CHAPETR 12: INVESTMENTS

Learning Objectives

1. Demonstrate how to identify and account for investments classified

for reporting purposes as held-to-maturity.

2. Demonstrate how to identify and account for investments classified

for reporting purposes as trading securities.

3. Demonstrate how to identify and account for investments classified

for reporting purposes as available-for-sale securities.

8. Discuss the primary differences between U.S. GAAP and IFRS with

respect to investments.

NOT COVERED

4. Explain what constitutes significant influence by the investor over the

operating and financial policies of the investee.

5. Demonstrate how to account for investments accounted for under the

equity method.

6. Explain the adjustments made in the equity method when the fair value

of the net assets underlying the investment exceeds their book value.

7. Explain how electing the fair value option affects accounting for

investments.

12-1

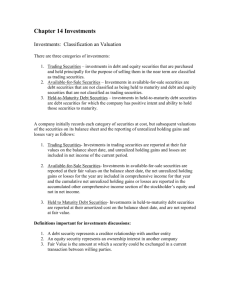

Nature of Investments

Bonds and

notes

(Debt

securities)

Common and

preferred stock

(Equity

securities)

Investments can be accounted for in a

variety of ways, depending on the nature

of the investment relationship.

12-2

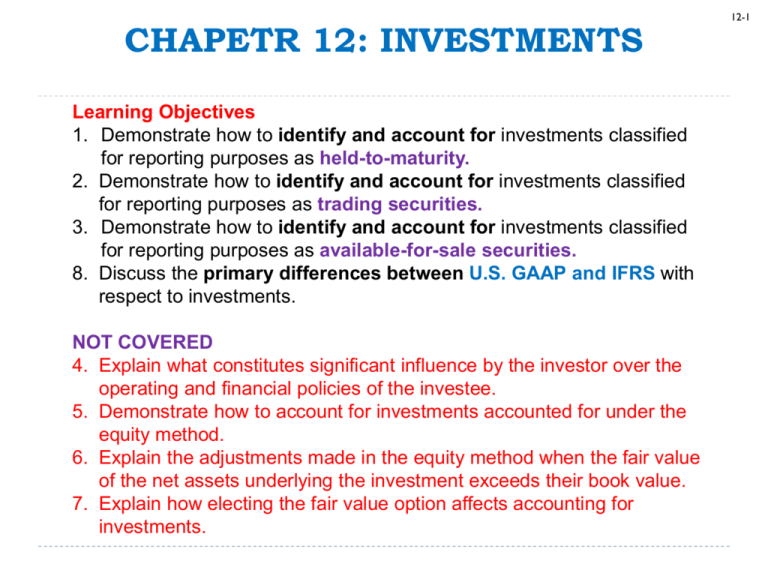

Reporting Categories for Investments

12-3

Reporting Categories for Investments

Control Characteristics of the Investment

Reporting Method Used by the Investor

e investor lacks significant influence over the

erating and financial policies of the investee:

nvestment in debt securities for which the investor

Held-to-maturity (HTM) - investment reported at

amortized cost.*

has the "positive intent and ability" to hold to

maturity.

nvestment held in an active trading account.

Other: Not HTM nor TS

e investor has significant influence over the operating

d financial policies of the investee:

Typically the investor owns between 20% and 50% of

he voting stock of the investee.

e investor controls the investee:

The investor owns more than 50% of the voting stock of

he investee.

Trading securities (TS) - investment reported at fair valu

with unrealized holding gains and losses included in net

income.

Securities available-for-sale (AFS) - investment reporte

at fair value with unrealized holding gains and losses

excluded from net income and reported in other

comprehensive income.*

Equity method - investment cost adjusted for subseque

earnings and dividends of the investee.*

Consolidation - the financial statements of the investor

and investee are combined as if they are a single compan

Investor Lacks Significant Influence

Treatment of

Unrealized Holding

eporting Approach

Gains and Losses

eld-to-maturity (HTM): used for debt Not recognized

hat is planned to be held for its entire

fe

rading (TS): used for debt or equity

hat is held in an active trading

ccount for immediate resale, or for

which the fair value option had been

lected.

