Daniel Suh - WVU College of Business and Economics

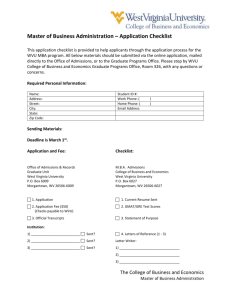

advertisement

Daniel Suh West Virginia University Department of Finance Division of Economics and Finance Morgantown, WV 26506-6025 EMAIL: Daniel.Suh@mail.wvu.edu Home: 3812 Bates Street Pittsburgh, PA 15213 412-607-5757 (Cell) Citizenship: U.S. Education Ph.D., Financial Economics, West Virginia University, May 2009 (expected) o Dissertation: “The Correlations and Volatilities of Stock Returns: The CAPM Beta and the Fama-French Factors” o Advisor: Dr. Ashok Abbott M.B.A., Finance, University of Florida, 1999 M.A., Economics, State University of New York, Stony Brook, 1979 B.A., Economics, Seoul National University, Korea, 1971 Academic Appointments Visiting Assistant Professor, Department of Finance, Division of Economics and Finance, West Virginia University, Spring 2008 Adjunct Faculty, Master of Business Administration, Seton Hill University, Greensburg, PA Summer 2003- Spring 2004 Research & Teaching Interests Research Interests: Asset Pricing, Corporate Finance, Investments, Derivative Securities Teaching interests also include Portfolio Management, Capital Markets, Governance/Ethics Research Papers___________________ “The Correlations and Volatilities of Stock Returns: The CAPM Beta and the FamaFrench Factors” to be presented at the Midwestern Finance Association Conference, March 6, 2009 and also at the Eastern Finance Association Conference, May 2, 2009 “Industry Restructuring, Market Risk, and the Cost of Capital: A case study of the electric power industry” to be presented at the Rutgers University, Annual Conference of the Center for Research in Regulated Industries, May 14, 2009 “Stock Returns, Volatilities, and CAPM Beta: Evidence from the Electric Power Industry,” presented at the Southern Finance Association Conference in November 2007 “The Term Structure of Interest Rates: Has the expectations theory recently become more valid?“ presented at the Southern Finance Association Conference in November 2007 Daniel Suh Page 1 Academic Teaching West Virginia University o Investments (two sessions), Spring 2008 o Financial Statement Analysis, Spring 2008 o Advanced Corporate Finance (a capstone course), Fall 2007 o Investments (Invited substitute lectures) Spring 2007 o Corporate Finance (TA and substitute lectures), Fall 2006 and Spring 2007 o Energy Economics (Invited guest lectures) Fall 2006 Seton Hill University, Greensburg, Pennsylvania o M.B.A. Financial Management, Summer and Fall 2003 and Spring 2004 o M.B.A. Economics, Spring 2004 o Finance, undergraduate, Fall 2003 Robert Morris University, Pittsburgh, Pennsylvania o C.F.A and C.P.A. candidate training in Finance and Economics, Summer 2004 Allegheny County Community College, Pittsburgh, Pennsylvania o Microeconomics, Spring 2003 o Business Statistics, Fall 2003 Frostburg University, Maryland o M.B.A. Financial Management, Summer 2001 Chartered Financial Analyst (CFA) Examinations Have passed the first two levels of examinations References*: Dr. Ashok B. Abbott (Chair) Associate Professor of Finance Division of Economics and Finance College of Business and Economics West Virginia University Morgantown, WV 26506-6025 (304) 293-7886 aabbott@wvu.edu Dr. Victor Chow Professor of Finance Division of Economics and Finance College of Business and Economics West Virginia University Morgantown, WV 26506-6025 (304) 293-7888 kchow@wvu.edu Dr. Strafford Douglas Associate Professor of Economics Division of Economics and Finance College of Business and Economics West Virginia University Morgantown, WV 26506-6025 (304) 293-7863 douglas@wvu.edu Dr. Alexander Kurov Assistant Professor of Finance Division of Economics and Finance College of Business and Economics West Virginia University Morgantown, WV 26506-6025 (304) 293-7892 alkurov@mail.wvu.edu Dr. Alexei Egorov Assistant Professor of Economics Division of Economics and Finance College of Business and Economics West Virginia University Morgantown, WV 26506-6025 (304) 293-7868 alexei.egorov@mail.wvu.edu Daniel Suh Page 2 Abstracts of Research Papers “The Correlations and Volatilities of Stock Returns: The CAPM Beta and the Fama-French Factors” This paper conducts time-series tests on the Capital Asset Pricing Model (CAPM) and the FamaFrench three-factor (FF3) model in the context of market beta estimation for the cost of equity capital. This paper focuses on the data generating process of the three risk factor loadings (the market index, SMB, and HML) with an objective to identify the underlying economic sources of factor loadings. The main focus of this paper is on the stock return correlations, as well as on the relative volatility of stock returns with the market portfolio volatilities. This paper attempts to find answers to the following research questions: (1) how stock returns and volatilities are correlated with the three risk factors and potentially other factors, (2) whether the CAPM beta provides economically consistent and statistically significant estimates for the cost of equity of a firm inter-temporally and cross-sectionally, or whether the CAPM beta provides a quantitatively reasonable and qualitatively useful reference in the estimation of the cost of equity capital of a firm, and (3) how much the Fama-French 3-factor model improves the CAPM beta estimates in terms of economic consistency, statistical explanatory power, and the significance of estimates, or how much the FF3 model adds useful information to the