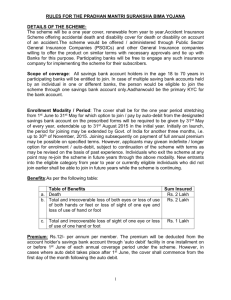

NCU Student Insurance

advertisement

NCU Student Insurance Eligibility : Every student in NCU (including interns) Coverage limits: This insurance covers injury due to accidents, illness, and disablement, but it’s only for the patients who need to hospitalized. (Outpatients are not included.) Payment of insurance fee: Insurants should pay for the insurance premium. Subsidy of NCU is based on the rules of Ministry of Education. The rest of the premium is paid by the insurant twice a year.(paid on the registration day of each semester) The Ministry of Education doesn’t subsidize those who don’t have student insurance, but the insurants listed below should submit related documents to the school to be examined. The name list should be kept by the school, and the insurants would be subsidized with the maximized amount based on the rules of the Ministry of Education. The left inadequate amount should be paid by the insurants themselves. 1.) Students who have the certificate of low-income issued by the Township Office of registered residence, and those who are the high and low degree of Psycho-physical disabled people’s children don’t have to pay for the tuition and fees. State financed students are not included. 2.) Aboriginal students Effective date of insurance: 1. ) The effective period of insurance is from August 1st to July 31st of next year. For those who don’t have student insurance, if they pay for the insurance premium after August 1st in the first semester and February 1st in the second semester, insurance is effective since August 1st and February 1st. If students graduate before July 31st, insurance is effective till July 31st. For those who graduate after July 31st, insurance is effective till the day they graduate. For those who graduate in the first semester, insurance is effective till January 31st. 2. ) For those who enroll the school after the insurance contract is effective, insurance is effective on their enrollment date and they should pay for the insurance premium based on the proportion of the rest of school days. 3. ) Insurance isn’t effective upon the day students lose their enrollment in school. Insurance company should refund the insurance premium based on the proportion of the days left. 4. ) If the students who still keep their enrollment in school suspend their schooling, they still need to continue to pay for the insurance premium. The one who is in charge of student insurance needs to give the insurance company the student’s name and school number for reference. If students lose their student status in school, the one who is in charge of insurance should inform the insurance company.