Credit Play Checkmate

Jamila

Awad

Credit Play Checkmate:

Trading Credit Risk Financial Instruments

Author

Jamila Awad

Rights Reserved

JAW Group

Date

June 2013

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

Executive Summary

The globalization of financial markets and the automation of monetary transactions

accentuated the desideratum to manage sophisticated economic instruments such as credit

play products. The delivered disquisition aspires to illuminate the comprehension of

market participants in sage credit risk derivative trading and thus prevent perilous

financial checkmate. The dissertation is partitioned in three sections. The inaugurating

section cements the regulatory and environmental foundations to embrace credit play

instruments. The following sections decapsulate the retained debt derivatives in two

distinct categories: simple-forms and multi-structures. In brief, the sound implementation

of credit risk derivative financial engineering innovation shall no longer be perceived as a

threat to the economic system.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group

2

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

Introduction

Credit derivative instruments intend to successfully transfer and redistribute credit risk.

Dynamic hedging with credit derivatives targets to retrench risk concentrations on

balance sheets as well as to liberate capital for regulatory purposes. Precisely, these

sophisticated financial tools partition a group of assets directed to dilute the panoply of

risks induced and offer new investment opportunities to a clientele with tailored risk

appetites. Financial institutions can therefore decrease chambered economic capital

ordered by authority regulations with sound credit derivative hedging.

The redaction strives to educate the financial community about a prudent and efficient

implementation of credit play instruments and thus safeguard the economic system from

meltdowns and armor common-man confidence. Financial institutions engaged in trading

activities are ordered to chamber regulatory capital to buffer unanticipated losses in their

banking and trading books. Credit derivative products shall therefore be adequately

processed to mitigate credit risk and contribute in relieving dormant economic capital.

The Basel banking guidelines as well as the Dodd-Frank-Volcker reform address the

restrictions of credit play products and the enforcement of trading boundaries. In

addition, international accounting bodies continuously modernize standards destined to

guide entities in the financial playfield on the concept of fair value hedging.

The International Swaps and Derivatives Association represents the organization

responsible for the superintendence and coercion of credit derivative trading. The

imminent Dodd-Frank-Volcker American regulatory ordinance will shift traditional

proprietary players towards the alternative investment field. In addition, the use of credit

derivative holds a history in the securitization process whereas debt financial tools

diminish credit risk concentrations and securitize loan portfolios.

Purchasing a credit derivative is equivalent to shorting a credit risk and selling a credit

derivative corresponds to vending a credit protection. Credit play instruments target the

following financial obligation domains: bonds, loans, borrowed cash and lastly payments.

The LIBOR or the Euribor swap curve depicts the interest rate benchmark at which

financial entities hedge credit risks. The credit derivative market is accessible to a wide

range of investors due to repacking vehicles who create securities to grasp a clientele.

The examination of portfolio trading requisites to evaluate the following parameters: the

number of assets in the portfolio, the default probabilities, the recovery rates, and finally,

the default correlations between the assets contained in the portfolio. In addition, the

default characteristics augment for large portfolios that necessitate a sophisticated

valuation model.

The credit derivative market breadth impacts the following financial participants: banks,

insurance firms, corporations, investment grade sovereign bonds, and finally, emerging

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group

3

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

countries sovereign debt. For example, insurance firms participate actively as buyers of

credit risk derivative instruments to hedge against sovereign risk.

The strength of credit sophisticated instruments compared to the equity market resides on

the structuring of credit derivatives that is linked to the credit quality of an institution in

the absence of tradable debt. In essence, investors are provided the opportunity to hedge

exposures to new credits inexistent in cash format.

Credit risk management aspires to implement a proactive framework destined to buffer

the probability of a counterparty failing to meet its contractual obligations. Credit play

governance intends to identify sound trading of credit derivative instruments and to

ensure secure transactions in light of market events. The credit risk analysis strives to

maintain an entity’s credit exposure methodologies in accordance with the credit risk

management mandate.

The research paper is segmented in three sections. The first section bonds the

environmental and regulatory regimes to prudently transact credit play products. The

second and third sections unravel the theoretical and mathematical foundations to discern

the retained debt derivatives in two distinct categories: simple-forms and multi-structures.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group

4

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

1.0 The Credit Risk Derivative Instrument Background

The inaugurating section presents the environmental and regulatory framework to address

sage credit risk derivative trading.

1.1 The Credit Play Financial Market Risks

Financial markets expose participants to a range of risks whereas the debt threat of

damage is hedged with credit play instruments. The retained categories of market perils

from a debt hedge point of view are summarized:

Market risk: The market risk represents the possible mark-to-market depletion on

positions from adverse moves in all risk parameters. Financial entities adhere to the

following methodologies in order to address the market risk: risk appetite management,

portfolio analyses, value-at-risk simulations, stress tests, and finally, scenario analyses.

