Tutorial 9 sol

advertisement

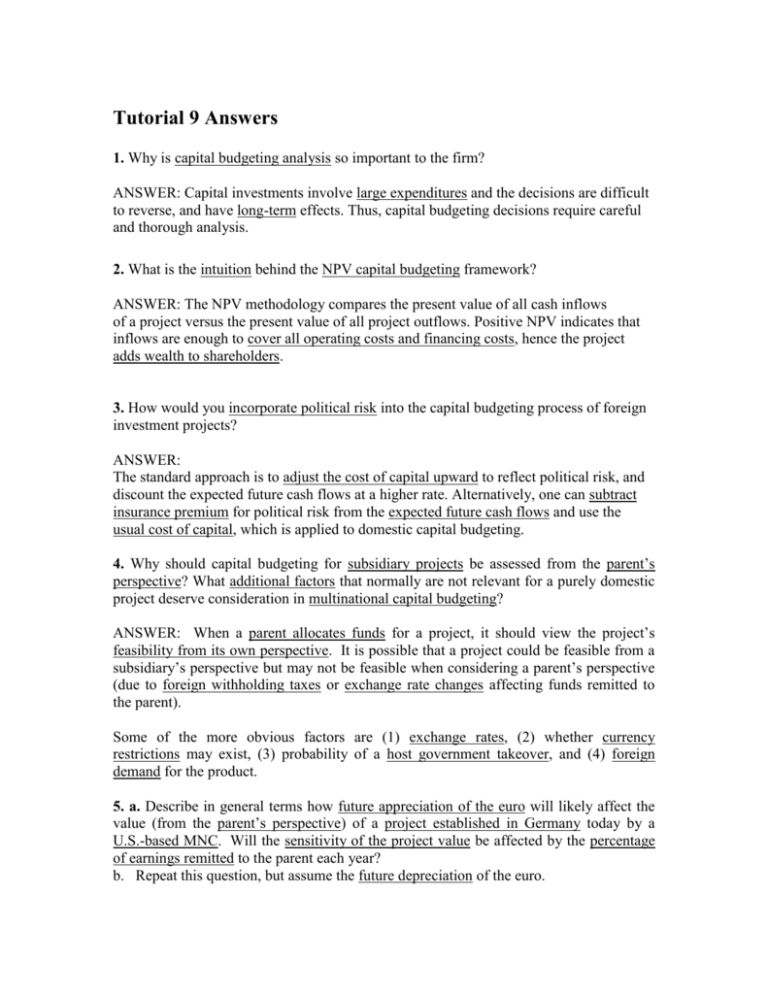

Tutorial 9 Answers 1. Why is capital budgeting analysis so important to the firm? ANSWER: Capital investments involve large expenditures and the decisions are difficult to reverse, and have long-term effects. Thus, capital budgeting decisions require careful and thorough analysis. 2. What is the intuition behind the NPV capital budgeting framework? ANSWER: The NPV methodology compares the present value of all cash inflows of a project versus the present value of all project outflows. Positive NPV indicates that inflows are enough to cover all operating costs and financing costs, hence the project adds wealth to shareholders. 3. How would you incorporate political risk into the capital budgeting process of foreign investment projects? ANSWER: The standard approach is to adjust the cost of capital upward to reflect political risk, and discount the expected future cash flows at a higher rate. Alternatively, one can subtract insurance premium for political risk from the expected future cash flows and use the usual cost of capital, which is applied to domestic capital budgeting. 4. Why should capital budgeting for subsidiary projects be assessed from the parent’s perspective? What additional factors that normally are not relevant for a purely domestic project deserve consideration in multinational capital budgeting? ANSWER: When a parent allocates funds for a project, it should view the project’s feasibility from its own perspective. It is possible that a project could be feasible from a subsidiary’s perspective but may not be feasible when considering a parent’s perspective (due to foreign withholding taxes or exchange rate changes affecting funds remitted to the parent). Some of the more obvious factors are (1) exchange rates, (2) whether currency restrictions may exist, (3) probability of a host government takeover, and (4) foreign demand for the product. 5. a. Describe in general terms how future appreciation of the euro will likely affect the value (from the parent’s perspective) of a project established in Germany today by a U.S.-based MNC. Will the sensitivity of the project value be affected by the percentage of earnings remitted to the parent each year? b. Repeat this question, but assume the future depreciation of the euro. ANSWER: a. Future appreciation of the euro would benefit the parent since the euro earnings would be worth more when remitted and converted to dollars. This is especially true when a large percentage of earnings are sent to the parent. b. The future depreciation of the euro would hurt the parent since the euro earnings would be worth less when remitted and converted to dollars. This is especially true when a large percentage of earnings are sent to the parent. 6. When considering the implementation of a project in one of various possible countries, what types of tax characteristics should be assessed among the countries? (See the chapter appendix) ANSWER: Corporate taxes in the country should be considered by an MNC, along with withholding taxes, and even individual tax rates imposed on the potential employees. Excise taxes are also relevant. Problems 1. Capital Budgeting Analysis. A project in South Korea requires an initial investment of 2 billion South Korean won. The project is expected to generate net cash flows to the subsidiary of 3 billion and 4 billion won in the two years of operation, respectively. The project has no salvage value. The current value of the won is 1,100 won per U.S. dollar, and the value of the won is expected to remain constant over the next two years. a. What is the NPV of this project (parent view point) if the required rate of return is 13 percent? b. Repeat the question, except assume that the value of the won is expected to be 1,200 won per U.S. dollar after two years. Further assume that the funds are blocked and that the parent company will only be able to remit them back to the U.S. in two years. How does this affect the NPV of the project? ANSWER: a) Year Investment Operating CF 0 –2,000,000,000 Net CF (won) –2,000,000,000 Exchange rate Cash flows to parent PV of parent cash flows 1,100 –$1,818,181.82 –$1,818,181.82 1 2 3,000,000,000 4,000,000,000 3,000,000,000 4,000,000,000 1,100 $2,727,272.73 $2,413,515.69 1,100 $3,636,363.64 $2,847,806.12 2 The NPV is $3,443,139.99. b) Year 0 1 Net CF (won) –2,000,000,000 0 Exchange rate Cash flows to parent PV of parent cash flows 1,100 –$1,818,181.82 –$1,818,181.82 7,000,000,000* 1,200 $5,833,333.33 $4,568,355.65 The NPV is $2,750,173.83 A situation where the funds are blocked and the won is expected to depreciate reduces the NPV by $692,966.16. *Note: assumed that the return generated on 3,000,000,000 for the blocked period will be NIL. 2. Break-even Salvage Value. A project in Malaysia costs $4,000,000. Over the next three years, the project will generate total operating cash flows of $3,500,000, measured in today’s dollars using a required rate of return of 14 percent. What is the break-even salvage value of this project? ANSWER: Note: CFt SVn I0 (1 k )n t (1 k ) ($4,000,000 $3,500,000)(1.14)3 $740,772 This is just the standard NPV equation (including initial investment, operating cashflows and salvage value) that has been rearranged to solve for salvage value! 