Investment

Reported in the

Balance Sheet at

Amortized Cost

Recognized in net income Fair Value

and therefore in retained

earnings as part of

stockholders' equity

vailable-for-sale (AFS): used for debt Recognized in other

r equity that does not qualify as

comprehensive income,

eld-to-maturity or trading.

and therefore in

accumulated other

comprehensive income

in shareholders' equity

12-4

Fair Value

Securities to Be Held to Maturity

12-5

Securities are investments in bonds or other debt security that have

a specified maturity date. The bonds or other debt are initially

recorded at cost. The investor may have the “positive intent

and ability” to hold the securities to maturity and can

therefore be classified as held-to-maturity (HTM).

They are reported on the balance sheet at “amortized cost.”

Amortized cost (Face amount less unamortized

discount, or plus unamortized premium).

Balance

Sheet

Securities to Be Held to Maturity

12-6

On January 1, 2013, Matrix Inc. purchased as an investment

$1,000,000, of 10%, 10-year bonds, interest paid semiannually. The market rate for similar bonds is 12%. Let’s look

at the calculation of the present value of the bond issue.

Present

Amount

PV Factor

Value

Interest $ 50,000 × 11.46992 = $573,496

Principal 1,000,000 × 0.31180 = 311,805

Present value of bonds

$885,301

PV of ordinary annuity of $1, n = 20, i = 6%

PV of $1, n = 20, i = 6%

12-7

Securities to Be Held to Maturity

Partial Bond Amortization Table

Date

1/1/13

6/30/13

12/31/13

6/30/14

12/31/14

Interest

Payment

$

50,000

50,000

50,000

50,000

Interest

Revenue

$

53,118

53,305

53,503

53,714

Discount

Amortization

$

January 1, 2013

Investment in bonds

Discount on bond investment

Cash

June 30, 2013

Cash (stated rate × face amount)

Discount on bond investment

Investment revenue

3,118

3,305

3,503

3,714

Unamortized

Discount

$ 114,699

111,581

108,276

104,772

101,059

Carrying

Value

$ 885,301

888,419

891,724

895,228

898,941

1,000,000

114,699

885,301

50,000

3,118

53,118

12-8

Securities to Be Held to Maturity

This investment would appear on the

June 30, 2013, balance sheet as follows:

June 30, 2013

Investment in bonds

Less: Discount on bond investment

Book value (amortized cost)

$ 1,000,000

111,581

$ 888,419

$114,699 - $3,118 = $111,581 unamortized discount

Unrealized holding gains and losses are not

recognized for HTM investments.

12-9

Securities to Be Held to Maturity

On December 31, 2013, after interest is received by Matrix, all the bonds

are sold for $900,000 cash.

Date

1/1/13

6/30/13

12/31/13

6/30/14

12/31/14

Interest

Payment

$

50,000

50,000

50,000

50,000

Interest

Revenue

$

53,118

53,305

53,503

53,714

December 31, 2013

Cash

Discount on bond investment

Investment revenue

Discount

Amortization

$

3,118

3,305

3,503

3,714

Unamortized

Discount

$ 114,699

111,581

108,276

104,772

101,059

50,000

3,305

December 31, 2013

Cash

900,000

Discount on bond investment

108,276

Investment in bonds

Gain on sale of investment

53,305

1,000,000

8,276

Carrying

Value

$ 885,301

888,419

891,724

895,228

898,941

Trading Securities

Investments in debt or equity securities acquired principally

for the purpose of selling them in the near term.

Adjustments to fair value are recorded

1. in a valuation account called fair value adjustment, or as a

direct adjustment to the investment account.

2. as a net unrealized holding gain/loss on the income

statement.

Unrealized Gain

Unrealized Loss

Income

Statement

12-10

12-11

Trading Securities

Matrix Inc. purchased securities classified as Trading Securities (TS)

on December 22, 2013. The fair value amounts for these

securities on December 31, 2013, are shown below. Prepare the

journal entries for Matrix Inc. to show the purchase of the

securities, and adjust the securities to fair value at 12/31/13.

Type

TS

TS

Name

Mining Inc

Toys and Things

Totals

No. of

Shares

1,000

1,500

12/22/13

12/31/13 Unrealized

Unit

Total

Fair

Gain or

Cost

Cost

Value

(Loss)

$ 42.00 $ 42,000 $ 41,000 $ (1,000)

15.00

22,500

20,000

(2,500)

$ 64,500

$ 61,000

$

(3,500)

12-12

Trading Securities

December 22, 2013

Investment in Mining Inc. stock

Investment in Toys and Things stock

Cash

Security

Cost

42,000

22,500

64,500

Fair Value

Adjustment

Mining Inc

$ 42,000

$ 41,000

Toys and Things

22,500

20,000

Total

$ 64,500

$ 61,000

Existing balance in fair value adjustment

Change needed in fair value adjustment

$ (1,000)

(2,500)

$ (3,500)

-0$ (3,500)

Reported on the balance sheet as

a adjunct account to the investment.

