Press Release - Bionor Pharma

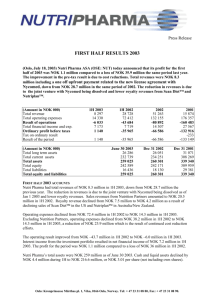

advertisement

Nutri Pharma ASA Kronprinsesse Märthas pl. 1, Vika, 0166 Oslo, Norway. Tel: + 47 23 31 08 80, Fax: + 47 23 31 08 90. Page 1 THIRD QUARTER 2006 RESULTS (Oslo, 16 November 2006) Nutri Pharma (OSE: NUT) today reports operating revenues of NOK 16.9 million and a loss of NOK 4.1 million for the third quarter of 2006. This compares to revenues of NOK 1.4 million and a loss of NOK 1.8 million in the third quarter of 2005. Operating costs in third quarter were NOK 20.8 million compared to NOK 3.0 million in Q3-2005. EBITDA in third quarter shows a deficit of NOK 2.4 million. Amortisation of intangible assets has been charged with NOK 1.5 million in the third quarter (NOK 0.4 million in Q3-2005). Net financial items are recorded with a deficit of TNOK 151 compared to a deficit of TNOK 82 in the same quarter the previous year. Total revenues decreased by 34% compared to the second quarter's revenues of MNOK 25.7. Out of the total sales of MNOK 16.9 in the third quarter, MNOK 15.8 were recorded in MIG (Russia/CIS) and MNOK 1.1 in the Nordic region. Nordic region Royalty income in Q3-06 from the Nordic area increased by 8% compared to second quarter 2005. Total revenues recorded in Q3-05 were NOK 1.4 million of which NOK 1.0 million derived from the Nordic area and 0.4 million from MIG (Russia/CIS) prior to the acquisition of the company. Royalty revenues in the third quarter 2006 were NOK 1.1 million. A provision of NOK 1.2 million relating to the liquidation process of Nutri Pharma's two Danish subsidiaries has been released. The operating profit from the Nordic region was NOK 1.6 million compared to an operating loss of NOK 1.7 million i Q3-2005. Amortisation of Royalty and Patent rights has been expensed with NOK 0.4 million (Q3-2005: NOK 0.4 million). Russia/CIS Compared to second quarter 2006 the revenues in Russia/CIS were reduced by 35%, and both sales of Nutri Pro and cosmetics products were reduced. MIG achieved a gross margin of 87% from sales in Q3, even after a stock provision of MNOK 0.8 million. The business segment Russia/CIS delivered a negative EBITDA of NOK 4.4 million. In Q3-2006 the variable proportion of MIGs costs were 77% of the revenues, covering cost of goods sold, commissions to distributors and service providers. A cost of MNOK 3 million for the annual Premium event in Moscow has been expensed in Q3-06. As from 1 October 2005 Nutri Pharma operates with two business segments; Nordic, with the existing royalty revenues, and Russia + CIS countries through the direct sales organisation of MIG. For further segment info. see page 8. Consolidated Income statement (main figures) Q3 2006 Q3 2005 16,921 20,876 -3,955 -151 -4,106 -4,106 -0.05 1,367 3,043 -1,676 -82 -1,758 -1,758 -0.02 (Amounts in NOK 000) Total revenue Total operating expenses Result of operations Net Financial items Profit/(loss) before taxes Income tax expense Profit/(loss) for the period EPS (NOK) 9M 2006 9M 2005 FY 2005 65,142 71,127 -5,985 -346 -6,331 -6,331 -0.08 3,579 13,862 -10,283 2 -10,281 -10,281 -0.14 25,345 35,088 -9,743 132 -9,611 Nutri Pharma ASA Kronprinsesse Märthas pl. 1, Vika, 0166 Oslo, Norway. Tel: + 47 23 31 08 80, Fax: + 47 23 31 08 90. - -9,611 -0.13 Page 2 Balance sheet (main figures) (Amounts in NOK 000) 30 Sept 2006 31 Dec 2005 30 Sept 2005 Total non-current assets Total current assets Total assets 104,922 12,366 117,288 105,913 14,204 120,117 7,292 10,700 17,992 Total equity Total liabilities Total equity and liabilities 36,074 81,214 117,288 18,712 101,405 120,117 