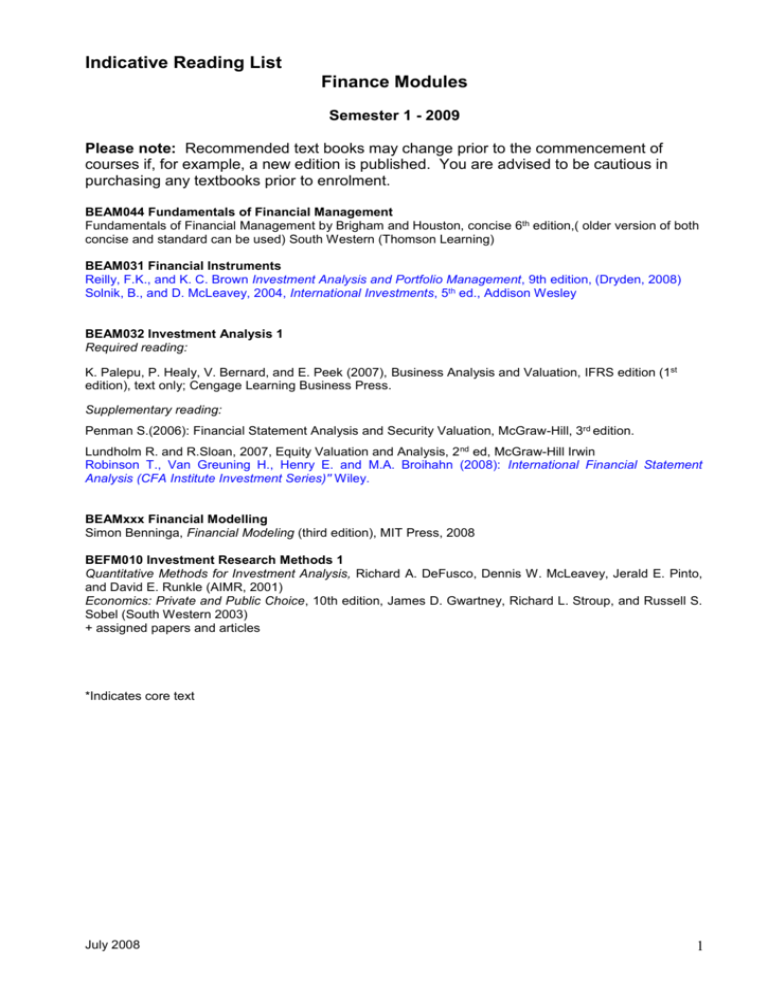

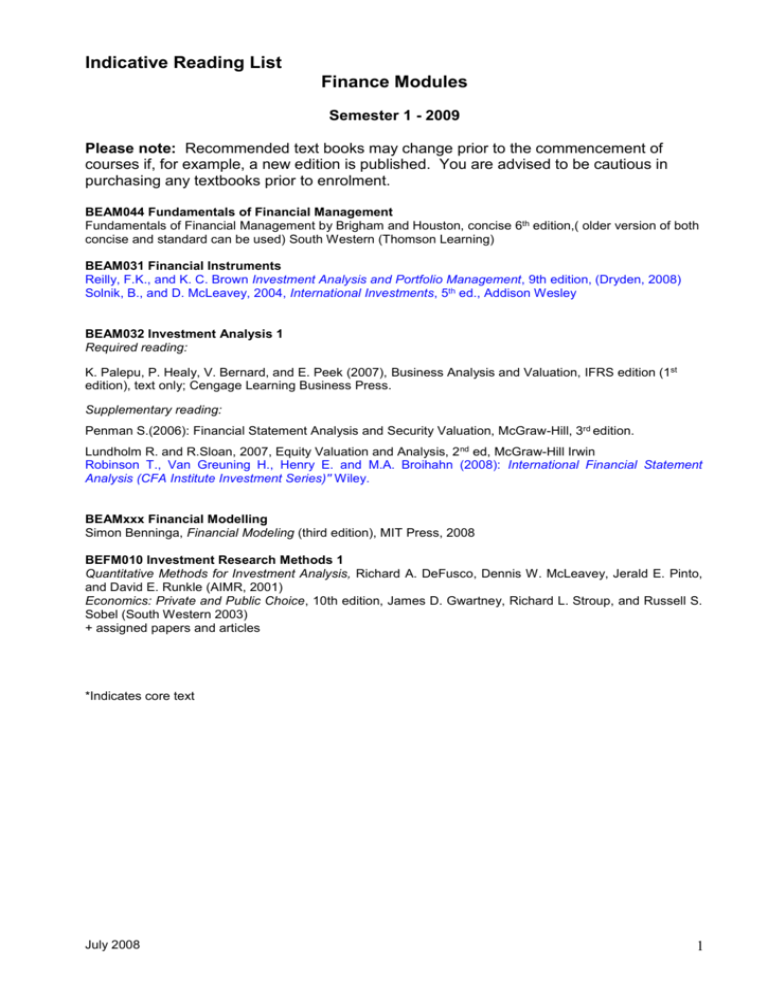

Indicative Reading List

Finance Modules

Semester 1 - 2009

Please note: Recommended text books may change prior to the commencement of

courses if, for example, a new edition is published. You are advised to be cautious in

purchasing any textbooks prior to enrolment.

BEAM044 Fundamentals of Financial Management

Fundamentals of Financial Management by Brigham and Houston, concise 6th edition,( older version of both

concise and standard can be used) South Western (Thomson Learning)

BEAM031 Financial Instruments

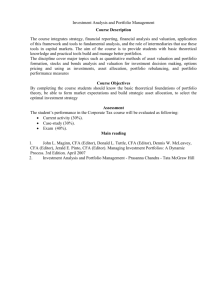

Reilly, F.K., and K. C. Brown Investment Analysis and Portfolio Management, 9th edition, (Dryden, 2008)

Solnik, B., and D. McLeavey, 2004, International Investments, 5th ed., Addison Wesley

BEAM032 Investment Analysis 1

Required reading:

K. Palepu, P. Healy, V. Bernard, and E. Peek (2007), Business Analysis and Valuation, IFRS edition (1st

edition), text only; Cengage Learning Business Press.

Supplementary reading:

Penman S.(2006): Financial Statement Analysis and Security Valuation, McGraw-Hill, 3rd edition.

Lundholm R. and R.Sloan, 2007, Equity Valuation and Analysis, 2 nd ed, McGraw-Hill Irwin

Robinson T., Van Greuning H., Henry E. and M.A. Broihahn (2008): International Financial Statement

