Quiz1a and answers

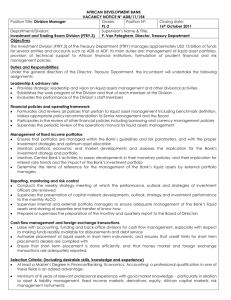

advertisement

Name: _____________________ ID number: _________________ FIN 406 Quiz 1 October 3, 2002 Instructions: Circle the best answer for each question in the exam. There are 45 questions and each question is worth 1 point. The exam is a closed book and closed notes exam. 1 1. Derivative securities can be based on _________. a. currencies b. common stocks c. home mortgages d. all of the above 2. The material wealth of a society is determined by the economy’s __________, which is a function of the economy’s ___________. a. investment bankers; financial assets b. investment bankers; real assets c. productive capacity; financial assets d. productive capacity; real assets 3. Asset allocation refers to the _______________. a. allocation of the investment portfolio across broad asset classes b. analysis of the value of securities c. choice of specific assets within each asset class d. none of the above 4. _____________ portfolio management calls for holding diversified portfolios without spending effort or resources attempting to improve investment performance through security analysis. a. active b. idiotic c. passive d. none of the above 5. _____________ is not a true statement regarding municipal bonds. a. A municipal bond is a debt obligation issued by state or local governments. b. A municipal bond is a debt obligation issued by the Federal Government. c. The interest income from a municipal bond is exempt from federal income taxation. d. The interest income from a municipal bond is exempt from state and local taxation in the issuing state. 6. Money market securities are characterized by ______________. a. a very short term to maturity b. a medium term to maturity c. a long term to maturity d. none of the above 2 7. Mutual funds perform the function of __________ for their shareholders. a. diversification b. professional management c. record keeping and administration d. all of the above 8. When computing the bank discount yield in a leap year, you would use ________ days. a. 260 b. 360 c. 365 d. 366 9. The ask price of a treasury bill is ______________. a. the price at which the dealer in treasury bills is willing to sell the bill b. the price at which the dealer in treasury bills is willing to buy the bill c. greater than the ask price of the treasury bill expressed in dollar terms d. the price at which the investor can buy the treasury bill 10. In a futures contract, the short position is taken by the person who ____________. a. commits to delivering the commodity b. commits to purchasing the commodity c. plays between second base and third base d. uses his margin 11. A __________ gives its holder the right to sell an asset for a specified exercise price on or before a specified expiration date. a. call option b. futures contract c. put option d. none of the above 12. A treasury bill has a face value of $10,000 and is selling for $9,800. If the treasury bill matures in 80 days, its effective annual yield is ___________. a. 2.04% b. 9.46% c. 8.42% d. 9.66% 13. The asked discount yield on a treasury bill is 5%. The ask price of the bill is ______________ if it matures in 60 days and has a face value of $1,000. a. $950.00 b. $991.67 c. $952.38 d. none of the above 3 14. If the market prices of the 30 stocks in the Dow Jones Industrial Average all change by the same dollar amount on a given day (ignoring stock splits), which stock will have the greatest impact on the average? a. the one with the highest price b. the one with the lowest price c. all 30 stocks will have the same impact d. the answer cannot be determined by the information given 15. Which of the following are not characteristic of common stock ownership? a. residual claimant b. unlimited liability c. voting rights d. all of the above are characteristics of stock ownership 16. Assume that you have just purchased some shares in an investment company reporting $300 million in assets, $20 million in liabilities, and 30 million shares outstanding. What is the net asset value of these shares? a. $10 b. $9.33 c. $15 d. $1.50 17. Sponsors of unit investment trusts earn a profit by ______________. a. deducting a quarterly management fee from fund assets b. deducting a percentage of any gains in asset value c. selling shares in the trust at a premium to the cost of acquiring the underlying assets d. none of the above 18. Investors who wish to liquidate their holdings in a unit investment trust may _______________. a. sell their shares back to the trustee at a discount b. sell their shares back to the trustee at net asset value c. sell their shares on the open market d. none of the above 19. ____________ is a false statement regarding open-end mutual funds. a. they offer investors a guaranteed rate of return b. they offer investors a well diversified portfolio c. they redeem their