Market risk management can be performed with the described quantitative tests to

evaluate the validation and back-testing procedures for market peril modeling.

Operational risk: The operational risk reflects the business and to some extent the legal

plunge that arises from losses due to human error, litigations with various parties and

daily operational business uncertainties not considered in the other retained financial risk

categories. The administration of operational uncertainty collects and interprets the

information. It also necessitates consulting committees to justify models and regulatory

capital figures.

Equity risk: The equity risk represents the economic wastes that arise from positions

with counterparties as well as from operational ventures that are filtered to measure the

required regulatory capital. The conservation of sage equity levels safeguards the firm to

raise additional capital and to increase business with credit-worthy counterparties.

Model validation risk: The model validation risk depicts the exposure of a firm to

assess appropriate model risks and to modernize model selections. It requires a proactive

participation of various departments and third-parties to establish protocols and monitor

models. The model validation risk management implements internal controls to assess

procedures and revise pricing strategies. Various committees are established within the

firm to approve the designed arrangements.

Event risk: The event risk identifies potential plunges that derive to losses following

events that are linked to market transactions such as loan defaults and investment-grade

fixed-income downgrades.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group

5

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

Counterparty risk: The counterparty risk illustrates the likelihood of peril across an

entity’s forward settlements, financial transactions and over-the-counter derivative

agreements.

Entities are therefore recommended to enforce credit risk management procedures to

buffer uncertainties in daily operations and safeguard all market participants’ confidence.

1.2 The ISDA Mechanism in Conjunction with the Dodd-Frank-Volcker

Reform

The international swaps and derivatives association (ISDA) depicts an organization

that channels financial participants to guide them in the over-the-counter derivative

market. An ISDA agreement portrays a multilateral agreement that facilitates various

over-the-counter standardized mechanisms to be processed on the basis that all parties

involved comply with the contracts. The ISDA body foresees operations in

conjunction with the Dodd-Frank-Volcker reform to provide the financial industry

with procedures and solutions that aim to safeguard sage derivative trading practices.

The American ordinance recommends swap market players to adhere to the DoddFrank protocols in collaboration with the ISDA organization that enables business

parties to secure provisions and transactions in the credit play field. Hence, the

counterparties are therefore scrutinized to enhance disclosures. In addition,

verifications are performed to validate the compliance of counterparties with the

Dodd-Frank protocols. The clearing requirements, the permitted amendments, the

regulatory regimes and other specifications related to debt derivative trading are

governed by the bilateral ISDA and Dodd-Frank protocol channeling. The merger

architecture encourages widespread information dissemination about organizations

involved in the over-the-counter market as well as delivers malleability to all parties

by permitting them to select optimal derivative transactions. The Dodd-Frank act will

be implemented in various jurisdictions and will therefore repercuss the global

financial system as an ensemble.

1.3The Credit Risk Derivative Market Arrangement

The framework of credit risk derivatives requires bonding an investor, wishing to receive

a compensation for incurred credit risk, to a hedger, aiming to honor the obligation by

removing the credit risk. The linkage between both parties relies on two parameters: the

probability of default and the recovery rate at the bond’s maturity.

The binomial tree represents the simplest form to characterize the credit risk derivative

instrument arrangement:

PBond = [1/(1+TFree)] * [(P * 100 * R) + (1-P) * 100]

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group

6

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

Definition of variables:

PBond: The expected bond payoff discounted from the risk-free curve.

TFree: The risk-neutral default-free rate that derives from the LIBOR or Euribor swap

curve.

P: The bond’s probability of default over the next year.

R: The recovery rate based on a fixed percentage of the face value.

In addition, the bond’s credit quality is measured by the spread derived from the credit

triangle formula:

S = [100/(PBond*(1+TFree)] -1

Definition of variables:

S: The spread which represents the annualized compensation for assuming credit risk.

PBond: The expected bond payoff discounted from the risk-free curve.

TFree: The risk-neutral default-free rate that derives from the LIBOR or Euribor swap

curve.

The spread illustrates a forward-looking compensation that encompasses for liquidity,

regulatory capital and credit risk premium to protect the bond holder for the bearing risk.

Hence, the described equations are primordial to comprehend how to price fixed recovery

default swaps and to examine cross default provisions of a firm’s debt portfolio.

Furthermore, international rating agencies provide information about the parameters

necessary to value credit risk derivatives: The default probability for various ratings and

maturities and the recovery rates relying on the level of subordination.