Analysis (CFA Institute Investment Series)" Wiley.

BEAMxxx Financial Modelling

Simon Benninga, Financial Modeling (third edition), MIT Press, 2008

BEFM010 Investment Research Methods 1

Quantitative Methods for Investment Analysis, Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto,

and David E. Runkle (AIMR, 2001)

Economics: Private and Public Choice, 10th edition, James D. Gwartney, Richard L. Stroup, and Russell S.

Sobel (South Western 2003)

+ assigned papers and articles

*Indicates core text

July 2008

1

Semester 2 - 2009

BEAM033 Banking and Financial Services

Core text:

Mishkin, F. S. 2007, Money, Banking, and Financial Markets. Eigth Edition. Pearson Addison Wesley.

Recommended texts:

Howells P. & Bain K., (2005), "The Economics of Money, Banking & Finance: A European Text", 3rd edition,

Prentice-Hall & Financial Times

Kohn, M. 2004, Financial Institutions and Markets. Second Edition. Oxford University Press.

BEAM039 Principles of Finance

E. Elton, M. Gruber, S Brown, and W Goetzman, 2007, Modern Portfolio Theory and Investment Analysis, 7th edition, John

Wiley & Sons, ISBN 0-470-05082-9.

H. Levy and T. Post, 2005, Investments, Prentice Hall, ISBN 0-273-65164-1.

Other readings recommended in the course of the semester.

