SEKUNJALO UNAUDITED INTERIM RESULTS

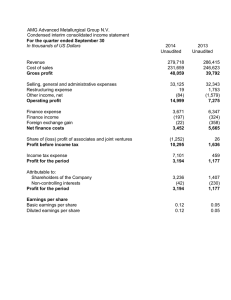

advertisement

SEKUNJALO INVESTMENTS LIMITED (Incorporated in the Republic of South Africa) Registration number 1996/006093/06 Share code: SKJ ISIN: ZAE000017893 (“SIL”) Unaudited interim results for the period ended 29 February 2008 OVERVIEW CORPORATE PROFILE SIL is a black-controlled investment holding company domiciled in the Republic of South Africa with points of representation in London and Mauritius. SIL is listed on the JSE Limited (“JSE”). The Sekunjalo Group (“the Group”) is invested in two primary sectors, i.e. Manufacturing and Resource-driven and Technology and Innovation-driven sectors. Within the Manufacturing and Resourcedriven sector the major investments are in Industrials (primarily fishing) and within the Technology and Innovation-driven sectors the main investments are in Healthcare and Pharmaceuticals, Information Technology and Communication, Financial Services, Aquaculture, Biotechnology and Enterprise Development. RECENT HIGHLIGHTS Sekunjalo has recently received a number of prestigious BEE awards: – The Business Map Foundation Top BEE Partnership Award for 2007 – Financial Mail/Empowerdex 2006 Award for Top Ranked BEE Firm – The Financial Mail Top Empowerment Companies Award for 2008 for the Top-ranked listed Company in the General Industrials sector of the JSE. ACCOUNTING POLICIES AND IFRS The financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) including IAS 34, using the historical cost convention except for certain financial instruments that are stated at fair value and adjustments, where applicable. The basis of preparation is consistent with the prior year. COMMENTARY ON RESULTS The SIL results for the first six months of the financial year are in line with expectations due largely to the seasonality of its fishing business. Compared to the same period in 2007, reporting revenue is up 22,5% to R229,7 million from R187,4 million, but has incurred an operating loss of R43,5 million compared to an operating profit of R12,1 million last year. The headline loss per share is reflected at 4,90 cents compared to a headline earnings of 2,91 cents per share as at 28 February 2007. In addition to the seasonal nature of fishing, the Group also changed its classification of its Biotechnology interests from an Investment to an Associate. This change arose as a result of a change in circumstances whereby the Group now has significant influence over this Biotechnology investment. As a consequence, last year’s interim results included a fair value adjustment of R27,4 million which was included in operating income, whereas no fair value adjustment is included in this year’s results. It should be noted that, historically, the Group has consistently performed well in the second half of the financial year due to the cyclical nature of its businesses. In line with this trend the Group expects a stronger performance in the second half of the financial year. REVIEW OF INVESTMENTS FISHING AND AQUACULTURE Premier Fishing has incurred a loss for the first six months of R10,7 million. This is due largely to the poor catches in the pelagic sector, high fuel prices, depressed prices for fish meal globally and poor west coast rock lobster catches. The pelagic total allowable catch(TAC)has been reduced to 90 000 tons from 165 000 tons last year and poor catches continue on the West Coast, with most catches occurring around Mossel Bay. Whilst the industry has experienced poor catches of west coast rock lobster, it is anticipated that catches will improve significantly in the next few months. South coast rock lobster catches have been good and the favourable rand/dollar exchange rate will boost revenues for the second half of the year. Premier’s success in the allocation of long-term fishing rights has provided a platform upon which Premier can roll out its high-growth business strategy, which is to