A dynamic AS

advertisement

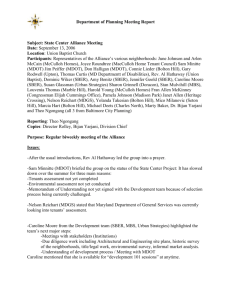

A dynamic AS-AD Model (Lecture Notes, Thomas Steger, University of Leipzig, winter term 10/11) This file describes a dynamic AS-AD model. The model can be employed to assess the dynamic consequences of macroeconomic shocks (fiscal policy shocks, monetary policy shocks, and supply shocks). This AS-AD model can be viewed as a simple business cycle model. It can explain recurrent business cycle fluctions in response to ongoing shocks. (Extension: reformulate the model by using a Taylor rule to describe monetary policy.) Reference: Shone, R., Economic Dynamics, CUP, 2002, Chapter 11. The model ü Aggregate demand (IS-LM model) The goods market (IS-curve) C C0 b 1 Y i I I0 h (1) e (2) real interest rate Y CIG (3) Notation: C: real consumption, Y : real income (output), I: real investment, i: nominal interest rate, pe : expected inflation rate,... The money market (LM-curve) Md ekY edi md k Y d i ms m p Ms (4) M (5) P ms md (6) Notation: md : (natural) logarithm of real money demand, ms : logarithm of real money supply, p: logarithm of the price level,... Solving for Y gives (the solution for i is suppressed) Y Defining a0 : C0 I0 G h d m p h e 1 b 1 C0 I0 G 1b 1 hk , a1 := (7) hk d hd 1-b1-t+ Y a0 a1 m p a2 e , d hk , and a2 : d 1b 1 a0 , a1 , a2 0 This equation represents an aggregate demand (AD) curve. h hk this equation can be written as d (8) 2 Dynamic_AS_AD_Model.nb ü Aggregate supply Aggregate supply is described by Y Yn e , 0 (9) Notation: p: inflation rate, pe : expected inflation rate, Y : real output, Yn : real potential output. Notice that this AS-curve results from an augmented Phillips curve, p = pe - aU - Un , together with Okun’s law, U - Un = -bY - Yn , where both a, b > 0. Alternatively, the following version of the Lucas supply curve Yt = Yn + hPt - Pte is also compatible with this AS-curve. Subtratcing and adding h Pt-1 on the RHS gives Yt = Yn + hPt - Pt-1 - Pte - Pt-1 . If Pt denotes the logarithm of the price level, one can write Yt = Yn + hpt - pet . ü Expected inflation We assume that expectations are formed according to an adaptive expectations scheme e e , 0 (10) ° e When the actual rate of inflation exceeds the expected rate (p - pe > 0), expectations are revised upwards (p > 0), and vice versa. ü Summarizing: the complete model Y a0 a1 m p a2 e Y Yn e e (11) e (12) (13) Model analysis ü Preliminaries: eliminating one equation We first take the time derivative of the AD-equation to yield e Y a1 m a2 (14) Next rewrite the AS-equation as p - pe = a Y - Yn and plug the right-hand side (RHS) into the expected inflation schedule ° pe = b p - pe , which gives e (15) Y Yn Finally, we plug the RHS of the AS-curve, equ. (12), and the RHS of equ. (15) into equ. (14). Y a1 m Y Yn e a2 Y Yn Y a1 Y a1 (16) e m a1 Y Yn a1 e a2 Y Yn m a1 a2 Y Yn a1 e ü The reduced-form model: two differential equations The reduced-form model is described by (plus two boundary conditions) (17) (18) Dynamic_AS_AD_Model.nb e Y Yn Y a1 m a1 a2 Y Yn a1 e ° ° e è This system can be solved for the steady state ( ,Y ), defined by pe = 0 and Y = 0. The steady state reads as follows e m implying : m Y Yn Numerical model evaluation ü The steady state In[2]:= In[3]:= In[4]:= paramInitial C0 10, I0 5, G 5, b 0.8, 0.3, h 0.1, k 0.05, d 0.05, 0.1, 1, mdot 0.01, Yn 1; paramFinal C0 10, I0 5, G 5, b 0.8, 0.3, h 0.1, k 0.05, d 0.05, 0.1, 1, mdot 0.01, Yn 1; a0, a1, a2 C0 I0 G 1 b 1 hk d , hd 1 b 1 h , hk d 1 b 1 hk d ; AS GraphicsLineYn . paramInitial, 0, Yn . paramInitial, 0.15, AxesLabel Y, e , PlotRange 0, 0.06; a1 a2 AD Plotmdot Y Yn . paramInitial, Y, 0.5, 1.5, a1 AxesLabel Y, e , PlotRange 0, 0.06; p1 ShowAS, AD, Axes True, AspectRatio 2 3; è e The steady state (long run equilibrium) is characterized by m and Y = Yn ! ü Dynamic responses At first, we