Course Syllabus - Villanova University

advertisement

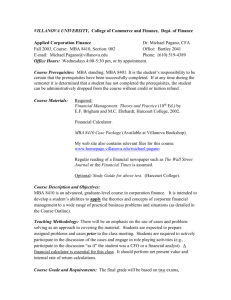

VILLANOVA UNIVERSITY, Villanova School of Business, Dept. of Finance Financial Modeling Spring 2009, Course: MSF 8625, Section: 001 E-mail: Michael.Pagano@villanova.edu Dr. Michael Pagano, CFA Office: Bartley 2041 Phone: (610) 519-4389 Office Hours: Tuesdays and Thursdays 1:00 – 2:30 pm, or by appointment. Course Materials: (Required:) 1. The Oxford Guide to Financial Modeling, Thomas S. Y. Ho and Sang Bin Lee, Oxford U. Press, 2004. 2. Supplementary Material on Forecasting and Financial Research Concepts. Course Objectives: This course will focus on conceptualizing, developing, and applying financial models to a diverse set of real-world companies / financial markets / events. The course will stress a hands-on, interactive approach to learning the cyclical nature of financial modeling. To accomplish this, the student will be introduced to numerous professional and academic databases, models, and software. The overall goal is to become proficient in using these tools so that the student can successfully apply proper modeling techniques to various real-world financial problems. Course Prerequisites: This course is open only to M.S. in Finance graduate students who have successfully completed all relevant MSF courses held during the previous Summer and Fall semesters. It is the student’s responsibility to be certain that the prerequisites have been successfully completed. If at any time during the semester it is determined that a student has not completed the prerequisites, the student can be administratively dropped from the course without credit or tuition refund. Teaching Methodology: There will be an emphasis on adaptive problem-solving and critical thinking as an approach to covering the material. Students are expected to prepare assignments and read text chapters and relevant media (e.g., the Wall Street Journal) prior to the class meeting. The course will be taught via a combination of lectures and hands-on exercises in the Applied Finance Lab. Students are required to actively participate in the discussion and participate in the hands-on exercises using spreadsheets, historical databases, analytical software, and real-time data services. Course Grade and Requirements: The final grade will be based on two exams, a term project prepared by groups of 2-4 students (described below), and course participation. The Midterm Exam, Final Exam, and Group Term Project will each account for 25% of your grade. The Final Exam will be cumulative. Course Participation accounts for the remainder of your grade, 25%, and is broken down into two parts ("Weekly Financial Analyses" participation of 15% and "Everyday" participation of 10%). The "Weekly Financial Analyses" component is based on how well you can participate in various tasks related to understanding and applying financial models to real-world companies, markets, and events (by using the financial models, software, and realtime / historical data services available in the Applied Finance Lab). It is your responsibility to inquire about any assignments, readings, handouts, etc. if you miss class for any reason. Please be prepared for class by reading the assigned material before the day that the material is scheduled to be discussed. Also, it is recommended that you keep up with current business and financial events by reading publications such as The Wall Street Journal, The Economist, and Barron’s. Please see rules for the exams below. Exam Rules: 1. You can bring one card or one sheet of formulas no larger than 8 ½’’ x 11”. 2. Except for a documented medical emergency, a missed exam will be graded as a zero (0 points). Students with documented medical emergencies will get a make-up exam that is different from the one given in class. 3. Academic dishonesty will not be tolerated. 