Stock Options Strategy Guide

advertisement

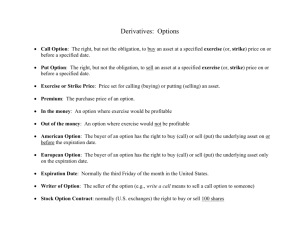

What are Options? An option is defined as the right, not the obligation, to buy (or sell) an asset at a fixed price before a predetermined date. Let's have a look at that definition and see if we can pick out the component parts: The right, not the obligation To buy or sell an asset At a fixed price Before a predetermined date These component parts have important consequences on the valuation of an option. Remember that the option itself has a value which we will look at after we finish with the definitions. Before we go ahead and look at the ways in which options are valued, let's consider the words "right not the obligation": The Right, not the Obligation Buying gives you the Right Buying an option (call or put) conveys the right, not the obligation to buy (call) or sell (put) an underlying instrument (eg a share). When you buy an option you are NOT obligated to buy or sell the underlying instrument - you simply have the right to do so at the fixed (Exercise or Strike) price. Your risk, when you buy an option, is simply the price you paid for it. Selling (naked) imposes the Obligation Selling an option (call or put) obliges you to buy (put) from or deliver (call) to the option buyer. Selling options naked (ie when you have not bought a position in the underlying instrument or an option to hedge against it) will give you an unlimited risk profile. Combined with the fact that you are obliged to do something, this is generally not a preferable position to put yourself in. Now let's consider the words "to buy or sell an asset": Types of Option - Calls and Puts Memory Tip Call is to Buy - think of calling up a friend - a call is the option to buy, you think the market is going up The real reason it is named a call is because when you buy a call you can "call" the underlying asset away from the person who sold it to you. Put is to Sell - think of a "put down" - a put is the option to sell, you think the market is going down The real reason it is named a put is because when you buy a put you can "put" the underlying asset to the person who sold it to you. 1 A CALL is an option to BUY A PUT is an option to SELL Therefore: A CALL option is the right, not the obligation to BUY an asset at a fixed price before a predetermined date A PUT option is the right, not the obligation to SELL an asset at a fixed price before a predetermined date Types of Calls and Puts Options can be either American Style or European Style. American Style options allow the option buyer to exercise the option at any time before the expiration date European Style options do NOT allow the option buyer to exercise the option before the expiration date. Most traded options are American Style and all US Equity options are American Style. American Style options are slightly more valuable than European Style options because of their added flexibility. Now we need to look at the words "at a fixed price": Exercise (or Strike) Price The Exercise (or Strike) Price is the fixed price at which the option can be exercised. So if you buy a call option which has a strike price of $50, then you have bought yourself the option to buy the asset at a price of $50. However, in the real world you only want to exercise your right to buy that asset at $50 if the underlying asset is actually worth more than $50 in the market. If the underlying asset is below $50, there is no point in doing so because you'd be exercising your right to buy the asset for $50, when it's only actually worth, say, $40. No-one would do that because they could buy it for $40 in the market. This leads us to the words "before a predetermined date" 2 Expiration Date This is the date before which the option can be exercised. At expiration, the call option is only worth the price of the asset less the strike price. At expiration the put option is only worth the strike price less the price of the asset. (For US Equity Options the Expiration Dates fall on the 3rd Friday of every month) Summary of Options Definition Stocks Options Stocks consist of individual shares which are units of ownership in a corporation or organization. Options are derivative instruments. In other words their value is derived from the underlying stock (or underlying asset). Options have expiration dates. This means that Individual shares go on in perpetuity options are wasting assets in that the passage of (unless the corporation goes bust or is time will erode that portion of the option's value taken over). They do not "expire" as such. as the expiration date looms. Stockholders are the owners of the company and have voting rights. Stockholders are also entitled to dividend payments as and when they are paid. Options convey no rights of ownership of the underlying asset. They merely convey the right to buy or sell the underlying asset. Why Options? You can trade options in order to accomplish a variety of investment objectives. Here are a few examples of how options can be useful coupled with examples of associated strategies: Rationale Example of a Strategy Insurance against existing positions Synthetic Call Collar Income enhancement Covered Call Naked Put Profit from declining stocks Profit from volatile stocks Long Put Straddle Strangle Profit from range-bound stocks 3 Rationale Example of a Strategy Butterfly Condor Invest in stocks by paying less out of your trading account Synthetic Future LEAPs You can also use options to apply longer-term strategies of up to 3 years for US stocks. LEAPs are Long Term Equity Anticipation Securities. In other words they are simply options with a longer time to expiration. LEAPs have expiration dates of up to 3 years away (from when they are first listed) and are available for over 300 individual stocks and a number of indices in the US. Risk Profile Charts In order to learn about options with maximum speed it's best to transform words and concepts into pictures. Do you know what buying an asset like a stock or a future looks like? In order to find out, we need to learn how to draw a Risk Profile Chart. This is the cornerstone on which we build far more complex strategies, so it's important to understand this. Unlike a standard price chart were the x axis represents time and the y axis represents price, a risk profile chart is structured as follows: Example - Consider buying a stock for $25.00: 1. The X-axis represents the stock price, with the price rising as the line moves right. 