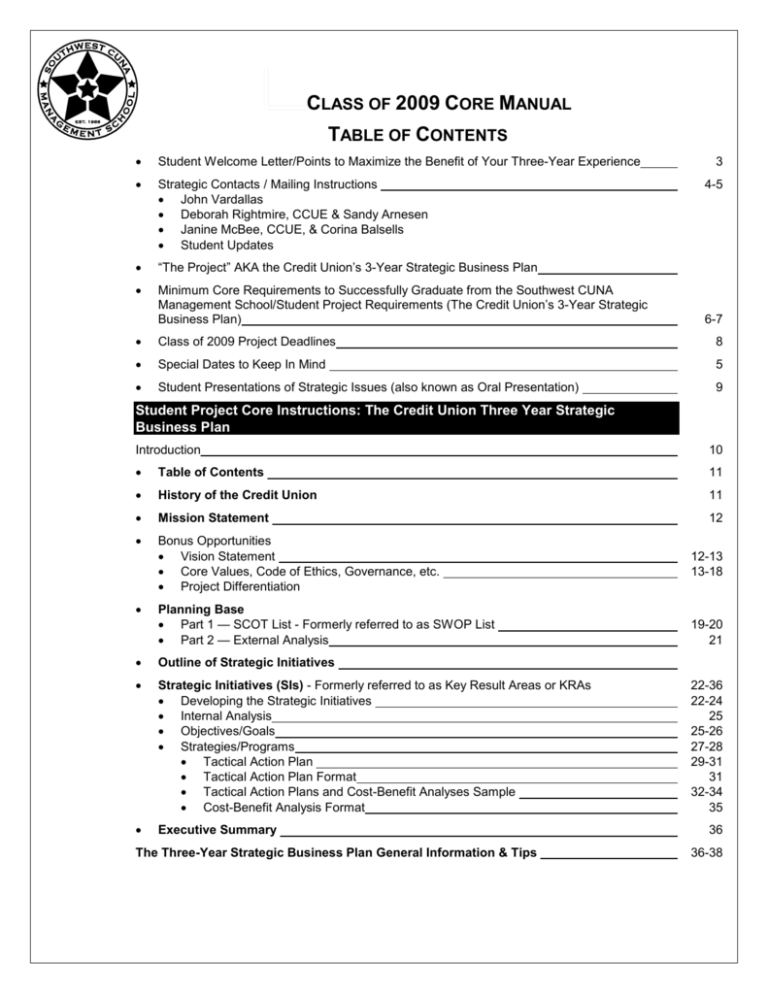

CLASS OF 2009 CORE MANUAL

TABLE OF CONTENTS

Student Welcome Letter/Points to Maximize the Benefit of Your Three-Year Experience

Strategic Contacts / Mailing Instructions

John Vardallas

Deborah Rightmire, CCUE & Sandy Arnesen

Janine McBee, CCUE, & Corina Balsells

Student Updates

“The Project” AKA the Credit Union’s 3-Year Strategic Business Plan

Minimum Core Requirements to Successfully Graduate from the Southwest CUNA

Management School/Student Project Requirements (The Credit Union’s 3-Year Strategic

Business Plan)

3

4-5

6-7

Class of 2009 Project Deadlines

8

Special Dates to Keep In Mind

5

Student Presentations of Strategic Issues (also known as Oral Presentation)

9

Student Project Core Instructions: The Credit Union Three Year Strategic

Business Plan

Introduction

10

Table of Contents

11

History of the Credit Union

11

Mission Statement

12

Bonus Opportunities

Vision Statement

Core Values, Code of Ethics, Governance, etc.

Project Differentiation

Planning Base

Part 1 — SCOT List - Formerly referred to as SWOP List

Part 2 — External Analysis

Outline of Strategic Initiatives

Strategic Initiatives (SIs) - Formerly referred to as Key Result Areas or KRAs

Developing the Strategic Initiatives

Internal Analysis

Objectives/Goals

Strategies/Programs

Tactical Action Plan

Tactical Action Plan Format

Tactical Action Plans and Cost-Benefit Analyses Sample

Cost-Benefit Analysis Format

Executive Summary

The Three-Year Strategic Business Plan General Information & Tips

12-13

13-18

19-20

21

22-36

22-24

25

25-26

27-28

29-31

31

32-34

35

36

36-38

SCMS CLASS OF 2009 CORE MANUAL

APPENDIX (Yellow)

Sample Student Progress and Feedback Form

40

Financial Management SI Evaluation Form

41

Project Samples – Provide solely as a reference for current students.

All samples are to be treated as confidential in nature.

Mission, Vision, History, & SWOP I (Effective with Class of 2009 referred to as SCOT)

42-42.22

Mission, Vision, History, & SWOP II (Effective with Class of 2009 referred to as SCOT)

43-43.7

External Analysis

44-44.7

Key Result Areas (Effective with Class of 2009 referred to as Strategic Initiatives or SIs)

Outline

Strategic Initiative Summary Statements – 2 Different Approaches

(includes a wide sampling of possible objectives, strategies and action plans)

46-46.11

Human Resources

47-47.20

Users of Services

48-48.9

Loan Growth

Executive Summary

45-45.3

49-49.30

50-50.4

Quick List for those who have alumni or have back

copies of student projects…some key terms have

changed effective with the SCMS Class of 2008:

Old Terms

New Terms

Key Result Area (KRA)

Strategic Initiatives (SI's)

Action Plan

Tactical Action Plan

SWOP

SCOT

- Strength

- Strength

- Weakness

- Challenge (formerly known as problems)

- Opportunity

- Opportunity

- Problem

- Threat (formerly known as weaknesses)

The real value of doing a business plan is not having the finished

product in hand; rather, the value lies in the process of research

and thinking about your business in a systematic way. The act of

planning helps you to think things through thoroughly, to study

and research when you are not sure of the facts, and to look at

your ideas critically. It takes time, but avoids costly, perhaps

disasterous mistakes later.

Author Unknown

Revised 06/07

Page 1

SCMS CLASS OF 2009 CORE MANUAL

Welcome to SCMS

(Southwest CUNA Management School)

The SCMS staff, faculty, current students, alumni, and League Oversight Committee are

committed to your success. You will find the school both rewarding and challenging. As with

everything else in life, you get out of the experience what you put into it.

Here is some information to help you get the maximum benefit from your three-year experience.

1)

This manual provides the core instruction for the development of your credit union’s three-year

strategic business plan. Strategic Planning courses rely on this as handout material.

Bring your manual to all future SCMS courses related to the development of your strategic

business plan.

Refer to this manual as you work on each section of your plan. There are many approaches and

terms used for planning. It is important to follow sequence and terms provided in this manual for

school purposes.

Replacement cost — $50.

2)

Deadlines are not negotiable - schedule your time to allow for unexpected demands, obstacles,

challenges, and constraints.

3)

Scholarship Applicants - students applying for scholarship assistance through the Southwest CUNA

Management School Scholarship Fund (administered by the Texas Credit Union Foundatiom – open to

all qualified applicants) must be on schedule with project deadlines to be eligible for scholarship

consideration.

4)

When you get submissions back from John Vardallas or Debbie Rightmire, always review the feedback

grid first to see if you are meeting requirements. If you are, it is up to you if you choose to address

comments. Comments are there for your thought and incorporation as you see fit. We expect students

to stretch. Should there be any question regarding your progess or pass/fail status, your feedback grid

is referred to. Always keep a copy for your records.

5)

Faculty, staff, and mentors are an email or phone call away. Let us know if you need assistance or

would like to discuss any aspect of your project. If you are not sure who to contact, contact Janine

McBee.

6)

Have someone else read and proof your work! We are looking for clear communication that is easy for

the reader to understand. Project reviewers may return submissions marked “redo” if work appears

thrown together and not to have been proofed.

