Complete Transcript

advertisement

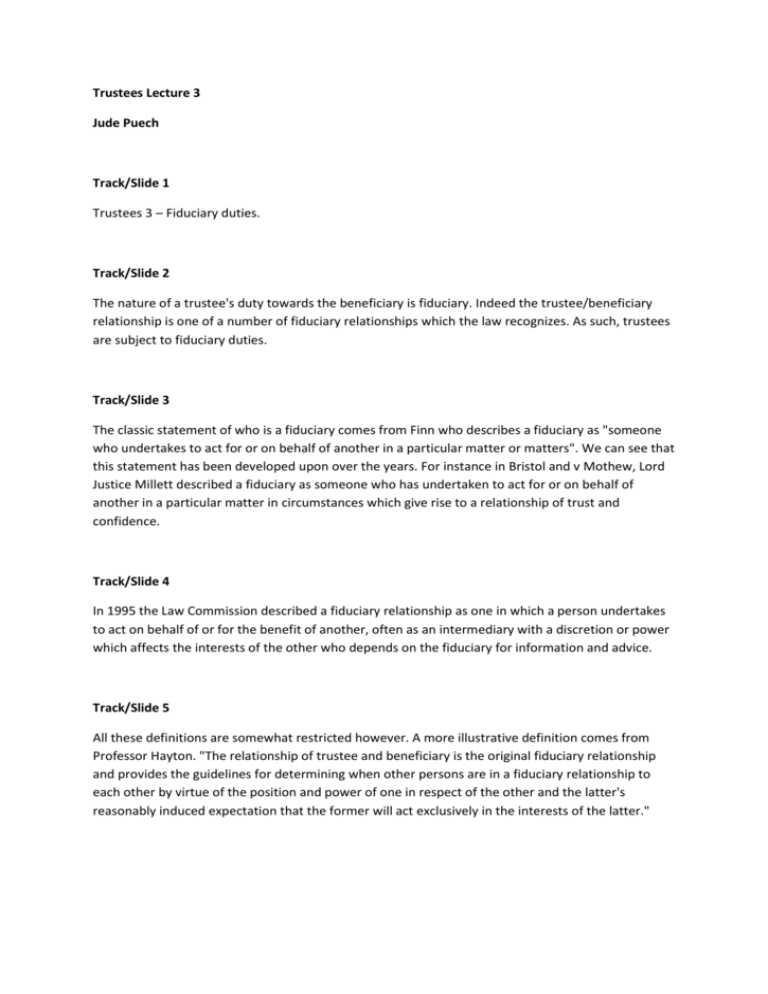

Trustees Lecture 3 Jude Puech Track/Slide 1 Trustees 3 – Fiduciary duties. Track/Slide 2 The nature of a trustee's duty towards the beneficiary is fiduciary. Indeed the trustee/beneficiary relationship is one of a number of fiduciary relationships which the law recognizes. As such, trustees are subject to fiduciary duties. Track/Slide 3 The classic statement of who is a fiduciary comes from Finn who describes a fiduciary as "someone who undertakes to act for or on behalf of another in a particular matter or matters". We can see that this statement has been developed upon over the years. For instance in Bristol and v Mothew, Lord Justice Millett described a fiduciary as someone who has undertaken to act for or on behalf of another in a particular matter in circumstances which give rise to a relationship of trust and confidence. Track/Slide 4 In 1995 the Law Commission described a fiduciary relationship as one in which a person undertakes to act on behalf of or for the benefit of another, often as an intermediary with a discretion or power which affects the interests of the other who depends on the fiduciary for information and advice. Track/Slide 5 All these definitions are somewhat restricted however. A more illustrative definition comes from Professor Hayton. "The relationship of trustee and beneficiary is the original fiduciary relationship and provides the guidelines for determining when other persons are in a fiduciary relationship to each other by virtue of the position and power of one in respect of the other and the latter's reasonably induced expectation that the former will act exclusively in the interests of the latter." Track/Slide 6 Professor Hayton goes on. "Trustees are persons who are under a duty to act exclusively in the interests of the trust beneficiaries who are vulnerable if the trustees seek to abuse their position, because trustees have rights and powers that are capable of being exercised so as detrimentally to affect the beneficiaries. Thus, if such aspects are present in other relationships these are treated as fiduciary relationships as a matter of law…” Track/Slide 7 Thus fiduciaries are those able unilaterally to later the position of their principal. The key point is really the power to affect the practical or legal interests of another. Track/Slide 8 Examples of relationships are firstly status-based fiduciary relationships. That is fiduciary relationships which, according to Professor Hayton, arise as a matter of law from status. Trustee and beneficiary we've already mentioned. Similarly personal representatives and beneficiaries of a deceased's estate, solicitor and client, company director and company, partner and partner and principal and agent are all examples of such fiduciary relationships. An employment relationship as such is not a fiduciary relationship but it can be although generally the relationship has to be more than an ordinary contractual relationship. In contract one can act in one's own interests. For example in Re Goldcorp an ordinary commercial relationship between a company and its customers was not fiduciary. Track/Slide 9 However the scope of the fiduciary relationship has been extended, in some cases very broadly, to cover instances which are strictly speaking outside the concept of fiduciary relationships. These are termed fact-based fiduciaries who become so because of a particular factual situation and imposed in the interests of justice because of the claimant's particular vulnerability to being taken advantage of by the defendant upon whose loyalty he is relying on. For example, in the case of Reading v Attorney General where an army sergeant received bribes for escorting lorries through checkpoints whilst wearing his uniform. Track/Slide 10 The class of relationships is not closed. It is undefined and a fiduciary relationship can be easily found to suit the circumstances and the desired remedy. Track/Slide 11 As Justice Slade said," I do not think that the categories of fiduciary relationships should be regarded as falling into a limited number of straightjackets as being necessarily closed. They are after all no more than formulae for equitable relief". Thus the class of such relationships is not yet closed. The problem then is of trying to find the extent of the rule by which fiduciary relations will be implied. Track/Slide 12 So what are the fiduciary obligations? A good summary of the nature of the fiduciary relationship was provided by Lord Justice Millett in the case of Bristol and West Building Society v Mothew. The distinguishing obligation of a fiduciary is the obligation of loyalty. The principle is entitled to the single-minded loyalty of his fiduciary. This