BEAM038 Investment Analysis 2

Required reading:

Alan Gregory, Strategic Valuation of Companies, 2nd Edition., Financial Times

K. Palepu, P. Healy, V. Bernard, and E. Peek (2007), Business Analysis and Valuation, IFRS edition (1st

edition), text only; Cengage Learning Business Press.

Supplementary reading:

T Copeland, T Koller, J Murrin, McKinsey & Co Inc, 2000, Valuation-Measuring and Managing Value of

Companies, 3rd ed., Wiley

John D. Stowe, Thomas R. Robinson, Jerald E. Pinto, Dennis W. McLeavey, Analysis of Equity Investments:

Valuation (Hardcover), Aug 2002, AIMR

BEAM034 Corporate Finance

Fundamentals of Financial Management by Brigham and Houston, Concise 6e, South Western. Older

editions of this book (either the Concise version or the standard version) can also be used.

BEAM035 Derivatives Pricing

Required texts:

Don M. Chance, Analysis of Derivatives for the CFA® Program, 2003

Frank J. Fabozzi, Fixed Income Analysis for the CFA® Program, 2007

Additional reading:

Hull, J., 2000, Options, Futures and other derivatives, 3rd ed., Prentice Hall

Kolb, R. W., 2002, Futures, Options and Swaps, 3rd ed., Blackwell Business

BEAM036 Domestic & International Portfolio Management

Required reading:

Solnik, B., and D. McLeavey, 2004, International Investments, 5th ed., AIMR, Addison Wesley

Additional reading:

Reilly, F.K., and K.C. Brown, 2006, Investment Analysis and Portfolio Management, 8th ed., Thomson SouthWestern

Hull, J.C., 2003, Options, Futures, and Other Derivatives, 5th ed., Prentice Hall

BEAM033 Banking & Financial Services

Core text:

Kohn, M. 2004, Financial Institutions and Markets. Second Edition. Oxford University Press.

Recommended texts:

Howells, P., and Bain, K. 2002, The Economics of Money, Banking and Finance. Second Edition. Financial

Times Prentice Hall.

Mishkin, F. S., and Eakins, S. G. 2000, Financial Markets and Institutions. Third Edition. Addison Wesley

Longman.

Valdez, S. 2003. An Introduction to Global Financial Markets. Fourth Edition. Palgrave Macmillan.

BEAM042 International Financial Management

Alan C. Shapiro, Multinational Financial Management, 8th ed. Wiley, 2006. OR

Jeff Madura, International Corporate Finance, 8th ed. Thomson, 2006

July 2008

2

BEAM037 Investment Analysis Project

K. Palepu, P. Healy, V. Bernard, 2003, Business Analysis and Valuation using Financial Statements, 3rd ed,

Thomson South Western;

G.I. White, A.C. Sondhi and D. Fried, 2003, The Analysis and Use of Financial Statements, 3rd ed, Wiley;

M. Fridson and F. Alvarez, 2002, Financial Statement Analysis: A Practitioner’s Guide, 3rd ed, Wiley;

Simon Benninga, Financial Modeling, 2000, Second edition, MIT Press.

MSc Financial Analysis & Fund Management

BEFM010 Investment Research Methods 1

CFA Curriculum set plus:

Quantitative Methods for Investment Analysis, Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto,

and David E. Runkle (AIMR, 2001)

Economics: Private and Public Choice, 10th edition, James D. Gwartney, Richard L. Stroup, and Russell S.

Sobel (South Western 2003)

+ assigned papers and articles

BEFM011 Financial Statement Analysis

CFA Curriculum set plus:

Financial Statement Analysis, Curriculum Volume 3, CFA Institute, CFA Program Level 1, 2008.

Supplementary:

G.I. White, A.C. Sondhi and D. Fried, 2003, The Analysis and Use of Financial Statements, 3rd ed, Wiley.

Assigned research papers to be distributed during the class.