CAPM for the estimation of the cost of equity for a firm. The major findings on the stock return correlations and volatility correlations with risk factors include the following. Stock returns are most consistently and strongly correlated with the market index, and next with the industry. The correlations of stock returns with the market and the industry are much more consistent and stronger than with SMB and HML. By design, FamaFrench portfolio return correlations with the market index returns are inter-temporally and crosssectionally most homogenous and highest among the six stock groups or portfolios. Realized return data often contradict the intuitive, standard theory of trade-off between expected total risk and return, particularly during high market volatilities. In a highly volatile market particularly in a market downturn, the correlations of individual stocks with the market index breakdown. When the market volatility is high, the market returns go to extremes, either very high or deeply negative; when market volatility is low, market returns also are generally low; and when market volatility is intermediate, market returns are widely dispersed. The contradictions between the theory and the realized return data confirm a fundamental problem of empirical test: estimation of expected value. (Merton, 1980) The relative volatilities of individual stocks generally remained more or less steady including the information technology bubble-and-burst period, except for the early 1990s when the relative volatilities were consistently higher (contrary to Campbell et al., 2001). Correlations of an individual stock appear to be an important determinant for intertemporal patterns of stock returns and the market beta estimates. The relative volatilities of individual stocks appear to be a main determinant for total stock returns and the levels of the market beta estimates. These characteristics of stock returns, correlations, and volatilities provide insight into the underlying process of market beta generation. The main findings and conclusions on the test of risk factor loadings include the following: The market index is by far the most consistent and powerful systematic risk factor throughout the sample period, for both large- and micro-cap stocks, in FF3 model specifications, and across industry sectors. The market index beta largely provides economically reasonable estimates for market risk, cross-sectionally (by industry) and inter-temporally. Consistent with a fundamental finance theory of non-zero relations of stock returns with systematic risk, the time-series market beta estimates are mostly positive, except during some portions of a period of high market volatility and deeply negative market returns. Consistent with the theory, most alpha estimates Daniel Suh Page 3 are statistically zero, a core test for the model specification. However, wide ranges of beta and alpha estimates indicate instability of the coefficients, model misspecification, or regime switching of beta. The estimated alpha, although statistically insignificant, often is negatively related with the estimated beta, another indication of model misspecifications. The implied crosssectional relations (the security market line, SML) of test results between the estimated beta and mean returns are generally positive except during high market volatilities, although the relations are weak and often statistically insignificant. However, the SML test is not necessarily a test of the CAPM. (Kandel and Stambaugh, 1995; Roll, 1977, 1978; Roll and Ross, 1994) The above findings all apply to both models. Market volatilities are critical for beta estimates; when the market is highly volatile, beta estimates breakdown as do correlations of stock returns with the market index. SMB and HML stabilize the market beta during periods of high market volatilities. The two factors also enhance the statistical power for micro-cap stocks. However, the SMB and HML add little to the CAPM during a stable market environment or for large-cap stocks in terms of market beta estimates and statistical significance. The CAPM beta predominates as a reference for systematic risk. “Industry Restructuring, Market Risk, and the Cost of Capital: A case study of the electric power industry” This paper conducts a focused test on the firms of the electric power industry, which has been going through a restructuring and deregulation process since the 1990s. The main objective of this chapter is to test for inter-temporal and cross-sectional regime-switching of beta and to identify the economic sources as the market and industry environment changes and a firm’s investment model and financing strategy evolve. This paper examines the industry background, the restructuring process at the market, government policy, and corporate investment and financing strategy levels to gain conditioning information; the information provides a basis for the design of research and sample data and for interpretation of test results. The sample period is divided into subsamples and firms are grouped by investment model and financing strategy. The main findings include the following. The market betas of the electric power industry switch their regimes to reflect the expected and realized changes in system risk. As the electric power industry becomes restructured and deregulated, the beta steadily has become higher over time, except during the period of Internet bubble-burst. Beta estimates during regulation are stable