Work Experience

advertisement

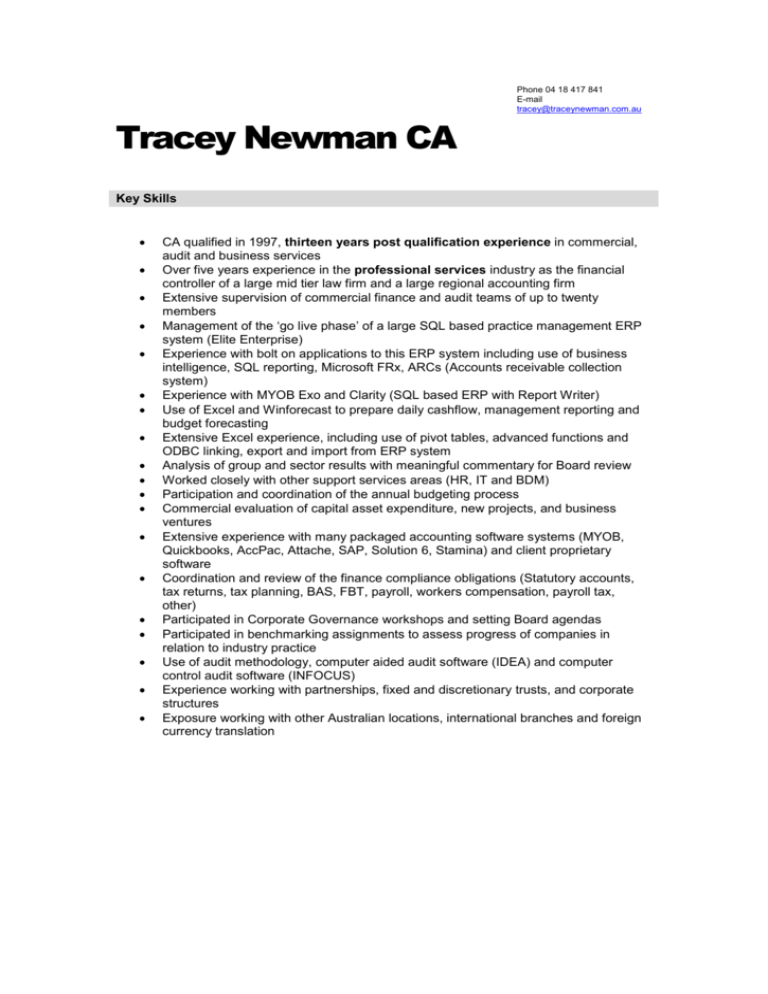

Phone 04 18 417 841 E-mail tracey@traceynewman.com.au Tracey Newman CA Key Skills CA qualified in 1997, thirteen years post qualification experience in commercial, audit and business services Over five years experience in the professional services industry as the financial controller of a large mid tier law firm and a large regional accounting firm Extensive supervision of commercial finance and audit teams of up to twenty members Management of the ‘go live phase’ of a large SQL based practice management ERP system (Elite Enterprise) Experience with bolt on applications to this ERP system including use of business intelligence, SQL reporting, Microsoft FRx, ARCs (Accounts receivable collection system) Experience with MYOB Exo and Clarity (SQL based ERP with Report Writer) Use of Excel and Winforecast to prepare daily cashflow, management reporting and budget forecasting Extensive Excel experience, including use of pivot tables, advanced functions and ODBC linking, export and import from ERP system Analysis of group and sector results with meaningful commentary for Board review Worked closely with other support services areas (HR, IT and BDM) Participation and coordination of the annual budgeting process Commercial evaluation of capital asset expenditure, new projects, and business ventures Extensive experience with many packaged accounting software systems (MYOB, Quickbooks, AccPac, Attache, SAP, Solution 6, Stamina) and client proprietary software Coordination and review of the finance compliance obligations (Statutory accounts, tax returns, tax planning, BAS, FBT, payroll, workers compensation, payroll tax, other) Participated in Corporate Governance workshops and setting Board agendas Participated in benchmarking assignments to assess progress of companies in relation to industry practice Use of audit methodology, computer aided audit software (IDEA) and computer control audit software (INFOCUS) Experience working with partnerships, fixed and discretionary trusts, and corporate structures Exposure working with other Australian locations, international branches and foreign currency translation Work Experience Project Accountant (Business Objects) McCullough Robertson Lawyers Brisbane QLD August 2008 to March 2009 McCullough Robertson Lawyers is a law firm in Brisbane that employs approximately 400 staff and 40 partners. I was engaged on a contract basis to project manage the upgrade of Business Objects v6.5 to Business Object Xir2. This process involved the creation, development and rollout of two suites of reports that were customized for the managers and staff of the firm. During this time I gained significant experience in the following applications: Webi (Web Intelligence) Deski (Desktop Intelligence) Infoview Designer CMC (Central Management Console) Attended business objects training on CMC and Webi SQL – writing /editing code and query analyzer Use of drills, hierarchies, hyperlinks, universe modifications, free form SQL queries, relational database issues, formatting, merges and joins The project was broken down and executed in the following components: User need survey and evaluation – this was presented as a report to the Operations Committee as an executive summary and recommendation Training of myself and project team members in the necessary applications Installation of the servers and application Development of report suites Pilot groups were conducted for evaluation purposes Rollout of training to partners and staff members – approximately 25 course sessions were held This was a contract position that ended in March 2009. I have not been working since this time due to the birth of my second child in late March. Consultant ABC Business Solutions Brisbane QLD May 2008 to August 2008 ABC Business Solutions is a professional services company that provides business services and software implementation advice primarily to the SME sector. I worked for them on a contractor basis part time and have gained experience in the following: Cleaning and importing data for the ‘go live’ phase using MYOB Exo. Preparing customized reports and forms using a business intelligence product called Clarity. Providing training and advice for clients on a suite of products designed for the SME sector, including MYOB, Quick Books, Exo, and Wage Easy. Financial Controller Sparke Helmore Newcastle NSW August 2005 to May 2007 Sparke Helmore is a large national second tier law firm headquartered in Newcastle NSW. The