The credit spread curve shapes are utilized to measure the excess yield, denoted credit

spread, necessary to compensate over a determined benchmark an investor for bearing a

risk appetite.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group

7

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

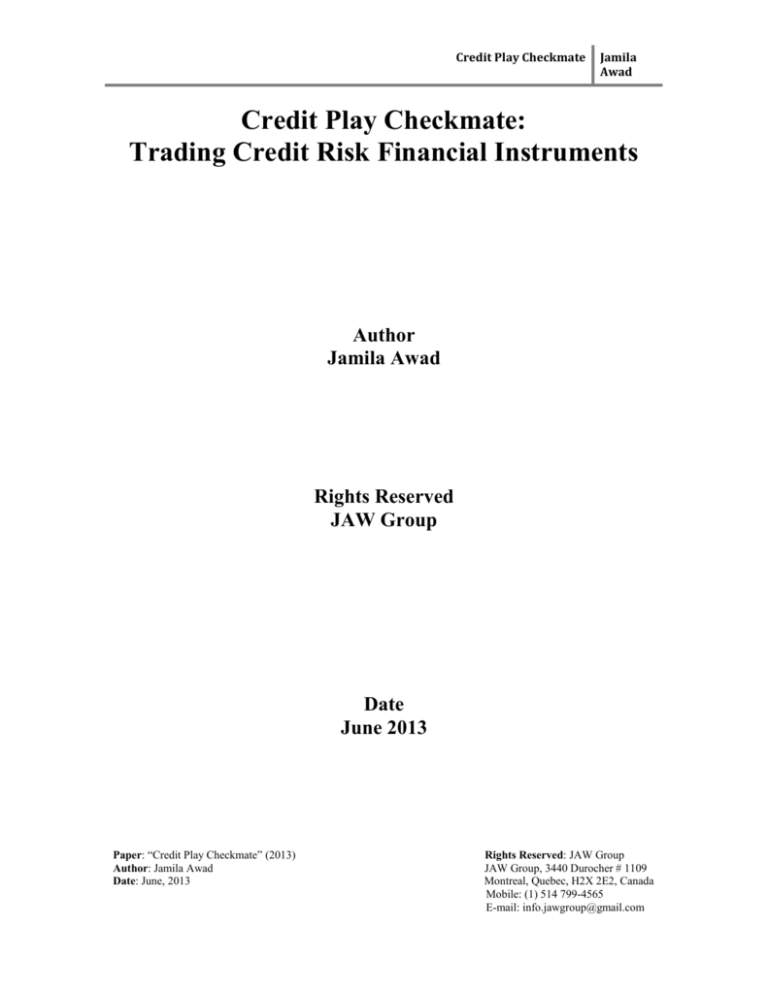

Figure I: The Dominant Credit Spread Curve Shapes

Inverted

Humped

Upward

The dominant credit spread curve shapes traced in the above figure and summarized with

the following description:

Inverted curve: The downward sloping yield curve is linked to credits that have

demonstrated a deteriorated credit quality with a high default probability. In

consequence, the short-maturity spread is increased and the spread curve is inverted.

Humped curve: The humped sloping yield curve occurs when credits holding a low

chance of default degrade in quality in the medium term. Hence, the credit spread with a

moderate survival rate then falls as the maturity increases.

Upward curve: The upward sloping yield curve illustrates a constant credit quality in the

short term and an elevated credit spread in the long run to compensate the investor for

increased uncertainty.

1.4 The Underlying Structure of Credit Derivative Instruments

Floating-rate notes portray a standard setting model for credit derivative pricing. In

precise terms, floating-rate notes are not defined as credit derivative products however

their existence play a prominent role in the comprehension of sophisticated financial

instruments.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group

8

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

Floating-rate notes depict pure credit plays where bonds are combined to variable interest

rate indexes, based on LIBOR or Euribor, which deflate the interest rate sensitivity of the

notes compared to fixed-rate bonds. In consequence, the price adjustment of floating-rate

notes derive from shifts in the market perception of the issuer’s credit quality. This type

of product compensates investors with a higher yield to reward for credit risk and

portrays a popular tool among investment grade banks and corporations. The pricing of

floating-rate notes is generated by two methods: the floater spread and the discount

margin.

First, the price on coupon dates of the floating-rate notes depend on the following factors:

the floater spread, the maturity timeframe, the coupon, and finally, the LIBOR or Euribor

curve. Therefore, the price of this product following the floater spread method deviates

from par value following movements in the LIBOR or Euribor rate between coupon dates

and exposes the investor to reset interest rate risk.

Second, the price of this instrument induced from the discount margin method disregards

the shape of the LIBOR or Euribor forward term structure and calculates a price by

inferring a discount margin linked to a fixed spread over LIBOR or Euribor. Hence, the

Newton-Raphson mathematical logic enables to solve the discount margin.