BEFM012 Financial Theory & Management

CFA curriculum set plus:

Fundamentals of Financial Management by Brigham and Houston, 11th edition (10th edition is OK), South

Western (Thomson Learning)

BEFM013 Investment Instruments

CFA curriculum set plus:

Reilly, F.K., and K. C. Brown Investment Analysis and Portfolio Management, 9th edition, (Dryden, 2008)

+ assigned articles and papers.

BEFM014 Investment Research Methods 2

CFA Curriculum set plus:

Quantitative Methods for Investment Analysis, Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto,

and David E. Runkle (AIMR, 2001)

The Analysis and Use of Financial Statements, 2nd edition, Gerald I. White, Ashwinpaul C. Sondhi, and Dov

Fried (Wiley, 1998)

+ assigned articles and papers

BEFM015 Portfolio Management & Asset Allocation

CFA Curriculum set plus:

Solnik, B., and D. McLeavey, 2004, International Investments, 5th ed., AIMR, Addison Wesley

Additional reading:

Reilly, F.K., and K.C. Brown, 2006, Investment Analysis and Portfolio Management, 8th ed., Thomson SouthWestern

Hull, J.C., 2003, Options, Futures, and Other Derivatives, 5th ed., Prentice Hall

Fixed Income Analysis for the Chartered Financial Analyst Program, Frank J. Fabozzi (Frank J. Fabozzi

Associates, 2000)

Standards of Practice Handbook, 8th edition (AIMR, 1999), Standards of Practice Casebook (AIMR, 1996)

BEFM016 Equity Valuation Models & Issues

CFA curriculum set plus:

Required reading:

Alan Gregory, Strategic Valuation of Companies, 2nd Edition., Financial Times

K. Palepu, P. Healy, V. Bernard, and E. Peek (2007), Business Analysis and Valuation, IFRS edition (1st

edition), text only; Cengage Learning Business Press.

Supplementary reading:

T Copeland, T Koller, J Murrin, McKinsey & Co Inc, 2000, Valuation-Measuring and Managing Value of

Companies, 3rd ed., Wiley

John D. Stowe, Thomas R. Robinson, Jerald E. Pinto, Dennis W. McLeavey, Analysis of Equity Investments:

Valuation (Hardcover), Aug 2002, AIMR

July 2008

3

BEFM017 Credit Instruments & Derivatives

CFA Curriculum set plus:

Required texts:

Don M. Chance, Analysis of Derivatives for the CFA® Program, 2003

Frank J. Fabozzi, Fixed Income Analysis for the CFA® Program, 2007

Additional reading:

Hull, J., 2000, Options, Futures and other derivatives, 3rd ed., Prentice Hall

Kolb, R. W., 2002, Futures, Options and Swaps, 3rd ed., Blackwell Business

MSc Accounting and Finance

Accounting modules: Semester 1

BEAM024 Advanced Financial Accounting (MSc A&F only)

There is no one core module text but the following books are relevant to various sections of the module:

Beaver, W. (1998), Financial Reporting: an Accounting Revolution, 3rd edition, Prentice Hall

Bromwich, M. (1991), Financial Reporting, Information and Capital Markets, Pitman

Hopwood A and Miller P. (eds) 1994, Accounting as Social and Institutional Practice, Cambridge University Press

Parker, R., Harcourt, G. and Whittington G. (1986), Readings in the concept and measurement of income, Philip

Allan

Belkaoui, A. (2004), Accounting Theory, 5th edition, Cengage Learning (formerlyThomson Learning)

Scott, W. (2006), Financial Accounting Theory, 4th edition, Prentice Hall

Watts, R. and Zimmerman, J. (1986), Positive Accounting Theory, New York: Prentice Hall

In addition reference will be made to a selection of academic journal articles, including:

Barth, M. and Landsman, W. (1995), Fundamental Issues Related to Using Fair Value Accounting for Financial

Reporting, Accounting Horizons, December, pp.97-107.

Beaver, W. and Demski, J. (1979), The Nature of Income Measurement, The Accounting Review, Vol. 54, No. 1.