December 31, 2013

Net unrealized holding gains and losses – I/S

Fair value adjustment

The Net Unrealized Holding Loss is

reported on the Income Statement.

3,500

3,500

12-13

Trading Securities

On January 3, 2014, Matrix sold all trading securities for

$65,000 cash. Let’s record the entry for the sale and the

adjustment to the fair value adjustment account.

January 3, 2014

Cash

Investment in Mining, Inc. stock – T/S

Investment in Toys and Things stock – T/S

Gain on sale of investment

December 31, 2014

Fair value adjustment

Net unrealized holding gains or losses – I/S

65,000

42,000

22,500

500

3,500

3,500

12-14

Financial Statement Presentation

Trading securities are presented on the financial statement as

follows:

1. Income Statement and Statement of Comprehensive Income:

Fair value changes are included in the income statement in the periods

in which they occur, regardless of whether they are realized or unrealized.

Investments in trading securities do not affect other comprehensive

income.

2. Balance Sheet: Securities are reported at fair value, typically as

current assets, and do not affect accumulated other

comprehensive income in shareholders’ equity.

3. Cash Flow Statement: Cash flows from buying and selling

trading securities typically are classified as operating activities,

because the investors that hold trading securities consider them as part of

their normal operations.

Financial Statement Presentation

12-15

Presented below are the partial financial statements showing

the accounting for TS owned by Matrix:

Income Statement

Revenue

Expenses

Other income (expenses):

Gain on sale of investment

Realized and unrealized gains and losses on investments

Total expenses

Net income

Balance Sheet

Assets:

Trading securities

Statement of Cash Flows (direct method)

Operating Activities:

Cash from investment revenue

Purchase of trading securities

Sale of trading securities

2013

2014

t

t

t

t

t

(3,500)

t

t

500

3,500

t

t

61,000

-0(64,500)

-0-

-0-

-0-065,000

12-16

Securities Available-for-Sale

Investments in debt or equity securities that are not for active trading and

not to be held to maturity are classified as available-for-sale (AFS).

Adjustments to fair value are recorded

1. in a valuation account called fair value adjustment, or as a direct

adjustment to the investment account.

2. as a net unrealized holding gain/loss in other comprehensive

income (OCI), which accumulates in accumulated other

comprehensive income (ACOI).

Unrealized Gain

Unrealized Loss

Other Comprehensive

Income (OCI)

12-17

Other Comprehensive Income (OCI)

Other comprehensive income:

Foreign currency translation gains (losses)

Net unrealized holding gains (losses) on investments

Minimum pension liability adjustment

Deferred gains (losses) from derivatives

Less: aggregate income tax expense (benefit)

Other comprehensive income

$ XX,XXX

-12,500

XXX

XXX

$ XX,XXX

X,XXX

$ XX,XXX

When we add other comprehensive income to net

income we refer to the result as “comprehensive income.”

Accumulated Other Comprehensive

Income

Unrealized holding gains and losses on availablefor-sale securities are accumulated in the

shareholders’ equity section of the balance sheet.

Specifically, the account is included in accumulated

other comprehensive income (AOCI).

Net unrealized

holding gains

and losses.

Shareholders’ Equity

Common stock

Paid-in capital in excess of par

Accumulated other comprehensive income

Retained earnings

Total shareholders’ equity

12-18

12-19

Securities Available for Sale Example

Assume the same information for our T/S example for

Matrix Inc., except that the investments are classified as

available-for-sale securities rather than trading

securities.

Security

Cost

Fair Value

Adjustment

Mining Inc

$ 42,000

$ 41,000

Toys and Things

22,500

20,000

Total

$ 64,500

$ 61,000

Existing balance in fair value adjustment

Change needed

$ (1,000)

(2,500)

$ (3,500)

-0$ (3,500)

December 31, 2013

Net unrealized holding gains and losses – OCI

Fair value adjustment

3,500

3,500

12-20

Financial Statement Presentation

AFS securities are presented on the financial statement as

follows:

1. Income Statement and Statement of Comprehensive

Income: Realized gains and losses are shown in net income in

the period in which securities are sold. Unrealized gains and

losses are shown in OCI in the periods in which changes in fair

value occur, and reclassified out of OCI in the periods in which

securities are sold.