7)

Make the most of the learning experience by steadily applying yourself and becoming acquainted with

your classmates, other students, faculty, staff and alumni.

Make a copy of your Project Completion Guidelines and the Minimum Requirements for your

supervisor, CEO, or chairman (whichever one is appropriate for your next reporting level up).

You are responsible for keeping the appropriate party aprised of your requirements and status in the

school.

If it appears that you are not meeting the school’s requirements, SCMS administration may contact the

individual you report to, checking to see if anything can be done to help.

It’s a good practice to review your feedback grid and project progress with the appropriate person on a

regular basis.

8)

Give at least one copy of your complete plan to your CEO or Board Chair, whichever is appropriate.

We wish you much success in the three years that you are with the school and the many years beyond!

Janine McBee, SCMS Director

Corina Balsells, SCMS Event Coordinator

STRATEGIC CONTACTS

Send ALL Project Work to . . .

John Vardallas/Project Evaluator

c/o The American BoomeR Group

Revised 06/07

Page 2

SCMS CLASS OF 2009 CORE MANUAL

PO Box 8486

Madison, Wisconsin 53708

Please mail your submissions regular, First Class, or Priority U.S. Mail. (Do not send FedEx, DHL, or UPS.)

For the return of your work, send self addressed/stamped return envelope to John in any form of mail or

delivery service you prefer (U.S. Mail, FedEx, DHL or UPS.)

To contact John. . .

(608) 221-4621

Cell - contact Janine or Corina for John's cell phone - It is okay to call his cell phone if you need to

reach him.

JVardallas@aol.com

Additional Resource for Project Questions:

Lily Newfarmer

lnewfarmer@tccu-tx.com

817-884-1470 x125

Mailing Project Submissions

With John’s travel schedule – we ask that all submissions sent to John are handled through US Mail

(regular or priority) and that you do not ask for signed receipt (as opposed to Fed EX, UPS, or other

special delivery services). Plan for deadlines accordingly.

For Debbie and her team, US Mail, Fed EX, or UPS are all good.

Always include sufficient return postage on project submissions for your material to be returned to you.

Do not use dated meter postage.

E-mail

Use judiciously. This medium is for brief Q&A or submissions, not pages and pages of copy.

Do not send project submissions by E-mail without prior approval.

Always keep a copy of your submitted and returned work, as well as the feedback grid.

Send the Financial Management SI along with SI Outline to . . .

Texas Credit Union League - ALM

4455 LBJ Frwy. Ste 1100

Farmers Branch, TX 75244-5998

Main number to contact Deborah “Debbie” Rightmire or one of her team members:

800.442.5762

469.385.6595 FAX

Direct Contact Information:

Deborah Rightmire

469.385.6496-Ext. 6496

drightmire@tcul.coop

Sandy Arnesen

469.385.6497-Ext. 6497

sarnesen@tcul.coopns

Overall SCMS Communications

TCUL TR - SCMS

4455 LBJ Frwy. Ste 1100

Farmers Branch, TX 75244-5998

Revised 06/07

Page 3

SCMS CLASS OF 2009 CORE MANUAL

Janine McBee

800.442.5762 x6634

469.385.6634

469.385.6734 FAX

jmcbee@cunaschool.org

Corina Balsells

800.442.5762 x6642

469.385.6642

469.385.6742 FAX

cbalsells@cunaschool.org

Third Year Students

John calls you to notify you of your final project approval. He does not return your project after the

final submission unless you request it (include return envelope with postage). Your final submitted

work will be returned to you during the summer session of school.

General Student Updates

The majority of communication is handled through the school’s website and email.

SOUTHWEST CUNA MANAGEMENT SCHOOL CORE PROJECT

AKA CREDIT UNION 3-YEAR STRATEGIC BUSINESS PLAN

REQUIREMENTS

Attend three Summer Sessions (8 days each July) and two Mid-Year Sessions (2 days each

February) for a minimum of 162 classroom hours. Any student missing a class will be given a

make-up assignment to complete before continuing with the next phase of the school.

Meet all project section deadline dates (submissions must be in the evaluator’s posession by

these dates and at least meet minimum requirements). Any student missing a deadline will be

given the opportunity to continue with the class after his or hers, and be expected to meet

those class deadlines. Students are expected to pace themselves to allow for the unexpected

and still complete their project work.

Live in on-campus residence during the Summer sessions, unless student lives in a

reasonable commuting distance. Students are expected to attend all school sponsored

courses and activities.

MINIMUM PROJECT REQUIREMENTS - DEVELOPING YOUR

CREDIT UNION’S THREE-YEAR STRATEGIC BUSINESS PLAN

(Refer to the Strategic Planning Sequence, Definition of Terms, and Samples section of this

manual for more detailed explanations and samples.)

Prepare a written three-year strategic business plan

(project) covering the following areas:

1) TABLE OF CONTENTS

This portion of the project is due out of sequence –

this is one of the last parts of the project to be

worked on.

2)

NARRATIVE HISTORY — five to eight pages,

focusing on the most recent five years.

3)

MISSION STATEMENT that defines the basic

purpose of the credit union.

Revised 06/07

Page 4

SCMS CLASS OF 2009 CORE MANUAL

Write a two to three sentence evaluation of the credit

union’s current mission statement:

reflecting why you feel the existing statement

accurately reflects the purpose of the credit

union, or

indicate what changes you would make and why.

Simply writing “I agree/disagree with the mission

statement” is not sufficient.

If you write your own mission statement, also include

wording indicating when statement would be

proposed to board or management, whichever would

be appropriate.

4) Planning base consisting of:

a)

SCOT LIST for the credit union:

1) Five Strengths

2) Five Challenges (formerly referred to as

Weaknesses)

3) Five Opportunities

4) Five Threats (formerly referred to as

Problems)

Explain each element as it relates to the credit

union with a minimum of one sentence.

b) Five EXTERNAL FACTORS that may affect

the credit union’s future. Be sure to examine

national, regional, and local implications as they

relate to the credit union.

For each factor, include:

1)

Factor

2)

Assumption

3)

Impact

4)

Response

5) An OUTLINE OF STRATEGIC INITIATIVES

(SI’s) including objective statements, strategy

statements, and Tactical Action Plan headings.

This is a work in process, initially used to provide

direction and help you get started on the

development of your plan.

Along the way, you may chose to change

direction.

Once your outline has been approved, you do not

need to resubmit it until you turn in your entire project

for final review.

Revised 06/07

Page 5

SCMS CLASS OF 2009 CORE MANUAL

6) Five STRATEGIC INITIATIVES (SIs), one of

which must be financial management. Your

historical, SCOT, and external analyses lay the

foundation for the selection and development of your

SIs.

For each SI, develop:

a) For each STRATEGIC INITIATIVE

1) A brief INTERNAL

ANALYSIS:

summarize the credit union’s past

performance,

compile a five-year history, and

indicate magnitude of change for each

strategy and tactical action plan, along

with expectations for business as usual.

2) At least one three-year OBJECTIVE/

GOAL with:

two STRATEGIES/PROGRAMS

— each with

one TACTICAL

— each with

ACTION PLAN

a COST-BENEFIT ANALYSIS,

including implementation costs.

This is a three-year business plan. With timing,

your first SI might have a majority of action steps

completed before graduation.

However, the greatest percentage of your project

should extend one to two years past graduation.

It’s an “automatic redo” if all action plans end the

year of graduation.

If the only action steps you have going past

current year involve re-evaluating the current

plan – won’t work. Re-evaluation becomes

business as usual.

There are three additional requirements for the FINANCIAL

MANAGEMENT SI. In addition to the previous requirements,

the Financial Management SI must also include:

1) An INTERNAL ANALYSIS highlighting

strengths and challenges and any information

that might impact financial projection outcome

(i.e., new building, expanding staffing, computer

conversions...)