core liability has several facets. A fiduciary must act in good faith. He must not make a profit out of his trust. He must not place himself in a position where his duty and his interest may conflict. He may not act for his own benefit or the benefit of a third person without the informed consent of his principal. Where the fiduciary deals with his principal, he must prove affirmatively that the transaction is fair and that he made full disclosure of all the facts material to the transaction. And Lord Justice Millett goes on to say breach of fiduciary obligation connotes disloyalty or infidelity. Thus the obligations of a fiduciary in essence reflect the core elements of loyalty and fidelity. Track/Slide 13 Looking at the application of these principles, firstly the self-dealing rule. This rule prevents trustees from purchasing interest property unless they are authorised. The justification for the rule is that a trustee to purchase trust property puts him into a clear conflict with the beneficiary's interests since he will be both selling the property and buying it. How then can the beneficiaries be assured that they have received the best price? There are exceptions to this rule. Firstly the trust instrument may expressly authorise a purchase. Secondly the court has discretion to allow a purchase and thirdly the beneficiaries can agree. However, the beneficiaries have to be sui iuris, i.e. of full age and mental capacity. The effect of the rule is that if the trustee sells trust property to himself, the transaction may be set aside, i.e. it is voidable at the instance of the beneficiary even if it was at an advantageous price. Track/Slide 14 The fair dealing rule deals with the situation where the trustee purchases the beneficiary's interest in the trust property rather than the property itself. The fair dealing rule is a less strict rule. The justification is obviously that this is more like a real sale. The beneficiary is dealing on his own behalf. The rule is that a trustee may purchase provided that he is able to show the transaction was fair, i.e. full value, and the beneficiary had all information prior to the sale. A trustee cannot circumvent these rules by dealing through a third party. Track/Slide 15 The most significant obligation of the fiduciary and of which the majority of case law centres around is that of the duty not to profit. The rule was established as early as 1896 in the case of Bray v Ford where Lord Herrshel laid down the following principle. "It is an inflexible rule of equity that a person in a fiduciary potion is not, unless otherwise expressly provided, entitled to make a profit. He is not allowed to put himself in a position where his interest and duty conflict.” Thus, unless authorised by his principal, a fiduciary cannot benefit from his position because of the risk of the fiduciary being swayed from his duty of loyalty. If he does, he cannot keep the profit for himself but has to pay it over to his principal. Only where the profit is authorised, i.e. the instrument creating the fiduciary obligation authorises the profit, or the fiduciary has received the fully informed prior consent or subsequent ratification of the principal is the fiduciary allowed to keep the profit. Track/Slide 16 We will see that the law is very strict even at times when it is clear that there is no real conflict present. The rule exists to avoid the remotest possibility of conflict occurring. It is irrelevant that the principal suffered not loss or even that it gains, even if such profit is obtained through the use of the fiduciary's own assets and by virtue of the fiduciary's skills and at the fiduciary's own risk or that the fiduciary acted in good faith. Indeed we can argue quite simply that a fiduciary cannot profit from his position. All that has to be shown is that link between the profit and the position. It is interesting to note Lord Justice Millett's analysis in Mothew. He separates the fiduciary's duty not to profit and his duty not to place himself in a position where his duty of loyalty and his interest may conflict. The former duty according to Bray v Ford and subsequent case law is en example of the second. Seemingly there are now two separate principles and arguably this supports the proposition that all that is required is to find a causal connection between the fiduciary's position and the profit obtained. It should not be necessary to go further and show a conflict of interest. Track/Slide 17 The rule against unauthorised incidental profits applies to trustees and extends to all fiduciaries. Although we are primarily concerned with the position of trustees, many of the cases considered relate to fiduciary relationships other than trustee-beneficiary and a number are actually companycompany