Kit Menkin's Leasing News www

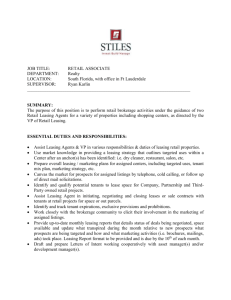

advertisement

Kit Menkin's Leasing News www.leasingnews.org Tuesday, May 29, 2001 ( to be posted soon ) ------------------------------------------------------------------------------------------Please send to a colleague as we are trying to build our readership. Subscription is free. -------------------------------------------------------------------------------------------Headlines--DVI To Be Placed for Sale? Salesman Pay Survey Results eCredit.com Selects ProactiveNet Donald P. Campbell to Head Commerce Bank's Leasing Business Lot of European Money: Boullioun Financing Oversubscribed Leasing News List Up-Dated ##### denotes company press release ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------12/2000 DVI Closed Broker Business Division Bloomberg Reports: DVI Holder Granite Capital Urges Prompt Sale of Company By Daniel Goldstein, Bloomberg DVI shareholder Granite Capital Management called for a "prompt sale" of the medical equipment leasing company, a regulatory filing said. Granite Capital, which holds a 6.6 percent stake in the Jamison, Pennsylvania-based company sent a letter to the board of directors "recommending the sale of the company in light of its inability to generate adequate returns," according to a Schedule 13D filing with the Securities and Exchange Commission. Granite Capital, controlled by investor Walter Harrison, urged "a prompt sale" of the company in a May 22 letter to DVI's Chief Executive Michael O'Hanlon. Harrison said in the letter, included in the 13D filing, that the company's performance "would rank as an egregious destroyer of value." Harrison said the company earns a "significantly sub par return on equity" between 8 and 10 percent and said that the company's book value per share "has grown at an even lower 6 percent." Bloomberg reports a spokesman for DVI was unavailable to comment. In January, the company was downgraded to "buy" from "strong buy" at U.S. Bancorp Piper Jaffray. The target price is $20 per share. ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Source 2001 Handbook Thank you for the nice plug for the Leasing Sourcebook. The web page is still under construction since we have been busy producing the new edition. I really enjoy reading leasingnews. Thank you for providing a terrific service. Barbara Low bibliotech@leasingsourcebook.com ( The website looked pretty good to me. editor ) --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------The List Chronological 104 changes ( This is also on line at our web site: http://www.leasingnews.org/list.htm Corona America Financial,So.CA ( 5/2001 ) purchased by TotalFunding.com, although called a merger.. Corona Pres. president, Jack Winsten worked at SDI Capital, leaving them the same month SDI says no more broker business. SDI Capital,So.CA (5/2001) reported has assets up for sale ( 5/2000 closed to broker programs ) Alliance Funding Group, La Habra, CA ( 5/2001 ) purchased by MSM Capital, headed by Mike Cingari, formerly pres. of Col. Pacific Leasing Bay View Capital, San Mateo, CA ( 5/2001) Jeff Allard, CLP, COO "... decided to exit the commercial leasing business and other business lines due to the strategic change in the company's direction as determined by the new management team." Parent company running out of money, a lot of good people let go. Terminal Marketing, NY,NY ( 5/2001) Announcement all assets for sale by creditors on May 31, 2001 at 2:00 p.m. (3/2001) Brokers report deals not being funded, commissions not paid, appears out of money. Bancorp Financial Services, Sacramento, CA (5/2001) Humboldt Bancorp closes Bancorp Financial, citing second quarter loss "...not at this time expected to exceed $8 million on an after-tax basis; Kevin Cochrane let go, Security Exchange Commission, Sacramento looking into disclosures, reportedly other activity. ( 4/2001) Humboldt Bancorp says "closing Bancorp Financial Services "in press release and report to Security Exchange Commission, but CFO Pat Rusnak says "company is for sale" and statement made for "accounting purposes." CIT ( 5/2001) CIT Shareholders Approve Proposed Tyco-CIT Acquisition (3/2001) Tyco International Ltd. makes offer for about $9.2 billion in cash and stock in a deal that would allow the manufacturer to finance purchases of its wide array of products. Bermuda Hq., N.H. operation office. ( 2/2001) Closing Atlanta office and others, "freeze" on new broker business from this office ( 5/2001) Bruce Nelson, Tempe, Arizona seeking broker business. "We are an asset based lender and provide equipment financing in the following industries: Construction, Transportation, Logging, Material Handling, Corporate Aircraft, Mining, Energy, & Marine." Imperial Credit Industries (ICII) (5/2001) Charles F. O'Hara, "We discontinued lease originations through our Imperial Business Credit (IBC) ....