Economics 514

advertisement

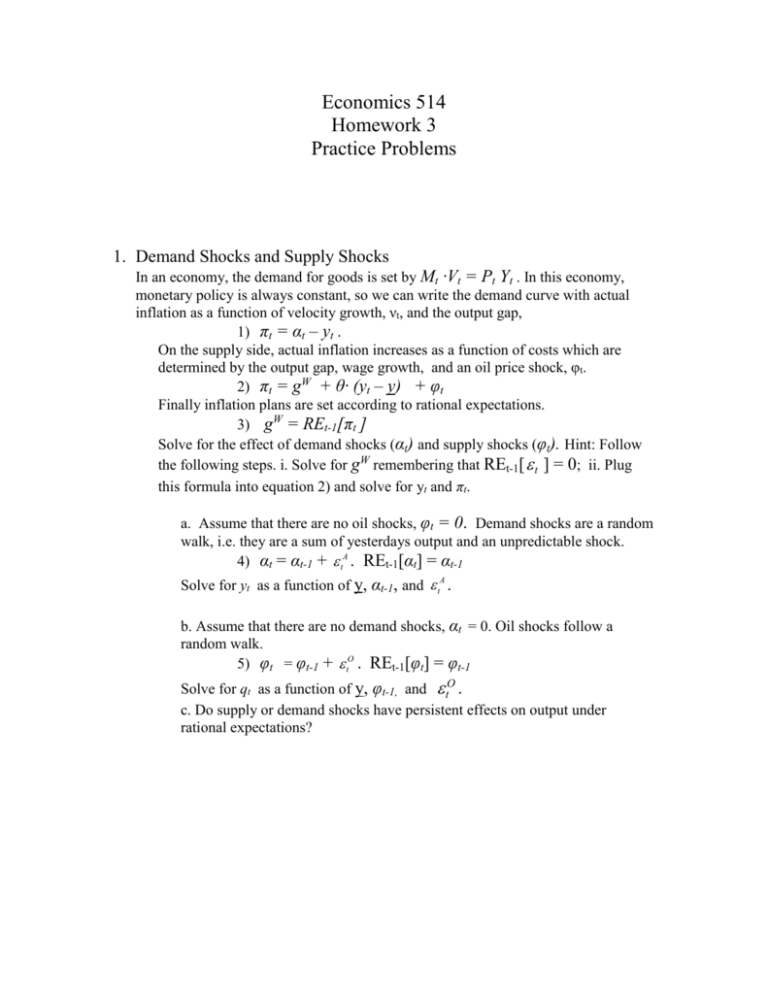

Economics 514 Homework 3 Practice Problems 1. Demand Shocks and Supply Shocks In an economy, the demand for goods is set by Mt ∙Vt = Pt Yt . In this economy, monetary policy is always constant, so we can write the demand curve with actual inflation as a function of velocity growth, νt, and the output gap, 1) πt = αt – yt . On the supply side, actual inflation increases as a function of costs which are determined by the output gap, wage growth, and an oil price shock, φt. 2) πt = gW + θ∙ (yt – y) + φt Finally inflation plans are set according to rational expectations. 3) gW = REt-1[πt ] Solve for the effect of demand shocks (αt) and supply shocks (φt). Hint: Follow the following steps. i. Solve for gW remembering that REt-1[ t ] = 0; ii. Plug this formula into equation 2) and solve for yt and πt. a. Assume that there are no oil shocks, φt = 0. Demand shocks are a random walk, i.e. they are a sum of yesterdays output and an unpredictable shock. 4) αt = αt-1 + tA . REt-1[αt] = αt-1 Solve for yt as a function of y, αt-1, and tA . b. Assume that there are no demand shocks, αt = 0. Oil shocks follow a random walk. 5) φt = φt-1 + tO . REt-1[φt] = φt-1 Solve for qt as a function of y, φt-1, and tO . c. Do supply or demand shocks have persistent effects on output under rational expectations? 2. Open Economy Construct a small model of the economy that includes A) a Planned expenditure curve; B) a Taylor rule; and C) an expectations augmented Philips curve A. The planned expenditure curve has two parts. The first part sets domestic demand as a negative function of the real interest rate and an exogenous demand shock, αt. The second part includes net exports. yt t b rt nxt Net exports are a function of the real exchange rate, st. The real exchange rate adjusts so that net exports are equal to outward, capital flows that are themselves a negative function of the gap between foreign and domestic interest rates. nxt f (st 1) cft g (r f rt ) So the expenditure curve can be written as yt t b rt g (r f rt ) t g r f (b g )rt B. The Taylor rule sets the real interest rate as an increasing function of the inflation rate rt r d t C. The SRAS curve sets inflation acceleration as a function of the output gap. t t 1 yt y Calibrate the parameters of the model equal to r = .1, rf = .1, y= 1, b = 2 , d = .5, f = 2, g = 2 and θ = .5. t 1 = 1.2 and that at time t-1, the economy is operating at potential output, i.e. t 1 t 2 and yt 1 y 1 . Solve for the inflation b. Assume that rate, real interest rate, and real exchange rate in this economy. c. Now, assume that at time t, an increase in fiscal spending leads to a shift out in domestic demand and t = 1.5. Solve for the new level of output, real interest rate, inflation, and real exchange rate. Does the increase in government spending cause an increase or decrease in net exports? Consider an alternate, extremely globalized economy with very strong capital movements, g = 10. Now, solve for the increase in output, yt that occurs when demand shifts from t 1 = 1.2 to t = 1.5. Is a globalized economy, more or less stable in terms of output? 3. Rational Expectations and Persistent Shocks Aggregate demand is given by: 1) πt = αt – yt where mt is (logged) money supply, αt is velocity, pt is the price level, and qt is the output level. We will assume a fixed monetary policy. The supply curve is given by 2) πt = gW + θ∙ (yt – y) + φt where gW is the growth rate of wages which is given by the expectation of the inflation rate formed with the information available at time t-1, gW = REt-1[πt ] and yt is the potential output level. Potential output is given by a constant, y, plus random technology, xt. yt y xt Both supply shocks (xt) and demand shocks (αt) follow persistent movements. t t 1 tD where the innovation terms, tD xt xt 1 tS and tS are unpredictable, so vte vt 1 xte xt 1 where vte is the expectation of the time t velocity formed at time t-1 and xte is the expectation of the time t technology formed at time t-1. Assume that expectations are formed rationally. Normalize m = y = 0. Solve for the expectation of the output level and the price level as a function of vt-1, xt-1, Solve for the actual output and price level as a function of vt-1, xt-1, tD and tS . 4. Baumol-Tobin Model An econometrician estimates a version of the Baumol Tobin Model of money demand. Her results suggest that velocity can be written as a function of the nominal interest rate Vt 14 i . Assume the real interest rate is equal to the real output growth rate. What is the seignorage maximizing growth rate of the money supply? What percentage of output can possibly be collected as seignorage? 5. Okun’s Law and Time Consistency Each % point increase in output above potential output results in θ% extra inflation. t REt 1 t yt y Each % point increase in output above potential output reduces unemployment below the natural rate by ψ%. urt ur NR yt y t REt 1 t ur ur NR t The government is interested in low inflation and pushing unemployment toward some target level ur*. The government sets inflation policy to minimize 2 2 a t b urt ur * subject to t REt 1 t urt ur NR taking expectations as given. a. Calculate the optimal inflation policy, πP, as a function of ur*, urNR, and REt 1 t . b. What will equilibrium inflation and unemployment be when REt 1 t P c. If the government can choose a target unemployment rate, ur*, in order to have zero inflation, what would it be?