become one of the largest lobster fishing companies in the Southern hemisphere. Premier’s success in reducing its long-term debt is allowing it to reinvest capital in acquiring further lobster rights and partnering smaller lobster rights holders. Premier Fishing is an exporter of choice and its lobster brands are highly sought after in the USA, China, Japan and Europe. The abalone farm continues to produce steady results and our strategy to expand this business has been fast-tracked with the recent acquisition of the Marine Growers Abalone Farm in the Eastern Cape. This acquisition complements our current pipeline and will provide sustainable earnings as well as being a substantial contributor to the sustainability of the abalone resource in the country. HEALTH CARE AND PHARMACEUTICALS Sekunjalo Health Care (SHC) and its associated health care companies, comprising Sekpharma(Pharmaceuticals), Rapimed(Rapid Diagnostics) and Health System Technologies(HST), continue to supply both the private and public sectors. In line with the strategy adopted at the end of last year, the Group has embarked on significant cost-cutting measures with a view to managing the Pharmaceuticals and Diagnostics businesses to break even by the 2008 financial year-end, whilst pursuing alternative strategies for these businesses. HST, the IT arm of SHC, continues to operate profitably and has won significant public sector tenders which will enhance the profitability of this business. The most recent tender awarded to HST is the National Health Laboratory System (NHLS) tender which will involve rolling out systems to public sector laboratories nationally. In accordance with good accounting practice and being consistent with the year-end treatment, the Group continues to impair loans owing by SHC and its Associates to Sekunjalo Investments. The operating loss of R19,7 million includes a loan impairment of R13,8 million. INFORMATION TECHNOLOGY AND TELECOMMUNICATIONS The Group’s ICT businesses are known as Sekunjalo TSG (Technical Solutions Group). The Group comprises three companies that we have invested in, namely, Synergy, Fios and Saratoga. These businesses have been consolidated and TSG is now being managed as an autonomous division focusing on closer collaboration in software development and implementation, marketing and sales and a reduction in corporate overheads. Sekunjalo TSG is a business solutions provider that is focused on: - providing business intelligence solutions, and - developing and supporting a variety of software products that are custom designed to meet the objectives of businesses operating in specific sectors. Sekunjalo TSG has performed well and is currently well positioned to deliver the full-year targeted results. Plans to list Sekunjalo TSG are currently under review and the Group will make an announcement in this regard shortly. FINANCIAL SERVICES The Group’s financial services interest is held through its whollyowned subsidiary, Sekunjalo Capital (Pty) Ltd. Sekunjalo Financial Services has developed an integrated financial services platform through extensive investment in software development. This platform is able to deal with the complexity of distributing financial services products. The strategy going forward is to market directly to established affinity groups. The business has concluded an agreement with one of South Africa’s largest trade unions. This has resulted in the business being significantly populated. A turnaround in performance is dependent on bringing on board additional affinity groups. Discussions are currently under way with two groups. BIOTECHNOLOGY Sekunjalo, through African Biotechnological and Medical Innovation Investments (Pty) Ltd (“ABMI”), owns 49% in Bioclones (Pty) Ltd, the leading biotechnology company on the African continent and in the developing world. Bioclones manufactures Erythropoietin (EPO) at its manufacturing plant in Pretoria. EPO is the leading