In conclusion, floating-rate notes are metamorphosed into asset swaps to become pure

credit derivative financial instruments.

2.0 The Simple-Structure of Credit Derivative Instruments

The second component of the dissertation describes the mathematical and theoretical

regimes implicated in the simple-form of credit risk financial instruments. The selected

products are: asset swaps, default swaps, credit-linked notes, special purpose vehicles,

principal protected structures, credit spread options, bond options, and lastly, total return

swaps.

2.1 Asset Swaps

The transformation of floating-rate notes is created with asset swaps that hedge out the

interest rate risk by swapping the fixed payments of a bond to floating installments. In

essence, the investor absorbs the credit risk that is equivalent to purchasing a floating-rate

note distributed by the issuer of the fixed-rate bond. The investor is therefore rewarded

for bearing the risk with an asset swap spread quoted as a stretch from LIBOR or Euribor.

The predominant asset swap structures are initiated in two distinct trades: The asset swap

buyer, in return for an up-front payment of par which represents the first trade, receives a

fixed rate bond or enters into an interest rate swap with the asset swap seller which

depicts the second trade.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group

9

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

The LIBOR or Euribor curve utilized to compute the asset swap spread implies that both

parties hold similar a credit quality rating. The asset swap spread is therefore measured

with the following equation:

SAsset Swap = (PVLIBOR/Euribor – PVMarket ) / PVBP

Definition of variables:

SAsset Swap: The asset swap spread.

PVLIBOR/Euribor: The present value of the bond price derived from the LIBOR or Euribor

swap curve.

PVMarket: The present value of the full market price of the bond.

PVBP: The present value of one-basis point annuity with the maturity of the bond.

Banking institutions depict important market participants who actively trade asset swaps

to convert long-term fixed-rate assets contained in their balance sheets to floating-rates in

order to align their short-term liabilities. However, an important element to drill in mind

derives from the fact that the buyer of an interest rate asset swap bears the fixed-side

payments in the absence of coupon funding when the bond defaults. Hence, the

counterparty default risk shall also be considered. The asset swap purchaser also loses the

redemption of the bond that is modified with compensation from a recovery rate paid by

the issuer. In consequence, the asset swap buyer holds a default contingent exposure to

the mark-to-market interest rate swap and to redeem the asset. The investor therefore

seats a leveraged position on the credit exposure and can stray from the initial

investment. The asset swap mark-to-market adaptation relies on the sensitivity of the

fixed side of the swap to parallel shifts in the LIBOR or Euribor curve. However, the

responsiveness in terms of sensibility of the bond price to parallel movements in the yield

curve is less pronounced than the sensitivity of the fixed side of the swap.

The pure play credit derivative swaps are illustrated with the following categories:

forward asset swaps, cross-currency asset swaps and callable asset swaps. The forward

asset swaps are applied when investors do not wish to bear a default risk until a forward

date. The investor then buys the credit derivative at some future date which might be

attractive than to incur a present risk with the purchase of an immediate asset swap. The

cross-currency swaps offer the investor the possibility to purchase debt in local currency

but denominated in foreign currency and receive floating-rate payments in local devise.

The bilateral devise swaps permit an investor to purchase credit risk derivatives

denominated in foreign currency while hedging interest rate and devise risk. Lastly, the

callable asset swaps enable an investor to acquire a convertible bond on an asset swap

and to receive a floating-rate coupon from the seller whereas the embedded call option is

sold separately to the equity investor. Hence, callable asset swaps aim to provide the

equity holder the right to convert the bond into the underlying stock.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 10

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

In conclusion, asset swaps depict efficient over-the-counter credit derivatives that enable

investors to grasp mispricing opportunities in the floating-rate note market.

2.2 Default Swaps

Default swaps portray simple bilateral credit play contracts intended to safeguard

investors from an asset’s default with the purchase of a protection. The specifications of

such bidirectional agreements are explicitly regulated by the ISDA. These instruments

target hedging concentrations of credit risk such as large exposures on balance sheets.

They can be customized with tailored maturity and seniority requirements for over-thecounter trades. They provide flexible investing options such as trading for the

deterioration or the improvement of a credit quality. Finally, default swaps offer an

unfunded route to bear credit risk with leveraging.