firm employs in excess of 700 professional and administrative staff and generates revenue of over $100M per annum. The firm has approximately 50 equity and fixed draw partners. Sparke Helmore is administered via a partnership and a service trust. My role at Sparke Helmore as the financial controller was to supervise a national finance team of approximately twenty members. This team included a systems accountant, accounts payable, payroll and general ledger (financial and assistant accountants). I worked closely with and reported to the Chief Financial Officer of the firm. The firm went live with a new ERP system (SQL based) called Thomson Elite Enterprise during the same month my position commenced. During the first year of this role, I was primarily involved in all aspects of the ‘go live’ phase of Thompson Elite. The suite of products introduced as part of the Elite conversion were FMS (GL) and ELBS (billing), Webview, Business Intelligence, ARCs (Accounts Receivable) and FRx (Financial Reporting). I worked directly with the local Elite team during the first three month ends and had extensive contact with Elite support during the first year. I was able to develop a good network of contacts, and attended the Elite global conference in Chicago in June of 2006. Specific areas of experience in this role included: Supervision of large finance team based in eight locations across Australia – hiring, terminations, performance reviews, weekly catch up meetings with individuals and facilitation of monthly finance team meetings Coordination of month end processes including notifications to users, closing out each financial area, creation of monthly reports and data warehouses, preparing month end balancing reports Publication of a monthly financial reporting package, published in Microsoft FRx, and issued electronically via the FRx web portal Contribution to the finance section of the Sparke Helmore Intranet Creation and publication of SQL reports written in Business Intelligence and published via BI report link (an intranet based website) Close liaison with other support services areas which involved monthly reports and meetings with business development and marketing, information technology, human resources, and information management Participation in finance special projects, such as internal controls review, service trust review, web based expenditure reimbursements, implantation of new credit cards Cash flow review Supervision of preparation and coordination of the annual audit, trust audit, fringe benefits return, corporate and partnership income tax returns Preparation of the fortnightly partner (both equity and fixed) drawings, preparation of reports for partners including annual taxation statements, reconciliation of drawings accounts, YTD drawings summary and quarterly IAS statements Calculation and payment of partnership quarterly profit draw Review of NSW trust compliance (audit, statutory deposit, trust statements, controlled money) Daily signing of cheques (operating and trust), daily EFT approvals using on line banking software Daily approval of employee termination pays Management of relationship with our bankers including attendance at meetings and preparation of documentation for compliance with bank covenants Preparation, upload, weekly maintenance and support for employee productivity budgets Assistance to the CFO of schedules to support the annual financial budget sessions, which is a month long process involving pre work and meetings with all of the practice groups Preparation of a monthly financial projection for the partnership of the current year financial performance with a drawings forecast projected to the end of the financial year Preparation of other financial templates including the financial section of the partnership nomination process, review of partner capital contributions, lateral hire proposals, evaluation of business opportunities I resigned from this position in January 2008 as I had been on maternity leave and it was not possible to return on a part time basis. We subsequently moved to Brisbane. Financial Controller Forgacs Group Carrington NSW October 2004 to August 2005 The Forgacs Group specializes in heavy engineering and ship building and repair. The group generates revenue in excess of $80M per annum and employs up to 1,000 staff members on a casual and permanent basis. I was responsible for six geographic locations and supervised a group of approximately twenty staff members in these locations. I reported directly to the Group General