biopharmaceutical product by sales revenues with a market size in excess of US$12 billion. Bioclones has embarked on increasing the capacity of the Pretoria plant to serve the private market in South Africa and is looking to further increase capacity of EPO production through the use of funds obtained from an intended international exchange listing in London or New York. This will allow Bioclones to enter the global EPO market with its trademarked product Repotin®. The listing is planned for 2009 but is dependent on market conditions and liquidity at the time. Ribotech, a Bioclones subsidiary based in Cape Town, is in the early stages of developing a facility for the manufacture of G-CSF, a partner product to Repotin®, used in the treatment of Neutropaenia. It is estimated that the facility will be completed within 18 months and G-CSF released into global markets shortly thereafter. Bioclones is also assessing additional investments and licensing opportunities to expand its product portfolio. The key mission of the company is to enhance the infrastructure and skills of the African biotechnology sector and to ensure the provision of affordable and life-saving drugs to those on the African continent and throughout the world. DIVIDENDS No dividend has been declared for the current period. The directors continue to work toward payment of dividends in the foreseeable future. PROSPECTS Sekunjalo is firmly established as a pre-eminent black economic empowerment (BEE) group and is in its 9th year of listing on the JSE. The directors expect a strong second half performance from the Fishing, IT and Financial Services businesses. Furthermore, the Group will continue with its strategy of migrating to an investment holding company and unlocking value through separate listings of its IT and Biotechnology divisions. Sekunjalo Investment Holdings (Pty) Ltd (“Holdings”) is the largest shareholder of SIL. Holdings, through Sekunjalo Telekom (Pty) Ltd, recently acquired 13% of Nokia Siemens Networks (“NSN”) RSA, by fulfilling the stringent empowerment and other criteria. Holdings has tabled a memorandum of agreement to SIL whereby SIL will accrue the full benefit of the NSN RSA investment, subject to conditions precedent being fulfilled by 31 July 2008 - including the approval of NSN RSA and NSN globally. Dr MI Survé Executive chairman M Y Kajee Chief executive officer Cape Town 13 May 2008 GROUP INCOME STATEMENT Unaudited 29 February 2008 R’000 229 660 Unaudited 28 February 2007 R’000 187 442 Audited 31 August 2007 R’000 449 516 (29 684) (14 902) (65 375) Loan impairments Fair value adjustments Profit from operations after material adjustments Income from associate Finance cost Profit before tax Tax Profit/(loss) after tax Attributable to: Outside shareholders (13 789) - 27 000 250 904 (43 473) (1 404) 747 (44 130) 5 263 (38 867) 12 098 241 (2 146) 10 193 (1 117) 9 076 185 529 (13) (11 413) 174 103 (61 690) 112 413 (4 306) (1 711) (2 204) Parent (34 561) (38 867) 10 788 9 076 114 619 112 413 Headline earnings (20 171) 10 788 116 353 Number of shares in issue Weighted number of shares in issue Diluted number of shares in issue 487 860 984 396 794 806 469 205 361 411 428 631 370 828 820 399 727 904 414 377 452 425 352 624 416 478 528 Revenue Profit from operations before material adjustments Headline earnings/(loss) per share (cents) Earnings/(loss) per share (cents) Diluted earnings/(loss) per share (cents) Net asset value per share (cents) (4,90) 2,91 29,11 (8,40) 2,91 28,67 (8,34) 2,54 27,52 61,11 101,62 125,97 Unaudited 29 February 2008 R’000 Unaudited 28 February 2007 R’000 Audited 31 August 2007 R’000 418 809 203 171 13 006 2 733 591 299 185 385 – - 721 010 201 374 12 362 3 553 21 250 92 286 2 943 2 348 18 528 18 357 19 639 24 548 211 642 41 978 3 042 - 22 950 89 261 14 891 172 629 10 120 17 331 48 901 29 831 190 575 36 954 5 300 62 22 100 85 885 2 166 346 153 17 882 14 928 14 607 232 764 35 279 