Section 105 Medical Reimbursement Plan (MRP)

advertisement

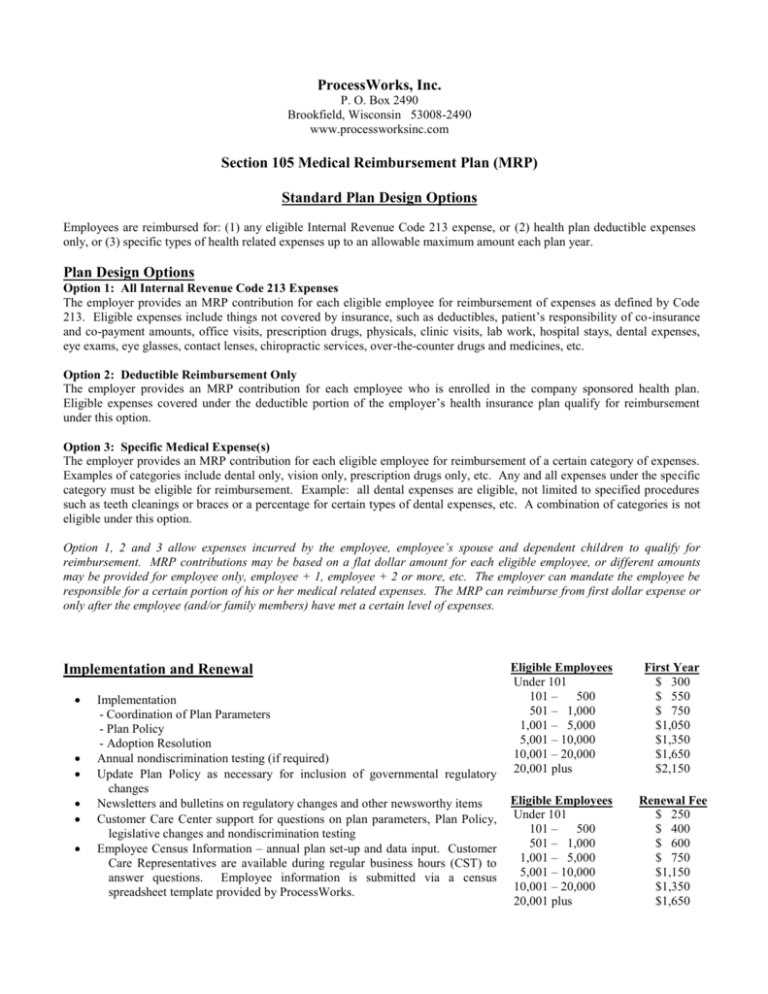

ProcessWorks, Inc. P. O. Box 2490 Brookfield, Wisconsin 53008-2490 www.processworksinc.com Section 105 Medical Reimbursement Plan (MRP) Standard Plan Design Options Employees are reimbursed for: (1) any eligible Internal Revenue Code 213 expense, or (2) health plan deductible expenses only, or (3) specific types of health related expenses up to an allowable maximum amount each plan year. Plan Design Options Option 1: All Internal Revenue Code 213 Expenses The employer provides an MRP contribution for each eligible employee for reimbursement of expenses as defined by Code 213. Eligible expenses include things not covered by insurance, such as deductibles, patient’s responsibility of co-insurance and co-payment amounts, office visits, prescription drugs, physicals, clinic visits, lab work, hospital stays, dental expenses, eye exams, eye glasses, contact lenses, chiropractic services, over-the-counter drugs and medicines, etc. Option 2: Deductible Reimbursement Only The employer provides an MRP contribution for each employee who is enrolled in the company sponsored health plan. Eligible expenses covered under the deductible portion of the employer’s health insurance plan qualify for reimbursement under this option. Option 3: Specific Medical Expense(s) The employer provides an MRP contribution for each eligible employee for reimbursement of a certain category of expenses. Examples of categories include dental only, vision only, prescription drugs only, etc. Any and all expenses under the specific category must be eligible for reimbursement. Example: all dental expenses are eligible, not limited to specified procedures such as teeth cleanings or braces or a percentage for certain types of dental expenses, etc. A combination of categories is not eligible under this option. Option 1, 2 and 3 allow expenses incurred by the employee, employee’s spouse and dependent children to qualify for reimbursement. MRP contributions may be based on a flat dollar amount for each eligible employee, or different amounts may be provided for employee only, employee + 1, employee + 2 or more, etc. The employer can mandate the employee be responsible for a certain portion of his or her medical related expenses. The MRP can reimburse from first dollar expense or only after the employee (and/or family members) have met a certain level of expenses. Implementation and Renewal Implementation - Coordination of Plan Parameters - Plan Policy - Adoption Resolution Annual nondiscrimination testing (if required) Update Plan Policy as necessary for inclusion of governmental regulatory changes Newsletters and bulletins on regulatory changes and other newsworthy items Customer Care Center support for questions on plan parameters, Plan Policy, legislative changes and nondiscrimination testing Employee Census Information – annual plan set-up and data input. Customer Care Representatives are available during regular business hours (CST) to answer questions. Employee information is submitted via a census spreadsheet template provided by ProcessWorks. Eligible Employees Under 101 101 – 500 501 – 1,000 1,001 – 5,000 5,001 – 10,000 10,001 – 20,000 20,001 plus First Year $ 300 $ 550 $ 750 $1,050 $1,350 $1,650 $2,150 Eligible Employees Under 101 101 – 500 501 – 1,000 1,001 – 5,000 5,001 – 10,000 10,001 – 