shares at their net asset value d. none of the above 4 20. Mutual funds that hold both equities and fixed-income securities in relatively stable proportions are called ______________. a. income funds b. balanced funds c. asset allocation funds d. index funds 21. In a recent study, Malkiel finds that evidence of persistence in the performance of mutual funds _______________ in the 1980s a. grows stronger b. remains about the same c. becomes slightly weaker d. virtually disappears 22. Empirical evidence suggests that investors become ____________ as they approach retirement. a. greedier b. less interested in investments c. more risk averse d. more risk tolerant 23. The ___________ average ignores compounding. a. geometric b. arithmetic c. both a and b above d. none of the above 24. Of the alternatives available, _____________ typically have the highest standard deviation of returns. a. commercial paper b. corporate bonds c. stocks d. treasury bills 25. If you purchase a stock for $50, receive dividends of $2, and sell the stock at the end of the year for $53, what is your holding period return? a. 5% b. 10% c. 14% d. 18% 26. The arithmetic average of 12%, 15%, and 20% is ________________. a. 15.7% b. 15% c. 17.2 d. 20% 5 27. The geometric average of 10%, 20% and 41% is ____________. a. 14.9% b. 18.2% c. 19.7% d. 23% 28. The dollar weighted return is the same as the _______________. a. difference between cash inflows and outflows b. arithmetic average return c. geometric average return d. internal rate of return 29. Suppose you pay $9,700 for a Treasury bill maturing in three months. What is the effective annual rate of return for this investment? a. 3.1% b. 13% c. 8.42% d. 10.66% 30. The reward/variability ratio is given by ________________. a. the slope of the capital allocation line b. the second derivative of the capital allocation line c. the point at which the second derivative of the investor’s indifference curve reaches zero. d. none of the above. 31. If you are promised a nominal return of 12% on a one year investment, and you expect the rate of inflation to be 3%, what real rate do you expect to earn? (exact rate, not approximation) a. 5.48% b. 8.74% c. 9% d. 12% 32. A Treasury bill pays a 6% rate of return. A risk averse investor _____________ invest in a risky portfolio that pays 12% with a probability of 40% or 2% with a probability of 60% because ___________________. a. might; she is rewarded a risk premium b. would not; because she is not rewarded any risk premium c. would not; because the risk premium is small d. cannot be determined 6 33. Consider a treasury bill with a rate of return of 5% and the following risky securities: Expected Return Variance A 0.15 0.0400 B 0.10 0.0225 C 0.12 0.1000 D 0.13 0.0625 The investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. The security the investor would choose as part of his complete portfolio would be _____________. a. security A b. security B c. security C d. security D 34. An investor invests 40% of his wealth in a risky asset with an expected rate of return of 15% and a variance of 4% and 60% in a treasury bill that pays 6%. The portfolio’s expected rate of return and standard deviation are _____________ and ______________. a. 8.0%; 12% b. 9.6%; 8% c. 9.6%; 10% d. 11.4%; 12% 35. Consider the following two investment alternatives. First, a risky portfolio that pays 15% rate of return with a probability of 60% or 5% with a probability of 40%. Second, a treasury bill that pays 6%. The risk premium on the risky investment is a. 1% b. 5% c. 9% d. 7% 36. You invest $100 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 12% and a standard deviation of 15% and a treasury bill with a rate of return of 5%. ____________ of your money should be invested in the risky asset to form a portfolio with an expected return of 9%. a. 28% b. 86% c. 57% d. 50% 7 37. A portfolio is composed to two stocks, A and B. Stock A has a standard deviation of return of 25% while stock B has a standard deviation of return of 5%. Stock A comprises 20% of the portfolio while stock B comprises 80% of the portfolio. If the variance of returns on the portfolio is 0.0050, the correlation coefficient between the returns on A and B is ____________. a. -0.225 b. -0.474 c. 0.474 d. 0.225 38. The standard deviation of return on investment A is 0.1 while the standard deviation of return on investment B is 0.05. If the covariance of returns on A and B is 0.0030, the correlation coefficient between the returns A and B is ____________. a. 0.12 b. 0.36 c. 0.60 d. 0.77 39. An investor can design a risky portfolio based on two stocks, A and B. The standard deviation of return on stock A is 20% while the standard deviation on stock stock B is 15%. The correlation coefficient between the return on A and B is 0.The expected return on stock A is 20% while on stock B is 10%. The proportion