2) A three-year PROJECTION with supporting

balance sheet income/expense projections, and

3) The calculation of a minimum number of key

FINANCIAL RATIOS specifically relating to

the CAMEL rating system.

Revised 06/07

Page 6

SCMS CLASS OF 2009 CORE MANUAL

Send the Financial Management SI portion of the threeyear strategic business plan, along with a copy of your

the project outline of all SIs, to:

Debbie Rightmire (see Strategic Contacts).

Debbie must approve this portion of the project before

John will approve the total project.

John needs to see the total project (including your

approved Financial Management SI with a copy Debbie’s

assessment form) on your final project submission.

You do not need to send a copy of your projections.

7) An EXECUTIVE SUMMARY is a one to two

page document providing a general overview of the

three-year strategic business plan. It should highlight

areas or services that the credit union should either:

Improve or enhance

Eliminate

Bring in-house, outsource, or partner

Explore

Implement

Include everything that you would cover in fiveminutes if you gave an overview of your plan to new

staff, board members, or potential SEGs (select

employee groups). Make it enthusiastic,

professional, complete, and concise.

8)

INDIVIDUAL STUDENT PRESENTATIONS

OF STRATEGIC ISSUES (formerly known as

Oral Presentations)

THE 3-YEAR STRATEGIC BUSINESS PLAN

(PROJECT) DEADLINES

The Initial Submission is not a rough draft. You are presenting a professional document. Be

sure to proof your work before sending and to make sure it follows the school format.

Evaulator time has been allocated based on initial submission deadlines. Missing the initial

submission deadlines may slow down project feedback and turn around time, as well as

reduce accessibility to faculty.

Deadlines are critical in today’s business environment. Pace yourself to allow for corrections

between “initial submission” and “deadline” dates. If a student misses a deadline, he or she

may be given the opportunity to join the next class and continue the next year, complying with

the appropriate class deadlines.

To qualify for scholarship consideration, students must be on track with project dates.

It is important that “project section submissions” are sent in the sequence outlined below.

Always include a return postage envelope with submissions.

Contact Janine McBee, school director, if you are stuck or do not understand format

expectations. You may be referred to a mentor for assistance. Of course, networking with

your classmates is another valueable source.

Revised 06/07

Page 7

SCMS CLASS OF 2009 CORE MANUAL

If you are meeting mimimum requirements, it is your choice whether or not to

addres comments. The comments are there for your thought and

incorporation as you see fit.

Project Sections

(Submit in this Order)

Initial Submission by

DEADLINE

Table of Contents

Section Approved

By DEADLINE

05/08/09

History

Mission Statement (Vision Statement, Code of Ethics, Code of

Conduct, Values Statement are all Optional)

10/19/07

12/14/07

SCOT & External Analyses

Must have above assignments approved to attend 2008 SCMS Mid Year Classes and continue with your class.

Outline of Strategic Initiatives (SIs)

02/29/08

Strategic Initiative 1

03/07/08

05/03/08

Must have above assignments approved to attend 2008 SCMS Summer Classes and continue with your class.

Strategic Initiative 2

Strategic Initiative 3

10/10/08

12/05/08

Strategic Initiative 4

Must have above assignments approved to attend 2009 SCMS Mid Year Classes and continue with your class.

Strategic Initiative 5 or last SI: Financial Management

03/13/09

04/10/09

Executive Summary

Entire Project for Final Review in John’s posession by 05/08/09 - John will call you regarding final

project approval. Unless you provide return postage, all final projects are returned to SCMS administration to

be returned to students on campus.

Must meet complete project approved by 05/23/08 to attend and graduate 2008 Summer Classes.

Send copy of completed project to your Oral Presentation class leader (as indicated when final oral

presentation schedule is sent out) for Receipt by June 12, 2009. After the final project deadlines have been

met, all projects have been reviewed, and school applications with full tuition have been received, further

instruction about who needs a copy of your strategic plan is provided. You may sign up for your presentation

slot during your second Mid-Year class session.

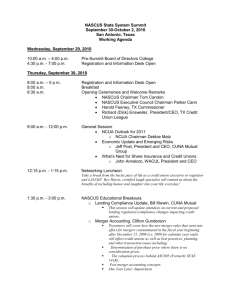

SPECIAL DATES TO KEEP IN MIND

Working calendars are included to help

you plan your time. The calendars

provide an overview of key state events

and student project deadlines as of

06/13/07. Dates were gathered from

CUNA’s and TCUL’s Calendars, as well

as other leagues and associations.

Dates are subject to change.

Important:

Initial Submission Dates – To stay

on track, work to meet these dates

with your project submissions. They

are planned to allow for you to make

necessary enhancements if your

submission does not meet minimum

requirements. Make sure you follow

Revised 06/07

Page 8

SCMS CLASS OF 2009 CORE MANUAL

the school format and submit

professional (not rough draft) work.

Deadline – At each deadline, the

work submitted must be in John’s

(or Debbie’s if referring to the

financial management strategic

initiative) possession by that date. At

this point, work not meeting

minimum requirements will lead to

your progress in the school being

delayed by a year.

We realize life happens. Plan ahead.

Don’t push the initial submission

or deadline dates.

Give yourself room for the unexpected.

STUDENT PRESENTATIONS OF CREDIT UNION STRATEGIC

ISSUES

(Previously referred to at the Oral Presentation)

Presentation Frame

1) Determine your audience – select to approach as if you are addressing:

a) your credit union’s board of directors, or

b) your credit union’s management team.

Your task is to simulate a real business environment and engage your audience.

2) Select one to two key strategic elements from your strategic business plan. Based on your

audience, make a presentation to gain “buy in” as to why the strategic element is important to

your credit union and / or to acquire funding:

a) provide the foundation/background that led to the proposal of this strategic direction

b) discuss proposed programs and strategies

c) provide cost/benefit analysis

d) discuss challenges, issues, trends related to implementation

3) Bring presentation to a conclusion.

Presentation Format

Time: minimum 30 minutes, maximum 40 minutes. (The stated time factors may be adjusted

to allow for class sizes, availability of reviewers and time constraints.)

Attire: Business Professional

Minimum of one audio-visual element.

Audience handouts as appropriate to presentation.

Keep the material interesting! Go through the full presentation several times before the

presentation date!

Revised 06/07

Page 9

SCMS CLASS OF 2009 CORE MANUAL

Think about what questions your identified audience might have and be prepared to answer them.

When you are not presenting, take your roll as an audience member seriously. If you were in your

classmate’s environment:

What might you want to know?

What questions do you have about the issue presented?

Do the recommendations sound important and reasonable for the credit union to implement?

Presentation Room Set-Up

Each presentation group room has a podium, LCD projector, document reader (Elmo), VCR,

and white board. Sorry folks, no remote controls.

If you chose to do a PC-based presentation, bring your presentation on disk or memory stick.

(Lessons learned – have a back up plan!)

Tips & Things To Consider

Make sure you have your thoughts together. Practice before class to be sure you stay within

the time frame.

Dress professionally.

You will never have a group pull harder for you during a presentation than your classmates.

We can all learn by listening to others.

Don’t read the material (your audience tends to have a limited attention span!).

After the project has been approved, you cannot fail because of a poor presentation.

However, an outstanding presentation may have an impact on honor consideration.

In the history of the school — no one has ever fainted or become deathly ill during an oral

presentation. The anticipation is much harder than the actual presentation.

Interested in improving your public speaking skills?

Take a course at a local college.

Join an organization like Toastmasters.

Enroll in a Dale Carnegie (or similar) course.

Check a local library for articles, books, tapes and other materials on making professional

presentations.

