Applied Corporate Finance

advertisement

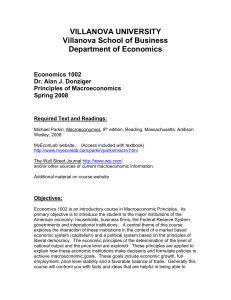

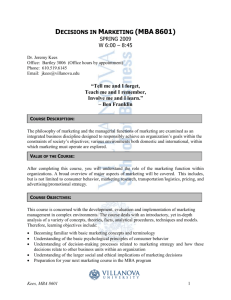

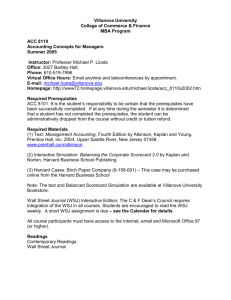

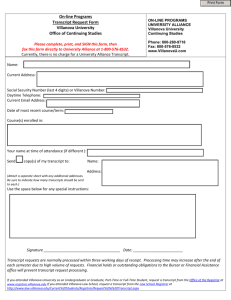

VILLANOVA UNIVERSITY, College of Commerce and Finance, Dept. of Finance Applied Corporation Finance Dr. Michael Pagano, CFA Fall 2003, Course: MBA 8410, Section: 002 Office: Bartley 2041 E-mail: Michael.Pagano@villanova.edu Phone: (610) 519-4389 Office Hours: Wednesdays 4:00-5:30 pm, or by appointment. Course Prerequisites: MBA standing; MBA 8401. It is the student’s responsibility to be certain that the prerequisites have been successfully completed. If at any time during the semester it is determined that a student has not completed the prerequisites, the student can be administratively dropped from the course without credit or tuition refund. Course Materials: Required: Financial Management: Theory and Practice (10th Ed.) by E.F. Brigham and M.C. Ehrhardt, Harcourt College, 2002. Financial Calculator. MBA 8410 Case Package (Available at Villanova Bookshop). My web site also contains relevant files for this course: www.homepage.villanova.edu/michael.pagano Regular reading of a financial newspaper such as The Wall Street Journal or the Financial Times is assumed. Optional: Study Guide for above text. (Harcourt College). Course Description and Objectives: MBA 8410 is an advanced, graduate-level course in corporation finance. It is intended to develop a student’s abilities to apply the theories and concepts of corporate financial management to a wide range of practical business problems and situations (as detailed in the Course Outline). Teaching Methodology: There will be an emphasis on the use of cases and problemsolving as an approach to covering the material. Students are expected to prepare assigned problems and cases prior to the class meeting. Students are required to actively participate in the discussion of the cases and engage in role playing activities (e.g., participate in the discussion “as if” the student was a CFO or a financial analyst). A financial calculator is essential for this class. It should perform net present value and internal rate of return calculations. Course Grade and Requirements: The final grade will be based on two exams, three 5-page Case Analyses and three 3-page Case Summaries and three 1-page Case Analyses-in-Brief. The Mid-Term Exam will account for 20% of your grade while the Final Exam represents 30%. The Final Exam will be cumulative. The three 5-page Case Analyses account for 30% of your grade (i.e., 10% for each case analysis). The remainder of your grade, 20%, is based on the completion of the six other case assignments (the three 3-page Case Summaries and three 1-page Case Analyses-in-brief). The three 5-page Case Analyses are to be written independently by groups of 3-4 students. The three 1-page Case Analyses-in-brief are to be completed by each student individually. For the three 3-page Case Summaries, you have the choice of completing the assignments either individually or by groups of 3-4 students. In preparing these assignments, unauthorized sharing of relevant spreadsheets and other electronic files between groups is also prohibited. Students/groups who fail to submit a paper on the due date will receive a letter grade penalty for that assignment for each day that it is late. Class Participation and Attendance Policy: Attendance of all classes is strongly encouraged. The success of this course depends on extensive class participation in weekly discussions. Class members are expected to read and complete all of the assigned materials. While there is no formal penalty for missing classes, poor attendance may adversely affect your exam performance and final grade in the course. Email Communication: Class announcements and other communications will be through your Villanova email account. You should monitor this account on a regular basis for information on “handouts,” announcements, assignments, readings, articles in newspapers, magazines, and journals, etc. Exam Rules: 1. You can bring one sheet of formulas no larger than 8 ½’’ x 11”. 