4. These rules complement the normal rules of the College/University. Academic Integrity Policy: The Code of Academic Integrity of Villanova University addresses cheating, fabrication of submitted work, plagiarism, handing in work completed for another course without the instructor’s approval, and other forms of dishonesty, such as discussing the content of an exam with a student who has not taken that exam. For the first offense, a student who violates the Code will receive 0 points for the assignment. The violation will be reported by the instructor to the Dean’s Office and recorded in the student’s file. In addition, the student will be expected to complete an education program. For the second offense, the student will be dismissed from the University and the reason noted on the student’s official transcript. Students with Disabilities: It is the policy of Villanova to make reasonable academic accommodations for qualified individuals with disabilities. If you are a person with a disability please contact me after class or during office hours and make arrangements to register with the Learning Support Office by contacting 610-519-5636 or nancy.mott@villanova.edu as soon as possible. Registration is needed in order to receive accommodations. Home Page: You can also see my web site for some useful information and updates: (www.homepage.villanova.edu/michael.pagano) Course Outline: Fundamentals of Financial Modeling and their Application to Real-World Problems This course is devoted to understanding the key components of financial models and how to apply them properly to various real-world financial problems (such as equity pricing, fixed income analysis, risk management, and portfolio analysis). Class/Date Jan 13, 15 Topic Introduction and Course Overview: The Fundamentals of Financial Modeling Chapter 1 Jan 20, 22, 27 How to Analyze the Effectiveness of a Financial Model Holden et al. Hand-out Jan 29, Feb 3, 5, 10, 12, 17 Modeling Equities, Investment Performance, and Equity Markets 2, Append. A – B Feb 19, 24 Basics of Bond Analysis and Fixed Income Models 3, Append. A – C Feb 26 Mar 2–8 Mar 10, 12, 17 MIDTERM EXAM Spring Break Basics of Bond Analysis and Fixed Income Models (continued) 3, Append. A – C Mar 19, 24, 26 Option-Adjusted Spread Analysis, Credit Scoring, and Bond Analytic Applications Mar 31, Apr 2, 7, and 14, 16 Risk Measurement and Back-Testing Techniques with Applications to Risk Management 8 Project Choices Due Mar 19 15 Apr 9–13 Apr 21, 23 Easter Recess (No Class on Apr 9) Apr 28 Apr 30 May 2 (Saturday) No Class due to Friday Schedule Group Presentations and Discussion 1-3, Hand-out Term Project and Review Due Review FINAL EXAM (4:15 – 6:45) Note: This is a preliminary outline that is subject to change. Cumulative Group-based Term Project: Overview: This group-based project is designed to give you an opportunity to apply some of the tools and principles learned in this course to real-world financial data and situations. The project involves gathering and analyzing information about a specific financial modeling problem of your choice. The project entails writing a (maximum!) 10-page research paper on your chosen financial modeling problem and discussing how the Journal Paper Review you have chosen relates to this problem. The Journal Paper Review is also part of the assignment and entails preparing a 20-minute presentation and 2-page write-up of the chosen journal paper’s Research Methods/Model, Intuition, and Key Findings, as well as incorporating this material into your group-based financial modeling work. Thus, you must choose your Journal Paper so that it relates to the financial modeling problem you have chosen. Indicate three possible choices for your Journal Paper from the following list and submit them to me by March 19th. Journal Paper Review and Group Project Presentation: The Journal Paper Review and Group Project Presentation is a 15-minute class presentation of a 2-page write-up that effectively synopsizes the chosen paper’s research methods, main empirical model, as well as the paper’s intuition and key results / findings. This presentation should also discuss your Group Project’s financial model and its key results. The goal is to put theory into practice by taking a relevant academic journal article and relating it to your chosen group-based financial modeling project. As noted above, this article should also be related to the group’s 10-page research paper by drawing parallels and linkages to the analysis of your chosen financial modeling topic. Choose your paper from the following 4 subsets of Journal Papers (pick three for your set of possible choices): 1. Debt and Equity Valuation: Almeida, H., and T. Philippon, 2007, Risk-adjusted costs of financial distress, Journal of Finance 62, 2557-2586. Hite, G., and A. Warga, 1997, The effect of bond rating changes on bond price performance, Financial Analysts Journal 53 (3), 35-51. Lintner, J., 1956, The distribution of incomes of corporations among dividends, retained earnings and taxes. American Economic Review 46, 97-113. 