16,794 1.198 17,992 Financial performance January - September 2006 The consolidated loss for the period is MNOK 6.3 (MNOK -10.3), and the EBITDA result shows a loss of MNOK 1.5 (MNOK -9.2). The Nordic operation has achieved an operating profit of MNOK 0.6 and Russia/CIS a deficit of MNOK 6.9 respectively. For segment information see page 8. Total revenue for the first 9 months is MNOK 65.1 compared to MNOK 3.6 last year which was royalty revenues from the Nordic area only. Royalty revenue from Nordic is MNOK 3.5 million in 2006. Sales revenue in Russia/CIS is MNOK 61.6 this year (MNOK 0.4). The nutrition products Nutrilett and NutriPro accounts for 64% of total sales revenue in 2006. Total operating expenses increased from MNOK 13.9 last year (only Nordic) to MNOK 71.1 for the first nine months of 2006. Operating expenses from the Nordic operation are MNOK 4.8 in 2006. Total amortization costs in 2006 are MNOK 4.5, of which MNOK 3.4 relates to the Software platform in MIG and MNOK 1.1 to royalty assets in Nutri Pharma ASA. The comparable amortization costs in 2005 were MNOK 1.1 relating to royalty assets in Nordic. Net financial expense is TNOK 346, compared to finance revenue of TNOK 2 in the same period of 2005. Cash and other liquid assets were MNOK 4.2 as of September 30 2006, compared to MNOK 6.6 as of June 30 2006. There has been no further financing activities in this quarter. Commercial Update Nordic Nutrilett, which is distributed through Orkla subsidiary Collett Pharma, as one of their core product lines, continues to show a growing trend. The market segment for nutrition and weight management is increasing in the Nordic market and Nutrilett is the market leader. In Q3-2006 sales from Collett Pharma increased by 17% compared to the Third Quarter of 2005. Russia and CIS countries With revenues of MNOK 15.8 in the Third Quarter, MIG experienced a revenue decrease of 35% compared to the second quarter. The implementation of the new commission plan this autumn has not yet lead to increased sales. However, considerable cost cutting has reduced the break-even to a level where we do not foresee any need for further financing going forward. Nutri Pharma ASA Kronprinsesse Märthas pl. 1, Vika, 0166 Oslo, Norway. Tel: + 47 23 31 08 80, Fax: + 47 23 31 08 90. Page 3 Oslo, 16 November 2006 The Board of Directors of Nutri Pharma ASA FOR FURTHER INFORMATION: Trond Syvertsen, CEO +47 23 31 08 80 For information about Nutri Pharma, Nutri Pharma products, Nutri Pharma management and Nutri Pharma financial performance, please point your web browser to: www.nutripharma.com For information about Meridian International Group (MIG), please point your web browser to: http://www.meridianinternational.net/public/home/home-welcome.asp Nutri Pharma ASA Kronprinsesse Märthas pl. 1, Vika, 0166 Oslo, Norway. Tel: + 47 23 31 08 80, Fax: + 47 23 31 08 90. Page 4 Accounting Principles The consolidated financial statements for the third quarter have been prepared in accordance with the statutory regulations governing the Stock Exchange, the Oslo Stock Exchange’s own rules and IAS 34 “Interim Financial Reporting”. The accounting policies used are consistent with those used in the Annual Financial Statements. The interim financial statements do not include all the information that is required of a complete set of year-end financial statements, and should therefore be read in conjunction with the consolidated annual financial statements for 2005. The Annual report for 2005 can be obtained upon request to the company’s head office, or from its website: www.nutripharma.com Income