The default swap buyer disperses a fee to compensate against the loss on the investment

following a credit event. The legal credit events include bankruptcy, failure-to-pay and

restructurings. The protection holder renders a regular stream of payments defined as the

premium leg calculated from the default swap spread until a credit event arises or until

maturity. On the other hand, the vendor rewards the buyer with a payment known as the

protection leg when a credit event occurs before the maturity date of the agreement. The

protection leg equals the difference between par and the price of the cheapest to deliver

asset of the reference entity on the face value as well as indemnifies the protection

purchaser for the peril. The protection buyer is then remunerated with the following

options: cash reception after the physical delivery of a defaulted security to the seller,

sum collection that is reduced from the default price of the reference asset or lastly

remittance of a fixed cash settlement. Fixed recovery default swaps enable investors to

leverage their credit exposure and in return be compensated with a higher yield.

However, some jurisdictions require that the regulatory capital treatment of fixed

recovery default swaps be allocated in proportion to the maximum loss.

Default swap protection buyers often prefer the fixed cash settlement in order to create a

synthetic short position in a credit. It also permits the protection acquirer to end premium

payments once the credit event occurs. However, the default swap depicts a par product

that does not hedge the peril on an asset currently trading away from par value. In

consequence, the investor is recommended to consider the size of the hedge to amortize

the face value of the bond. The marking to market of a default swap unravels the changes

in the value of the default swap following the issuer’s credit quality alterations. The

adapting default swap spread therefore also reflects the cost of entering into an offsetting

transaction on a mark-to-market basis. The cash flows in the annuity are weighed by the

non-occurrence of credit event before the cash flow date.

The combined position of the protection credit play buyer and seller results in net spread

payments market-to-market with the following equation:

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 11

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

SDefault Swap = [S(T+1) – S(T)] * PV1

Definition of variables:

SDefault Swap: The marking to market of a default swap.

S(T+1): The current swap spread to the maturity date.

S(T): The default swap spread at trade inception.

PV1: The present value of one-basis point zero-recovery annuity with the maturity of the

default swap that terminates following a credit event.

However, arbitrage-free relationships arise due to market dynamics whereas deviations

occur between cash and credit derivative platforms. For example, default swap spreads

can trade wider than a similar cash instrument due to the protection on the credit and

where loans are difficult to transfer. On the other hand, a default swap spread can tighten

if an investor sells a protection for a credit play in the occurrence of a lack of supply of a

corresponding cash format. Hence, investors shall consider all aspects of the trading

instruments and the market factors to determine tolerable differences between spreads in

the cash and the credit market. The dynamics in the credit market are affected as well by

liquidity injections that depend on the changes in bond maturities and the entrance of new

issues into the market. The market liquidity can therefore be examined as well by the bidoffer spread.

Default swaps are valued from models that examine a term structure of default swap

spreads and recovery rates. The risky price value of the present value of one basis point

unravels the uncertainty due to the premia payments termination following a credit event.

The calculation of the riskiness of the present value of one basis point is performed by

assessing the survival probability of the reference entity to each premium payment date.

The structural approach to modeling credit default swaps rely on the following

parameters: the default risk of the reference entity, the recovery rates, the timing of

default, and finally, the term structure of quoted default swap spreads.

The foundation of the model is illustrated with the probability of a credit event following

a Poisson distribution:

P [ Γ < t + dt | Γ ≥ t] = λ(t)dt

Definition of variables:

P [ Γ < t + dt | Γ ≥ t]: The probability of a default occurring within the time interval and

conditional on surviving to time t.

Γ: A parameter to identify a time to value the probability function.

t: A parameter to state the time interval in the probability function.

λ(t): The hazard rate of the dependant function.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 12

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

dt: The time interval in the dependant function.

The arrangement supposes that the hazard rate process is deterministic and independent

of recovery rates as well as interest rates. A one-period default modeling then arises from

a binomial tree from the above stated probability foundation, a recovery value as well as

a payment parameter (K) and that results in two distinct states; a survival probability state

that equals 1- λ(t)dt or a default state with a probability of λ(t)dt that compensates with

payment K.

The premium leg is defined as a series of payments of the default swap spread that occurs

following a default event or at maturity:

PL(tv,tN) = S(st,st+1)Σ Δ(tn,tn+1,C)LE(tv,tn+1)Q(tv,tn+1)

Definition of variables:

PL(tv,tN): The payment of premium until the time of the credit event known as the

premium leg.

N: Number of contractual payments.

tn: The maturity date of the default swap.

S(st,st+1): Default swap spread.

Δ(tn,tn+1,C): The day count fraction between premium dates tn and tn+1 in the appropriate

basis convention denoted C.

Q(tv,tn+1): The arbitrage-free survival probability of the reference entity from valuation

time tv to premium payment time tn+1.

LE(tv,tn+1): The LIBOR or Euribor discount factor from valuation date to the premium

date.