between 0.4-0.5, the lowest among industries. Beta estimates for recent years are near twice as high, or 0.7-0.9. Correlations of the industry with the market have increased while return volatilities of individual firms diverged. Structural breakpoint tests show unique structural breaks of the industry in terms of stock returns and correlation with the market index. Tests identify two major breakpoints for the industry: the middle of 2002 at the depths of the industry crisis and the early 1998 when California became the first state to deregulate the electric power industry and open its market to competition. On the other hand, no such clear breaks in other industry sectors of large- and micro-cap stocks are found. Market beta estimates of merchant power firms are consistently higher than regulated utilities. The merchant power investment model exposes firms to uncertain commodity price spread, and high financial leverage to finance capital-intensive investment increased a systematic risk (or interest rate risk). Daniel Suh Page 4 “The Term Structure of Interest Rates: Has the expectations theory become more valid?” Has the expectations theory of the term structure of interest rates recently become more valid? If so, what kinds of recent economic conditions and monetary policy may have contributed to it? What are the implications to the economic activities and policy? To address the above questions, I focus on a test of the expectations theory for short-term interest rates and briefly discuss the economic conditions and monetary policy factors that may have contributed to the increased validity of the theory. My initial test using Treasury bill data of the latest period finds evidence that the expectations theory has become increasingly valid since the early 1990s. The initial analysis also shows that the economic environment and monetary policy recently have become increasingly supportive of the validity of the theory. This paper concludes with an additional research plan to test a fuller range of term structure and more extensively investigate the contributing economic and policy factors and the implications. Daniel Suh Page 5 Graduate-level Study in Finance and Economics MBA Finance (Finance study at the University of Florida) Financial Statement Analysis Financial Decision Making (Corporate Finance) Measuring and Managing Value (Valuation) Studies in Valuation Investment Concepts Derivative Securities Portfolio Management Investment Banking I & II Venture Finance Secondary Mortgage Markets International Finance Ph.D Courses (at the West Virginia University) Advanced Microeconomics I & II Advanced Macroeconomics I & II Econometrics II, III Portfolio Theory Asset Pricing Seminar in Finance International Finance Microeconomics of Banking Monetary economics Daniel Suh Page 6 Industry Research Experience Economic and Financial Analysis Conducted Financial Due Diligence, Financial Valuation, and Strategic Analysis on the competitors and potential merger/purchase targets. The process included analysis of the cost of capital, discounted cash flows, external financing required, current and long-term assets, inter-corporate investment, business combinations/consolidations, off-balancesheet activities, economic value added, financial performance measurement. Directed an economic forecasting team in the development of econometric forecasting systems, economic analysis, statistical analysis/inference, sample design, regression modeling, and econometric forecasting. Conducted regular market analysis/research and consumer survey analysis to analyze consumer characteristics such as demographics, income, housing, appliance saturations, consumption, etc. Competitive Analysis and Strategic Study Conducted corporate strategic planning. Actively participated in the company’s development of corporate strategies, which required a broad analysis of the economy, the industry, the competition, and the company business, as well as a fundamental understanding of financial accounting principles and business valuation in the context of a specific industry environment and company strategies. Initiated competitive intelligence activities and published regular reports on strategically critical issues at an early stage of electric power industry deregulation. Also initiated a weekly publication of “Industry News” to disseminate strategically critical information to the senior management. Daniel Suh Page 7 Teaching Philosophy and Methods Daniel Suh My primary objective of teaching is to promote life-long application and benefits for my students. I constantly throw out thought-provoking questions for creative thinking and use illustrations familiar and realistic to students. I strive to provide a learning experience that is not only easy-tounderstand and instructive, but also enjoyable and long-lasting in application. An ultimate goal is to help students appreciate the value of theoretical concepts and application. My first academic teaching sparked my long-dormant, youthful desire for academic education and research. When I was teaching an MBA Financial Management course in Maryland in 2001, two MBA students not in my class approached me and said that they would like to take my course the next semester. They said that finance is a difficult subject but they heard from my students that I was teaching the course in an easy-to-understand and practical way. That course was my first teaching ever! I was teaching it while working full time. Alas, the two students