STUDENT PROJECT CORE INSTRUCTIONS

THE CREDIT UNION 3-YEAR STRATEGIC

BUSINESS PLAN

John Vardallas, TheAmericanBoomeR Group

Debborah Rightmire, Texas Credit Union League

Lily Newfarmer, Tarrant County Credit Union

Janine McBee, Texas Credit Union League

Strategic Planning is …

a systematic plan for implementing professional management throughout the credit union

and for developing the strategy to improve and mobilize the human and financial resources to

carry out the credit union’s mission (purpose).

the continuous, formal written process employed

— to identify future opportunities and member needs or wants,

— to determine objectives, and

Revised 06/07

Page 10

SCMS CLASS OF 2009 CORE MANUAL

— to make decisions relative to the investment of credit union resources in order to achieve

objectives.

the process by which an organization can become what it wants to be.

the rational determination of

— what business the credit union is in,

— where it is,

— where it wants to go, and

— how and when it is going to get there.

Strategic planning can have multiple objectives. Some of these are noted below and have been

drawn from corporate and public sector descriptions and ISNAR experiences:

Change organizational directions and respond to external changes

Rationalize component unit and structure

Identify strategic issues and decision points

Set priority objectives and allocate resources

Develop information for manager and policy maker decisions

Build a coherent and ddeefensible basis for decision-making

Provide a frame of reference for investments, budgets and action plans

Identify external opportunities and threats

Analyze the organizations’s strengths and weaknesses

Defind and plan necessary organization changes

Develop better internal coordination of activities

Set realistic and attainable objectives

Evaluate current situation and make adjustments in strategy and plans

Highlight and analyze environmental changes

Improve management capacity

Involve partners in decision-making

Address organizational constraings

Strategic Planning for Agricultural Research: Guidelines for an Issues-Oriented Approach Govert

Gijsbers, Warren Peterson, and Michele Wilks, isnar – International Service for National Agricultural

Research

Operational Planning is …

how you are going to run the credit union’s present business most effectively in the period

immediately ahead as you make progress toward the objectives of the strategic plan.

Revised 06/07

Page 11

SCMS CLASS OF 2009 CORE MANUAL

Strategic Planning is done by the Board

of Directors, CEO/President/Manager,

Committee Chairperson(s) and key staff.

Operational Planning is done by the

CEO/President/Manager and key staff (i.e.,

Tactical Action Planning, cost-benefit

analysis, etc.).

STRATEGIC PLANNING

SEQUENCE, DEFINITION OF TERMS, AND SAMPLES

SCMS challenges you to stretch and dream.

Your task is to prepare the Credit Union’s Three-Year

Strategic Business Plan as if you were the CEO.

If there are two students from the same credit union

in the first year class, please discuss with Janine

how much of the project may be jointly prepared

before leaving school.

There are a variety of ways to approach strategic

planning. Be sure, for the purposes of this project, to

follow the sequence and term definitions provided in this

booklet.

You are creating a profesisonal report. Please handle

accordingly.

Where appropriate, involve your credit union’s leadership

team in the development process.

If there is something in your project that needs to be

handled in a confidential manner, visit with John

Vardallas. He will work with you on how to handle it.

If anywhere along the way, you are not sure about

format, directions, concepts, etc., contact Janine McBee.

Plan to give your immediate boss a copy of your finished

work.

TABLE OF CONTENTS

Minimum requirement

Develop a comprehensive table of contents.

This is usually the last step in the development of the

three-year strategic plan. The table of contents continues

to change as the three-year strategic business plan is

changed, updated, and fine-tuned.

Be detailed. Use the table of contents as a tool to

enhance the value of the strategic plan to the reader.

HISTORY OF THE CREDIT UNION

Revised 06/07

Page 12

SCMS CLASS OF 2009 CORE MANUAL

Minimum requirement: Write five to eight pages of

narrative history, focusing on the last five years.

Write the history to help new employees, board

members, credit union members, and potential members

understand how the credit union has become what it is

today.

Consider creating in the form of a timeline or

benchmarks to easily identify the highlights.

Place a greater emphasis on the factors that have had a

significant impact on the credit union in the last five

years.

Include:

1) The date of origination.

2) What made the credit union what it is today and

helped set the direction for tomorrow? State the

history in terms of stimulus and response or cause

and effect.

Example: In (month) (year), ABC CU merged with

____________ to rebuild the capital base. The

merger lead to a __% decrease in the capital to

asset ratio.

3) When significant events occurred (i.e., membership

expansions, mergers, new products or services, new

facilities, obstacles that have been overcome, etc.).

a) Highlight milestone moments that have shaped

your credit union.

b) If something happened in “the early years” that is

still significant, cover it. Otherwise, focus on the

last five years.

c) If there was a problem with a sponsor company,

management, or other areas of the credit union,

allude to it here. Do not mention specific names

of individuals. The problem should also be

reflected further on in the plan, in the SCOT

listing.

4) Charts covering at least, with reference in the text,

the annual change over the last five years on assets,

membership, loans to assets, and net worth ratio.

5) If a previous student has already written a history, it

is OK to use their work to build on. Make sure to

change to your words and bring current. Important

for you to cite the source.

6) After the history has been approved, you do not need

to resubmit until the final project submission. At that

time, update the history to reflect anything that has

had a significant impact on the credit union. Also

bring charts current.

When people review their history and take personal ownership of their background, traditions, and

current momentum, they are in a better position to look at their future possibilities realistically.

Revised 06/07

Page 13

SCMS CLASS OF 2009 CORE MANUAL

Northbound Train, Karl Albrecht

MISSION STATEMENT

Minimum requirement: Provide a mission statement that defines the basic purpose of the credit

union.

If previously adopted, does the existing mission

statement give an adequate assessment of why the

credit union exists? Write a couple of sentences

explaining your positon.

If you write your own mission statement, include

wording indicating when statement would be

proposed to board or management, whichever would

be appropriate.

Write a two to three sentence evaluation of the

mission statement.

Indicate source (board, self, prior SCMS graduate),

status (adopted, submitted, never reviewed), and

date.

A mission statement simply states what an organization

is or does. It is a description of a desired state of affairs

that inspires action, determines behavior, and fuels

motivation. It answers the question, Why does the credit

union exist?

The mission statement is not the place for specifics such as ratios and numerical objectives.

Does the mission statement reflect reality?

Should the mission statement reflect:

credit union philosophy?

an obligation to the community?

an obligation to potential members (within the field of

membership (FOM) that are not using credit union

services)?

an obligation to expand the FOM?

The secret of success is constancy of purpose.

Benjamin Disraeli

The most commonly taken initial act in establishing organizational direction is to determine an

organizational mission. Organizational mission is the purpose for which — the reason why — an

organization exists. In general, the firm’s organizational mission reflects such information as what types of

products or services the organization produces, who its customers tend to be, and what important values it

holds. Organizational mission is a very broad statement of organizational direction and is based upon a

thorough analysis of information generated through environmental analysis [includes internal and external

analysis].

A mission statement is a written document developed by management, normally based upon input by

managers as well as non-managers, that describes and explains what the mission of an organization

actually is.

An organizational mission is normally very important to an organization because it usually helps

management to increase the probability that an organization will be successful. This probability is increased

for several reasons.

First, the existence of an organizational mission helps management to focus human effort in a common

direction. The mission makes explicit the major targets the organization is trying to reach and helps

managers keep these targets in mind as they make decisions.

Revised 06/07

Page 14

SCMS CLASS OF 2009 CORE MANUAL

Second, the existence of an organizational mission helps managers because it serves as a sound

rationale for allocating resources. A properly developed mission statement gives managers general but

useful guidelines about how resources should be used to best accomplish organizational purpose.

Third, the existence of a mission statement can help managers because it pinpoints broad but

important job areas within an organization. A well-developed mission generally helps management

define critical jobs that must be accomplished.

Samuel C. Certo, Modern Managemet

(CCUE Management Course Text)

BONUS OPPORTUNITY

Develop a Vision Statement for the credit union.

A mission statement indicates what one does.

Vision is the heart, the constancy of purpose. What

does your credit union aspire to be? You must

understand the vision to be able to move forward.

