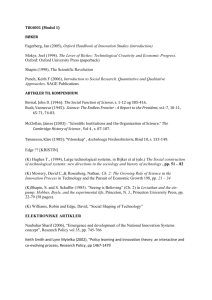

DOC - Fondazione Rosselli

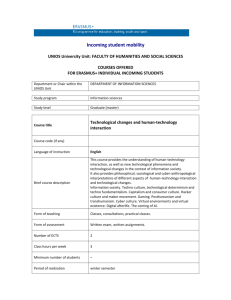

advertisement