of the minimum variance portfolio that would be invested in stock B is ________. a. 6% b. 50% c. 64% d. 100% 40. A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 5% while stock B has a standard deviation of return of 15%. The correlation coefficient between the returns on A and B is 0.5. Stock A comprises 40% of the portfolio while stock B comprises 60% of the portfolio. The variance of return on the portfolio is ___________. a. 0.0056 b. 0.0067 c. 0.0114 d. 0.0103 8 41. According to Tobin’s separation property, portfolio choice can be separated into two independent tasks consisting of ___________ and ___________. a. identifying all investor imposed constraints; identifying the set of securities that conform to the investor’s constraints and offer the best riskreturn tradeoff b. identifying the investor’s degree of risk aversion; choosing securities from industry groups that are consistent with the investor’s risk profile c. identifying the optimal risky portfolio; constructing a complete portfolio from the T-bills and the optimal risky portfolio based on the investor’s degree of risk aversion d. none of the above answers is correct. 42. The values of beta coefficients of securities are ___________. a. always positive b. always negative c. always between +1 and –1 d. usually positive, but not restricted in any particular way 43. Rational risk-averse investors will always prefer portfolios ____________. a. located on the efficient frontier to those located on the capital market line b. located on the capital market line to those located on the efficient frontier c. at or near the minimum variance point on the efficient frontier d. rational risk-averse investors prefer the risk-free asset to all other asset classes 44. Risk that can be eliminated through diversification is called _____________ risk. a. firm-specific b. unique c. both of the above d. none of the above 45. The term excess returns refers to ______________. a. returns earned illegally by means of insider trading b. the difference between the rate of return earned and the risk-free rate c. the difference between the rate of return earned on a particular security and the rate of return earned on other securities of equivalent risk d. the portion of the return on a security which represents tax liability and therefore cannot be reinvested 9 Answers to Quiz 1 (Since the correct answers are circled in red pen on your returned quizzes, only the work for computational questions are provided here.) 12. Holding period return = (face value – price)/price = 0.02041 Effective annual yield = (1.02041)(365/80) - 1 = 0.0966 I also accepted 9.46% since if you use 360/80 rather than 365/80, your answer is closer to 9.46%. 13. Ask discount yield = (face value – price)/face value x 360/60 0.05 = (1000-P)/1000 x 360/60 solving for P yields $991.67 16. NAV = (assets-liabs)/shares outstanding = (300m-20m)/30m = $9.33 25. Return = (selling price +dividend)/purch price - 1 = (53+2)/50 - 1 = 10% 26. Arithmetric average = (0.12 + 0.15 + 0.20)/3 = 0.157 = 15.7% 27. Geometric average = ((1.1)(1.2)(1.41))1/3 –1 = 23% 29. Holding period return = (10,000-9,700)/9,700 = 0.0309278 EAR = (1.0309278)4 - 1 = 0.1296 = 13% 31. (1 + nom rate) = (1+real rate)(1+inflation rate) (1.12) = (1+real rate)(1.03) solving for real rate yields 8.74% 32. Expected return on the risky portfolio = (0.4)(0.12) + (0.6)(0.02) = 0.06 No point in investing in the risky portfolio since you can get the same rate of return from the risk free asset (there is no risk premium) 33. Calculate the slope of the CAL between the risk free asset and each of the risky securities. Slope of the CAL = (Expected return on risky asset – risk free rate)/std dev of risky asset For A: (0.15-0.05)/sqr root of 0.0400 = 0.5 For B: = 0.33 For C: = 0.22 For D: = 0.32 Security A is best since it allows for a CAL with the highest slope. 34. Expected return on portfolio = (0.4)(0.15) + (0.6)(0.06) = 0.096 Standard deviation = (0.4)(sqr root of 0.04) = 0.08 10 35. Expected return on risky portfolio = (0.6)(0.15)+(0.4)(0.05) = 0.11 The risk premium = 0.11 – risk free rate = 0.11-0.06 = 0.05 36. Expected return on portfolio = x(0.12) + (1-x)(0.05) We want the expected return to equal 0.09 so 0.09 = x(0.12) + (1-x)(0.05) solving for x yields 57% 37. using the equation for variance of returns on a portfolio: 0.0050 = (0.2)2(0.25)2 + (0.8)2(0.05)2 + 2(0.2)(0.8)(0.25)(0.05)(corr) solving for correlation yields 0.225 38. correlation coeff = covariance/(std dev of A x std dev of B) = 0.003/(0.1*0.05) = 0.6 39. using the equation for solving the weight of asset B in the minimum variance portfolio = (0.2)2 - (0.2)(0.15)(0) (0.15)2 + (0.2)2 - 2(0.2)(0.15)(0) = 0.64 = 64% 40. using the equation for variance of returns on a portfolio = (0.4)2(0.05)2 + (0.6)2(0.15)2 + 2(0.4)(0.6)(0.05)(0.15)(0.5) = 0.0004 + 0.0081 + (0.0018) = 0.0103 11