Vision is what one wants to “become”, not what one

“does”. A vision is from the heart and encompasses the

value of the organization. It is a dream, a fantasy of what

the organization ideally can be — its guiding principle.

Vision is idealistic; it raises us above everyday problems

to look at an ideal future.

Niki McCuistion, “The Quality Sales Leadership System

for Today’s Financial Executive”

Even though vision directs us toward the future, it is important

to understand that it is experienced in the present. The tension

that comes from comparing the image of a desired future with

today’s reality is what fuels a vision to action.

Qualities of a Vision

It motivates, inspires.

It is a stretch, moves towards greatness.

It is clear, concrete.

It is achievable, not a fantasy.

It fits with the highest values.

It is easy to communicate, clear and simple.

Vision Questions

If we could be what we wanted in five years, what

would we be?

How would we know we were there?

What would be a stretch for ourselves?

What kind of organization do we want to be?

What do we really want to do or create?

What would be worth committing to over the next 10

years?

How do we differentiate ourselves from our

competition?

Revised 06/07

Page 15

SCMS CLASS OF 2009 CORE MANUAL

What are the right things to do?

Cynthia D. Scott, MPH, PhD;

Dennis T. Jaffe, PhD; and Glenn R. Tobe MA

“Organizational Vision, Values and Mission”

BONUS OPPORTUNITY

Develop Core Values Statement, Code of Ethics,

Governance, or similar material to supplement your

plan.

Back to the Beginning - Core Values

by Rick Sidorowicz

An article in the Harvard Business Review provided the insight

into what is an ingredient missing in many organizations.

"Building Your Company's Vision," by James Collins and Jerry

Porras talks about core ideology, core values, core purpose,

"big hairy audacious goals" and envisioned future. It's a very

interesting read, but the 'gem' is in the very simple notion of

core values, which I think can be better defined as an

organization's sense of character or integrity.

The authors define 'core values' as the essential and enduring

tenets of an organization - the very small set of guiding

principles that have a profound impact on how everyone in the

organization thinks and acts. Core values require no external

justification. They have intrinsic value and are of significant

importance to those inside the organization. They are the few

extremely powerful guiding principles; the soul of the

organization - the values that guide all actions.

The core values or ideology define the enduring character of

an organization - a consistent "identity" that transcends

product and market life cycles, management fads,

technological change, and individual leaders. The organization

may develop new purposes, employ new strategies, reengineer processes and significantly restructure; however, the

identity and ideology remains intact. In the authors' words, "...

core ideology provides the glue that holds an organization

together through time." A few examples:

Disney - the obvious core values of imagination and

wholesomeness stem not from any market requirement but

from Walt Disney's belief that imagination and wholesomeness

should be nurtured for their own sake;

Proctor and Gamble - product excellence is cultural, more

like a religious tenet than a business strategy for success;

Nordstrom - service to the customer above all else and being

part of something special; a way of life at Nordstrom long

before customer service programs became stylish;

Sony - being pioneers and doing the impossible; seemingly

obsessed with creativity and innovation.

It does seem that the 'greatest' companies over time possess

unwavering intrinsic core values that define their identity.

These organizations are not all things to all people. 'Customer

service' doesn't have to be a core value - it's not for Sony.

Neither is 'teamwork' for Nordstrom, nor 'respect for the

individual' for Disney. This is not to say that Disney or Sony or

Nordstrom do not embrace 'quality' or 'customer service,' or

'teamwork.' The greatest organizations have operating

practices that contain these elements, but the elements are

Revised 06/07

Page 16

SCMS CLASS OF 2009 CORE MANUAL

not the essence of their being. Nor is there a requirement that

they be likable or 'humanistic.'

The greatest companies seem to have decided for themselves

what values are core, independent of the current environment,

competitive challenges, or management fads. Core values

may be a competitive advantage in a current context; however,

they are core values because they define what an organization

stands for. They are core values ... just because. (Just

because some individual decided they were important.) Values

are 'core' "if they are so fundamental and deeply held that they

will change seldom, if ever." Values are core if they would be

held even if they were a competitive disadvantage in certain

circumstances.

Core values are deep, very deep. They are extremely

important. Core values rarely change in light of market

changes. On the other hand it is more likely that the

organization will change markets if necessary to remain true to

its core values.

The insight? It appears that for the greatest companies it

doesn't matter what the core values are - as they are so

diverse. What really matters - is that an organization has core

values at all. I think that is worth repeating somewhat more

boldly …

What really matters - is that an

organization has core values at all.

Perhaps the key to 'greatness' in the sense of viability,

adaptability, longevity, and relevance for organizations is this

sense of character, identity, unwavering purpose, integrity and

the core values that you truly stand for.

So how do we get core values that inspire us to greatness?

How can we create them? It's quite obvious that we cannot get

them by looking outside at the external environment or

competitors. It's also quite obvious that our strategic planning

exercises cannot possibly uncover the ideology that is the soul

of our endeavors. It's not an intellectual exercise. It's not a

wish list or vision of what the values should be. It is somewhat

like, (exactly like), discovering the core values we hold as

individuals that provide unwavering guidance in our lives.

The authors offer a few clues:

Listen to people in truly great companies talk about their

achievements - you will hear very little about earnings per

share. Maximizing shareholder value does not inspire people

throughout an organization and does not provide any

guidance. Maximizing shareholder value is "the off-the-shelf

purpose for those organizations that have not yet identified

their core purpose. It is a substitute - and a weak one at that."

You discover core ideology by looking inside. It has to be

authentic. You can't fake it. It's meaningful only to people

inside your organization and it need not be exciting to others

outside. It's an individual journey. And it is in the authenticity,

the discipline and the consistency of the values, not the

content, that differentiate the greatest companies from the

rest.

"How do we get people to share our core values?" You don't.

You can't. Just find people that are "predisposed" to share

your values and purpose, attract and retain those people, and

let those who don't share your values go elsewhere.

Revised 06/07

Page 17

SCMS CLASS OF 2009 CORE MANUAL

This entire exercise is about having your integrity in - in the

sense of your authentic values and your courage to act

congruently all of the time.

And could it be that the seemingly unending quest for the

answer - will ultimately take you back to the beginning - to

what you are and what you stand for? And perhaps, this could

be the first step to the beginning ... on the path to greatness.

Source: http://www.refresher.com/!corevalues.html

Codes of Ethics

A code of ethics (otherwise an ethical policy, code of conduct,

statement of business practice or a set of business principles)

can be a management tool for establishing and articulating the

corporate values, responsibilities, obligations, and ethical

ambitions of an organization and the way it functions. It

provides guidance to employees on how to handle situations

which pose a dilemma between alternative right courses of

action, or when faced with pressure to consider right and

wrong.

No two codes will be the same. They must reflect the concerns

of the employees of the particular organization and the context

of the relationships and business environment in which it

operates.

Having a code of conduct is not enough, however. It can only

be effective and practically useful with committed

dissemination, implementation, monitoring and embedding at

all levels so that behaviour is influenced.”

Key areas to include –

A.

The Purpose and Values of the Business - The service,

which is being provided - a group of products, or set or

services - financial objectives and the business' role in

society as the company sees it.

B.

Employees - How the business values employees. the

company's policies on: working conditions, recruitment,

development and training, rewards, health, safety &

security, equal opportunities, retirement, redundancy,

discrimination and harassment. Use of company assets

by employees.

C.

Customer Relations - The importance of customer

satisfaction and good faith in all agreements, quality, fair

pricing and after-sales service.

D.

Shareholders or other providers of money - The protection

of investment made in the company and proper 'return' on

money lent. A commitment to accurate and timely

communication on achievements and prospects.

E.

Suppliers - Prompt settling of bills. Co-operation to

achieve quality and efficiency. No bribery or excess

hospitality accepted or given.

F.

