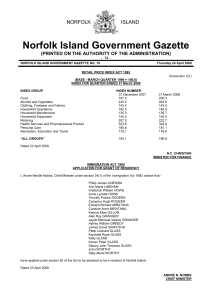

6. Quality of the Norfolk Island Government Financial and Budgetary

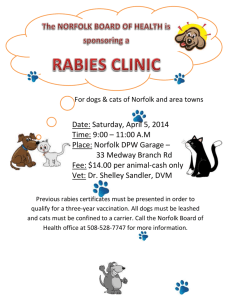

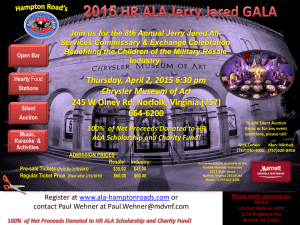

advertisement