2 981 14 45 451 6 085 5 560 40 433 19 170 1 932 74 465 38 689 3 885 486 98 771 39 557 1 166 80 692 53 029 630 451 781 874 953 774 29 402 174 12 255 28 327 963 11 238 29 386 764 8 056 GROUP BALANCE SHEET ASSETS Non-current assets Property, plant and equipment Investment properties Software development costs Patents and trademarks Contract costs due from customers Pharma dossiers Goodwill Intangibles Other investments Investments in subsidiaries Investments in associates Biological assets Loans receivable Deferred tax Current assets Inventory Prepaid expenses Forward exchange contract asset Non-current assets held for sale Current loans Contract costs due from customers Current group loans Tax Trade and other receivables Bank Total assets EQUITY AND LIABILITIES Capital and reserves Share capital Share premium Non-distributable reserves Other distributable reserves Accumulated losses Equity attributable to parent Outside shareholders’ interest Total equity Non-current liabilities Interest-bearing borrowings Deferred tax Operating lease liability Policyholders’ liabilities Post-employment medical costs Non-interest-bearing borrowings Current liabilities Trade and other payables Income received in advance Policyholders’ liabilities Current group loans Contract costs payable Liabilities held for sale Provisions Current portion of LTL Bank overdraft Tax Total equity and liabilities (141 761) 272 697 25 436 298 133 128 553 47 438 63 538 507 2 072 14 998 203 765 69 394 5 403 32 091 18 498 9 635 54 572 14 172 630 451 100 62 372 401 701 44 937 446 638 152 542 58 770 70 214 578 2 212 20 768 182 694 67 495 6 192 15 603 3 113 13 725 10 101 60 455 6 010 781 874 166 481 561 330 29 742 591 072 155 816 35 957 106 911 348 2 072 10 528 206 886 68 445 6 177 28 684 30 926 27 115 29 991 15 548 953 774 Unaudited Unaudited Audited 29 February 2008 28 February 2007 31 August 2007 R’000 R’000 R’000 (12 217) (1 938) (13 347) (23 604) (14 377) (33 794) (3 101) 6 285 81 044 (38 922) (10 030) 33 903 23 038 (10 865) (10 865) (15 884) (20 895) 23 038 GROUP CASH FLOW STATEMENT Cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Increase/(decrease) in cash and cash equivalents Cash and cash equivalents at beginning of the year Cash equivalents at the end of the year STATEMENT OF CHANGES IN EQUITY Attributable to parent Balance at 31 August 2006 Change in accounting policy Prior period error R’000 365 191 (1 142) Outside shareholders’ interest R’000 49 655 (1 012) Total equity R’000 414 846 (2 154) Restated balance 2006 Net profit/(loss) for the year Dividends paid Movement in share capital Movement in share premium Movement in other distributable reserves Movement in non-distributable reserves Acquisitions of subsidiaries Balance at 31 August 2007 Change in accounting policy Prior period error Restated balance 2007 Net profit/(loss) for the year Dividends paid Movement in share capital Movement in share premium Movement in other distributable reserves Movement in non-distributable reserves CRRF Reclassification of investment fair value on becoming an associate Acquisitions of subsidiaries Balance at 29 February 2008 364 049 114 619 (382) 2 85 356 48 643 (2 204) - 412 692 112 415 (382) 2 85 356 (100) - (100) (2 214) 561 330 561 330 (34 561) 15 410 (16 697) 29 742 29 742 (4 306) - (2 214) (16 697) 591 072 591 072 (38 867) 15 410 - - - 4 176 - - 4 176 - (273 658) 272 697 25 436 (273 658) 298 133 Financial Services Informatics Fishing Healthcare Unaudited Unaudited Unaudited Unaudited 29 Feb 2008 29 Feb 2008 29 Feb 2008 29 Feb 2008 Revenue External sales Intergroup sales R’000 74 965 72 427 2 538 R’000 34 912 34 912 - R’000 93 566 93 566 - R’000 14 919 14 919 - Segment result Operating profit/ (loss) (6 333) 5 007 (10 677) (19 657) (601) - (95) (13 789) (289) (209) (969) (1 463) GROUP SEGMENTAL REPORT Included in segment results: Fair valuations and impairments Depreciation and amortisation Carrying amount of assets