20,000 20,001 plus Renewal Fee $ 250 $ 400 $ 600 $ 750 $1,150 $1,350 $1,650 Recordkeeping and Administration Employee Services Daily claims processing Weekly claims reimbursement frequency Choice of submitting claims by mail or fax Toll-free fax claims submission Short two-business day turnaround for claims processing Employee choice of direct deposit or paper check reimbursements Direct deposit advices via e-mail or mailed to employees’ homes (postage included) Paper checks mailed to employees’ homes (postage included) 24/7 employee account access via Internet Automatic e-mail notification of claims receipt or reimbursements Detailed explanation of benefits with each reimbursement Toll-free Customer Care Center support Employer Services Internet access to view participant account information On-demand reports via Internet Check register e-mailed or faxed weekly No check minimum (unless requested by employer) Check and deposit advice stock included Toll-free Customer Care Center support Paper submission of new hires, terminations, and other life event changes Electronic transfer of funds for payment of administration invoices Fee: $4.50/participant/month Monthly minimums: Under 21 eligible employees - $50 21-50 eligible employees - $75 51 or more eligible employees - $100 The above represents the minimum monthly recordkeeping and administration fees ProcessWorks must receive. Note: When an employer has an FSA and MRP plan administered by ProcessWorks, it is likely that some employees will participate in both plans. The standard recordkeeping and administration fee will apply to employees who participate in one plan. If an employee participates in the second plan, an additional fee of $2.00 per participant per month will apply. Additionally, the monthly minimum for the second plan is 50% of the first plan. Optional Services and Fees Debit Card – Employees with the debit card can also obtain one additional spouse/dependent debit card free of charge. Additional spouse/dependent cards are available for a one-time $5 fee for each card. Replacement cards are $5 for each reissuance. These fees are the responsibility of the employee and are payable by personal check. $1.50/month/cardholder Debit card services are available for MRPs that reimburse any Internal Revenue Code 213 expense, provided the MRP is the first level of reimbursement with no employee cost share prior to MRP benefits. The debit card is not available for any other type of MRP plan design. Preparation of signature-ready Form 5500 and Summary Annual Report (if required). $150 Direct mail of fourth quarter participant account balance notification statements to employees’ homes (no charge if statements are sent to employer for distribution). $.25/statement plus postage Amendments to current Plan Policy. $100/amendment All prices provided are based on a one year Service Agreement and are valid for a period of 60 days from the proposal date. ProcessWorks may bill for services rendered after written acceptance of this proposal should acceptance be cancelled prior to execution of a Service Agreement. Because of the unique nature of this information, we encourage you to share the contents with your legal counsel, finance office or business advisor. Consider this information proprietary. We request that your company not divulge any part of this information to representatives from other benefit-related firms. 4/05