Society or the wider community - Compliance with the

spirit of laws as well as the letter. The company's

obligations to protect and preserve the environment. The

involvement of the company and its staff in local affairs.

The corporate policy on giving to education and charities.

G. Implementation - The process by which the code is issued

and used. Means to obtain advice. Code review

procedures. Training programme.

Revised 06/07

Page 18

SCMS CLASS OF 2009 CORE MANUAL

Source: http://www.ibe.org.uk/codesofconduct.html

BONUS OPPORTUNITY

Create a Statement of Commitment to Members – Project Differentiation

“Credit unions today remain as unique as their history. Officially chartered as a financial "movement" in

1934, credit unions undertook the mission to bring economic democracy to "people of modest means"

through the extension of affordable financial services.

The fervor of the early pioneers is echoed in today's credit union movement. As cooperatives, credit unions

are working hard to position themselves competitively in the financial market through emphasis of their

basic cooperative philosophy and democratic principles.

In the past few years, credit unions have refocused attention on how they can best communicate to their

members the difference between credit unions and other financial institutions. Successful marketing

position has led many of them to examine how they incorporate the basic principles of credit unions into the

everyday work of serving their members, and how to proactively communicate these activities to members,

legislators, and consumers.

In 1998, CUNA's Board appointed a Project Differentiation Committee to reemphasize credit unions'

philosophy and their commitment to members. The result? A "Statement of Commitment to Members"

encouraging all credit unions to develop their own statements.

Introduction

What is a Statement of Commitment to Members? Why should you make the effort to create one for your

credit union?

The "what is it?" answer is relatively simple. Think of the Statement as a "Philosophy Policy"-- similar in

nature to your asset/liability management (ALM) policy, but focusing instead on the philosophical aspects of

your operations.

The "why do it" answer is a little longer:

Do it because it's a great way to capture the real value of belonging to your credit union.

Do it to reinforce your commitment to credit union principles.

Do it to evaluate how well you carry out your commitment to credit union principles--to

document your successes as well as to find gaps that need to be filled.

Do it because the information it yields can give you a new and exciting strategic

marketing position.

Do it because, once completed, it's great information to share with your board, your

staff, your membership, your sponsor(s), and your community at large.

Do it because it's a great tool for advocacy efforts.

Do it because it's a great tool for education.

Do it to put some focus back on our philosophical roots; always keep safety and

soundness in mind, but never forget why credit unions exist and what our difference is.

Do it to articulate our difference.

"It's time to show in a tangible way how credit unions practice what we preach."

Credit unions practice what we preach by:

Providing service to all groups within our fields of membership;

Providing consumer education;

Keeping to our demographic principles and ensuring that diversity is embraced, not

rejected;

Supporting other credit unions and our movement as a whole;

Participating in noncredit union cooperative activities; and

Revised 06/07

Page 19

SCMS CLASS OF 2009 CORE MANUAL

Supporting our communities, through financial as well as in-kind donations.

Completing this exercise will be well worth your time. Winning H.R. 1151 (the Credit Union Membership

Access Act of 1998) has given credit unions terrific visibility and an outstanding opportunity to differentiate

ourselves from others in the financial service industry. This Statement of Commitment to Members can be

your best tool for accomplishing that, and for taking your credit union into the next century--looking to the

future, but keeping an eye on our past. (Click here for how-to instructions.)

Copyright © 2007 - Credit Union National Association, Inc.

PLANNING BASE (PART 1) — SCOT LIST

Minimum requirement:

Develop a SCOT list for the credit union:

Strengths – build on

Challenges – identify and address

Opportunities – capitalize on

Threats - minimize

Identify at least five areas in each category, including a minimum of one sentence explaining how

the factor relates to the credit union.

Include in the SCOT list those areas relative to the financial position of the credit union that have

been identified in the credit union’s ALM report.

SWOT [SCOT] analysis is based on the assumption that if managers carefully review such

strengths, weaknesses, opportunities, and threats, a useful strategy for ensuring organizational

success will become evident.

Samuel C. Certo’s Modern Management

(CCUE Management Course Text)

It is possible that areas may fall into more than one category.

The same factor can represent both a threat and an opportunity. The way you respond to it and

how well your response works out puts it either on the “win” side of the scorecard or the “loss”

side. In working through the oportunity scan, it helps to think carefully about what it takes to

discern an opportunity or a threat?

Karl Albrecht, “orthbound Train”

According to Webster

Strengths

o Power to withstand strain, force or stress: toughness.

o Power to sustain or resist attack: impregnability.

o Legal, intellectual, or moral force.

o The power or capability of generating a reaction or effect: operative potency.

Revised 06/07

Page 20

SCMS CLASS OF 2009 CORE MANUAL

o Degree of concentration, distillation, or saturation: potency.

o Numerical force or supportive personnel measured as to concentration.

Challenge

o To take a stand against.

o To confront boldly and courageously.

o To call on another to do something requiring boldness.

o A call to engage in a contest or fight.

o A demand for an explanation.

o Requirement for full use of one’s abilities or resources.

o To call to engage in a contest or fight.

Opportunity

o Favorable or promising combination of circumstances.

o A chance for advancement or improvement.

Threat

o An expression of an intention to do something harmful.

o An indication if impending danger or harm.

o One regarded as a possible danger: menace.

SAMPLE SCOT FACTORS TO CONSIDER

Strengths – Build On

Internal items that have a positive impact on the credit union. These items are specifically within the control

of the credit union.

What factors directly contribute to the success of your credit union. What core competencies does your

team excel in? What are your credit union’s major competitive strengths?

Brand/Identity

Community Charter

Competitive Products & Services

Competent Board & Staff

Member Satisfaction

Educated board and staff

Strong Capitol Position

Innovative

Technology

Location

Strong Sponsor Relations

Challenges – Identify & Address (formerly referred to as Problems)

Internal items that have a negative impact on the credit union. These items are specifically within the control

of the credit union.

Revised 06/07

Page 21

SCMS CLASS OF 2009 CORE MANUAL

A major financial institution has lured away two of our employees in the last 6 months with offers of

better pay and benefits packages.

Board Composition

Package of Products/Services

Rate Responsiveness

Lack of Marketing

Lack of Political Involvement

Lack of Training

Lack of ….

Single Sponsor SEG

(Select Employee Group)

Staffing/Succession Plan

Accessibility of Products/Services

Location

Charter

Aging Membership

Facilities

Information Security (in-house)

Opportunities – Capitalize On

Items in the environment that present opportunities for the credit union, but which have not been thoroughly

explored.

Most of our members are not taking full advantage of the full array of products and services we offer.

The potential for increased product penetration and creating a stronger long term financial service

provider with our members is high.

Small Business Services

Community Charters

Community Outreach (financial education, unique ways to help members improve financial position,

increase political awareness of industry, social responsibility)

Home Banking

Lending – i.e. Recapture, Participations, Risk-Based Pricing, Intergenerational Credit Cards, Lifestyle

Lending

Marketing – using new methods/tools to reach market

Mergers

Partnerships/Alliances/Collaborations

Retail Outlets / Shared Branching

Technology

Untapped/underserved Markets

Expand FOM

Streamline Procedures/Products/Services

Financial Planning

HSAs? (Health Savings Accounts)

Threats – Minimize (formerly referred to as Weakness)

Revised 06/07

Page 22

SCMS CLASS OF 2009 CORE MANUAL

Items in the environment that could have a negative impact on the credit union. These items are out of the

control of the credit union.

Banker Attacks

Bankruptcies

Changing Labor Market

Economy

Potential for CU Taxation

Member Demographics

Over the last 18 months, 3 major financial institutions have started operations within a five mile radius.

They have actively advertised no or low fee products and services to attract customers.