express the differential equations in Mathematica notation In[7]:= In[9]:= In[10]:= In[11]:= (19) (20) (21) (22) ° ° To illustrate, below we plot the two curves pe = 0 and Y = 0 in (pe ,Y )-plane. In[1]:= 3 dee e't Yt Yn; deY Y 't a1 mdot a1 a2 Yt Yn a1 et; esol, Ysol mdot, Yn . paramInitial; ns NDSolvedee, deY, e0 1.1 esol, Y0 1.1 Ysol . paramFinal, et, Yt, t, 0, 100; ent_ : Evaluatens1, 1, 2 Ynnt_ : Evaluatens1, 2, 2 In[13]:= t_ : Ynnt Yn ent . paramFinal this defines the actual inflation rate In[14]:= Needs"PlotLegends`" 4 Dynamic_AS_AD_Model.nb In[22]:= Plotent, t, mdot . paramFinal, t, 0, 30, AxesLabel t, "e blue,red", PlotRange 0, 0.025, AxesOrigin 0, 0 PlotYnnt, 1, 1, t, 0, 30, AxesLabel t, Y, PlotRange 0.93, 1.1, AxesOrigin 0, 0.93 pe blue,pred 0.025 0.020 0.015 Out[22]= 0.010 0.005 0 5 10 15 20 25 30 25 30 t Y 1.10 1.05 Out[23]= 1.00 0.95 0 In[17]:= 5 10 15 20 t AS GraphicsLineYn . paramFinal, 0, Yn . paramFinal, 0.15, AxesLabel Y, e , PlotRange 0, 0.03; a1 a2 Y Yn . paramFinal, Y, 0.5, 1.5, AD Plotmdot a1 AxesLabel Y, e , PlotRange 0, 0.03; p2 ShowAS, AD, Axes True, AspectRatio 2 3; Dynamic_AS_AD_Model.nb In[20]:= 5 tra ParametricPlotYnnt, ent, t, 0, 100, AxesLabel Y, e , PlotRange 0.9, 1.13, 0, 0.03, AspectRatio 2 3; Show tra, p1, p2 pe 0.030 0.025 0.020 Out[21]= 0.015 0.010 0.005 0.000 0.90 0.95 1.00 1.05 1.10 Y ü How to model shocks ° (1) Monetary policy shock: change m (Ø set of parameters) (2) Fiscal policy shock (permanent increase in G): change initial conditions (Y -dimension: Y = a2 pe + a1 m - p + a0 ; pe dimension: pe = const.) (Ø initial conditions; increase G in the set of parameters) (2) Supply side shock: change Yn (Ø set of parameters) Results ü Monetary expansion (code) 6 Dynamic_AS_AD_Model.nb ü Graphical output In[257]:= Showtra, p1, p2 timepath timepathY pe 0.04 0.03 Out[257]= 0.02 0.01 0.00 0.90 0.95 pe blue,pred 0.025 1.00 1.05 1.10 1.15 Y 0.020 Out[258]= 0.015 0.010 0 5 10 15 20 25 30 25 30 t Y 1.05 1.04 1.03 1.02 Out[259]= 1.01 1.00 0.99 0.98 0 5 10 15 20 t Dynamic_AS_AD_Model.nb ü Fiscal expansion (code) ü Graphical output In[432]:= Showtra, p1, p2 timepath timepathY pe 0.030 0.025 0.020 Out[432]= 0.015 0.010 0.005 0.000 0.90 0.95 pe blue,pred 0.030 1.00 1.05 1.10 1.15 Y 0.025 0.020 Out[433]= 0.015 0.010 0.005 0 5 10 15 20 25 30 25 30 t Y 1.10 1.05 Out[434]= 1.00 0.95 0 5 10 15 20 t 7 8 Dynamic_AS_AD_Model.nb ü Negative supply shock (code) ü Graphical output In[409]:= Showtra, p1, p2 timepath timepathY pe 0.025 0.020 0.015 Out[409]= 0.010 0.005 0.000 0.90 0.95 pe blue,pred 0.018 1.00 1.05 1.10 Y 0.016 0.014 Out[410]= 0.012 0.010 0.008 0.006 0 5 10 15 20 25 30 25 30 t Y 1.00 0.99 0.98 0.97 Out[411]= 0.96 0.95 0.94 0.93 0 5 10 15 20 t Dynamic_AS_AD_Model.nb 9 Phase diagram and economic intuition ° The mechanics of the model can be understood by discussing the phase diagramm, which shows the two curves pe = 0 and ° Y = 0 in (pe ,Y )-plane. In addition, the arrows indicate the direction the economy moves to given a position in (e ,Y )-plane. pe 0.06 °e p =0 0.05 II 0.04 I 0.03 0.02 III ° Y =0 IV 0.01 0.7 0.8 0.9 1.0 1.1 1.2 1.3 Y ° ° Consider the following Y -equation and the pe -equation YYn Y a1 m change in AD due to changes in MP e a2 YYn e change in AD due to changes in real interest rate e Y Yn Comments (23) (24) ° ° ° ° ° 1. Above (to the right of) the Y = 0 locus, we have Y < 0, i.e. a1 m - p + a2 pe < 0. To illustrate, start on the Y = 0 locus and increase Y , holding pe fix. This decreases the RHS of (23), via p, by more than it increases the RHS of ° ° (23), via pe , provided that a1 a > b a a2 ! Consequently, Y falls. Alternatively, increasing pe (starting on the Y = 0 locus and holding Y const.) increases p and thus reduces AD. ° ° ° 2. To the right of the pe = 0 locus, Y - Yn > 0 implying that pe > 0; recall: pe = a b Y - Yn . An alternative model structure