never had an opportunity because my company just had transferred me from Maryland to Pittsburgh in the middle of the course and I was making a 370-mile round trip to teach twice a week. I began to prepare myself to become a scholar, exploiting my teaching talent and research orientation. The following two teaching examples demonstrate my teaching philosophy and methods. On the first day of the Investments class last year, I began with a question: “Have you ever made an investment in your life?” One student immediately raised his hand and he talked about his stock investment. After a brief discussion on his investment, I said to the class: “I know EVERYONE in this class has made an investment, at least one investment with NO exception. Can you think of an investment EVERYONE of you has made?” After a moment of silence, two students raised hands. A student who said, “Education.” “EDUCATION! That’s right, EDUCATION!” I responded. The second student said that she also had the same answer. Then I began to discuss why education is an investment. Investment is an action or a payment made today for expected future payoffs. Investment requires a known sacrifice today for unknown future potential or probable benefit. Investment is a temporal decision, where time is an important decision factor, unlike economic theory students have learned. Education has the same characteristics of investment; so every student has been an investor. Education is relatively less uncertain about the future payoffs and so less risky than other investments. The payoffs are lifelong. Therefore, education is among the safest and the most valuable investment. And so on… With a discussion of education as an example of investment, I achieve dual objectives: (1) motivate students to exert themselves with today’s sacrifice including this investments course for future benefit and (2) help students to have a life-long understanding of investment and its application. Next I move on to an illustration to teach a second lesson: financial investment also is a business investment decision. On the first day class of the financial statement analysis, I used a real-life-like illustration to teach two critical concepts: accrual vs. cash accounting and capitalization vs. expensing of expenditures. Suppose you open a small business. You borrow $50K and put in your own money (equity) of $50K. You pay $80K to purchase equipment and materials. Each of the first two months, your sales are $150K with an expense of $10K for rent and wage. Daniel Suh Page 8 Then I asked: What do you report in the first-month income statement? A loss of $75K (=$15K-$10K-$80K)? Or some other numbers? Why? How about in the second month? A positive $5K (=$15K-$10K? How about the cost of materials used up in the first two months, for which you had paid before the opening of business but no payment during the two months of operation? I ask a question at a time and conduct class discussions before moving to the next question. I let students present common-sense logic as well as accounting principles for an answer. To help students understand and remember accounting principles and rules I focus on logic, because accounting principles and rules are based on common-sense logic and reporting purposes. After discussions on those questions, I modified the $80K expense into $60K in cash payment and $20K on credit. An ultimate objective for the first day is to naturally flow into another core concepts of financial accounting and analysis: economic vs. accounting income, accounting income and cash flows. During my MBA, I was determined to become a well-rounded financial economist; I took 50% more courses than the MBA requirements, including six more finance courses than required for finance specialization. Afterwards I became fully engaged in strategic financial decision-making in the industry. I also have prepared myself to become a scholar in finance who is well-balanced in academic teaching and research, in theory and applications to corporate finance, investment and financial accounting. My preparations so far include (1) Ph.D. study and research, (2) teaching experience in MBA and undergraduate economics, advanced corporate finance, financial management, investments, financial accounting analysis, and statistics, and (3) successful CFA examinations in Levels I and II. I believe that three factors have helped me enjoy and become successful in teaching. The first factor is my passion for teaching and strong desire to help others. My teaching evaluations testify to it; I will never compromise it. The second factor is my long experience of teaching and training of others. Before coming to academia, I had taught and delivered speeches for 25 years as an elder and overseer of both Korean- and English-speaking churches. Several times a year, I also delivered speeches before an audience of thousand members at church conventions. The teaching and speeches required not only to capture mental attention but also to move the heart. I always attempt to incite students to heart-felt appreciation as well as mental understanding of economic and finance concepts; a goal is to help students act on what they learn. The third factor is my natural talent in teaching. My teaching and speeches are filled with thought-provoking questions and real-life examples and illustrations familiar to the audience. A goal is to lead students naturally to understanding theoretical concepts and applications. Thank you very much. Daniel Suh Page 9