director illustrations. Nevertheless all these cases are authoritative on the position of trustees. Track/Slide 18 The rule against benefits being obtained by a fiduciary as a result of his position has emerged as a result of the rigorous application by the courts of a decision in 1726 which established a prohibition on trustees renewing for their own benefit leases formerly held for their trusts. In Keech v Sanford the trustee obtained a renewal of a lease by virtue of him being trustee of the original lease. The trustee was not able to acquire the lease for the trust as the leasor refused to grant the lease in favour of the minor beneficiary. The trustee then took the lease for his own benefit and the profits from it. The court held that the trustee held the lease on trust for the minor beneficiary. Track/Slide 19 The issue has arisen on several occasions where the trust has shares in a private company and the trustees use the voting rights to secure their appointment as directors. Accordingly Re Macadam involved trustees of a trust with shares in a private company. The trustees used their position to appoint themselves directors of the company and received fees as directors. The trustees were held liable to account for the remuneration received as they had acquired it by use of their powers as trustees. The question is did the trustee acquire the position in which he drew the remuneration by virtue of his position as trustee. Track/Slide 20 However, the remuneration received will not be accountable to the trust if for example as in Re Dover Coalfield where a trustee had already become a director before becoming trustee or as in Re Gee where a trustee became a director independently of the votes of the shares of the trust or as in Re Lewis where the trustee obtained the remuneration not by the use of his position as trustee but by an independent bargain with the firm employing him. Track/Slide 21 Trustees can receive incidental profits in a variety of ways. For example, fees for introducing business, bribes or commissions received by the trustee in order either to induce him to take a particular course of action or to reward him for already having done so. However, whatever the profit is, the position is the same. If it has come to the trustee by virtue of his position then it belongs to the trust. Track/Slide 22 As we have seen from Bray v Ford, the no profit rule applies to any person in a fiduciary position. The most significant cases have tended to involve company directors. As outlined in the introduction to the lecture, the relationship of director and company is a fiduciary relationship. Company directors cannot therefore profit from their offers unless the companies articles permit or the shareholders consent. Track/Slide 23 The leading case is the decision of the House of Lords in Regal Hastings v Gulliver. In this case Regal Hastings only had sufficient funds to purchase 2,000 out of 5,000 shares in a subsidiary company it set up for investment purposes. Accordingly the directors agreed to purchase the remainder. When Regal Hastings Ltd. was transferred to new owners, the directors made a profit on their shares in the subsidiary company. The new controls of Regal sued the ex-directors for their profit and they were held liable to account by the court. The directors had profited from their position. Lord Russell had this to say. “ The rule of equity which insists on those, who by use of a fiduciary position make a profit, being liable to account for that profit, in no way depends on fraud or the absence of bona fides; or upon such questions or considerations as whether the profit would or should otherwise have gone to the plaintiff, or whether the profiteer was under a duty to obtain the source of the profit for the plaintiff, or whether he took a risk or acted as he did for the benefit of the plaintiff, or whether the plaintiff has in fact been damaged or benefited by his action. The liability arises from the mere fact of a profit having, in the stated circumstances, been made.” Track/Slide 24 There are several points worthy of note. Firstly the directors had acted in good faith. However, as is clear from the court of Lord Russell, the liability to account in no way depends on fraud or the absence of good faith. Secondly nor does it matter whether the plaintiff has in fact been damaged or benefited by the fiduciary's action. Indeed the new controllers of Regal Hastings obtained a windfall as they ended up paying less for the company than they had originally bargained to pay. Thirdly Lord Russell gives a clear statement that all that needs to be established is the link between the position and profit. In his words the liability arises from the mere fact of a profit having in the stated circumstances