Statement Amount in NOK '000 Nutri Pharma Consolidated - IFRS July 1 - Sept 30 Jan 1 - Sept 30 Q3 2006 Q3 2005 9m 2006 9m 2005 FY 2005 REVENUE 15,863 1,058 16,921 388 979 1,367 61,638 3,504 65,142 388 3,191 3,579 20,821 4,524 25,345 Cost of goods sold Personnel costs Depreciation of intangible and tangible fixed assets Other operating expenses Total operating expenses 2,021 499 1,531 16,825 20,876 454 362 2,227 3,043 5,977 1,795 4,455 58,900 71,127 1,998 1,086 10,778 13,862 504 2,488 2,549 29,547 35,088 RESULT FROM OPERATIONS -3,955 -1,676 -5,985 -10,283 -9,743 -151 -82 -346 2 132 -4,106 -1,758 -6,331 -10,281 -9,611 - - - -4,106 -1,758 -6,331 -10,281 -9,611 -0.05 -0.02 -0.08 -0.14 -0.13 Net sales revenues Royalty income Total revenue OPERATING EXPENSES FINANCIAL INCOME AND EXPENSES Net financial income and expenses PROFIT BEFORE TAXES Income tax expense PROFIT FOR THE PERIOD Earnings per share/diluted earnings per share Nutri Pharma ASA Kronprinsesse Märthas pl. 1, Vika, 0166 Oslo, Norway. Tel: + 47 23 31 08 80, Fax: + 47 23 31 08 90. - - Page 5 Balance Sheet Nutri Pharma Consolidated - IFRS Amount in NOK '000 30 Sept 2006 31 Dec 2005 30 Sept 2005 NON CURRENT ASSETS Intangible non-current assets Patent and royalty assets Goodwill Software platform Distributor lists Total intangible non - current assets 5,843 64,699 18,561 15,819 104,922 6,929 62,325 21,342 15,317 105,913 7,292 Total non - current assets 104,922 105,913 7,292 Debtors Accounts receivable Other short term receivables Total debtors 1,349 2,092 3,441 1,563 1,744 3,307 5,673 505 6,178 Stocks 4,768 4,853 - Short term Investments Bonds and certificates Total short term Investments 1,997 1,997 3,448 3,448 4,132 4,132 Cash and bank deposits Cash and bank deposits 2,160 2,596 390 12,366 14,204 10,700 117,288 120,117 17,992 Issued capital Treasury shares Retained earnings Translation differences Total capital 19,668 11,794 4,612 36,074 19,668 -1,500 -1,076 1,620 18,712 19,668 -1,500 -1,374 Total equity 36,074 18,712 16,794 3,516 114 15,330 62,254 81,214 3,570 105 12,903 84,827 101,405 79 1,119 1,198 117,288 120,117 17,992 7,292 CURRENT ASSETS Total current assets TOTAL ASSETS EQUITY 16,794 LIABILITIES Current liabilities Accounts payable Public duties payable Short term loans Other current liabilities Total liabilities TOTAL EQUITY AND LIABILITIES Nutri Pharma ASA Kronprinsesse Märthas pl. 1, Vika, 0166 Oslo, Norway. Tel: + 47 23 31 08 80, Fax: + 47 23 31 08 90. Page 6 Cash Flow Statement Consolidated IFRS Amount in NOK '000 July 1 - Sept 30 Q3 2006 Q3 2005 Jan 1 - Sept 30 9m 2006 9m 2005 FY 2005 Cash flow from operations Profit before taxes Depreciation and amorization Change in stocks Change in accounts receivables Change in accounts payable Change in other provisions Net cash flow from operations -4,106 1,531 162 558 538 -1,254 -2,571 -1,758 362 -317 -2,012 840 -2,885 -6,330 4,455 85 214 -54 -2,130 -3,760 -10,281 1,086 -5,154 -27 -685 -15,061 -9,611 2,549 -81 113 -9,429 -1,615 -18,074 467 2,682 1,451 12,290 467 2,682 1,451 1,850 14,140 12,975 1,392 1,850 16,217 139 139 - 1,873 1,873 - 3,142 3,142 -1,965 -203 -436 -921 1,285 Cash assets at beginning period 4,125 593 2,596 1,311 1,311 Cash assets at end period 2,160 390 2,160 390 2,596 Cash flow from investments Changes in bonds and certificates Acquisition of subsidiary net of Cash Proceeds from sales of own shares Net cash flow from investments Cash flow from financing Short term loans Net cash flow from financing Net cash flow Consolidated statement of changes in equity for the period ended 30 Sept 2006 IFRS NOK 1.000 YTD-2006 At 1 January 