Weekly Advisor Analysis September 3, 2013 August Worst Month of

advertisement

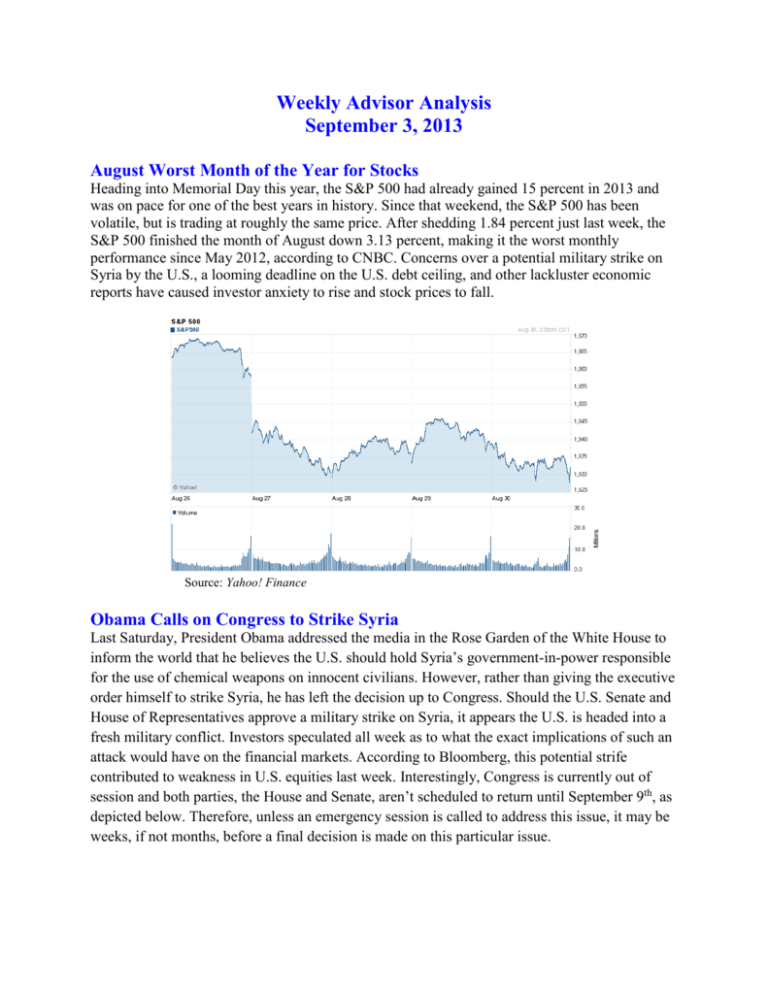

Weekly Advisor Analysis September 3, 2013 August Worst Month of the Year for Stocks Heading into Memorial Day this year, the S&P 500 had already gained 15 percent in 2013 and was on pace for one of the best years in history. Since that weekend, the S&P 500 has been volatile, but is trading at roughly the same price. After shedding 1.84 percent just last week, the S&P 500 finished the month of August down 3.13 percent, making it the worst monthly performance since May 2012, according to CNBC. Concerns over a potential military strike on Syria by the U.S., a looming deadline on the U.S. debt ceiling, and other lackluster economic reports have caused investor anxiety to rise and stock prices to fall. Source: Yahoo! Finance Obama Calls on Congress to Strike Syria Last Saturday, President Obama addressed the media in the Rose Garden of the White House to inform the world that he believes the U.S. should hold Syria’s government-in-power responsible for the use of chemical weapons on innocent civilians. However, rather than giving the executive order himself to strike Syria, he has left the decision up to Congress. Should the U.S. Senate and House of Representatives approve a military strike on Syria, it appears the U.S. is headed into a fresh military conflict. Investors speculated all week as to what the exact implications of such an attack would have on the financial markets. According to Bloomberg, this potential strife contributed to weakness in U.S. equities last week. Interestingly, Congress is currently out of session and both parties, the House and Senate, aren’t scheduled to return until September 9th, as depicted below. Therefore, unless an emergency session is called to address this issue, it may be weeks, if not months, before a final decision is made on this particular issue. Debt Ceiling Deadline Approaching According to an estimate from the U.S. Treasury Department, the U.S. government will no longer be able to borrow additional funds by the middle of October due to current federal limits on spending. Given the new Syria distraction, this leaves very little time for lawmakers to come to an agreement on this issue before the deadline. Earlier this year, investors had hoped that Congress would address this issue with more permanent legislation via wide-ranging tax and spending reforms rather than simply kicking the can down the road with another temporary fix. These hopes have most likely disappeared completely, now that Congress faces a fast approaching deadline with not much progress made to date. Unless the $16.7 trillion ceiling is raised, the government won’t be able to pay all of its bills, according to the Treasury Department. Treasury Secretary Jacob Lew told Congress last week that after mid-October, the government would have only $50 billion in cash available from partaking in emergency measures that would likely be spent by the beginning of November. Failure by Congress to extend the nation’s borrowing limit would result in, “irreparable harm to the American economy,” as quoted by Jacob Lew in a now public letter to House Speaker John Boehner. Source: Zero Hedge Stock Valuations Increase Fastest Since Dot-Com Bubble Bloomberg released an article