2. The Y-axis represents your profit/loss for the trade. 3. The 45�� diagonal line is your risk profile for the trade. As the price of the stock rises, so does your profit. So when the asset price rises to $50, you make $25 profit. Current Price - Buy Price = Profit (loss) $50.00 - $25.00 = +$25 $10.00 - $25.00 = ($15) 4 Long Stock Risk Profile Chart Steps to creating a Risk Profile Chart Step 1: Y axis for profit / loss position Step 2: X axis for underlying asset price range 5 Step 3: Breakeven line Step 4: Risk Profile line Short Stock Risk Profile Now you can see what buying a stock looks like, let's look at what "shorting" a stock looks like. Shorting just means selling something that you don't already own. Shorting is an accepted concept in some stock markets such as the US, but is not currently allowed in some other stock markets such as the UK. Remember that when you short you can lose an unlimited amount as the asset price rises, and your maximum profit is the shorted price, here, let's say $25.00. In order to make maximum profit from a short stock position, the asset would have to fall to zero. 6 Short Stock Risk Profile So, now you know how to draw the most basic risk charts, we can move to options risk profiles... Option Risk Profiles The importance of a risk profile chart becomes clearer when we look at options strategies. Consider a call option: A call option is the right, not the obligation, to buy an asset (eg a share) at a fixed price before a predetermined date. Let's say we want to buy a call option to buy a stock at $25.00 (strike price) before December (expiration date) and we pay $3.50 (premium) for this option. Call Option Risk Profile Put Option Risk Profile A put option is the right, not the obligation, to sell an asset (eg a share) at a fixed price before a predetermined date. Let's say we want to buy a put option to sell a stock at $25.00 (strike price) before December (expiration date) and we pay $3.50 (premium) for this option. 7 Put Option Risk Profile 4 Risk Profiles Long Call Buying a Call 1. belief that stock will rise (bullish outlook) 2. risk limited to premium paid 3. unlimited maximum reward 8 Short Call Writing a Call 1. 2. 3. 4. belief that stock will fall (bearish outlook) maximum reward limited to premium received risk potentially unlimited (as stock price rises) can be combined with another position to limit the risk Long Put Buying a Put 1. belief that stock will fall (bearish outlook) 2. risk limited to premium paid 3. unlimited maximum reward up to the strike price less the premium paid 9 Short Put Writing a Put 1. 2. 3. 4. belief that stock will rise (bullish outlook) risk unlimited down to the Strike Price less the premium received maximum reward limited to the premium received can be combined with another position to limit the risk Long Call Risk Profile We already know that a call option is the right to buy an asset. Logically, this suggests that the call option risk profile direction will be similar to that of buying the asset itself. So let's have a look at an example: Stock Price $56.00 Call Premium $7.33 Exercise Price $50.00 Time to Expiration 2 months Remember that: 10 Buying gives you the Right Buying a call option gives you the right, not the obligation to buy an underlying instrument (eg a share). When you buy a call option you are not obligated to buy the underlying instrument you simply have the right to do so at the Strike Price. Your maximum risk, when you buy an option, is simply the price you paid for it. Your maximum reward is uncapped. Short Call Risk Profile For every call that you buy, there is someone else on the other side of the trade. The seller of an option is called an option writer. Logic and common sense tell us that the option seller's risk profile must be different to that of the option buyer. Stock Price $56.00 Call Premium $7.33 Exercise Price $50.00 Time to Expiration 2 months Remember that we already discussed the implications of selling an option - here's a reminder: Selling (naked) imposes the Obligation Selling a call obliges you to deliver the underlying asset to the option buyer. Selling options naked (ie when you have not bought a position in the underlying instrument or an option to hedge against it) will give you an unlimited risk profile. The continuous downward diagonal line is generally a bad sign because it means unlimited potential risk. Combined with the fact that you are obliged to do something, this is not an ideal strategy for the inexperienced, however it can be combined with other positions to create a new strategy. 11 Long Put Risk Profile So, now you know what long and short calls look like, let's look at the risk profile of a put option. We already know that a put option is the right to sell an asset. Logically, this suggests that the put option risk profile direction will be the opposite to that of calls or buying the asset itself. So, again, let's have a look at an example: Stock Price $77.00 Put Premium $5.58 Exercise Price $80.00 Time to Expiration 4 months Remember that: Buying gives you the Right Buying a put gives you the right, not the obligation to sell an underlying instrument (eg a share). When you buy a put you are not obligated to sell the underlying instrument - you simply have the right to do so at the Strike Price. Your maximum risk, when you buy an option, is simply the price you paid for it. Your maximum reward is uncapped. With long puts your reward is uncapped to the downside, ie the strike price less the put premium. In this example that is: $80.00 $5.58 = $74.42. For every put that you buy, there is someone else on the other side of the trade. The seller of a put option is will have a different risk profile to that of the put option buyer. 