Carrying amount of liabilities 88 078 83 621 340 817 55 639 94 761 72 893 163 863 192 486 Loss from associate - - - - Capital expenditure 49 173 16 128 61 GROUP SEGMENTAL REPORT (CONTINUED) Biotechnology Unaudited 29 Feb 2008 R’000 Revenue External sales Intergroup sales - Investments Unaudited 29 Feb 2008 R’000 114 114 - Other Unaudited 29 Feb 2008 R’000 15 439 13 722 1 717 Segment result Operating profit/(loss) – (34 092) 3 626 Included in segment results: Fair valuations and impairments Depreciation and amortisation - (24 577) (187) (164) Carrying amount of assets Carrying amount of liabilities 349 351 1 185 504 49 565 81 699 165 677 51 254 Loss from associate (1 404) - - Capital expenditure - 62 53 GROUP SEGMENTAL REPORT (CONTINUED) Eliminations Unaudited 29 Feb 2008 R’000 Revenue (4 255) External sales Intergroup sales (4 255) Group Unaudited 29 Feb 2008 R’000 229 660 229 660 - Segment result Operating profit/ (loss) 18 653 (43 473) Included in segment results: Fair valuations and impairments 24 577 (14 485) Depreciation and amortisation - (3 281) Carrying amount of assets Carrying amount of liabilities (1 518 123) 634 452 (486 315) 336 318 Loss from associate - (1 404) Capital expenditure - 16 526 GROUP SEGMENTAL REPORT Financial Services Unaudited 28 Feb 2007 R’000 Revenue 37 456 External sales 37 456 Intergroup sales - Informatics Unaudited 28 Feb 2007 R’000 27 567 27 567 - Fishing Unaudited 28 Feb 2007 R’000 101 983 101 983 - Healthcare Unaudited 28 Feb 2007 R’000 19 451 19 451 - Segment result Operating profit/ (loss) (2 102) 2 560 (3 102) (1 751) - - - - (155) (293) (552) (1 758) 108 293 81 068 322 052 122 332 71 748 70 532 149 708 183 139 Loss from associate - - - - Capital expenditure 60 170 2 452 621 Included in segment results: Fair valuations and impairments Depreciation and amortisation Carrying amount of assets Carrying amount of liabilities GROUP SEGMENTAL REPORT (CONTINUED) Biotechnology Investments Other Unaudited Unaudited Unaudited 28 Feb 2007 28 Feb 2007 28 Feb 2007 Revenue External sales R’000 - R’000 320 - R’000 2 165 985 Intergroup sales - 320 1 180 Segment result Operating profit/ (loss) 27 474 (7 064) (3 917) Included in segment results: Fair valuations and impairments Depreciation and amortisation 27 000 - (197) - Carrying amount of assets Carrying amount of liabilities 119 033 37 992 1 071 817 138 655 20 499 24 346 Loss from associate - - - Capital expenditure - - 59 GROUP SEGMENTAL REPORT (CONTINUED) Eliminations Group Unaudited Unaudited 28 Feb 2007 28 Feb 2007 Revenue External sales Intergroup sales R’000 (1 500) (1 500) R’000 187 442 187 442 - Segment result Operating profit/ (loss) - 12 098 Included in segment results: Fair valuations and impairments Depreciation and amortisation - 27 000 (2 955) Carrying amount of assets Carrying amount of liabilities (1 063 220) (340 884) 781 874 335 236 Loss from associate - - Capital expenditure 3 362 Notes: 1. Operating profits/(losses) are stated after elimination of management fees. 2. These financial statements have been prepared in accordance with the disclosure requirements of IAS 14. DIRECTORS: *Dr MI Survé (Executive chairman), *M Y Kajee (Chief executive officer), *K Abdulla (Chief financial officer), *Rev. V C Mehana, N T Noland, M Goamab The First, Z A KotaFredericks, J P van der Merwe, S Young *Executive Company Secretary: NC Katamzi Registered Address: Sekunjalo House, Block F, The Terraces, Steenberg Office Park, Tokai, 7945, Cape Town, South Africa Postal Address: PO Box 31344, Tokai, 7966, Cape Town, South Africa Tel: +2721 702 7700 Fax: +2721 702 7744 Email:info@sekunjalo.com Transfer Secretaries: Link Market Services (Pty) Ltd, 11 Diagonal Street, Johannesburg, 2001 Sponsor: Rand Merchant Bank (A division of FirstRand Bank Limited)

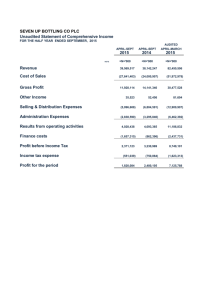

![Accounts - GFPL [ 18 May 2015 ]](http://s3.studylib.net/store/data/007190112_1-146eb980362ee79364105ad70cf6aa55-300x300.png)