being made. Remembering the quote from Bray v Ford, the rationale for the rule that a fiduciary may not profit from his position is to prevent the fiduciary from putting himself in a position where his duty and interest conflict. From Regal Hastings however it would appear that it is not necessary to go further and show a conflict of interest. Indeed it is arguable that there was no conflict of interest given that the company were not in a position to afford to purchase the shares for themselves. However it is also arguable that there was in fact a conflict of interest as the decision that the company could not afford the shares was taken by the directors who were the very people who benefited from that decision. Track/Slide 25 A far more clear case of conflict of interest and duty can be seen in the case of Guinness v Saunders. In Guinness one of the directors, Ward, received £5.2 million for assisting in the takeover of Distillers, another company, by Guinness. The agreement for Ward's fee was made with two other directors, one of whom was Saunders, but not the board of directors. Ward provided his services in the takeover for a fee, the size of which was dependent on the amount of the takeover bid. Guinness claimed repayment of this fee. The House of Lords held that Ward was not entitled to retain the money because the contract with the two directors was void. The contract should have been made with the board and accordingly Ward was not authorised to have the profit. Accordingly he was constructive trustee of the money. Clearly the conflict of interest can be seen here as in agreeing the contingency fee, Ward was inevitably putting his interest and his duty in conflict since the more Guinness paid for distillers, the greater would be Ward's fee. His duty to negotiate a good price conflicted with his interest in enhancing his own fee. Track/Slide 26 In Industrial Development Consultants v Cooley the defendant who was managing director of the claimant company which provided construction consultancy services had been attempting on behalf of the claimant to obtain a contract with a gas board. The attempts failed because the gas board's policy was not to employ development companies. However, the following year the gas board offered the defendant the contract in his personal capacity if he could secure his release from his contract with the claimant company. Accordingly the defendant secured his release by representing falsely to the company that he was ill. He accepted the offer from the gas board to do substantially the same work which he had unsuccessfully attempted to obtain for the claimant company the year before. The claimant sought and obtained an account of the defendant's profits. At the time when the defendant realised that he had an opportunity of obtaining the contract for himself, the only capacity in which he was carrying on business was as director of the claimant company and as such he was under a fiduciary duty to pass on to the claimant any information which reached him while carrying on business in that capacity. His failure to do so and utilisation of the information for his own benefit was a clear breach of fiduciary duty. Accordingly the claimant was entitled to all the profit. Track/Slide 27 Not the more generous approach taken by the Privy Council in Queensland Mines Ltd v Hudson. The company had obtained mining exploration licences. However, due to a shortage of finance, [it] was unable to exploit the licences itself. The defendant resigned as managing director and with the knowledge of the company's board took over the venture himself and successfully developed the mines. The claimant claimed the profit obtained by the defendant. The Privy Council held that the defendant had obtained the opportunity to make this profit by virtue of his position as managing director of the claimant company and was therefore in principle liable under Regal Hastings v Gulliver to account for this profit. However, as the defendant had acted with the full knowledge of the company's board, this amounted to sufficient consent to enable the defendant to retain his profit. The difficulty with this decision is that only the shareholders and not the board could condone the defendant's breach. However, the Pricy Council's approach may be justified on the grounds that the claimant had only 2 shareholders, both of whom were represented on the company's board. Track/Slide 28 More recently in the case of Crown Dilmun the director rejected an investment opportunity on behalf of the company and later exploited it for himself. Accordingly he was held liable to account for the profit he had made. Track/Slide 29 An honest fiduciary who profits may be awarded an allowance for the work involved in making the profit. Compare