( last year ) ICII decided that it could not compete effectively in the small-ticket leasing arena. IBC, however, continues to service the portfolio that they originated and have expanded their servicing options to include middle- market leasing. ( for entire list, go to: http://www.leasingnews.org/list.htm Chronological and Alphabetical; the above is the Chronological up-dated version only, not the complete list ) ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Salesman Pay Survey Today it appears the industry average for salesmen who work for companies that "discount" their leases ( sell their lease contracts to others ) is approximately 50% of the profit. This is the present value of the lease contract, less funders discount charges. Many are paid a percentage of the override is fees charged, such as for documentation, site inspections, etc. Some provide other expenses, such as health benefits, travel, but that is not common. A few will pay up to 60% over a "quota." One company did report paying 30%, but all expenses, health, medical, and when the residual was received, 30% of the residual, if the salesperson was still working for the company. ( This company is no longer in business .) Another paid 45%, and when the quota was exceeded, 55%. Volume was basically $10,000 to $20,000 in gross profits per month ( less processing fees ), meaning the salesmen made anywhere from $60,000 to $120,000 a year, averaging $80,000 per year. As anywhere, 20% of the salesmen made in excess of $120,000 per year, always exceeding quota. All were paid a draw against the commission in either by-monthly or monthly installments with charge backs against quota not met; often implied. Most were not given "house accounts", but relied on their production of signed leases. The industry average for salesmen who work for companies who act as lessors, not selling or discounting their lease contracts, is more complex to state due to the various volume requirements for salesman. The main difference is "rate" versus "volume." Lessor salesmen generally have accounts that the lessor services and remuneration is not on the difference between the rate of the lease, but primarily on the volume of transactions. Most salesmen here earn a base salary versus a draw. They are paid in excess of making their quota, or an additional percentage based on volume. Where minimum volume was $6 million, .0075 to .008 was common, or $45,000 per year. A report of .02 on volume over $200,000 was stated, meaning the quota was $2.4 million a year in sales for the base salary. One salesman reported making $50,000. plus.0025% of volume. He was hoping to make $100,000, meaning his goal was $20 million a year. It appears the average lessor salesman must produce $10 million a year. This figure, of course, is based on the market. Larger ticket or smaller tickets have a different ratio. To sum up the remuneration schedule to satisfy all requirements would take many, many more pages than this report. Again, this report is from our readers. It was also reported that transaction the lessor did not carry, probably for credit reasons, were either brokered by the company, giving a split of 30% to 50%, or as the circumstance with many, some approved by the company, such as practiced formerly by Sierra Cities, the salesmen could send to another source and received the total commission. It was not reported if this is common wide in the industry for lessors. In the 1970's, most leasing companies had salesmen who handled "house" accounts, this changed in the 1980's with the growth of brokers who worked solely for a "commission." The 1990's saw the growth of "super brokers," who funneled other brokers transactions for a commission. In addition, many funders were in essence super brokers, discounting transactions for the present value, often including the residual in the discount or pledge of the contract. Discount Response: From your survey it appears that we may be giving the shop away. We have a very simple commission only program. As a small to mid ticket lessor broker/discounter we pay 50% of the gross fee on the transaction. Higher amounts up to 60% are paid to consistent producers, We pay every Friday for deals that fund that week. We provide complete office and back room processing and pay for all internal costs such as D&B, CBR, rent, phone, overnight etc.. Salesman pay for all external costs such as entertainment and travel. We share in all promotional and trade show expenses. We will work with established, proven producers for a few months should a draw be necessary and we are always interested in finding new talent. Len Sperl, Onyx Capital Corp, Pittsburgh Pa. occ@sgi.net +++\\ Here in Minneapolis at NFG our sales reps earn 50% of GP on all transactions. We provide office, phone, internet, marketing and trade show reimbursement. We have a credit, documentation and funding staff to handle most of the non-selling processes. In addition we do a draw on future commissions if a rep is new. Our monthly bonus plan is $240 over $7500 (which is the reps 1/2) and $600 over $10,000 . Quarterly bonus is $720 over $22,500 and $1800 over $30,000. If a rep hits $100,000 annually then the company provides a $600 per month car reimbursement for the entire next year. We feel we have an aggressive compensation package because we want all of our people to succeed. We are nothing without our people who got us here. Oh yeah we also have a condo in Vail available to all our staff and reps to use at no cost. We are currently attempting to create a way to pass ownership to super stars as well, but have not finalized it as of yet. Will Abbott President Northland Financial Group, Inc. Direct (952) 746-5251 888-485-5834 Fax (952) 979-1590 email wabbott@northland-financial.com