2. Balance Sheet: Investments in AFS securities are reported at

fair value. Unrealized gains and losses affect AOCI in

shareholders’ equity, and are reclassified out of AOCI in the

periods in which securities are sold.

3. Cash Flow Statement: Cash flows from buying and selling AFS

securities typically are classified as investing activities.

12-21

U. S. GAAP vs. IFRS

Until recently, IFRS did not allow transfers out of their “Fair

Value through Profit and Loss” (FVTPL) classification.

U.S. GAAP also allows transfers

out of the trading security

category.

Reclassifications under U.S. GAAP

are rare.

IAS No. 39 now allows transfer of

debt investments out of the fair

value category into AFS or HTM in

“rare circumstances.”

The current financial crisis

qualified as one of those

circumstances.

12-22

U. S. GAAP vs. IFRS

IFRS No. 9 eliminates the HTM and AFS classifications, replaced by new

classifications that are more restrictive. This has the general effect of pushing more

investments into being accounted for at “Fair Value Through Profit & Loss”

(FVTPL), and thus having unrealized gains and losses included in net income.

U.S. GAAP permits classification as

HTM, AFS, and TS.

No significant tests are required

to classify a debt investment.

There is no comparable FVTPL or

FVTOCI classification.

Investments in debt securities are

classified as either “Amortized Cost” or

FVTPL.

To be classified as a debt investment,

two important tests must be met. The

current financial crisis qualified as one

of those circumstances.

Investments in equity securities are

classified as either “FVTPL” or

“FVTOCI” (“Fair Value through Other

Comprehensive Income).

12-23

Transfers Between Reporting Categories

Any unrealized holding gain or loss at reclassification should be accounted for in a

manner consistent with the classification into which the security is being

transferred. Securities are transferred at fair market value on the date of transfer.

Unrealized Gain or Loss from

Transfer from:

To:

Transfer at Fair Market Value

Either of the other Trading

Include in current net income the total

unrealized gain or loss, as if it all occurred in the

current period.

Trading

Either of the other Include in current net income any unrealized

gain or loss that occurred in the current period

prior to the transfer. (Unrealized gains and

losses that occurred in prior periods already

were included in net income in those periods.)

Held-to-maturity

Available-for-sale No current income effect. Report total unrealized

Available-for-sale Held-to-maturity

gain or loss as a separate component of

shareholders’ equity (in AOCI

No current income effect. Don’t write off any

existing unrealized holding gain or loss in AOCI, but

amortize it to net income over the remaining life

of the security (fair value amount becomes the

security’s amortized cost basis).

12-24

Impairment of Investments

Occasionally, an

investment’s value will

decline for reasons

that are other-thantemporary (OTT).

For HTM and AFS investments, a company recognizes an OTT

impairment loss in earnings. Determining an “other than

temporary” decline for debt securities can be quite complex. For

both equity and debt investments, after an OTT impairment is

recognized, the ordinary treatment of unrealized gains and losses

is resumed.

12-25

U. S. GAAP vs. IFRS

Until recently, IFRS did not allow transfers out of the “fair value

through P&L” (FVTPL) classification (which is roughly

equivalent to the trading securities classification in U.S. GAAP).

U.S. GAAP has no prohibition

against transfers between

categories as long as they can be

reasonably justified.

Under IAS No. 39 transfers of debt

investments out of the FVTPL

category into AFS or HTM in “rare

circumstances.”

The 2008 financial crisis qualifies

as one of those “rare

circumstances.”

Financial Statement Presentation

and Disclosure

Aggregate

Fair Value

Gross realized &

unrealized holding

gains & losses

Maturities of

debt securities

Amortized cost

basis by major

security type

Change in net

unrealized holding

gains and losses

Inputs to fair

value estimates

12-26

12-27

Investor Has Significant Influence

Reporting Categories for Investments

Control Characteristics of the Investment

Reporting Method Used by the Investor

The investor lacks significant influence over the

operating and financial policies of the investee:

Investment in debt securities for which the investor Held-to-maturity (HTM) - investment reported at

has the "positive intent and ability" to hold to

amortized cost.*

maturity.

Investment held in an active trading account.