The above stated formula has to be adjusted to encapsulate the effect of premium accrued

by considering the probability of default between two premium dates as well as by

calculating the probability weighted to accrued premium payment:

PL(tv,tN)adjusted = S(st,st+1)Σ ∫Δ(tn,s,C)LE(tv,s)Q(tv,s)λ(s)ds

Definition of variables:

PL(tv,tN)adjusted: The adjusted payment of premium until the time of the credit event

known as the premium leg.

N: Number of contractual payments.

S(st,st+1): Default swap spread.

Δ(tn,s,C):The day count fraction between premium dates tn and s in the appropriate basis

convention denoted C.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 13

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

Q(tv,s)λ(s)ds: The arbitrage-free survival probability of the reference entity containing the

probability of surviving from the valuation date tv to each time s in the premium period

and then defaulting in the next small time interval ds.

LE(tv,s):The LIBOR or Euribor discount factor from valuation date to the premium date.

The effect of the premium accrued can be demonstrated by computing the difference

between the breakeven default swap spread with and without premium accrued.

The protection leg represents a contingent payment on the face value of the protection

rendered following a credit event. It is measured by evaluating the following factors: the

anticipated recovery rate which is obtained from the expected cheapest to deliver bond

into the protection at the time of the credit event, the probability of a credit event, the

survival probability at some future date and finally the timing of the credit event.

The protection leg’s expected present value of the recovery payment is formulized by:

(1 – R)∫ LE(tv,s)Q(tv,s)λ(s)ds

Definition of variables:

(1 – R): The amount to be paid deducted from the expected recovery rate.

Q(tv,s): The probability of surviving to some future time s.

λ(s)ds: The probability of a credit event in the next small increment ds.

LE(tv,s):The risk-free rate to discount the amount to be paid deducted from the expected

recovery rate.

The final step of the credit default swap requisites to calculate the breakeven default swap

spread whereas the market default swap spreads and the survival probabilities are

considered:

S(tv,tN) = ((1 – R)Σ LE(tv,tm)[Q(tv,tm-1) – Q(tv,tm)])/ RPV1

Definition of variables:

S(tv,tN): The breakeven default swap spread where the present value of the premium leg

equals the present value of the protection leg.

(1 – R): The amount to be paid deducted from the expected recovery rate.

LE(tv,tm): The risk-free rate to discount the amount to be paid deducted from the expected

recovery rate.

Q(tv,tm-1): The probability of surviving from tv to some future time tm-1.

Q(tv,tm): The probability of surviving from tv to some future time tm.

RPV1: The risky present-value of one basis point.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 14

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

The hazard term structure used in the credit default swap can be constructed with an

iterative method such as bootstrapping by considering the shortest maturity contract and

incorporating it to solution the first survival probability.

In conclusion, financiers trade credit default swaps to seek advantage in price

dislocations between the cash and default swap market. A protection purchase in the

default swap market is therefore less demanding in financial capital than shorting an

asset.

2.3 Credit-Linked Notes

Credit-linked notes depict securities that are issued by a corporate entity following an

arrangement by an investor and a financial entity. They hold an embedded credit

derivative and pay a fixed- or floating-rate coupon. These instruments are dedicated to

investors who require a cash instrument but wish an exposure in the credit derivative

market. The investor retains an exposure to the note issuer. The structure of credit-linked

notes requires an investor to purchase a note at par which then compensates LIBOR or

Euribor plus two distinct spreads: a default swap spread and a spread derived from the

issuer’s funding. In brief, credit-linked notes are used as synthetic par floaters but without

default contingent interest rate risk. If the reference asset defaults, the credit-linked note

accelerates and the investor is rewarded with the defaulted asset.

2.4 Special Purpose Vehicles

Special purpose vehicles portray bankruptcy remote trust entities that aim to repackage

credit risk structures in a securitized form destined to attract a panoply of investors. They

can therefore enhance liquidity appearances and convert existing credit derivative

instruments into cash format. In consequence, investors are protected from the

bankruptcy of a sponsor but exposed to the underlying asset or embedded option.

They promote routes to trade the following instruments: interest rate swaps, crosscurrency swaps and credit-linked notes. Firstly, investors are sometimes restricted from

directly purchasing certain credit instruments such as interest rate swaps. In consequence,

a special purpose vehicle acquires the underlying security and embarks into an interest

rate swap that enables investors to possess a note that combines the securitization of the

asset swap. If the asset in the special purpose vehicle defaults, the interest rate swap is

then closed out and the swap counterparty grasps the first recourse of liquidation

proceeds followed by the investor who collects the remaining value of the asset. A crosscurrency swap is performed when a special purpose vehicle converts an asset

denominated in a selected currency into an investor’s designated currency. The trust

purchases the foreign devise asset and enters into a cross-currency swap to exchange the

cash flows into the designated currency. The investors are however prone to devise and

interest rate risk. If a default occurs, the agreement is terminated and the swap

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 15

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

counterparty is first to collect the liquidation proceeds from the defaulted asset and the

investors obtain the remaining sum from the recovery. Lastly, a credit-linked note can be

collateralized with the participation of a special purpose vehicle that acquires securities

targeted by investors and enters into a default swap with a bank that purchases a default

protection from the special purpose vehicle in question. If a default arises, the special

purpose vehicle liquidates the securities to indemnify the bank and then recompenses the

investor.

