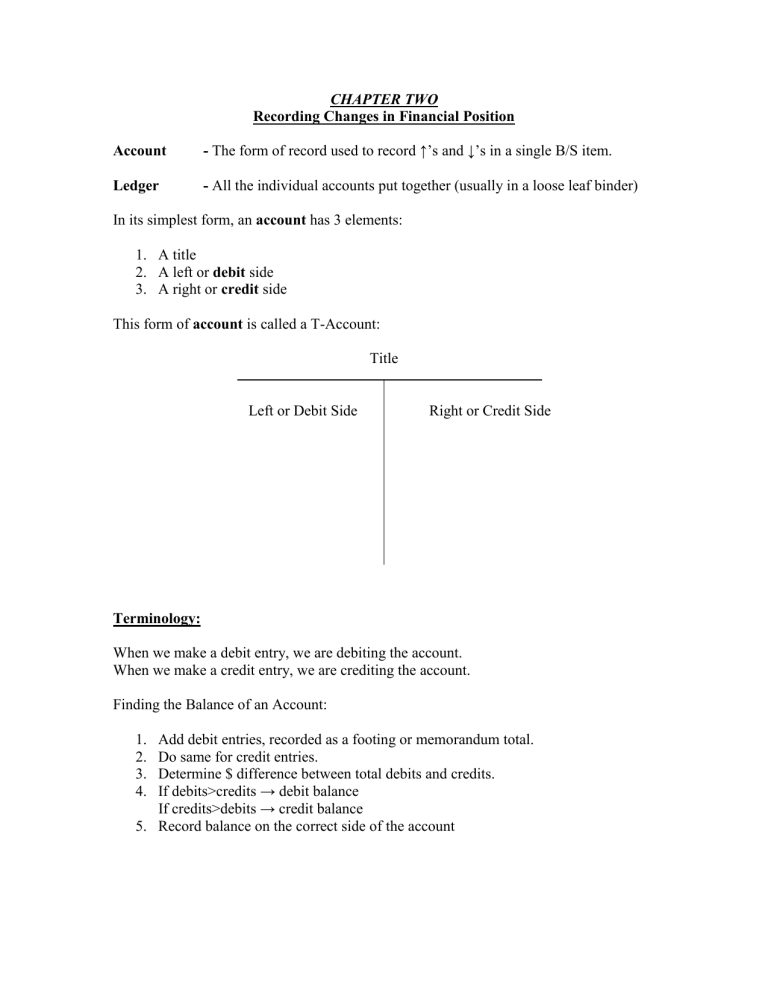

In its simplest form, an account has 3 elements:

1.

A title

2.

A left or debit side

3.

A right or credit side

This form of account is called a T-Account:

Title

Left or Debit Side Right or Credit Side

Terminology:

When we make a debit entry, we are debiting the account.

When we make a credit entry, we are crediting the account.

Finding the Balance of an Account:

1.

Add debit entries, recorded as a footing or memorandum total.

2.

Do same for credit entries.

3.

Determine $ difference between total debits and credits.

4.

If debits>credits → debit balance

If credits>debits → credit balance

5.

Record balance on the correct side of the account

Debit or Credit Entry:

LEFT

A =

Dr/Cr

+/-

L

Dr/Cr

-/+

RIGHT

+ OE

Dr/Cr

-/+

Increase/Decrease Decrease/Increase Decrease/Increase

EFFECTS OF BUSINESS TRANSACTIONS ON THE BALANCE SHEET

Steps to analyzing transactions:

1.

Which accounts are affected? (there are always at least 2)

2.

Increase or decrease fro each account?

3.

Amount?

4.

Does equation (A=L+OE) still balance?

Running Balance Form of Ledger Account

T-Account → used for illustrative purposes.

In practice, however, we need more information than a T-account provides

We use a running balance form of ledger account as is illustrated on pg. 59

Normal Balance of an Account pg. 59

Asset → Dr

Liability → Cr

Equity → Cr

On account page, if balance is “normal” we don’t need to write Dr or Cr.

Sequencing and Numbering of Ledger Accounts

Accounts are arranged in ledger in Financial Statement order.

1.

Assets

2.

Liabilities

3.

Owner’s Equity

4.

Revenue

5.

Expenses

A – All

L – Little

C- Cars

D- Drive

R- Really

E- Efficiently

Chart of Accounts

A listing of the account titles and account numbers being used by a given business.

The Journal or Book of Original Entry

Where each transaction is originally recoded.

A chronological record of transactions

Organized by “transactions” whereas the ledger is organized by

“accounts”

This offers several advantages (pg. 61)

General Journal

A business may have many journals. The simplest type is called a general journal. It has two columns (Dr & Cr) and may be used for any type of transaction.

Journalizing pg. 62-64

The process of recording a transaction in a journal.

Posting pg. 64-67

The process of transferring the debts and the credits from the general journal to the proper ledger accounts

The Trial Balance

Before preparing financial statements, one should prove that the total of accounts with debit balances is equal to the total of accounts with credit balances. This proof is called a “Trial Balance”.

T/B = a two column schedule listing the names and balances of all the accounts in the order in which they appear in the ledger (F/S order).

Example, see p. 68.

Uses & Limitations of the Trial Balance

T/B proves only that D = C. It does not prove that transactions have been correctly analyzed and recorded in the proper accounts.

To locate errors when T/B does not balance, follow the steps on pp. 69 –

70.

Double-Entry Accounting

For every transaction, the total $ amount of debit entries must equal the total $ amount of credit entries.

This is called the Double-Entry system of accounting

Example:

Purchase equipment worth $20,000

Pay $5,000 cash and issue a $15,000 note payable

Analysis: Dr Cr

Dr Equipment $20,000

Cr Cash

Cr Note Payable

$5,000

$15,000

$20,000 = $20,000

Dr = Cr

Recording Transactions in Ledger Accounts

Refer to pages 56-58 for detailed examples.

The Trial Balance pg. 68

Before preparing financial statements, one should prove that the total of accounts with debit balances is equal to the total of accounts with credit balances. This proof is called a trial balance.

Trial Balance a two-column schedule listing the names and balances of all the accounts in the order in which they appear in the ledger.

Uses and Limitations of Trial Balance pg. 68

The trial balance proves only that debits = credits. It does not prove that transactions have been correctly analyzed and recorded in the proper accounts.

To locate errors when the t/b does not balance, follow steps on pg. 69 – 70.

Dollar Signs

Not used → General Journal or Ledger

Used → Trial Balance

Balance Sheet

Income Statement

*Put a $ in front of the first and last total amount in each column

Decimal Points and Commas

Not used → Columnar Paper

Used → Unruled Paper (with even dollar amounts, use a dash in cents column)

The Accounting Cycle

1.

Record transactions in journal

2.

Post to ledger accounts

3.

Prepare a Trial Balance

4.

Prepare Financial Statements.