Manager and supervised one divisional financial controller in Brisbane. The role was focused on the following: Debt reduction Cash Flow forecasting Management Accounting Improvement of the internal control processes Structure and definition of the finance group Month End Reporting and Budgets Supervision of a large national finance team Financial Controller – 6 Month Contract Position Tunnel Mining Australia Pty Ltd Gateshead NSW April 2004 to October 2004 Tunnel Mining is a group of associated entities and is a “one stop shop” to the mining industry providing mining equipment (both underground and above ground) and labour for hire. This position is a hands-on role with supervision of one assistant accountant. The company operates both domestically and through satellite companies in Indonesia and India Group revenue is projected to be in excess of $10M. Complex payroll awards and interpretation of legislation The majority of the contract has been comprised of implementing budgets, long term cash flows and providing financial analysis of commercial ventures to the management team. Financial Controller Lawler Partners Newcastle NSW November 2001 to March 2004 The Lawler Group is the largest regional accounting firm in NSW and at the time was a group of associated entities with total revenue in excess of $14M. Supervision of a finance team of five individuals responsible for Practice Management (WIP), GL, payroll, debtors and creditors Close working relationship with all equity partners (7) and directors (9) of the group. Assumed the financial responsibility for three entities (partnership, trust and company) and reporting business divisions (up to 10) Member of the Executive team that is comprised of finance, marketing, human resources and information technology. This team reports to an external management team and to the Chairman of the Board Attendance at monthly Executive, Management Team and Board meetings; participated in development of the firm’s Corporate Governance Structure Attended numerous professional development workshops dealing with various aspects of reporting and budgeting (Flexible budgeting and One Day Reporting, In Depth FBT, Employee Packaging, ICAA Newcastle Convention) Assume primary responsibility for: o Financial and management reporting Review and consolidation of month end management accounts for two geographic locations, three legal entities and up to ten reporting divisions Prepared variance analysis and provided commentary on all firm P&L, balance sheet and cashflow budgets o Cashflow management Work extensively with Winforecast (budgeting and reporting software) Weekly reforecasting and close liaison with business divisions for cashflow inputs on revenue expectations Direct contact with bank, frequent review of facility terms and negotiation of several financial instruments o Budgeting and forecasting Facilitating rollout of flexible budgeting and one day reporting, developed financial KPIs for balanced scorecard reporting Budgets prepared and updated on a quarterly basis o Cost Savings Reviewed and implemented changes in a number of different overhead areas including telephone, printing, stationery and electricity. Achieved 50% savings in some major overhead areas by employing cost savings initiatives by using economy of scale Tendered several major cost areas to vendors o Maintenance and development of accounting and costing systems and financial policies. Implemented an improved system of accountability by implementing internal controls o Taxation and Compliance Statutory accounts and tax returns for the group Tax planning review Monthly and Quarterly BAS o Fringe Benefits Payroll tax and workers compensation Other firm projects Provided commercial evaluation of new projects, business ventures, and development plans Benchmarking to other professional service organisations Worked closely with partners and rental advocate to secure a new rental location for the Sydney office Participation in many internal committees (technology infrastructure review, division start ups and closures) Manager, Public Practice KH Chartered Accountants Newcastle NSW October 2000 – November 2001 Responsible for supervising ten junior and senior staff members Practice management/ Business Consulting for clients, including o Preparation and review of personal, corporate, partnership, trust, superannuation fund accounts and taxation returns o Attended numerous ICAA and CPA workshops dealing with taxation reform issues (GST reform, taxation reform, Practice management forums) o