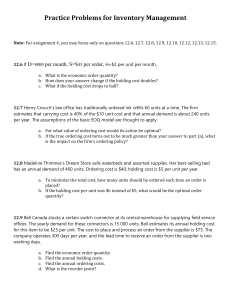

Farell is the purchasing manager for the headquarters of a large

advertisement

Farell is the purchasing manager for the headquarters of a large insurance company chain with a central inventory operation. His fastest moving inventory item has a demand of 6,000 units per year. The cost of each unit is RM100, and the inventory carrying cost is RM10 per unit per year. The average ordering cost is RM30 per order. It takes 5 days from an order to arrive, and the demand for 1 week is 120 units. The company works for 250 days per year. Assume Q system is being used: a. b. c. d. e. f. What is the EOQ? What is the average inventory if the EOQ is used? What is the optimal number of orders per year? What is the optimal number of week(s) in between any two orders? What is the annual cost of ordering and holding inventory? What is the total annual inventory cost, including the item’s cost? Old Town coffee shop in Damansara is open 200 days a year and sells an average of 75 pounds of Kona coffee beans a day. Demand is normally distributed with a standard deviation of 15 pounds per day. After ordering (fix cost= RM16 per order), beans are always shipped from Thailand within exactly 4 days. Per-pound annual holding costs for the beans are RM3. Assume Q system is being used: a. b. c. d. What is the EOQ for Kona coffee beans? What are the total annual holding costs of stock for Kona cofee beans? What are the total annual ordering costs for Kona cofee beans? Assume the management has specified that no more than a 1% risk during stockout is acceptable. What should the reorder point be? e. What is the safety stock needed to attain a 1% risk of stockout during lead time? f. What is the annual holding cost of maintaining the level of safety stock needed to support a 1% risk? g. If management specified that a 2% risk of stockout during lead time would be acceptable, would the safety stock holding costs decrease or increase?