Credit Union Charter Conversions

Increased Competition

Increasing Legislation/Regulation

Sponsor Company Layoffs

Natural Disaster

Taxation

Labor Market

Fraud

Terrorism

Identity Theft

Disaster

Information Security (external – i.e. Department Store records)

PLANNING BASE (PART 2) — ETERNAL ANALYSIS

Minimum requirement:

Identify and analyze at least five external factors that affect (or could affect) the credit union.

These are factors over which the credit union has little or no control. Be specific, listing single

events or trends, not broad topics. Also, be sure to cite any reference materials.

Follow the FAIR Format

1)

Factor — identify the present and future trends in each of the areas.

2)

Assumptions — make assumption(s) as to the future course of the trends.

3)

Impact on the credit union — relate the trend’s probable impact on the demand or supply of

the program or services and the effect on costs and profits.

4)

Response — determine what are the probable responses your credit union can make

based on potential impact.

Think in terms of:

Operating environment

Business logic/strategy

Customer values

Possible driving or key factors to consider:

Revised 06/07

Page 23

SCMS CLASS OF 2009 CORE MANUAL

1) Political/legislative/regulatory/legal

2) Population Dynamics - Social/cultural/

demographic

How and why people live and behave as

they do?

What are the demographic trends of

your existing membership? Potential

membership?

Labor Pool

3) Economic

4) Technology

Skills/equipment

New products/new processes

(ways of doing things)

5) Competitition

Has anything changed in this area?

6) Physical Environment

The physical surroundings of the credit union facilities and operations

Location/proximity to suppliers, transportation, members

Risk for natural disasters/pandemics

Not sure where to start? See if your credit union or a

classmate has a copy of CUNA’s Environmental Scan

that they might share with you.

Johnny Vs

Tips from the Evaluators Corner

Tie the factor back as it specifically relates to the credit union.

Be thoughtful and creative here and your plan will go from “Good to Great”.

EXTERNAL ANALYSIS

SUGGESTED INFORMATION SOURCES

Industry Periodicals & White Papers

CUNA Publications (www.cuna.org)

CUNA data subscription service: CU360

Credit Union League/Association educational events, newletters, magazines, list serves, etc.

CUNA Mutual Group’s Dimensions Reports

The Economist magazine

Federal Reserve Banks

U.S. Department of Commerce

Regulatory News Letters

Google :-)

Libraries — community and campus

Local:

Revised 06/07

Page 24

SCMS CLASS OF 2009 CORE MANUAL

Business Meetings

Chamber of Commerce

College/University Professors

Credit Union Chapter/Manager Meetings

Publications

Newspapers (local, state, Wall Street Journal, etc.)

Professional Associations

Soundview Executive Summaries (summarizes current business books)

STRATEGIC INITIATIVES (SIS)

OUTLINE OR SUMMARY

Minimum requirement:

Create an Outline or Summary of SI’s 1-5, including objective statements, strategy statements,

and Tactical Action Plan headings.

This step helps bring into focus the direction as you proceed to develop the Strategic Initiatives.

As you develop SIs, you will want to refer to this section, adding detail and modifying it

accordingly.

Important:

This must be included when you send Debbie Rightmire your Financial Management Strategic

Initiative (SI).

DEVELOPING THE STRATEGIC INITIATIVES

Minimum requirement:

Five complete SIs.

One must be financial management.

(Start with a Strategic Initiative like membership or growth, using financial management as the last

SI.)

Strategic Initiatives focus on a few critical areas vital to position your credit union for success in

the future. The serve as a way to focus attention of board, management, and staff at all levels.

For each SI, a minimum of . . .

A brief INTERNAL ANALYSIS with

One three-year, measurable, OBJECTIVE/GOAL

Achieve and maintain or exceed

Bring in-house, out source, or partner

Develop and market

Eliminate or phase out

Establish

Explore

Identify

Improve, enhance, change, or revise

Revised 06/07

Page 25

SCMS CLASS OF 2009 CORE MANUAL

Increase

Keep pace with or outdistance

Produce and market

Attract or retain

Two STRATEGIES/PROGRAMS for each objective/goal

One Tactical Action Plan for each strategy/program

A COST-BENEFIT ANALYSIS for each Tactical Action Plan

Additional Requirements for the Financial Management Strategic Initiative

An internal analysis highlighting strengths and challenges and any information that might

impact financial projection outcome (i.e., new building, expanding staffing, computer

conversions...)

A three-year projection with supporting balance sheet income/expense projections, and

The calculation of a minimum number of key Financial Ratios specifically relating to the

CAMEL rating system.

Note:

The ALM and financial management courses provide further details to aid in the

development of the financial managemanagement SI.

Johnny Vs Tips from the Evaluators Corner

Strategic Initiatives are the heart of the plan. Developing and writing the first one is harder than

the other three (non-financial) SIs combined. Tackle it early!

Key Result Areas are critical or essential issues that can determine the success of the credit

union. They are areas where the credit union will focus its resources, in connection with the

strategic plan.

Key Result Areas are the foundation for setting objectives, goals, policies, strategies and short

range plans [Tactical Action Plan].

CUNA’s VAP Module —

The Strategic Planning

A SAMPLING OF POTENTIAL STRATETIC INITIATIVES

STRATEGIC INITIATIVES

METHOD OF MEASUREMENT

(Always Include a Completion By Date!)

1) Membership

# and % of increase

# and % of increase in secondary or family members

# and % of increase in age bracket (member/primary potential

member ratio)

2) Growth

Increase in regular share base by $ and %

Increase in share drafts by $ and %

Increase in loan volume by $ and %

Increase in average share balance by $ and %

Increase in average personal loan balance by $ and %

3) Image

Revised 06/07

Conduct a member survey by _______ (date)

Page 26

SCMS CLASS OF 2009 CORE MANUAL

To ensure the viability of credit unions as independent

institutions to allow people to have the fredom of choice when

selecting financial service providers.

# of programs to educate and increase member awareness

about the uniqueness of credit unions as financial service

providers

Develop a plan to educate SEGs on the importance of credit

unions to company employees by _____ (date)

# of lobbying efforts at the state and national level to educate

and increase politcal awareness about the uniqueness of credit

unions as financial service providers

Develop a plan to become involved in the political process with

local and national politicians by _________ (year)

Conduct an employee morale survey by ______ (date)

# and % of return on survey

# and % of favorable responses to

(price,

professionalism, quality of service, convenience, etc.)

# and % of increase in positive member perception of service or

product quality from one survey to the next

# and % of members viewing CU as primary financial institution

(PFI)

Time on hold or number of calls on hold

Time member enters credit union until teller/loan/member service

transaction is complete

# of statement or transaction errors

Measures that reflect aspects of speed/convenience (both

internally and externally)

4) Financial Management

Asset Yield

Cost of Funds

Gross Spread

Net Operating Expense Ratio

Operating Return on Assets

Net Charge Offs/Average Total Assets

Net Return on Assets

Loan/Asset Ratio

Net Charge Offs/Average Loans

Capital/Assets Ratio

% of change for:

— assets

— loans

— capital

5) Users of Services

Asset or deposit redistribution

# of users per service

Borrowing members/members ratio

Revised 06/07

Page 27

SCMS CLASS OF 2009 CORE MANUAL

Average # of services per member or household

% of members viewing CU as their primary financial institution

(PFI)

6) Innovation/Technology

# of new services (the kind of new services with year of

services implementation)

# of employees enrolled in PC related/software courses

Develop training program for employees/members with written

plan due by _______ (date)

Establish technology task force to define technology based

needs and deliver written technology plan by _______ (date)

To design amd implement technology plan by ______ (date)

Increase PC usage within the credit union by # of employees or #

of programs employees are proficient at

Increase % of member usage of technology based services

7) Human Resource

Management

(Includes

Personnel

Management)

# and % of turnover (due to termination and employee

dissatisfaction)

On-site evaluation of training (scale of 1-10)

6-month post-training evaluation (degree of improvement on scale of

1-10)

programs

Degree of improvement — pre-test/post-test # of training

held/attended each year

Salary and benefit as a percentage of operating expense

# of staff/officials to be trained each year

Target dates when type of training will be held

# of full time equivalent employees/million dollars in loans and

share drafts ratio

Additional areas for SI that have been successfully developed in the past:

Remote Facilities/Facilities Expansion

Service Quality

Delivery Systems

Target Marketing

Political Action

Project Differentiation

If you are considering an innovative, new, or novel SI, contact John Vardallas to discuss before

you have spent much time on it. One test of a potential SI is to see if you can support it with

enough detail to carry it through to the Tactical Action Plan and cost benefit analysis process. If

you are finding Tactical Action Plana challenge, you may be working on a strategy addressing

another SI.