2006 IFRS YTD-2005 Issued capital 19,668 Treasury Shares -1,500 -1,076 Foreign currency translation Profit for the year Sale of treasury shares At 30 Sept 2006 IFRS 19,668 1,500 0 -6,330 19,200 11,794 At 1 January 2005 IFRS 19,668 -1,625 6,810 Foreign currency translation Profit for the year Sale of treasury shares FY-2005 Retained earnings Translation differences Total equity 1,620 18,712 2,992 4,612 2,992 -6,330 20,700 36,074 373 25,226 -10,282 0 -10,282 125 1,725 1,850 At 30 Sept 2005 IFRS 19,668 -1,500 -1,747 373 16,794 At 1 January 2005 IFRS 19,668 -1,625 6,810 373 25,226 1,247 125 1,725 -9,611 1,247 1,850 -9,611 -1,500 -1,076 1,620 18,712 Foreign currency translation Sale of treasury shares Profit for the year At 31 December 2005 IFRS 19,668 Nutri Pharma ASA Kronprinsesse Märthas pl. 1, Vika, 0166 Oslo, Norway. Tel: + 47 23 31 08 80, Fax: + 47 23 31 08 90. Page 7 Segment information The primary reporting format is determined to be business segments as the Group's risks and rates of return are affected predominantly by differences in the products services sold. Secondary information is reported geographically. The operating businesses are organized and managed separately according to the nature of the products and services provided, with each segment representing a strategic business unit that offers different products and serves different markets. Following the acquisition of MIG Ltd Nutri Pharma operates with two business segments; Nordic, with the existing royalty revenues, and Russia + CIS countries through the direct sales organisation of MIG Transfer prices between business segments are set on an arm's length basis in a manner similar to transactions with third parties. Segment revenue, segment expense and segment result include transfers between business segments. Those transfers are eliminated in consolidation. The group's geographical segments are based on the location of the Group's assets. Sales to external customers disclosed in geographical segments are based on the geographical location of its customers. Business segment (NOK 1000) Nordic Russia + CIS Eliminations 9M 2006 FY 2005 9M 2006 FY 2005 61,638 20,821 3,504 3,504 1,889 5,393 0 4,524 4,524 1,007 5,531 61,638 20,821 61,638 Segment result Unallocated revenue 612 -9,771 Operating result Net finance Income taxes Profit for the year 611 1 Sales Royalty Total revenue Inter segment sales Revenue Assets and liabilities Assets Total assets Other business segment information (NOK 1000) Segment liabilities Not allocated liabilities Total liabilities Amortisation Investments Impairment Geography (NOK 1000) Revenue from external customers Segment Assets Investments Consolidated 9M 2006 FY 2005 20,821 61,638 3,504 65,142 0 65,142 20,821 4,524 25,345 0 25,345 -6,942 160 -6,330 -9,611 -10,045 274 -6,595 -347 303 -143 612 -9,771 -6,942 160 0 0 -5,984 -346 0 -6,330 -9,742 131 0 -9,611 9,286 9,286 12,548 12,548 108,002 107,568 108,002 107,568 0 117,288 120,117 0 117,288 120,117 FY 2005 95,005 0 95,005 1,449 0 0 Russia + CIS 9M 2006 FY 2005 27,262 22,860 0 0 27,262 22,860 3,368 1,100 0 0 0 0 Nordic 9M 2006 72,600 0 72,600 1,087 0 0 Nordic 9M 2006 3,504 9,286 0 FY 2005 4,136 12,548 0 9M 2006 1,889 Russia + CIS 9M 2006 61,638 108,002 0 FY 2005 1,007 Eliminations 9M 2006 FY 2005 18,649 16,461 18,649 16,461 Consolidated 9M 2006 FY 2005 81,213 101,405 0 0 81,213 101,405 4,455 2,549 0 0 0 0 Consolidated FY 2005 9M 2006 21,209 65,142 107,568 117,288 0 0 FY 2005 25,345 120,117 0 Nutri Pharma ASA Kronprinsesse Märthas pl. 1, Vika, 0166 Oslo, Norway. Tel: + 47 23 31 08 80, Fax: + 47 23 31 08 90. Page 8