Participated in restructuring engagements for clients with large corporate structures o GST consulting engagements to set up client’s GST reporting structure o Fringe benefit tax assignments o Preparation and review of PAYG summaries o Preparation and review of monthly and quarterly business activity statements and monthly management accounts o Managed several audit engagements (> $10M) for companies deemed “large” by ASIC o Management of due diligence engagement for a local company limited by guarantee o Involved in all aspects of new company setup including review of compliance with ASIC requirements o Extensive experience with MYOB and other packaged software, audited client’s proprietary computer systems o Practice development and practice management responsibilities, including budgeting, billing, human resources and networking Supervisor, Assurance Services Group Grant Thornton Chartered Accountants May 2000 – October 2000 Sydney, Australia (large 2nd tier firm in Sydney) Planned and executed engagements for audit clients Business sectors where experience was gained – advertising, professional services/consulting, and manufacturing Most clients had an extensive corporate structure and full consolidations were prepare to generate final accounts Audit of two public companies – one listed and the other non listed. Managed a public company engagement that included preparation of an Appendix 4C and the annual report to be filed with ASX Preparation of special purpose and general purpose accounts Taught various courses on assurance based products Supervision of audit teams of up to six people Responsibility for billing clients and preparation of budgets Responsible for junior’s performance appraisals and self development Extensive experience with client in-house computerised accounting systems, including preparation and completion of general computer controls questionnaires Manager, Professional Development Grant Thornton Chartered Accountants (Canada) 1998-2000 Worked in Grant Thornton’s “national” division Responsible for developing and instructing various Professional Development courses to the over 1,000 professional staff members and 50+ offices of Grant Thornton, Canada. The position required extensive traveling throughout North America a significant portion of the year. Areas of expertise and course curriculum included taxation, implementation of the Horizon Audit Approach, applications of Interactive Data Extraction and Analysis (IDEA), INFOCUS (computer controls auditing), and many other emerging tax and audit related concepts Accountant – Trainee through Manager Grant Thornton Chartered Accountants (Canada) 1994-1998 More detail can be provided upon request Professional Training Cert IV qualified in Training and Assessment FBT SQL reporting GST Reform Taxation Reform Flexible Budgeting One Day Reporting Practice Management Competency Development Corporate Law Balanced Scorecard Professional Memberships Institute of Chartered Accountants of Australia (ICAA) Institute of Chartered Accountants of Nova Scotia and Canada (ICANS and CICA) Education Cert IV Training and Assessment Outsource Services May 2008 Corporation and Taxation Law Charles Sturt University, NSW. 2001 Passed with Distinction Certified Microsoft Instructor Microsoft Accredited Training Organization 1998 This designation is needed to teach Microsoft products worldwide Uniform Final Examination (UFE) Canadian Institute of Chartered Accountants 1997 This exam is a four day, sixteen hour series of papers, which is the final module of the Canadian Chartered Accountancy Process. Passed with honours Atlantic School of Chartered Accountancy (ASCA) Nova Scotia, Canada. 1994-1997 Successful completion with honours of the five preparatory courses that are required to write the Canadian Institute of Chartered Accountants (CICA) UFE. These courses are Personal Taxation, Corporate Taxation, Management Accounting, Advanced Financial Accounting, and Advanced Auditing Bachelor of Business Administration, Major in Accounting, Honours Acadia University, Nova Scotia, Canada 1990-1994 Awards Placement on the David Hope Honour Roll for securing honours on the Canadian Final CA Examination. Achieved a Top 30 ranking out of over 2000 UFE candidates The Silver Medal for placing second in the Province of Nova Scotia and the Canadian Atlantic Provinces on the CICA UFE, second highest mark in Grant Thornton Canada The Carswell Award for achieving the highest grade in the Canadian Atlantic Provinces in the Corporate Taxation course