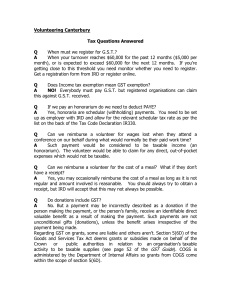

Taxation (Annual Rates, GST and Miscellaneous Provisions) Bill

advertisement