Trading securities (TS) - investment reported at fair

value with unrealized holding gains and losses included

in net income.

Other.

Securities available-for-sale (AFS) - investment

reported at fair value with unrealized holding gains and

losses excluded from net income and reported in Other

Comprehensive income.*

The investor has significant influence over the

operating and financial policies of the investee:

Typically the investor owns between 20% and 50% Equity method - investment cost adjusted for

of the voting stock of the investee.

subsequent earnings and dividends of the investee.*

The investor controls the investee:

The investor owns more than 50% of the voting

Consolidation - the financial statements of the investor

stock of the investee.

and investee are combined as if they are a single

company.

* If the investor elects the fair value option, this type of investment also can be accounted for using the same approach that's used for

trading securities, with the investment reported at fair value and unrealized holding gains and losses included in earnings.

12-28

Investor Has Significant Influence

Extent of Investor Influence

Lack of significant influence

(usually < 20% equity ownership)

Significant influence

(usually 20% - 50% equity ownership)

Has control

(usually > 50% equity ownership)

Reporting Method

Varies depending on classification

previously discussed

Equity method

Consolidation

12-29

What Is Significant Influence?

If an investor owns 20% of the voting stock of an investee, it is

presumed that the investor has significant influence over the financial

and operating policies of the investee. The presumption can be

overcome if

1. the investee challenges the investor’s ability to exercise significant

influence through litigation or other methods.

2. the investor surrenders significant shareholder rights in a signed

agreement.

3. the investor is unable to acquire sufficient information about the

investee to apply the equity method.

4. the investor tries and fails to obtain representation on the board of

directors of the investee.

12-30

A Single Entity Concept

Under the equity method . . .

1. The investor recognizes investment income equal to its

percentage share (based on stock ownership) of the net

income earned by the investee rather than the portion of

that net income received as cash dividends.

2. Initially, the investment is recorded at cost. The carrying

amount of this investment subsequently is:

a) Increased by the investor’s percentage share of the

investee’s net income (or decreased by its share of a

loss).

b) Decreased by dividends paid.

12-31

Equity Method

On January 1, 2013, Wilmer Inc. acquired 45%

of the equity securities of Apex Inc. for

$1,350,000. On the acquisition date, Apex’s

net assets had a fair value of $3,000,000.

During 2013, Apex paid cash dividends of

$150,000 and reported net income of

$1,750,000.

What amount will Wilmer Inc. report on the balance

sheet as Investment in Apex Inc. on December 31,

2013?

12-32

Equity Method

January 1, 2013

Investment in Apex Inc. stock

Cash

1,350,000

1,350,000

$ 3,000,000 Fair value of net assets

×

45% Percentage ownership

$ 1,350,000 Fair value of assets purchased

2013

Investment in Apex Inc. stock

Investment revenue

$

×

$

787,500

787,500

1,750,000 Reported earnings

45% Percentage ownership

787,500 Share of earnings

2013

Cash

67,500

Investment in Apex Inc. stock

$

×

$

150,000 Dividends paid

45% Percentage ownership

67,500 Share of dividends

67,500

12-33

Equity Method

Investment in Apex Inc.

Investment

1,350,000

45% Earnings

787,500

67,500 45% Dividends

Reported amount 2,070,000

If the investee had a loss,

the investment account

would have been

reduced with a credit.

12-34

Equity Method

On January 1, 2013, Wilmer Inc. purchased 25% of the

common stock of Apex Inc. for $180,000. At the date of

acquisition, the book value of the net assets of Apex was

$400,000, and the fair value of these assets is $600,000.

During 2013, Apex paid cash dividends of $40,000, and

reported earnings of $100,000.

Fair value of assets

Percentage ownership

Share of fair value of assets

Cost of investment in Apex

Excess of cost over fair value

$ 600,000

25%

150,000

180,000

$ 30,000

12-35

Equity Method

The excess of the fair value of net assets over book value of

those net assets is 75% attributable to depreciable assets

with a remaining life of 20 years and is 25% attributable to

land. Wilmer uses the straight-line depreciation.