last week highlighting the fact that price gains in the S&P 500 are outpacing corporate profit growth at the fastest pace in fourteen years. According to the article, the S&P 500 index has increased by 14 percent relative to corporate profits over this last year, and now trades with a price-to-earnings multiple of 16 times earnings. The last time valuations increased this quickly was the final year of the 1990s technology bubble, before the index began to decline, eventually losing 49 percent from the market highs. However, it’s also important to note that even though the pace has been similar to 1999, the S&P 500 is still trading with a priceto-earnings ratio of 16 times, much less than the 31 times multiple witnessed in 2000. Also, the Bloomberg study points out that the average price-to-earnings multiple since 1957, during times when the S&P 500 has been advancing, is 17.4, or about 10 percent higher than today’s multiple. The S&P 500 traded at 17.5 times earnings in October 2007, when the index hit what was at that time the all-time high price of 1,565.15. Source: The Options Guide Best regards, UDB Financial * Securities offered through LPL Financial, Member FINRA/SIPC. * This newsletter was prepared by Peak Advisor Alliance. Peak Advisor Alliance is not affiliated with the named broker/dealer. * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. * The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. * Gold represents the London afternoon gold price fix as reported by the London Bullion Market Association. * The DJ Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998. * The DJ Equity All REIT TR Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones. * Yahoo! Finance is the source for any reference to the performance of an index between two specific periods. * Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. * Past performance does not guarantee future results. * You cannot invest directly in an index. * The S&P 500 is an unmanaged inden. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. * Consult your financial professional before making any investment decision. *This newsletter was prepared by Peak Advisor Alliance * Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. * Stock investing involves risk including loss of principal. Sources: http://www.cnbc.com/id/100999465 http://www.cnbc.com/id/101000397 http://finance.yahoo.com/q/bc?s=%5EGSPC+Basic+Chart&t=5d http://www.bloomberg.com/news/2013-08-30/u-s-stock-index-futures-are-little-changed-before-data.html http://www.bloomberg.com/news/2013-08-29/dollar-gains-after-gdp-as-japan-futures-rise-oil-slips.html http://www.bloomberg.com/news/2013-08-30/consumer-spending-in-u-s-increased-in-july-for-a-third-month.html http://gai.georgetown.edu/wp-content/uploads/2013/06/2013-Congressional-Calendar.jpg http://online.wsj.com/article/SB10001424127887323407104579037181763668714.html http://www.bloomberg.com/news/2013-08-26/lew-tells-congress-treasury-will-hit-debt-limit-in-mid-october.html http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2013/08-2/debt%20limit%20GS.jpg http://www.bloomberg.com/news/2013-08-25/multiples-expanding-fastest-since-dot-com-bubble-as-rally-ages.html http://www.theoptionsguide.com/price-to-earnings-ratio.aspx http://www.theoptionsguide.com/images/price-to-earnings-formula.gif