the case of Boardman v Phipps which we shall now move on to look at with the case of Guinness v Saunders considered earlier. Track/Slide 30 An important case and one that raises a number of issues is that of Boardman v Phipps. The Phipps Trust had a minority shareholding in a private company which was not doing very well. Boardman who was the solicitor to the trust and T. Phipps, one of the beneficiaries, attended an annual general meeting with proxies of two of the trustees. They weren't satisfied with the state of the company's affairs. Boardman and Phipps accordingly wanted to acquire the majority shareholding. They suggested this to the trustees who said that the trust had no power to purchase more shares. Boardman and Phipps decided to obtain control of the company by themselves. There then followed negotiations with the company, throughout which Boardman purported to represent the trust and during which he obtained valuable information about the company. Eventually Boardman and Phipps acquired the outstanding shares. They reorganised the business and assets were sold off. The transaction was highly profitable and the trust benefited to the tune of £47,000. Boardman and Phipps also made a profit of £75,000. J. Phipps, the brother of T. Phipps, and one of the beneficiaries, brought an action against Boardman and his brother that they held the shares on constructive trust and had to account for the profits made on those shares. Track/Slide 31 By a three to two majority the House of Lords held that the information and opportunity to purchase the shares came as a result of Boardman's acting or purporting to act on behalf of the trustees and accordingly Boardman and Phipps were constructive trustees of the shares and liable to account to the beneficiary for the profit thereon. Track/Slide 32 It made no difference to the defendants' liability that they had acted honestly. It made no difference that the trust had lost nothing. Indeed it had gained from the defendants' activities. Nor did it matter that the trust was unable or unwilling to make the purchases. Track/Slide 33 The decision however is somewhat confused because of the differing judgements. Lords Hodson and Guest thought that the information received by Boardman and Phipps whilst purporting to represent the trust was trust property. Boardman and Phipps had used trust property and therefore were clearly liable. They and Lord Cohen thought that Boardman had placed himself in a position where his interest and his duty might conflict. Boardman as solicitor to the trustees was not in a position to give disinterested impartial advice at the stage when he was almost about to make a large profit for himself. And yet when he ought to have been advising the trustees to obtain wider investment powers from the court so as to enable the trust and not himself to make large profits. Because he had placed himself in this position, he had to account for any profit. However, in a dissenting judgement by Viscount Dilhorne and Lord Upjohn, they considered that there was no conflict or possibility of conflict. Boardman was however awarded payment on a liberal scale for his work and skill in obtaining the shares and the profit thereof. Note that such allowance was not granted to the director Ward in the case of Guinness and Saunders. It will be recalled that this case concerned a fee of £5.2 million received by the director Ward for his services in assisting with a take over bid. The question arose whether he should receive any allowance for the services he had provided and the House of Lords held that he should not. Such remuneration would be inappropriate because Ward had agreed to provide his services in return for a substantial fee and was accordingly putting himself clearly in a position in which his interests were in conflict with his duty as director. Track/Slide 34 Employees can be fiduciaries. For example In Reading V Attorney General an army sergeant who would probably not normally be regarded as a fiduciary was in this case considered to be a fiduciary because of the use of his uniform in his activities of escorting lorries through check-points. A significant case on the liability of the fiduciary is that of Attorney General for Hong Kong v Reid. The defendant was a public prosecutor. He took bribes to obstruct trials and invested the money received in purchasing 3 freehold properties in New Zealand. The Privy Council held that Reid was a constructive trustee of the bribes and as the houses were the traceable proceeds of the bribes. They were held on trust for the Crown. This is an important case because Lister v Stubbs established that a fiduciary who received bribes was only personally liable to account for the bribe received. Hence if he turned the bribe