Fair value of net assets

$ 600,000

Book value of net assets

400,000

Difference

200,000

Percentage of net assets acquired

×

25%

Excess

50,000

Amount attributable to land (25% or excess)

12,500

Amount attributable to depreciable assets

37,500

Remaining life of depreciable assets

20 years

Additional depreciation expense per year

$ 1,875

12-36

Equity Method

January 1, 2013

Investment in Apex stock

Cash

2013

Cash

180,000

180,000

10,000

Investment in Apex stock

Investment in Apex stock

Investment revenue

December 31, 2013

Investment revenue

Investment in Apex stock

$ 40,000 Dividends paid

×

25% Percentage ownership

$ 10,000 Share of dividends

10,000

25,000

25,000

1,875

1,875

$ 100,000 Reported earnings

×

25% Percentage ownership

$ 25,000 Share of earnings

Changing From the Equity Method to

Another Method

When the investor’s level of influence changes, it

may be necessary to change from the equity

method to another method.

At the transfer date,

the carrying value of

the investment under

the equity method is

regarded as cost.

12-37

Changing from Another Method to the

Equity Method

When the investor’s ownership level increases to the point

where they can exert significant influence, the investor

should change to the equity method.

At the transfer date, the recorded value is the initial cost

of the investment adjusted for the investor’s equity in

the undistributed earnings of the investee since the

original investment.

Reported earnings

– Dividends paid

= Undistributed Earnings

12-38

Changing from Another Method to the

Equity Method

12-39

The original cost, the unrealized holding gain or

loss, and the valuation account are closed.

A retroactive change is recorded to recognize the

investor’s share of the investee’s earnings since

the original investment.

12-40

Fair Value Option

GAAP allows companies to use a “fair value option” for HTM, AFS,

and equity method investments.

The investment is carried at fair value.

Unrealized gains and losses are included in income.

For HTM and AFS investments, this amounts to classifying the

investments as trading.

For equity method investments, the investment is still classified on

the balance sheet with equity method investments, but the portion at

fair value must be clearly indicated.

The fair value option is determined for each individual investment,

and is irrevocable.

Financial Instruments and

Investment Derivatives

12-41

Financial Instruments:

Investment Derivatives:

1. Cash.

2. Evidence of an

ownership interest in

an entity.

3. Contracts meeting

certain conditions.

1. Value is derived from

other securities.

2. Derivatives are often

used to “hedge” (offset)

risks created by other

investments or

transactions

12-42

Appendix 12A – Other Investments

It is often convenient for companies to set aside money to

be used for specific purposes. In the short-term, funds may

be set aside for

1. Petty cash funds.

2. Payroll accounts.

In the long-run, funds are often set aside to:

1. Pay long-term debt when it comes due.

2. Acquire treasury stock.

Special purpose funds set aside for the long-term are

classified as investments.

12-43

Appendix 12A – Other Investments

It is a common practice for companies to purchase

life insurance policies on key officers. The

company pays the premium and is the beneficiary

of the policy. If the officer dies, the company

receives the proceeds from the policy. Some types

of policies build a portion of each premium as cash

surrender value. The cash surrender value of such

a policy is classified as an investment on the

balance sheet of the company.

Appendix 12B – Impairment of

Investments

If the fair value of an investment declines to a level below

cost, and that decline is not viewed as temporary, companies

typically have to recognize an other-than-temporary (“OTT”)

impairment loss in earnings.

We use a three-step process to determine whether an OTT

impairment loss must be recognized: (1) determine if the

investment is impaired, (2) determine whether any

impairment is OTT, and (3) determine where to report the

OTT impairment.

12-44

Appendix 12B – Impairment of

Investments

Is the investment impaired?

Is any of the impairment

other-than-temporary (OTT)?

12-45

Equity

Investment

Yes, if the fair value is less

than the investment's cost

Debt

Investment

Same (yes, if the fair value is

less than the investment's

amortized costs)

Yes, if the investor cannot

assert that it has the intent

and ability to hold the

investment until fair value

recovers

Yes, if the investor (a) intends

to sell the investment, (b)

believes it is "more likely than

not" that the investor will be

required to sell the investment

prior to recovering the

amortized cost of the

investment, or ( c ) has

incurred credit losses.

Appendix 12B – Impairment of

Investments

Where is the OTT inpairment

reported?

Equity

Investment

In net income

Debt

Investment

In net income, if the investor

intends to sell the security or

is "more likely than not" to

be required to sell it before

recovery of its amortized

cost.