3. Suppose the Taiwan government is willing to provide a loan of $10 million at 5% to Xebec to build a factory there. The loan would be paid off in equal annual installments over a five-year period. If the market interest rate for such an investment is 14%, what is the before-tax value of the interest subsidy? ANSWER. Borrowing at 5% when the market rate of interest is 14% saves Xebec 9% annually on the principal balance outstanding. This leads to annual before-tax savings and their associated present values as follows: Year Note: This is the principal balance at the beginning of the year. The company gets charged interest for the year on this opening balance. However, interest is actually paid at the end of the year. 1 2 3 4 5 Principal Interest Savings PV Factor (@ 14%) Present Value $10,000,000 8,000,000 6,000,000 4,000,000 2,000,000 $900,000 720,000 540,000 360,000 180,000 .8772 .7695 .6750 .5921 .5194 $789,480 554,040 364,500 213,156 93,492 Total $2,014,668 The value of this five-year stream of cash, discounted at 14%, is $2,014,668. 4. Capital Budgeting Example. Brower, Inc. just constructed a manufacturing plant in Ghana. The construction cost 9 billion Ghanian cedi. Brower intends to leave the plant open for three years. During the three years of operation, cedi cash flows are expected to be 3 billion cedi, 3 billion cedi, and 2 billion cedi, respectively. Operating cash flows will begin one year from today and are remitted back to the parent at the end of each year. At the end of the third year, Brower expects to sell the plant for 5 billion cedi. Brower has a required rate of return of 17 percent. It currently takes 8,700 cedi to buy one U.S. dollar, and the cedi is expected to depreciate by 5 percent per year. a. Determine the NPV for this project. Should Brower build the plant? b. How would your answer change if the value of the cedi was expected to remain unchanged from its current value of 8,700 cedis per U.S. dollar over the course of the three years? Should Brower construct the plant then? ANSWER: a Cash Flows: Note: The exchange rate for each period (F) is calculated from the previous period spot rate (S) using: (F-S)/S = x% However, be careful that this formula gives you x% as the appreciation/ depreciation of the base currency. In this question you are given the term currency depreciation. The theoretically correct way is to take the reciprocal exchange rate (since no bid/ask spread) then apply this formula (see assignment 1). Alternatively you can use the other formula for term currency appreciation. However, in this model answer it looks like they simply assumed that 5% depreciation of cedi (term) means a 5% appreciation of US$ (base), then they applied the base currency formula! Year Investment Operating CF Salvage Value Net CF (cedi billions) Exchange rate Cash flows to parent PV of parent cash flows NPV Just the cumulative sum 0 –9 –9 8,700 –$1,034,483 –$1,034,483 –$1,034,483 1 2 3 3 3 2 5 3 3 7 9,135 9,592 10,071 $328,407.23 $312,760.63 $695,065.04 $280,689.94 $228,475.88 $433,978.15 –$753,793.06 –$525,317.18 –$91,339.03 of PVs at each date Since the project has a negative net present value (NPV), Brower should not undertake it. ANSWER: b If the cedi was expected to remain unchanged from its current value of 8700 cedis per U.S. dollar over the course of the three years: Year Investment Operating CF Salvage Value Net CF (cedi billions) Exchange rate Cash flows to parent PV of parent cash flows NPV 0 –9 –9 8,700 –$1,034,483 –$1,034,483 –$1,034,483 1 2 3 3 3 2 5 3 3 7 8,700 8,700 8,700 $344,827.59 $344,827.59 $804,597.70 $294,724.44 $251,901.23 $502,367.11 –$739,748.56 –$487,847.33 +$14,519.78 If the value of the cedi remains constant, the NPV is positive. Thus, Brower should undertake the project in this case. Of course, the NPV is only slightly positive. Whether or not Brower actually undertakes the project depends on the confidence it has in its exchange rate forecasts.