into anything which made a profit, he would only be liable to pay the original sum of the bribe and keep any profits. Attorney General for Hong Kong v Reid held that Lister v Stubbs was wrongly decided. Lord Templeman said that the decision in Lister v Stubbs was not consistent with the principles that a fiduciary must not be allowed to benefit from his own breach of duty, that the fiduciary should account for the bribe as soon as he received it and that equity regards as done that which ought to be done. From those principles it followed that the bribe and the property from time to time representing the bribe were held on a constructive trust for the person injured. Referring to Boardman v Phipps, “If a fiduciary acting honestly in good faith and making a profit which his principal could not make for himself becomes a constructive trustee of that profit, then a fiduciary acting dishonestly who accepts a bribe must also be a constructive trustee.” Track/Slide 35 Before Reid the inconsistency in the treatment of bribes and other profits was inexplicable, unsupportable and heavily criticized. The fiduciary who received a bribe was only accountable for that bribe. He did not hold it on constructive trust for his principal. Seemingly the courts were treating a dishonest fiduciary more favourably than an honest one. This can be seen in the case of Boardman v Phipps. Reid is thus a welcome decision. Of course it is not formally binding on the English courts. It will however presumably be followed although in Attorney General v Blake Lister v Stubbs were said to be still binding on the court. Reid's status as a precedent is therefore questionable but in a recent Chancery decision in Daraydan Holdings Ltd & Ors v Solland International the judge considered that Attorney General v Reid applied, there being powerful policy reasons for ensuring that a fiduciary does not retain gains acquired in violation of fiduciary duty. Both a judge of first instance and the Court of Appeal were free to follow decisions of the Privy Council. The system of precedent would be shown in a most unfavourable light if a litigant in a case was forced by the doctrine of precedent to go to the House of Lords in order to affirm a decision of the Privy Council. Track/Slide 36 This leads on to the question of the remedy against the fiduciary who has received an unauthorised profit. Is it a personal or a proprietary remedy? Liability to account for the profit is a personal remedy. The imposition of a constructive trust is a proprietary remedy. The question is particularly important where the fiduciary is insolvent or if he has wisely invested the profit in assets which have increased in value. In such circumstances claiming a constructive trust of the profit will put the principal in a favourable position. The courts have not been consistent in their approach, at times awarding the personal remedy of an account of profits and in other cases imposing a constructive trust over the profits. As we have seen, the inconsistency of approach was particularly marked in the case of bribes and indeed in consequence of the decision in Attorney General for Hong Kong v Reid it would appear that a fiduciary who receives an unauthorised profit will now hold it on constructive trust for his principal. Track/Slide 37 Returning to the general principle, trustees and other fiduciaries are not entitled to profit from their fiduciary position. It is clear from case law that should a trustee obtain a benefit from his trusteeship then he is required to account for it to the trust. It follows from this general principle that trustees are not entitled to be remunerated for their services which they provide to the trust. Indeed the office of trustee has traditionally been considered as gratuitous. There are two reasons for this rule. Firstly that a trustee is not allowed to derive a benefit from the trust property and secondly to allow payment would place a trustee in a position where his or her interest and duty would conflict. However there are specific instances where equity will authorise payment, the most common being where the trust instrument contains an express charging clause and further the advent of the Trustee Act 2000 has seen a change in the law's stance. Track/Slide 38 Aside from the Trustee Act 2000, there are various statutory provisions which authorise the payment of fees, usually where the court is involved and has had to appoint a statutory trustee, for example the public trustee. The court has an inherent jurisdiction to authorise remuneration. This inherent jurisdiction permits the court not only to award retrospective and future remuneration but also to increase the level of remuneration above what was in the trust instrument. This occurred in Re Duke