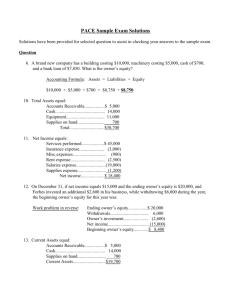

Financial Accounting - Jps

advertisement