2.5 Principal Protected Structures

Principal protected structures represent a funded credit derivative that guarantee the

investor’s principal with high-grade credit transactions which limits the investor’s

participation in the reference credit. The principal protected structure illustrates a funded

credit derivative trading similarly to a credit-linked note whereas the investor is

compensated with a spread over LIBOR or Euribor. In consequence, this credit play

offers a route to market default baskets, emerging-market sovereign assets and assets

holding wide spreads.

2.6 Credit Spread Options

Credit spread options provide an investor with the choice to transact a credit view

independent of interest rates. They depict optional contracts that are exercised contingent

on the credit spread of a reference credit relative to a strike spread. In addition, the

reference asset is illustrated by a floating-rate note or a fixed-rate bond. The pricing of

credit spreads whether American or European is modeled with sophisticated

mathematical regimes. The volatility and the time-value are parameters considered to

value an option.

2.7 Bond Options

Bond options present an economical credit play destined to express a view on fixedincome instruments. They provide a hedging strategy for credit spreads, interest rates and

credit spread volatilities. Furthermore, they offer investors long and short positions to

enhance yields in the bond investment. Lastly, fixed-income options provide participants

the opportunity to hedge uncertainty about the reference credit and pursue proprietary

trading.

2.8 Total Return Swaps

Total return swaps depict a tool for balance sheet arbitrage where it is permissible to

short an asset without selling the asset to temporarily hedge credit risk as well as to take a

leveraged exposure to a credit. Total return swaps are defined as arrangements that permit

to collect all of the cash flows benefits of owning an asset without actually physically

Paper: “Credit Play Checkmate” (2013)

Rights Reserved: JAW Group 16

Author: Jamila Awad

Date: June, 2013

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

holding the underlying on their balance sheet. The total return swap mechanic is induced

by the total return receiver who pays LIBOR or Euribor plus a fixed spread to the total

return payer who in exchange renders a sum equivalent to the difference between the

asset’s final market price and its initial price. The total return receiver buffers the loss in

the event of a default. The pricing dynamic of total return swaps depend on the total

return payer’s funding cost and on the regulatory capital charges.

3.0 The Multi-Forms of Credit Derivative Instruments

Section 3 presents the practical applications of trading multi-structure credit risk

derivatives. The retained financial instruments are: index swaps, basket default swaps,

portfolio default swaps and finally collateralized debt obligations.

3.1 Index Swaps

Index swaps expose the investor’s total return of a universe of securities without

jeopardizing the investor to the default of any solo issuer. The index swap frame offers

the acquirer a gain or a peril in the value of the index plus any coupon accrual in return of

floating-rate payments of LIBOR or Euribor plus a fixed spread. The total return payer

therefore hedges to purchase the index. The superiority of investing in an index swap

compared to a total return swap derives from the possibility to replicate indexes with

wider bid-offer spreads. This credit play benefits participants who seek a diversified

portfolio with a significant amount of capital and who hold restricted specialized

knowledge. Lastly, index swaps are less demanding in liquidity resources than to trade all

the assets contained in the portfolio.

3.2 Basket Default Swaps

Basket default swaps portray a credit play in which credit event is described by the

default of an amalgam of credit in a specified pool of credits. They permit investors to

leverage their credit risk through the exposure of high-quality grades and be compensated

with higher yield. The basket structure enables investors to retail default protection and to

control the downside risk. In exchange, the protection acquirer indemnifies the protection

vendor with a basket spread representing a set of regular accruing cash flows. Basket

default swaps depict default correlation products that examine the covariance of assets for

risk-averse participants. The basket spread equals the sum of spreads of the reference

credits in the basket. Correlation default valuation models loop optimal dynamic hedging

strategies. In brief, basket default swaps offer investors the opportunity to trade default

correlations and increase yield compensation.