2. Asset Pricing, Financial Markets, and Market Efficiency: Fernholz, R. and C. Maguire, Jr., 2007, The statistics of statistical arbitrage, Financial Analysts Journal 63, no. 5, 46-52. George, T.J., and C-Y. Hwang, 2007, Long-term return reversals: Over-reaction or taxes? Journal of Finance 62, 2865-2896. Hahn, J., and H. Lee, 2006, Yield spreads as alternative risk factors for size and book-to-market, Journal of Financial and Quantitative Analysis 41, 245-269. Lettau, M., and S. Ludvigson, 2001, Resurrecting the (C)CAPM: A cross-sectional test when risk premia are time-varying, Journal of Political Economy 109, 1238-1287. 3. Investing and Portfolio Management: Malkiel, B.G., and A. Saha, 2005, Hedge funds: risk and return, Financial Analysts Journal 61, no. 6, 80-88. Avromov, D., and R. Wermers, 2006, Investing in mutual funds when returns are predictable, Journal of Financial Economics 81, 339-377. Bekaert, G., and C.R. Harvey, 1995, Time-varying world market integration, Journal of Finance 50, 403-444. Wilcox, S.E., 2007, The adjusted earnings yield, Financial Analysts Journal 63, no. 5, 54-68. 4. Trading and Market Microstructure: Amihud, Y., and H. Mendelson, 1986, Asset pricing and the bid-ask spread, Journal of Financial Economics 17, 223-250. Schwartz, R.A., and D. Whitcomb, 1977, The time-variance relationship: Evidence on autocorrelation in common stock returns, Journal of Finance, 32, 41-55. Stoll, H.R., 2000, Presidential address: Friction, Journal of Finance 55, 1479-1514. Written Report Format and Guidelines: In addition to the Journal Paper Review described above, you must submit a (maximum!) tenpage Term Project (double-spaced and excluding tables/graphs) that covers all of the main areas described below. Financial and statistical analysis for your chosen modeling topic, as well as other relevant principles covered in class, should be applied in order to develop a coherent, concise, properly referenced (and grammatically correct) report. Graphs and tables may be incorporated. All sources employed in your analysis must be included in a bibliography and footnotes should be used to cite specific information from those sources. A computer-generated spreadsheet supporting your financial analysis should also be included, along with other relevant supporting materials, in an appendix. DO NOT INCLUDE ANY COMPUTER OUTPUT DIRECTLY FROM A STATISTICAL ANALYSIS PACKAGE. Plagiarism will clearly not be tolerated. Data Sources: Several on-line and hard-copy sources of information can be of use to you in preparing your report. A list of some relevant sources includes (but is not limited to) the following: WRDS’ access to the Center for Research in Security Prices (CRSP) Stock Return database, Compustat accounting database, Global Insight online U.S. macroeconomic database, NYSE TAQ (Trade and Quote) database, FIS Bank Holding Company database, and real-time data services such as Reuters TradeStation and the Bloomberg Terminal (all available at the Applied Finance Lab in Bartley 25), as well as via targeted searches on VUCAT, Datamonitor, ABI, Factiva, etc. Report Guidelines: Your 10-page (maximum!) report should follow the outline presented below: I. Executive Summary: This section should provide a brief (e.g., in 1-2 paragraphs) description of the financial modeling problem you have chosen to analyze and your overall assessment of your model’s effectiveness. II. Statement of Your Financial Modeling Problem: This section should describe in detail the financial problem you have chosen to analyze and discuss the relevant literature and motivation for your choice of a specific financial model(s). III. Effectiveness of Your Financial Model: This section should report the results of your financial model in terms of its overall effectiveness in solving your previously stated financial problem (e.g., via measuring: out-of-sample forecasting power, explanatory power of the model, statistical significance of key model parameters, and/or back-tested investment return results), IV. Linkage to Journal Paper Review: This section should discuss how the journal article you have chosen relates to your financial modeling problem and the model’s performance. V. Conclusion: This section should briefly (i.e., in 1-3 paragraphs) summarize the main points described in the previous sections and provide an overall conclusion based on your financial analysis. Project Due Date: Your report is due at the beginning of either April 21st or 23rd). LATE SUBMISSIONS WILL NOT BE ACCEPTED.