(Jan) pp. 38-46

Benston, G. (2006), Fair-value accounting: A cautionary tale from Enron, Journal of Accounting and Public

Policy, 25, pp.465-484

Dechow, P. and Skinner, D. (2000), Earnings Management: Reconciling the views of Accounting Academics,

Practitioners and Regulators, Accounting Horizons, Vol. 14 (2), pp. 235-250.

Dechow, P., Hutton, A. and Sloan, R. (1999), An empirical assessment of the residual income valuation model,

Journal of Accounting and Economics, Vol. 26, pp1–34.

Holland, K. and Jackson, R. (2004), Earnings Management and Deferred Tax, Accounting and Business Research,

Vol. 34 No 2, pp.101-123.

O’Hanlon, J. (1995), The Univariate Time Series Modelling of Earnings: A Review, British Accounting Review,

Vol. 27(3), 1995, 187-210.

Ohlson, J. (1995), Earnings, Book Values, and Dividends in Equity Valuation, Contemporary Accounting

Research, 11(2), pp. 661-687

Potter B., (2005), Accounting as a social and institutional practice: perspectives to enrich our understanding of

accounting change, Abacus, Vol. 41 (3), pp. 265-289,

Verrechia, R., (1983), Discretionary disclosure, Journal of Accounting and Economics, December, pp.179-194

Walker, M., (1988), The Information Economics Approach Towards Financial Reporting, Accounting and

Business Research, Vol.18, pp.170–182.

Walker, M., (1997) Clean Surplus Accounting Models and Market Based Accounting Research: A Review,

Accounting and Business Research, Autumn, pp. 341-355.

BEAM025 Advanced Management Accounting (MSc A&F only)

Core Text (used extensively):

Taha, H. A. (2007), Operations Research: An Introduction, 8th Ed., Pearson

Prentice Hall.

Selected Journal Articles:

Davis, S. and Albright, T. (2004), An investigation of the effect of

Balanced Scorecard implementation on financial performance, Management

Accounting Research, Vol 15, No 2, June, pp. 135-153.

Melnyk, S.A., Stewart, D.M. and Swink, M. (2004), Metrics and performance

measurement in operations management: dealing with the metrics maze,

Journal of Operations Management,Vol 22, No 3, pp. 209-218

Ozbilgin, M. and Penno, M. (2005), Corporate Disclosure and Operational

Strategy: Financial vs. Operational Success, Management Science, Vol 51,

No 6, June.

July 2008

4

BEAM026 Corporate Governance and Reporting (MSc A&F only)

A selection of book parts, including readings from:

Solomon, J and Solomon A (2004), Corporate Governance and Accountability, Wiley,

Bebchuk, L.A. and Fried, J. M. (2004), Pay without performance: The unfulfilled promise of executive

compensation, Harvard University Press, Harvard

A selection of academic journal articles, including:

Gregory, A. and Collier, P. (1999), Audit Committee Activity and Agency Costs, Journal of Accounting and

Public Policy, 18: 4-5, Winter

Solomon, A. (2000), Could Corporate Environmental Reporting Shadow Financial Reporting?, Accounting

Forum, Vol. 24, No 1, March, pp. 35-61.

Solomon, A. and Lewis, L.A. (2002), Incentives and Disincentives for Corporate Environmental Disclosure,

Business Strategy and the Environment, Vol 11, No 3, pp.154-169.

Solomon, J. F., Solomon, A., Joseph, N. L. and Norton, S.D. (2000), Institutional Investors' Views on

Corporate Governance Reform: Policy Recommendations for the 21st Century, Corporate Governance: An

International Review, Vol 8, No 3, July, pp. 217-226.

A selection of web-based materials, including:

The Revised Combined Code on Corporate Governance and other materials via http://www.frc.org.uk/

FTSE4GOOD materials at, http://www.ftse.com/ftse4good/index.jsp

The International Corporate Governance Institute at http://www.icgn.org/

BEAM027 60 credit Dissertation (MSc A&F only)

July 2008

5