Otherwise:

lCredit loss portion in net

income. (Credit loss =

amortized cost - PV of

expected cash flows);

l Noncredit loss portion in

OCI (Noncredit loss portion =

total impairment - credit

loss)

12-46

Appendix 12B – Impairment of

Investments

12-47

United Intergroup, Inc., buys and sells both debt and equity securities of other companies

as investments. United’s fiscal year-end is December 31. The following events during 2013

and 2014 pertain to the investment portfolio.

Purchase Investment: July 1, 2013, $1,000,000 of Bendac common stock. Adjust

Investment to Fair Value:

• December 31, 2013: Valued the Bendac stock at $990,000 and determined that the

decline in FV should not be treated as an OTT impairment.

• December 31, 2014 : Valued the Bendac stock at $985,000 and determined that

the decline in FV should be treated as an OTT impairment

The journal entries to record the adjustments of the Bendac stock investment to fair

value are:

December 31, 2013

Net unrealized holding gains and losses – OCI

Fair value adjustment

10,000

10,000

Appendix 12B – Impairment of

Investments

December 31, 2014

Other-than-temporary impairment loss – I/S

Investment in Bendac

12-48

15,000

15,000

Fair value adjustment

10,000

Net unrealized holding gains and losses – OCI 10,000

Appendix 12B – Impairment of

Investments

12-49

United Intergroup, Inc., buys and sells both debt and equity securities of other

companies as investments, and classifies these investments as AFS. United’s fiscal

year-end is December 31. The following events occurred during 2014:

Purchase Investment: July 1, 2014, $1,000,000 of Bendac bonds, maturing on

December 31, 2019.

Adjust Investment to Fair Value: December 31, 2014, valued the Bendac

bonds at $950,000. Of the $50,000, impairment, $30,000 is credit loss and

$20,000 is noncredit loss.

Case 1: United either plans to sell the investment or believes it is more likely

than not that it will have to sell the investment before fair value recovers.

Case 2: United does not intend to sell the investment and does not believe it is

more likely than not that it will have to sell the Bendac investment before fair

value recovers, but estimates that $30,000 of credit losses have occurred.

Let’s look at the necessary journal entries in these two cases.

Appendix 12B – Impairment of

Investments

12-50

Case 1

December 31, 2014

OTT impairment loss – I/S

Discount on bond investment

50,000

50,000

Case 2

December 31, 2014

OTT impairment loss – I/S

Discount on bond investment

OTT impairment loss - OCI

Fair value adjustment – Noncredit loss

30,000

30,000

20,000

20,000

12-51

U. S. GAAP vs. IFRS

Under IAS No. 39, companies recognize OTT impairments if there exists

objective evidence of impairment. Objective evidence must relate to one or

more events occurring after initial recognition of the asset that affect the

future cash flows that are going to be generated by the asset.

U.S. GAAP recognizes in OCI any

non-credit losses on debt

investments.

Calculation of the amount of

impairment differs depending on the

classification of an investment.

Under IFRS, an OTT impairment for a

debt investment is likely to be larger

if it is classified as AFS than if it is

classified as HTM, because it includes

the entire decline in fair value if

classified as AFS but only the credit

loss if classified as HTM.

12-52

Investments:

A Chapter Supplement

Supplement to Chapter 12

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

GAAP vs. Proposed

Accounting Standard Update

Reporting Category Used in

Current GAAP

Proposed ASU

Accounting Approach

Held-to-maturity ("HTM)*

Amortized Cost**

Investment recorded at amortized

cost.

Trading securities ("TS")

Fair Value through Net

Income ("FV-NI")

Investment reported at fair value.

Unrealized holding gains and losses

included in net income.

Securities available-for-sale

("AFS")

Fair Value through Other

Comprehensive Income

("FV-OCI")**

Investment reported at fair value.

Unrealized holding gains and losses

excluded from net income and

reported in OCI. Gains and losses

reclassified from OCI and reported

in net income whenrealized through

the sale of the investment.

Equity method*

Equity method**

Investment reported at cost

adjusted for subsequent earnings

and dividends of the investee.

Consolidation

Consolidation

The financial statements of the

investor and investee are combined

as if they are a single company.

12-53

12-54

Accounting for Equity Investments

Determining how to account for equity investments in stock under the

proposed ASU is easy. If the investor does not have “significant influence”

over the investee, the equity investment is accounted for as FV-NI. If the

investor has significant influence over the investee, but lacks control, the

equity method is used. If the investor has control, the investment is

consolidated.

Under current GAAP, the

investor accounts for the

equity investment as a

trading or as an AFS

security.