www.northland-financial.com ++++ We pay our sales reps 50% of the GP after inspections, UCC's and routine office costs. We also pay for marketing and promotion items, business cards, brochures, handouts, mailings, etc, etc. The reps responsibility is to bring in the business and that is it. I do not require a monthly volume, but do ask that they stay in contact, preferably in person, with any customer or vendor once a month at least. I price, doc, close and fund the deals. All they do is make the contact. Any deal originated or referred by that salesperson's vendor or customer is theirs even if they haven't talked with them about the specific deal. Average annual compensation is usually 50 to 65K, but the opportunity is unlimited. We are presently looking for reps in northern New Jersey and western NY and eastern PA. 888-583-0400 Bob Runyon, Capital Agreements Corporation capitallease@adelphia.net + ++ Here we make no salary, 45% of the gross margin on $1.00 residual deals, and 55% of the GM on the deals that we retain the FMV or 10% residual. We make 100% of the doc fee over what our sources charge and a draw is available on a case by case basis. ++++ I pay my in-house sales people as follows: Base Salary of 30K per year. this covers the first $5,000 in GP. I allocate 50% of any deal the generate themselves and 10% of the GP on any house deal that I assign to them to help them cover the first $5,000 in GP. On the second 5,000 in GP the sales rep earns 25% and 40 % on any GP generated after that. A rep working for me can justify their existence at about $800K per year in volume. They will make $45-50K at $100K per month in volume and about $75K at $150K per month in volume. +++ We get 35% of the first $10,000 per month in gross that we bring into the company. We get 45% above $10,000 and 50% above $18,000 per month. We split document fees over the amount required in the approval. It is all commission, no guarantee. +++ W compensated salespeople with a 50% split of the gross commission due on the leasing transaction. The salespeople generally had use of our office space, and we paid for special promotions. In addition, we provided an auto allowance of $300 per month, and a telephone allowance of $150 per month. We found it necessary, in virtually all cases, to provide the salespeople with a draw against future earned commissions. We found that even our most experienced salespeople did not break-even on this arrangement until they were employed with us at least three years. The most generous compensation program I have first-hand knowledge of provides the leasing salespeople with 65% of the gross transaction commission. This company, a longtime, successful leasing broker, also provides office space, use of telephone, and the payment of advertising promotions. In fairness to all leasing salespeople, their compensation potential depends as much on their company's access to capital, and flexible financing plans, as it does on their individual sales ability and work ethic. In our case, at just the time our salespeople began to realize their individual potential, their ability to grow their earnings was drastically curtailed by our loss of bank funding. My only advice to your inquirer is: carefully evaluate the company you represent or will represent. Your ability to cultivate vendor and lessee relationships depends to a great degree on your company's ability to deliver on its credit program and funding promises. Unfortunately, in today's economic and leasing environment, the only thing you can count on is uncertainty. Steve Chriest schriest@aol.com Lessor Salesmen Working for a tech company, as the Leasing Manager in a captive scenario I find am in the a middle of the road in you compensation survey. I am paid a base salary of 45K, .0075 of volume on deals until I hit 50% of a 6MM quota. Over 50%, I am bumped to .1025 on volume. I also receive 33% of GP on fee income from transactions. Volume Commissions paid out monthly, and Fee commission paid out at the end of each quarter (the bonus incentive). +++ I work for a leasing sub. of a large foreign bank. Mostly small ticket. Bases are in the 30's-40's depending on experience. We get .008 of volume with a kicker on spreads that exceed 50 over. Quotas are $6mm-10mm depending on territory. ++++ $50K base .25% of volume Cell phone paid for. I should be making $100,000++++ As a sales rep, with 4 years experience I make a base salary of $48k with a chance to make commission once I make more money for the company than it takes to keep my seat, i.e. $4000 per month. It seemed to be online with the Advanta commission plan but unless you really generate volume you cannot realize commission. ++++ We pay 2% of equipment volume in compensation. Generally there is a base of $48K and the 2% commish is paid for volume over $200K. They also earn 25% of the fee of any brokered deal they bring in. The 25% split of broker income is independent of our funded equipment volume We pay monthly though will probably shift to quarterly. +++ Around here, be it small ticket or big ticket, I believe all the lease origination personnel have had a base salary and then a bonus once a certain minimum volume was done on a monthly (for the small ticket group) or annual (for the large ticket group) basis. Our most experienced and senior large ticket salesperson makes well