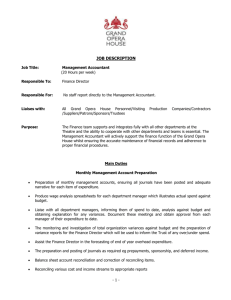

job and person specification approval

advertisement

South Australian Public Service JOB AND PERSON SPECIFICATIONS 1. POSITION IDENTIFICATION Title of Position : SENIOR FINANCIAL ACCOUNTANT Classification : ASO7 Location : Corporate Finance Reports To : Manager Corporate Finance Ongoing Job Status: X PSM Act Contract 1-5 Yrs X Financial Delegation: CORRECTIONAL SERVICES Position No. : CS Division : Finance & Asset Services Temporary 1-12 Mths Casual. FTE: 1.0 Nil JOB AND PERSON SPECIFICATION APPROVAL ……............................................……/….…/……. Chief Executive or Delegate JOB SPECIFICATION 2. KEY PURPOSE OF THE POSITION The Senior Financial Accountant is accountable to the Manager, Corporate Finance for: the preparation of annual financial statements, including the year end return for the Department of Treasury and Finance, and the provision of specialist financial advice and assistance to senior and other officers of the agency, including advice on Departmental accounting policies and procedures, taxation legislation and Australian Accounting Standards. The Senior Financial Accountant is responsible for: the preparation and integrity of the Department’s Financial Statements, Goods and Services Tax and Fringe Benefits Tax returns, and for the preparation of periodic financial statements. The Senior Financial Accountant supervises and leads Financial Accounting staff including ensuring development of contemporary financial accounting and taxation knowledge and skills. 3. KEY STAKEHOLDER INTERACTION The Senior Financial Accountant reports to the Manager, Corporate Finance. The Senior Financial Accountant co-ordinates the workload of the Financial Accounting team. The Senior Financial Accountant consults regularly and extensively with senior staff and business unit managers, and provides professional and technical advice concerning financial accounting matters. The Senior Financial Accountant maintains working relationships with Internal and External Auditors. D:\106759515.doc JOB & PERSON SPECIFICATION 2 4. BRANCH PROFILE The Corporate Finance Branch, located within Central Office, is responsible for providing a professional financial management and accounting services in the Department for Correctional Services through the provision of relevant, accurate and timely financial reports for budget monitoring and the preparation of general purpose financial reports. The Corporate Finance Branch is also responsible for providing management accounting expertise and support for all business units (including prisons, community corrections regions and Prime SA) and coordinating and managing the process of preparing their budgets. 5. SPECIAL CONDITIONS A current driver’s licence is essential. Some out of hours work will be required and a willingness to undertake intrastate travel, to visit the State’s prisons and community correction centres. Applicants are required to authorise the Department to undertake Police security checks. 6. HIGHLIGHTED EMPLOYMENT CONDITIONS A requirement to understand, observe, conform and adhere to: DCS Human Resource policies and guidelines, the Public Sector Management Act general public sector aims and standards, Treasurer’s Instructions, Accounting Policy Statements, personnel management standards, and employee conduct standards as well as the Government and DCS Codes of Conduct and the DCS values system legislative requirements that apply to the role, including but not limited to the Public Sector Management Act, FBT and GST legislation, relevant industrial awards and enterprise agreements, Correctional Services Act, Occ. Health Safety & Welfare Act, Equal Opportunity Act, and the Workers Rehabilitation & Compensation Act. 7. KEY AREAS OF ACCOUNTABILITY The Senior Financial Accountant contributes to the Department meeting its statutory reporting requirements by: leading the preparation of designated financial statements and reporting that meet all relevant guidelines and best practice standards incorporating Treasurer’s Instructions, Accounting Policy Statements and Australian Accounting Standards; overseeing the development and implementation of the Department’s financial policies in liaison with the Management Accounting team to ensure the production of financial reports which comply with Australian Accounting Standards and the Treasurer’s Instructions; coordinating or undertaking the preparation of other financial reports and statistical returns as required; ensuring that processes and systems within the Department produce reliable and timely data for the preparation of annual financial statements; liaising with Internal and External Auditors. JOB & PERSON SPECIFICATION 3 The Senior Financial Accountant also contributes to the Department meeting its taxation obligations by: overseeing the development, implementation and maintenance of policies and procedures that support the appropriate administration of the Goods and Services Tax (GST) and Fringe Benefits Tax (FBT) obligations of the Department; providing expert advice and high level assistance to Departmental personnel at all levels in the interpretation and management of their GST and FBT obligations; ensuring that the (GST and FBT) tax consequences of all activities and transactions conducted by the Department are identified and that effective business practices necessary to support compliant GST and FBT processes are developed, monitored and maintained; ensuring that any changes to GST and FBT legislation, or any rulings that affect the way they are applied, are identified and communicated across the Department and for ensuring that changes to legislation and public or private rulings are identified and actioned as appropriate; leading the preparation of periodic (GST and FBT) taxation returns and ensuring they are prepared and submitted by stringent deadlines; contributing to the ongoing effectiveness of information systems (or in their absence, appropriate contingency procedures) by identifying any necessary remedial work or opportunities for efficiency improvements and assisting with the specification of any new requirements. The Senior Financial Accountant will also contribute to the: ongoing development and the proper and effective administration of the Department’s accounting systems, operations, procedures and controls; The Senior Financial Accountant will be responsible for the: supervision of the Financial Accounting team as well as the development and mentoring of staff. JOB & PERSON SPECIFICATION 4 8. QUALIFICATIONS Essential: A degree qualification in Commerce, Accounting, Finance or Economics, majoring in Accounting. Desirable: Membership of professional accounting group. 9. PERSON CRITERIA 9.1 Essential Criteria Demonstrated experience in the preparation of general purpose reports involving consolidations and preparation of taxation returns, particularly relating to the Goods and Services Tax and Fringe Benefits Tax. High level knowledge of Australian Accounting Standards, relevant Treasurer’s Instructions and Accounting Policy Statements. Experience in writing and reviewing accounting policies and procedures. Proven ability to establish and maintain effective collaborative working relationships with senior managers and staff across a range of agencies. Proven ability to effectively lead a team and to also work as a team member, and to effectively deal with high volumes of work and meet deadlines. Proven high level written and oral communication, and presentation skills, which enable effective and appropriate communication with a broad range of people. Demonstrated experience in interpreting and applying accounting standards and in implementing professional practices, policies and procedures. Experience in the use of Masterpiece, in particular, the General Ledger module. 9.2 Desirable Criteria Experience in the use of Business Objects. JOB & PERSON SPECIFICATION 5 JOB PROFILE – Senior Financial Accountant This position leads the Financial Accounting team of the Corporate Finance Branch within the Department for Correctional Services (DCS). The Corporate Finance Branch comprises the following teams: Financial Accounting Management Accounting Procurement The Financial Accounting team comprises of six accounting qualified staff under the direct supervision of the Senior Financial Accountant who reports to the Manager, Corporate Finance. The Corporate Finance Branch is located in Central Office. There may be occasions when the Senior Financial Accountant may be required to visit prisons and community corrections centres located both in the metropolitan and country areas across the State. DCS maintains the Masterpiece accounting system and the accounting modules include: General Ledger Accounts Payable Accounts Receivable Fixed Assets Purchase Order Inventory Control. Other accounting interfaces to the Masterpiece system include Quickbooks, Chris Payroll and JIS Prisoner Finance. DCS uses Business Objects as its financial reporting system. The key challenges for this position include: Keeping abreast with changes to accounting and financial reporting standards. Keeping abreast with tax legislation in relation to Fringe Benefits Tax and Goods and Services Tax. As team leader for Financial Accounting, contribute to the training and development of other members of the team. Contribution to the proper and effective administration of the Department’s accounting systems, operations, procedures and controls. Flexitime arrangements apply in Corporate Finance. Some hours outside normal time will be required to be worked. Manager Corporate Finance 16 September 2008