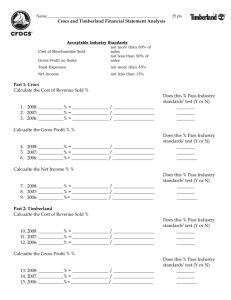

Crocs and Timberland Financial Statemetn Analysis

advertisement

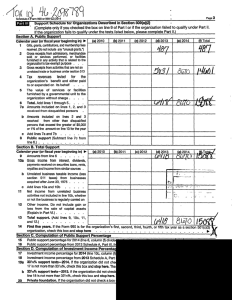

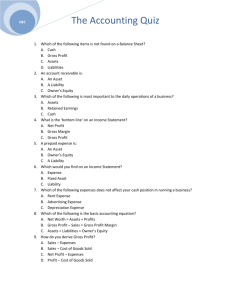

Name:___________________________________________________________ 30 pts Financial Statement Analysis of two Public Retailers Company Choices: Crocs vs Timberland, Target vs. Walmart, Apple vs. Microsoft, or Barnes and Noble vs Amazon Acceptable Industry Standards Cost of Merchandise Sold not more than 50% of sales Gross Profit on Sales not less than 50% of sales Total Expenses not more than 35% Net Income not less than 15% Access this data from the Income Statement on finance.yahoo.com Part 1: Company:__________________________________ Calculate the Cost of Revenue Sold % Cost of Revenue / Total Revenue 2009: ___________% = ________________ / __________________ 2010: ___________% = ________________ / __________________ Does this % Pass Industry standards’ test (Y or N) ________ ________ Calculate the Gross Profit % Gross Profit / Total Revenue 2009: ___________% = ________________ / __________________ 20010: ___________%= ________________ / __________________ Does this % Pass Industry standards’ test (Y or N) ________ _________ Calculate the Net Income % Net Income / Total Revenue 2009: ___________% = ________________ / __________________ 20010: ___________%= ________________ / __________________ Does this % Pass Industry standards’ test (Y or N) ________ _________ Calculate the Selling General and Administrative Expense % Selling General & Admin Expense / Total Revenue 2009: ___________% = ________________ / __________________ 2010: ___________%= ________________ / __________________ Does this % Pass Industry standards’ test (Y or N) ________ _________ Acceptable Industry Standards Cost of Merchandise Sold Gross Profit on Sales Total Expenses Net Income not more than 50% of sales not less than 50% of sales not more than 35% not less than 15% Part 2: Company:________________________________________ Calculate the Cost of Revenue Sold % Cost of Revenue / Total Revenue 2009: ___________% = ________________ / __________________ 2010: ___________% = ________________ / __________________ Does this % Pass Industry standards’ test (Y or N) ________ ________ Calculate the Gross Profit % Gross Profit / Total Revenue 2009: ___________% = ________________ / __________________ 20010: ___________%= ________________ / __________________ Does this % Pass Industry standards’ test (Y or N) ________ _________ Calculate the Net Income % Net Income / Total Revenue 2009: ___________% = ________________ / __________________ 20010: ___________%= ________________ / __________________ Does this % Pass Industry standards’ test (Y or N) ________ _________ Calculate the Selling General and Administrative Expense % Selling General & Admin Expense / Total Revenue 2009: ___________% = ________________ / __________________ 2010: ___________%= ________________ / __________________ Does this % Pass Industry standards’ test (Y or N) ________ _________ Part 3: There are 8 major Indicators on Financial Statements, BS and IS, that Stakeholders can look to in order to determine the company’s overall Financial Health Company:________________________________________(Choose one company from above) 1. How has the TOTAL ASSET account values changed over the past 2 fiscal years…increase, decrease, consistent?______________________________________ 2. How do the profitability %s compare to its competitor….better, worse, the same? _____________________________________ 3. Liquidity: Has cash increased or decreased throughout the past 3 fiscal years? ____________ a. By how much? $____________________ 4. Has the AR (net receivables) amount increased or decreased throughout the past 3 fiscal years? _________________________ 5. Has the AP amount increased or decreased throughout the past 3 fiscal years? ____________ 6. How has the value of Inventory changed throughout the past 3 fiscal years? _______________ 7. Analysis of Solvency – long-term survival: a. What is the Net Income/Loss for the past 3 fiscal periods? i. ________________ ____________________ __________________ b. What is the Demand for products they sell, in your opinion, is it going up or down and WHY? 8. Debt-Equity Ratio for 2010: ______________________________ Total liabilities / Total Stockholder Equity Part 4: Accountant Recommendations: 1. What are 3 FINANCIAL ways that both retailing companies you analyzed can increase their Profit Margin? a. b. c. 2. Do you feel comfortable investing your money in the company you analyzed? ______________ 3. Which 2 indicators helped you the most in making your decision to invest or not invest? a. _________________________________________________ b. _________________________________________________