2. Except for a documented medical emergency, a missed exam will receive a grade of zero. Students with documented medical emergencies will get a make-up exam that is different from the one given in class. 3. Academic dishonesty will not be tolerated and will be enforced as stated in the University’s Code of Academic Integrity. Academic Integrity Policy: The Code of Academic Integrity of Villanova University addresses cheating, fabrication of submitted work, plagiarism, handing in work completed for another course without the instructor’s approval, and other forms of dishonesty, such as discussing the content of an exam with a student who has not taken that exam. For the first offense, a student who violates the Code will receive 0 points for the assignment. The violation will be reported by the instructor to the Dean’s Office and recorded in the student’s file. In addition, the student will be expected to complete an education program. For the second offense, the student will be dismissed from the University and the reason noted on the student’s official transcript. Students with Disabilities: It is the policy of Villanova to make reasonable academic accommodations for qualified individuals with disabilities. If you are a person with a disability please contact me after class or during office hours and make arrangements to register with the Learning Support Office by contacting 610-519-5636 or nancy.mott@villanova.edu as soon as possible. Registration is needed in order to receive accommodations. Course Outline: Date Chapter(s) Case Study Topic(s) A. Usage of Fundamental Tools This section of the course is devoted to understanding the key components and ethical issues related to the financial system (Ch. 1, 5) and the essential tools (Ch. 3, 11) needed to make informed financial decisions in a global, technologically advanced market place (Ch. 13, 14). Aug. 27 1, 5 Sept. 3 3, 4 (pp. 122-129) Sept. 10 11 13 Sept. 17 13 Sept. 24 Hand-out Oct. 1 14 Introduction, Finance Pre-test, and the Financial Environment Analysis of Financial Statements Cost of Capital and The Basics of Capital Budgeting Hampton Machine Tool (A & B) (9-280-103) The Basics of Capital Budgeting (continued) Legal and Ethical Considerations in Corporate Finance Cash Flow Estimation and Risk Analysis in Capital Budgeting Investment Analysis & Lockheed Tri Star (A & B) (9-291-031) Oct. 8 Mid-term Examination Oct. 13-19 Fall Break B. Advanced Applications of Fundamentals to Various Financial Problems This section is devoted to applying the key tools and concepts learned during the first portion of the course to more complex, real-world financial decisions. These principles will be applied to financial decisions facing the firm such as estimating the effect on firm value of staggering investment decisions (Ch. 15), altering capital structure (Ch. 16), issuing and repurchasing securities (Ch. 18, 19), and managing multiple risks (Ch. 24). Lease-versus-buy decisions (Ch. 20) and short-term capital management (Ch. 22) will also be explored. Date Chapter(s) Oct. 22 15 (skip pp. 605-608) Introduction to Real Options 16 (skip pp. 632-641) Capital Structure Decisions Oct. 29 Nov. 5 Nov. 12 18 Case Study Topic(s) Du Pont: Titanium Dioxide (B) (9-284-066) Arundel Partners (A) (9-292-140) Also, read HBS Tutorial: 9-295-074 19 (skip pp. 763-776) Distribution to Shareholders: Dividends and Repurchases; and Issuing Securities, Investment Banking, Etc. 24 Corporate Risk Management Cox Communications (B) (9-201-003) Sealed Air Corp. (A) (9-294-122) Nov. 19 20 Leasing Decisions Cephalon Inc. (B) (9-298-116) Nov. 25 – Nov. 30 Dec. 3 22 Thanksgiving Break Current Asset Management Riverbend Telephone (A) (9-197-104) Dec. 10 Dec. 17 Summary & Concluding Thoughts Final Examination (TBA) Note: This is a preliminary outline that is subject to change. Hanson Ski Products (A & B) (9-187-038)