Under the ASU an equity

investment always is treated as

FV-NI (equivalent to being

accounted for as a trading

security).

12-55

Accounting for Debt Investments

Determining how to account for debt investments under the proposed ASU

is more complicated than accounting for equity investments. Under the

proposed ASU we base classification of debt investments on two criteria:

1. The characteristics of the debt instrument.

2. The business activity in which the instrument is used.

We discuss each of the criteria in turn.

Characteristics of a Simple Debt Instrument

1. An amount is transferred to the borrower (debtor) when the debt instrument is

issued that will be returned to the lender (creditor) when the debt matures or is

settled. The amount is the principal or face amount of the debt adjusted for any

discount or premium.

2. The debt cannot be prepaid or settled in such a way that the lender does not

recover substantially all of its original investment, unless the lender chooses to

allow it.

3. The debt instrument is not a derivative.

12-56

Accounting for Debt Investments

Characteristics of a Complex Debt Instrument

Debt that lacks one or more of the characteristics of

simple debt is considered complex. Under the

proposed ASU, debt that is complex always is

classified as fair value in net income.

12-57

Business Purpose of a Debt Instrument

For simple debt, we next must consider the business activity

that motivates the investor to hold the debt. The proposed ASU

identifies three primary business activities as

1. lending,

2. long-term investing, or

3. held for sale.

The debt holder’s purpose is lending or

customer financing with a focus on

collecting cash flows (interest and

principal). The debt holder must have the

ability to renegotiate, sell, or settle the

debt to minimize losses due to a borrower's

deteriorating credit. The appropriate

accounting approach is amortized cost.

12-58

Business Purpose of a Debt Instrument

For simple debt, we next must consider the business activity

that motivates the investor to hold the debt. The ASU identifies

three primary business activities as

1. lending,

2. long-term investing, or

3. held for sale.

The debt holder may choose to hold on to

the debt investment or sell it as a way of

either (a) maximizing its return on

investment or (b) managing risk. The

appropriate accounting approach is Fair

Value – Other Comprehensive Income (FVOCI)

12-59

Business Purpose of a Debt Instrument

For simple debt, we next must consider the business activity

that motivates the investor to hold the debt. The ASU identifies

three primary business activities as

1. lending,

2. long-term investing, or

3. held for sale.

For the business purpose to be classified as

held for sale, the debt instrument is either

(a) held for the purpose of being sold or (b)

actively managed internally on a fair value

basis. The appropriate accounting approach

is Fair Value – Net Income.

12-60

Summary of Classification Criteria

Classification Criteria

Debt investment

Characteristics: Simple Debt

Business Purpose:

1. Lending or Customer Financing

2. Investment Returns or Risk Management

3. Trading Gains from Sale

Characteristics: Complex Debt

Equity investment

Accounting Approach

Amortized Cost

FV-OCI

FV-NI

FV-NI

FV-NI

The proposed ASU does not allow transfers of debt from one

category to another. After the debt is initially classified,

reclassifications are not permitted.

Impairments When the Investor Does

Not Exercise Significant Influence

Because equity investments are reported at FV-NI, no impairment

guidance is necessary. The same is true for debt investments

recorded at FV-NI. Declines in fair value always are reported in

net income. However, for debt investments reported at amortized

cost or at FV-OCI, impairment losses are possible. Let’s look at the

“three-bucket” approach currently under consideration.

1

Investments not affected

by observed events.

2

Investments affected by

observed events (but

individual defaults have

not been identified).

3

Individual debt

investments suffering

credit losses.

12-61

12-62

Debt Impairment (continued)

Objective: Use expected value (probability-weighted

average) of losses of principal and interest on a discounted

basis.

Time horizon of estimated losses:

Bucket 1: over near term (say, 1-2 years).

Buckets 2 and 3: over remaining life of investment.

No impairment upon acquisition of distressed debt (interest

based on expected cash flows rather than contractual cash

flows).

12-63

Equity Method

The criteria for applying the equity method are the same in the

ASU as in current GAAP. If a company is holding an investment

for sale that normally would qualify for the equity method, the

investment is accounted for as FV-NI.

If facts indicate an impairment in value of an equity

method investment, the investor recognizes an

amount equal to the difference between the

investment’s carrying value and its fair value. If fair

value increases in the future, the impairment

cannot be reversed.

12-64

End of Chapter 12