CACTTC legislative platform - California Association of County

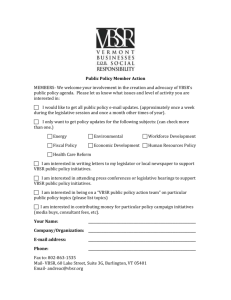

advertisement