on account

Grade 11 Accounting Review

Chapter 1

Types of Business

Service business – does not make or sell a product as its main activity

Merchandising business – buys goods and resells them at a higher price

Manufacturing business – buys raw materials, converts them into a new product and sells that new product

Non-Profit Organization – carries on activities to meet social needs and not for financial profit

Types of Business Ownership

Sole Proprietorship – one owner

Partnership – two or more people share ownership

Corporation – owned by shareholders

Accounting Cycle

Transactions occur, recorded in journal, posted to ledger, trial balance, work sheet, formal financial statements, adjustments and closing entries, post-closing trial balance.

Professional Accounting Organizations

CPA – new designation in Canada merging CGA, CA and CMA

CGA – certified general accountants association

CMA – certified management accountant

CA – Chartered Accountant

CICA

– Canadian Institute of chartered accountants – CICA handbook – GAAPs

Duties of an Accounting Clerk

- ensure transactions are properly recorded

- record accounting entries in journal/ledger

- make payroll calculations

- make banking transactions

Duties of an Accountant

- developing accounting systems

- ensuring all GAAPs are followed

- interpreting data

- preparing reports

- going to management meetings

- supervising work of all accounting employees

Chapter 2 The Balance Sheet

Assets Things owned by an individual or firm, which have value

Debts Liabilities

Equity Difference between assets and liabilities, also called capital, or net worth

Fundamental Accounting Equation

Assets – Liabilities = Owner's Equity

Assets = Liabilities + Owner's Equity

Know the parts of a balance sheet. Be familiar with the different accounts!

Creditor's Claims on Assets – liabilities

Owner's Claim on Assets – Equity

GAAPS

Business Entity Concept – accounting for a business organization must be kept separate form the personal affairs of its owner

Continuing Concern Concept

– business will continue to operate unless it is known that it will not

Chapter 3 Transactions

Source Document

A business paper which serves as the original record of a transaction.

Transaction

A change in financial position. A minimum of 2 accounts ALWAYS change in a transaction! After every transaction, the fundamental accounting equation will still equal.

GAAP – The Objectivity Principle

Accounting will be recorded on the basis of objective evidence.

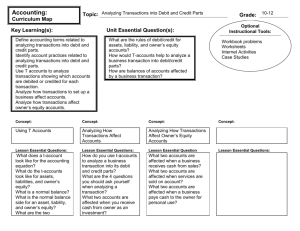

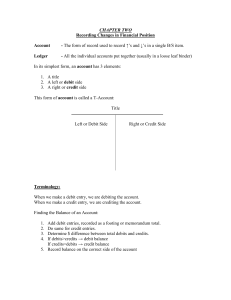

Chapter 4 The Simple Ledger

Account – a page specially designed to record the changes in each individual item affecting financial position

Ledger – group or file of accounts

Assets – have natural debit balances, increase on debit side

Liabilities – have natural credit balances, increase on the credit side

Equity – accounts which increase equity (revenue, owner's equity) have natural credit balances, and increase on the credit side – accounts which decrease equity (drawings, and expenses) have natural debit balances, and increase on the debit side

Know what to debit, and what to credit in various transactions!

1.

2.

3.

4.

Exceptional Balances

Occur when an account carries a balance opposite to its natural balance. (i.e. bank account has a credit balance)

4 Uses of the term "on account"

Purchase on account

Sale on account

Payment on account

Receipt on account debit an asset debit A/R debit A/P debit bank credit A/P credit revenue credit bank credit A/R

Trial Balance

The adding of all ledger balances. Debit balances added in dr column, Credit balances added in cr column.

Ledger is said to be in balance if dr column = cr column.

Called "taking off a trial balance"

Steps to take if trail balance is out of balance

1.

2.

3.

4. re-add columns check that all account balances transferred from ledger, and transferred properly recalculate each account balance in the ledger

Check that each accounting entry (transaction) is balanced

Chapter 5 The Expanded Ledger: Revenue, Expense and Drawings

Expanding of the Ledger

Equity – Revenues

Expenses

Drawings

1.

2.

Know the various parts of the income statement (and know how to date an income statement!)

Users of the Income Statement

Owners and managers

Bankers

– is it earning a profit? How much? What should our future plans be?

– should we lend money? Will they be able to repay a loan?

3. Income tax authorities (government) – How much tax should they pay?

Fiscal Period

Period of time over which earnings are measured. All fiscal periods for an individual business are of the same length. Also called the accounting period. Most companies have a 12 month (year) long fiscal period.

Chart of Accounts

Assets

Liabilities

100-199

200-299

Capital/Drawings

Revenues

Expenses

300-399

400-499

500-599

Chapter 6 The Journal and Source Documents

Journal

A book in which the accounting entries for all transactions are first recorded, in chronological (order that they happened) order. Also called the book of original entry.

Journal Entry

All accounting changes for one transaction in the form in which they are written up in the journal.

Journalizing

Process of recording accounting entries in the journal.

Know how to write the date properly in the journal. (pg. 159)

1.

2.

- debits come before credits

- credits should be indented

Opening Entry

Journal entry that starts the books off, or opens them.

Source Documents – 2 purposes

They serve as proof of a transaction.

Serve as reference for checking work, finding errors, etc.

Cash Sales Slip

- goods/services sold for cash

Dr bank, Cr sales

Sales Invoice

- goods/services sold on credit

Dr A/R, Cr sales

Purchase Invoice

- goods/services purchased on credit

Dr asset account, Cr A/P

Point of Sale Summary

- summary of revenues collected in the form of debit and credit card transactions

- use P.O.S. or point of sale terminal (electronic, computerized cash register)

Dr bank, Cr sales

Cheque Copies

- Document supporting the accounting entry for a payment by cheque

Dr A/P

Cr Bank

Cash Receipts Daily Summary

- lists money coming in from customers

- made by a mail-room clerk who opens the mail, checking for customer cheques

Dr Bank

Cr Accounts Receivable

Bank Advice

- document informing a business about an increase or decrease to their bank account

Bank Credit advice – Dr bank, Cr interest earned (revenue)

Bank Debit advice – Dr interest expense, Cr bank