Ryosuke Wada's Bio

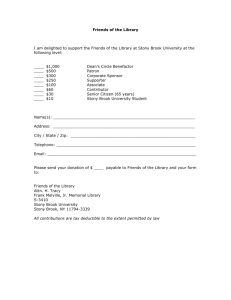

advertisement

Financial Economics Spring 2011 Professor Wada, Ryosuke 和田良介 office: room 537 phone: 27-5319 office hours: Tueseday and Thursday 17:30-18:00 in room537 or 319 email: rwada@res.otaru-uc.ac.jp web page: http:www.otaru-uc.ac.jp/~rwada 1. Course objective and method The objective is to understand basic concepts of financial economics. a. optimization over time b. asset valuation c. risk management by derivatives To help clear understanding, numerical exercise is emphasized. In principle, homework is assigned every week. Many of the homework questions involve numrical calculations. It is recommended to use software called, Mathematica as well as Excel. Its use will be explained. Mathematica 7 is available in a study room next to International Office, Mathematica 8 is instolled in room 319 and Computing Center Exercise Room No.2. Extra handout and homework answers will be downloadable be from the web page. 2. Course contents: 1. time value of money and discounted cash flow analysis 2. valuation of bonds and stocks 3. risk management 4. prices of derivatives; futures, forward and options contracts The level of mathematical sophistication is elementary algebra, including sum of geometric sequences. Its formula appears repeatedly. 3. Teaching materials text book: Zvi Bodie,Robert Merton, David Cleeton, Financial Economics, 2nd ed. Prentice Hall, 2009. 4.Grading: Allocation of weights will be two exams (60 %), homeworks (25%), class participation (15%). Class participation includes asking constructive questions as well as attendance. Also, it includes solving homework questions on black board. Working together on homeworks is encouraged. Midterm will be 30 minute test. Numerical ability is also evaluated. If you have to leave Japan early in July, a separate exam can be arranged. 5.Remarks: Neat appearance and legibility of homework answers are subject to evaluation. It is encaraged to submit homework answers as computer printouts. Ryosuke Wada’s Bio BA in Economics, School of Political Science and Economics, Waseda University, Tokyo, Japan MA in Economics, Cornell University, Ithaca, New York Ph.D in Economics, State University of New York at Stony Brook, Stony Brook, New York Work experience: The Bank of Hiroshima for 4 years before graduate studies at SUNY Stony Brook. 1 Worked as a teaching assistant for “macro-“ and “micro economics” and an instructor of “money and banking” at SUNY Stony Brook. Schedule week 0 1 date 2011/4/6 2011/4/13 2 3 2011/4/20 4 2011/4/27 5 2011/5/11 6 2011/5/18 7 2011/5/25 8 2011/6/1 9 2011/6/8 10 11 2011/6/15 2011/6/22 12 2011/6/29 13 2011/7/6 14 2011/7/13 15 2011/7/20 textbook contents Ch. 4 ・sum of the geometric sequence Ch. 4 Allocating Resources Over Time ・interest rate and compounding ・present value of money Ch. 4 ・loan amortization Ch. 6 How to Analyze Investment Projects ・Net Present Value ・annualized capital cost Ch. 6 How to Analyze Investment Projects ・Internal Rate of Return ・comparison between net present value and internal rate of return Ch. 7 Principles of Asset Valuation ・law of one price and arbitrage Ch. 8 Valuation of Bonds ・pure discount bond and zero rate (spot rate) Ch. 8 ・coupon bond ・coupon bond as a set of pure discount bonds ・yield to maturity Ch. 8 Valuation of Bonds ・premium, par and discount bonds ・relationship between coupon rate and yield to maturity Ch. 10 An Overview of Risk Management ・three dimension of risk transfer, hedging, insuring, diversifying Ch. 11 Hedging, Insuring, and Diversifying ・hedging a risk ・swap contract ・insuring versus hedging Ch. 14 Forward and Futures Prices ・distinctions between forward and futures contracts 30 minute mid-term exam Ch. 14 ・relation between commodity spot and futures prices Ch. 15 Options and Contingent Claims ・put, call, strike price, expiration date ・American and European type Ch. 15 ・investing with options, payoff diagram Ch. 15 ・intrinsic value, time value ・put-call parity relation ・replicating portfolio ・binomial option pricing Review 2