of Norfolk's Settlement Trust where the trustees' work had increased significantly and the court felt able to increase the rate of remuneration above the amount authorised by the settler in the trust instrument. The court considered that there was no difference in increasing remuneration and granting remuneration when no remuneration had been provided by the trust instrument. The court's previous exercise of the jurisdiction had been limited to such cases. This power has also been applied to award unauthorised remuneration to fiduciaries in breach of their fiduciary obligations. For example Boardman v Phipps and in O’Sullivan v Management Music where the performer's agent procured the contract through undue influence. Track/Slide 39 The trustees may secure the agreement of the beneficiaries to payment. The beneficiaries must be sui iuris to agree and there is potential for a claim of undue influence. A trustee may be remunerated under the rule in Cradock v Piper which provides that a solicitor/trustee is entitled to charge for work done in a litigious matter. Track/Slide 40 A trustee has the right to reimbursement of expenses under section 31 of the Trustee Act 2000 and indeed this Act will have an effect on the issues we have just outlined. The powers of the court to award remuneration and for the beneficiaries to agree to remuneration still apply but presumably will be rarely used following the introduction to eh Act. Also the anomalous rule in Cradock v Piper will be rendered obsolete. Track/Slide 41 The Act has changed the position on remuneration in a number of ways. Firstly where there is an express professional charging clause within the trust instrument, the Act provides for new rules of construction of the clause. Firstly the services for which the professional trustee or trust corporation can charge for include services which could have been provided by a lay trustee. Secondly the remuneration is not treated as a gift for the purposes of section 15 of the Wills Act 1837. This means that a trustee may witness the will without the risk of invalidating the benefit he or she receives under the will. Such a provision is particularly useful to solicitors who may have drawn up the will and are appointed as trustees with the benefit of a charging clause. Track/Slide 42 Secondly if there is no provision for remuneration in the trust instrument then a professional trustee or a trust corporation is entitled to reasonable remuneration from the trust funds. Track/Slide 43 Reasonable remuneration means such remuneration that is reasonable in the circumstances for the provision of those services. Such right to remuneration only applies to a trustee who is a trust corporation or is acting in a professional capacity. A trustee acts in a professional capacity if he acts in the course of a profession or business which consists of or includes the provision of services in connection with a) the management or administration of trusts generally or of a particular kind of trust or b) any particular aspect of the management or administration of trusts generally or a particular kind of trust. Track/Slide 44 In the case of a professional trustee the other trustees must agree to the payment in writing and the right to remuneration does not apply to a sole trustee nor does it apply to charity trustees. Track/Slide 45 Section 29 thus provides a statutory default power of remuneration and reverses the common law rule against remuneration of trustees. Track/Slide 46 In this section on the fiduciary duties of trustees we have considered the question of who is a fiduciary. What are the characteristics of a relationship which makes it fiduciary? Examples such as trustee-beneficiary, company and company director, principal and agent. We have seen that it is important to decide whether a relationship can be classed as fiduciary due to the duties imposed on fiduciaries as examined by Lord Justice Millett in Bristol and West v Mothew. The core obligation of loyalty being developed by the courts into particular duties with the majority of instances and case law centring around the fiduciary's duty not to profit and the rationale for the rule. A fiduciary should not place himself in the position where his duty and his interest may conflict. We have examined the question of whether, whilst it appears the reason behind the rule is to deter a fiduciary from the slightest temptation of swaying from his duty of loyalty, all that is seemingly required for liability to be imposed is to profit from the position, whether or not a conflict does in fact exist. Finally we have considered the application of the rule to the issue of trustee's remuneration and the circumstances when a trustee is authorised to be paid for his work on behalf of the trust.