Flexible Spending Account Examples Of Eligible And Ineligible

advertisement

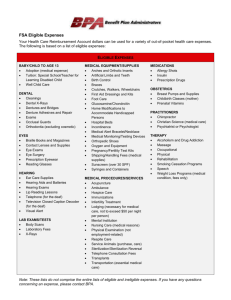

Flexible Spending Account Examples of Eligible and Ineligible Expenses under a Healthcare Reimbursement Account Your Healthcare Reimbursement Flexible Spending Account lets you pay for medical care expenses not covered by your insurance plan with pre-tax dollars. Eligible items must meet the definition of medical care under 213(d). Under this definition, “Medical care” means amounts paid for the diagnosis, cure, mitigation, treatment or prevention of disease or for the purpose of affecting any structure or function of the body. For example, the typical use of the item is to alleviate or treat personal injuries or sickness. Items that are merely beneficial to general health are not reimbursable. The products and services listed below are examples of medical expenses eligible for payment under your Healthcare Reimbursement FSA, to the extent that such services are not covered by your medical and dental insurance plan. This listing is not allinclusive and additional expenses may qualify. The items listed below are subject to change in accordance with IRS regulations. Dental Services 9 Crowns/Bridges 9 Dental Implants 9 Dental X-rays 9 Dentures 9 Exams/Teeth Cleaning 9 Extractions 9 Fillings 9 Gum Treatment 9 Occlusal Guard 9 Oral Surgery 9 Orthodontia/Braces 9 TMJ related expenses Insurance Related Items 9 Copay Amounts 9 Deductibles 9 Pre-existing Condition Expenses (medical) 9 Private Hospital Room Differential Lab Exams/Tests 9 Blood Tests 9 Cardiographs 9 Diagnostic 9 Laboratory Fees 9 Metabolism Tests 9 Spinal Fluid Tests 9 Urine/Stool Analyses 9 X-rays Medications 9 Prescription Drugs Obstetric Services 9 Childbirth Classes (Lamaze) 9 Midwife Expenses 9 OB/GYN Exams 9 OB/GYN Prepaid Maternity Fees (reimbursable after date of birth) 9 Post-natal Treatment/Pre-natal Treatment Practitioners 9 Allergist 9 Chiropractor 9 Christian Science 9 Dermatologist 9 Homeopath 9 Naturopath 9 Osteopath 9 Physician (licensed medical professional) 9 Psychiatrist / Psychologist Other Medical Treatments or Procedures 9 Abortion (legal) 9 Acupuncture 9 Alcoholism (inpatient treatment) 9 Drug Addiction 9 Hearing Exams 9 Hospital Services 9 Infertility 9 In-vitro Fertilization 9 Lasik/Laser and Vision Correction Including prescription glasses 9 Norplant Insertion or Removal 9 Patterning Exercises 9 Physical Examination (if not employment related) 9 Physical /Occupational Therapy 9 Rolfing 9 Smoking Cessation Programs 9 Speech Therapy 9 Sterilization 9 Transplants (including organ donor) 9 Treatment for Handicapped 9 Vaccinations/Immunizations 9 Well Baby Care Over the Counter Drugs 9 Allergy medicine 9 Antacids 9 Anti-diarrhea medicine 9 Cold medicine 9 Cough drops, throat lozenges, sinus medications, nasal sinus sprays 9 Diabetic Supplies 9 Items that used to be a prescribed drug and now available over the counter 9 Laxatives 9 Menstrual cycle products for pain and cramp relief 9 Motion sickness pills 9 Pain reliever 9 Pedialyte for ill child’s dehydration 9 Sleeping aids to treat occasional insomnia (note-if taken regularly will require medical practitioner’s note) 9 Suppositories and creams for hemorrhoids Other Medical Equipment Supplies, and Services 9 Abdominal/Back Supports 9 Acne Treatment 9 Ambulance Services 9 Arches/Orthopedic Shoes 9 Bactine, Calamine lotion 9 Band-Aids, bandages, gauze pads 9 Blood Pressure Monitoring devices 9 Braille Books and Magazines 9 Carpal Tunnel Wrist supports 9 Cold/hot packs for injuries 9 Contact lens cleaning solution 9 Contraceptives and Prescribed birth control 9 Counseling 9 Crutches 9 First aid cream 9 First aid kits 9 Guide Dog (for visually/hearing impaired person) 9 Hearing Aids and Batteries 9 Hospital Bed 9 Incontinence supplies 9 Learning Disability (special school/teacher) 9 Liquid adhesive for small cuts 9 Medic Alert Bracelet or Necklace 9 Muscle or joint pain products such as BenGay 9 Nasal Strips 9 Nicotine gum or patches for stopsmoking purposes 9 Ovulation Monitor 9 Oxygen Equipment 9 Pregnancy test kits 9 Prosthesis 9 Reading glasses 9 Rubbing alcohol 9 Special ointment or cream for sunburn 9 Splints/Casts 9 Syringes 9 Thermometers (ear or mouth) 9 Transportation Expenses (essential to medical care) ** 9 Tuition Fee at Special School for Disabled Child 9 Visine and other such eye products 9 Wart remover treatments 9 Wheelchair ** Reimbursed at government approved annual rate Æ Flexible Spending Account Examples of Eligible and Ineligible Expenses under a Healthcare Reimbursement Account Items that may be covered when accompanied by a medical practitioner’s note must be used to treat a specific medical condition of limited duration. 9 9 9 9 9 9 Pills for persons who are lactose intolerant Nasal sprays for snoring Orthopedic shoes and inserts (for orthopedic shoes, you can only be reimbursed for the extra cost over buying non-orthopedic shoes) Capital Expenses Equipment, supplies and materials relating to physical/mental handicaps. Marriage Counseling 9 9 9 9 Fiber supplements to treat a specific medical condition Cosmetic Surgery-covered only when treating a congenital abnormality, a personal injury resulting from an accident or trauma or disfiguring disease Weight loss drugs to treat a specific disease Medicated shampoos and soaps, unless prescribed by a medical practitioner for a specific scalp/skin infection 9 9 9 9 9 9 9 9 9 Dietary or herbal medicines to treat a specific medical condition Sunscreen Prenatal vitamins Support Hose Wigs (hair loss due to disease) Massage Therapy Health Club monthly premium Prescribed Medical and Exercise Equipment Vitamins Claims substantiation: The participant must submit adequate claim substantiation. The receipt must state the name of the medicine or drug, the purchase date and the amount paid. The participant must sign the reimbursement form indicating that the claim was for the individual, their spouse, or eligible dependent. Where a physician’s note is required, it does not need to state the precise medical condition. Items that are NOT eligible for reimbursement under a Health Care Spending Account: 9 9 Suntan lotion 9 Toothpaste or toothbrushes (electric 9 9 Cosmetics or otherwise), even if a dentist 9 9 Ear Piercing recommends treating a condition 9 9 Maternity Clothes 9 Burial Expenses 9 9 Dental bleaching or any other teeth 9 Illegal operations, treatments and whitening medications Toiletries Dietary supplements Items paid or payable by insurance Premiums for group health coverage Personal hygiene products Whose Medical Expenses can I Reimburse? You can generally include medical expenses you pay for yourself as well as those you pay for someone who was your spouse, qualifying child or qualifying relative when the product or services were acquired. A qualifying child is a child who is you son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister or a descendent of any of them, who is under 19 years old or under, 24 years old and a full time student or permanently disabled, and who lived with you for more than half the year and did not provide over half of his or her own support. A qualifying relative is virtually anyone who lived with you throughout the year and who was not a qualifying child for another taxpayer and who you provided over half of the support Special Note: Due to recent IRS guidance, up front payments for Orthodontia may be Reimbursed even though the services for all treatments have not as of yet been incurred. With your reimbursement request you must submit the contract which specifies payment and total amount of the contract and the start date of the treatment.