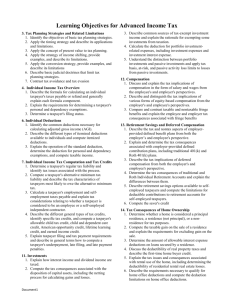

Income Tax Outline

advertisement