INTERNAL ANALYSIS

(5-Year History of Performance)

Minimum requirement:

Revised 06/07

Page 28

SCMS CLASS OF 2009 CORE MANUAL

Develop one internal analysis for each SI, including a five-year history/analysis of each. Use

narrative, charts, graphs, policies, and suggested policies as applicable to each SI.

Draw conclusions.

Don’t leave the reader wondering what direction the plan is taking.

Johnny Vs Tips from the Evaluators Corner

The internal analysis makes or breaks more SIs than any other part of the SI write-up,

with the exception of possibly the cost-benefit analysis.

OBJECTIVES/GOALS

Minimum requirement:

Develop at least one three-year objective/goal for each Strategic Initiative. These goals/objectives

should define the basis for action.

Objectives — qualitative statements

Goals — quantitative statements

Be careful how objectives/goals are stated:

Right: The delinquency ratio will not exceed 1%.

Wrong: To maintain a delinquency ratio of 1%. (This does not allow for a ratio of less than 1%.)

Smart Goals

Sensible

Does it make sense to do this?

Measurable

How will I measure when I have arrived?

Attainable

Can I actually attain this now?

Realistic

Is it possible and realistic at the same time?

Time line

How much time will it take me?

Full Esteem Ahead: 100 Ways to Build

Self-Esteem in Children & Adults

Diane Loomans with Julia Loomans

It is important to set corporate objectives for many reasons.

— The most general reason is that, as experience has shown, the act of setting objectives for a

corporation considerably increases the chances of achieving them.

— Another reason is to communicate a common framework to both management and

employees so that “everybody is pulling in the same direction.”

— A third reason is that corporate objectives serve as a consistent set of criteria for evaluating

alternative strategies that are developed as part of the planning process.

— Finally, corporate objectives can be used to judge the performance of the company and its

management.

AMA’s How to Develop The Strategic Plan

Goal:

What you want to accomplish expressed as a result. It is a desired performance or a specific

outcome to be completed within a given period of time. It represents progress, a gain beyond past

accomplishments, a tangible improvement over existing conditions.

Goals provide:

Revised 06/07

Page 29

SCMS CLASS OF 2009 CORE MANUAL

— direction [communicate expectations]

— orientation

— a performance standard

— a work plan

— a progress measurement

— motivation

— discipline

6 basic characteristics of a measurable, effective goal:

A) Written in terms of desired results or outcomes.

B) Has a specific time frame or deadline.

C) Has a norm or standard for judging success.

D) Is realistic and attainable.

E) Is understandable.

F) Agrees or corresponds with the mission statement.

Formula for a measurable goal:

Action Verb

Build

Recommend

Increase

Publish

Achieve

Purchase

Identify

Design

Reduce

Provide

Develop

Implement

Complete

+

Measurable Result

+

Deadline Date

That you want

to accomplish.

Once the goal is written, ask if it is understandable and realistic.

CUNA’s CU Planning Seminar: Facilitator’s Manual

Sample objective statements:

Increase total membership 5% per year from x to y by 12/31/10.

Conduct the annual member survey by 12/31/09.

Maintain a minimum member satisfaction rating of 90%.

Implement remote banking options by 12/31/10.

Enroll 20 new youth account members, increasing membership by x%, by June 30, 2009.

Form a task force to review types of loans offered and prepare recommendations for

streamlining the lending process by reducing or combining various types of loan products

by 12/31/09.

STRATEGIES/PROGRAMS

Minimum requirement:

Develop at least two strategies/programs for each objective/goal.

NOTE: Each program/strategy has an effect on the credit union’s future and its financial

condition.

Revised 06/07

Page 30

SCMS CLASS OF 2009 CORE MANUAL

Strategies/programs describe how the identified goals/objectives are to be achieved.

The strategy should be congruent with the professional mission, with available resources, and

with market conditions. Moreover, the strategy should be monitored and changed to reflect shifts

in the wind, including the status of the competition.

Stephen Covey,

Principle-Centered Leadership

Today, the word strategies, in a planning sense, means a general program of action and an

allocation of resources and activities to achieve objectives.

Strategies are developed after objectives and policies have been set. Strategies are written to

attain objectives in light of policies.

The purpose of strategies is to determine and communicate how the credit union will get where it

wants to go through a system of objectives and policies. Strategies, then, are a set of decisions

made over time that will achieve objectives and goals. They point you in a unified direction in

regard to what activities will be emphasized and how resources will be allocated.

Strategies deal with action and direction of financial, human and material resources to achieve

objectives.

Major strategies which give a unified direction to a credit union are likely to be in the following

areas:

1) Products and Services. This is the area in which the credit union responds to the changing

needs of members.

2) Marketing. Marketing strategies are the part of the plan that concentrates on getting products

or services to members.

3) Growth. Growth strategies give direction to such questions as how much growth, how fast,

where, and how.

4) Financial. Every credit union must have a clear strategy as to how to operate a financially

stable and competitive institution.

5) Organizational. This kind of strategy has to do with the type of organizational structure the

credit union will create and use. This structure defines a system of roles and relationships

that helps people accomplish objectives in effective ways.

6) Personnel. Major strategies in the human resource area deal with such topics as

compensation, selection, recruitment, training, and appraisal, as well as strategy in special

areas such as the quality of work life.

CUNA’s VAP Module,

The Strategic Planning Process

Strategy is a broad and general plan developed to reach long-term organizational objectives; it is

the end result of strategic planning . . . Organizational strategy can, and generally does, focus on

many different organizational areas, such as marketing, finance, production, research and

development, personnel, and public relations . . . For a strategy to be worthwhile, however, it

must be consistent with organizational objectives, which in turn must be consistent with

organizational purpose [mission] . . .

After managers involved in the strategic planning process have analyzed the environment and

determined organizational direction through the development of a mission statement and

organizational objectives, they are ready to formulate strategy. Strategy formulation is the

process of determining appropriate courses of action for achieving organizational objectives and

thereby accomplishing organizational purpose.

Managers formulate strategies that reflect environmental analysis, lead to the fulfillment of

organizational mission, and result in the reaching of organizational objectives. Special tools

managers can use for assistance in formulating strategies include:

Revised 06/07

Page 31

SCMS CLASS OF 2009 CORE MANUAL

1) Critical Question Analysis

a) What are the purposes and objectives of the organization?

b) Where is the organization presently going?

c) In what kind of environment does the organization now exist?

d) What can be done to better achieve organizational objectives in the future?

2) SWOT Analysis [see page 19].

3) Business portfolio analysis, a technique that is based on the philosophy that organizations

should develop strategy much as they handle investment portfolios. Just as sound

investments should be supported and unsound ones should be discarded, sound

organizational activities should be emphasized and unsound ones de-emphasized.

4) “Porter’s Model for Industry Analysis”, a model that outlines the primary forces that determine

competitiveness within an industry and illustrates how the forces are related. Porter’s model

suggests that in order to develop effective organizational strategies, managers must

understand and react to forces within an industry that determine an organization’s level of

competitiveness within that industry:

a) Differentiation,

b) Cost leadership, and

c) Focus.