into the 6 figure range I've heard but they consistently book volume in the tens of millions each year. I think all our large ticket group that have been here two or more years each make over $100,000 per year between base and bonus. Our small ticket people have had the potential to make six figures but it has always been heavily volume dependent. There are several different bases, based on whether or not they hit their bogey for the year or month. Bonus is only paid once minimum target volume is reached. If someone is not hitting their target within a year around here they usually let them go. *** we are still open to collecting comments as we are relaying on our readers for information and have no axe to grind. Comments may be “on” or “off the record.” To those who have responded, we have held your comments “off the record” as requested, or quoted you, giving you the opportunity to plug you compensation plan. editor ################### ############## eCredit.com Selects ProactiveNet To Optimize Online Performance; ProactiveNet's Realtime Analytics Enable Corrective Measures Before Performance Slowdowns Impact eBusinesses ALVISO, Calif.--(BUSINESS WIRE)--May 29, 2001--ProactiveNet, Inc., a leading provider of performance management solutions for Internet, intranet and extranet applications, today announced that eCredit.com will adopt its software as a key element of the company's online operations. eCredit.com provides automated credit and financing solutions for Fortune 1000 companies, financial services organizations and e-businesses. About ecredit.com eCredit.com enables Fortune 1000 companies, financial services organizations and ebusinesses to transform business processes throughout the financing supply chain to strengthen customer relationships, increase customer purchasing power, and grow the bottom line. eCredit.com solutions automate credit and underwriting to better manage risk and deliver a portfolio of financing options at the point-of-sale. Included among the Company's customers are Cisco, CIT, Chevron, Fleet Leasing, Gateway and Ryder System, Inc. eCredit.com, headquartered in Dedham, Mass., is a member of the Internet Capital Group (NASDAQ: ICGE) partner company network. For additional information, visit eCredit.com on the Web at www.ecredit.com. About ProactiveNet ProactiveNet, Inc. is a leading provider of performance management solutions for Internet, intranet and extranet applications. The company's solutions enable businesses to deliver a consistently positive web experience to end-users resulting in measurable improvements in ency and online revenues. Customers include leading enterprises and xSPs such AIG, eBay, Exodus and Walmart.com. ProactiveNet has been named one of Computerworld's Top 100 Emerging Companies to Watch in 2001, and was a winner of The 2001 CrossRoads A-list Award. ProactiveNet is based in Silicon Valley at 2150 Gold Street, Alviso, CA 95002-2159. International offices are located in the UK and India. For more information, phone 877-277-6686, or visit the company's web site at www.proactivenet.com. # # # # # # # # # # # # # # # # # # # ## ##### ### #### ### #### ##### ##### Donald P. Campbell to Head Commerce Bank's Leasing Business CHERRY HILL, N.J.--(BUSINESS WIRE)--May 29, 2001--Commerce Bancorp, Inc. (NYSE Symbol: CBH) announced today that Donald P. Campbell has joined Commerce Bank to head the company's growing leasing business. Campbell, former CEO of De Lage Landen/Tokai Financial Services, will serve as President of Commerce's leasing operation. Campbell assumed the position of CEO of Tokai - a leading vendor/leasing firm - in 1993, where he rapidly expanded the company, increased sales and started three new businesses. "Our leasing services are the perfect addition to our diverse portfolio of financial services and will enable us to better serve the growing number of small- to medium-sized businesses that are playing a crucial role in the region's economic development." "Commerce will provide leasing services throughout the Bank's footprint in New Jersey, eastern Pennsylvania, northern Delaware and Manhattan, and focus on every type of equipment that our customers use - from office and restaurant equipment, to printing and production equipment to vehicles," explained Campbell. ( for full press release with contact information: go to: www.leasingnews.org ) # # ## # # ## ### #### #### #### # # # # # # # # # # # # # # ## # # # ## # ## # # # Boullioun Financing Oversubscribed Syndicate of 24 Major U.S., European, Japanese Financial Institutions Commit To Provide US$1.45 Billion in Bridge Financing BELLEVUE, Wash., -- Boullioun Aviation Services (www.boullioun.com) today announced it has completed its first external financing under the ownership of Westdeutsche Landesbank Girozentrale (WestLB). Boullioun -- one of the world's premier aircraft operating lessors -- was purchased by WestLB on Feb. 1. WestLB is based in Dusseldorf/Munster, Germany. After launching the facility at US$1.3 billion and receiving substantially greater commitments, Boullioun accepted oversubscriptions up to US$1.45 billion from a syndicate of 24 major U.S., European and Japanese financial institutions. Three banks -ABN AMRO Bank N.V. in the Netherlands, JPMorgan in London and WestLB -- are Joint Mandated Arrangers of the 345-day bridge financing.