3.3 Portfolio Default Swaps

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 17

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

Portfolio default swaps depict a sliced basket default swap that contains more than forty

brandings and that redistribute risks in proportion of the investor’s exposure rather than

the number of assets. The notional of the tranches in the portfolio default swap is

amortized down when the default occurs however the spread remains remunerated as a

constant percentage of the notional. The spread tranche remuneration depends on the

brandings contained in the portfolio, the number of brandings, and finally, their default

correlations. In essence, they illustrate a product that permits investors to seek an

exposure to a large group of assets with an unfunded or fully funded format.

3.4 Collateralized Debt Obligations

Collateralized debt obligations (CDO) represent an arrangement of fixed-income

securities containing cash flows that are bonded to the incidence of default in a pool of

debt products. They strive to redistribute credit risk via special purpose vehicles that emit

tranches of notes to appeal investors with distinct risk appetites. The notes however

generate payments following a waterfall structure. The mechanic of the product requisites

to issue credit play instruments from the assemblage of default bonds or loans and cash

flows are backed by the payments due on the bonds or loans. In consequence, the

occurrence of a default impacts uniquely every tranche depending on their seniority level.

The product’s pricing is determined by the rating of the instrument that considers the

shape of the portfolio loss distribution, the role of default correlation and the risk level of

the securities issued.

Arbitrage collateralized debt obligations emit credit plays to exploit differences in credit

spreads between high-yield instruments and investment-grade securities. The cash flow

collateralized debt obligation class enables to shift a portfolio of loans off the balance

sheet of a commercial bank and hence to liberate economic capital. The synthetic

collateralized loan obligations provide an entity a product to move credit risk from its

balance sheet and to reduce obligatory regulatory capital via a synthetic credit derivative.

In precise terms, an institution uses a portfolio default swap structure to relocate credit

risk with a special purpose vehicle that emits notes. In summary, synthetic collateralized

loan obligations facilitate the securitization of bulk loan transfers.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 18

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

Conclusion

The research paper delivers an enhanced understanding of credit derivatives that

combines environmental and regulatory frameworks to promote sage financial

transactions. The simple-form and the multi-structure of credit risk instruments need to

be discerned before being traded to thwart hazardous downturns. In conclusion, the

demystification of debt play products and the coherent channeling of all market

participants can strengthen optimal credit derivative management.

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 19

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

References

Alan C. Shapiro (2009), Multinational Financial Management, John Wiley & Sons, New

York, U.S.A..

Anthony Saunders and Linda Allen (2002), Credit risk measurement, John Wiley & Sons,

New York, U.S.A..

Antonio Corbi (2012), Netting and Offsetting: Reporting derivatives under U.S. GAAP

and under IFRS, International Swaps and Derivatives Association (ISDA), New York,

U.S.A.

Armstrong, J. and J. Kiff (2005), Understanding the Benefits and Risks of Synthetic

Collateralized Debt Obligations, Bank of Canada, Financial System Review, Ottawa,

Canada.

Basel Committee on Banking Supervision (2012), Basel III counterparty credit risk and

exposures to central counterparties-FAQ, Bank of International Settlements, Basel,

Switzerland.

Basel Committee on Banking Supervision (2004), Credit Risk Transfer, Bank of

International Settlements, Basel, Switzerland.

Das S. (1998), Credit Derivatives: Trading and management of credit & default risk, John

Wiley & Sons, New York, U.S.A..

Franke G, Krahnen J (2006), Default risk sharing between banks and markets: the

contribution of collateralized debt obligations, The risks of financial institutions,

University of Chicago Press, Chicago, IL, pp 603–631

Gorton G, Souleles N (2006), Special purpose vehicles and securitization, The risks of

financial institutions, University of Chicago Press, Chicago, IL, pp 549–597

Jarrow, R.A. and S.M. Turnbull (1995), Pricing Derivatives on Financial Securities

Subject to Credit Risk, Journal of Finance, 50:53-85.

Kiff J, Michaud F-L, Mitchell J (2002), Instruments of credit risk transfer: effects on

financial contracting and financial stability, Bank of Canada, Ottawa, Canada.

Lins KV, Servaes H, Tamayo A (2007), Does derivative accounting affect risk

management? International survey evidence, London Business School, London, U.K..

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 20

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com

Credit Play Checkmate

Jamila

Awad

U.S. Securities Exchange Commission (2010), “Dodd-Frank Wall Street Reform and

Consumer Protection Act: Specialized Corporate Disclosure”,

http://www.sec.gov/spotlight/dodd-frank/speccorpdisclosure.shtml

Paper: “Credit Play Checkmate” (2013)

Author: Jamila Awad

Date: June, 2013

Rights Reserved: JAW Group 21

JAW Group, 3440 Durocher # 1109

Montreal, Quebec, H2X 2E2, Canada

Mobile: (1) 514 799-4565

E-mail: info.jawgroup@gmail.com