12 Short Put Risk Profile Stock Price $77.00 Put Premium $5.58 Exercise Price $80.00 Time to Expiration 4 months Remember that we already discussed the implications of selling an option - here's another reminder for puts: Selling (naked) imposes the Obligation Selling a put obliges you to buy the underlying asset to the option buyer. Remember, when you sell a put, you have sold the right to sell to the person who bought that put. Selling options naked (ie when you have not bought a position in the underlying instrument or an option to hedge against it) will give you an unlimited risk profile. The continuous downward diagonal line is generally a bad sign because it means uncapped risk. Combined with the fact that you are obliged to do something, this is not an ideal strategy for the inexperienced. 13 Risk Profiles Summary You have now learned what the essential risk profiles look like and what they mean to you in terms of maximum risk and reward. Profile Description Max Risk Buy Asset purchase price Sell Asset uncapped Buy Call call premium Sell Call uncapped Buy Put put premium Sell Put strike price less put premium received Max Reward Breakeven uncapped short sale price purchase price short sale price strike price plus call premium paid strike price plus call call premium received premium received uncapped strike price less put premium paid strike price less put premium paid strike price less put put premium received premium received ITM, OTM and At the Money (ATM) Calls ITM where the current stock price is above the call strike price ATM where the current stock price is equal to or near to the call strike price OTM where the current stock price is below the call strike price 14 ITM, OTM and ATM Puts ITM where the current stock price is below the put strike price ATM where the current stock price is equal to or near to the put strike price OTM where the current stock price is above the put strike price Intrinsic and Time Value for Calls - Example 1: ITM Call Intrinsic Value Stock Price Call Premium Exercise Price Time to Expiration $56.00 $7.33 $50.00 2 months Call Time Value Stock Price Call Premium Exercise Price Time to Expiration Intrinsic Value $56.00 - $50.00 = $6.00 Time Value Notice how [Intrinsic Value + Time Value] = the Option Value $56.00 $7.33 $50.00 2 months $7.33 - $6.00 = $1.33 Formulae for Intrinsic and Time Values for Calls: Call Intrinsic Value = Stock Price - Exercise Price Call Time Value = Call Premium - Call Intrinsic Value The minimum Intrinsic Value is zero. Intrinsic and Time Value for Calls - Example 2: OTM Call Intrinsic Value Stock Price Call Premium Exercise Price Time to Expiration Intrinsic Value $48.00 $0.75 $50.00 2 months $48.00 - $50.00 = $0.00 Call Time Value Stock Price Call Premium Exercise Price Time to Expiration Time Value $48.00 $0.75 $50.00 2 months $0.75 - $0.00 = $0.75 Notice how [Intrinsic Value + Time Value] = the Option Value 15 Formulae for Intrinsic and Time Values for Calls: Call Intrinsic Value = Stock Price - Exercise Price Call Time Value = Call Premium - Call Intrinsic Value The minimum Intrinsic Value is zero. Intrinsic and Time Value for Puts - Example 3: ITM Put Intrinsic Value Stock Price Put Premium Exercise Price Time to Expiration $77.00 $5.58 $80.00 4 months Put Time Value Stock Price Put Premium Exercise Price Time to Expiration Intrinsic Value $80.00 - $77.00 = $3.00 Time Value Notice how [Intrinsic Value + Time Value] = the Option Value Formulae for Intrinsic and Time Values for Puts: $77.00 $5.58 $80.00 4 months $5.58 - $3.00 = $2.58 Put Intrinsic Value = Exercise Price - Stock Price Put Time Value = Put Premium - Put Intrinsic Value The minimum Intrinsic Value is zero. Intrinsic and Time Value for Puts - Example 4: OTM Put Intrinsic Value Stock Price Put Premium Exercise Price Time to Expiration Intrinsic Value $85.00 $1.67 $80.00 4 months $80 - $85.00 = $0.00 Put Time Value Stock Price Put Premium Exercise Price Time to Expiration Time Value $85.00 $1.67 $80.00 4 months $1.67 - $0.00 = $1.67 Notice how [Intrinsic Value + Time Value] = the Option Value Formulae for Intrinsic and Time Values for Puts: Put Intrinsic Value = Exercise Price - Stock Price Put Time Value = Put Premium - Put Intrinsic Value The minimum Intrinsic Value is zero. 16 The 7 Factors affecting the Pricing of Options Premiums 1. 2. 3. 4. 5. 6. 7. Type of option (call or put) The current Price of the underlying asset The Exercise (Strike) Price Time remaining to Expiration Volatility of the underlying asset The Dividend payable on the underlying asset Current Interest Rates (the risk free 90 day T-Bill rate) Put / Call Parity Explained Call prices, Put prices and the associated asset prices are all related to each other. This must be the case or else professional traders would be able to arbitrage (make risk free trades). Put-call parity is a fundamental relationship that must exist between the prices of a put option and call option if both have the same underlying asset, Strike Price and Expiration Date. The Put-call parity model is based on expiration date investment values associated with 4 different securities: 1. 2. 3. 4. A call option; A put option with identical terms; The underlying asset for the above call and put; A risk-free security with the same maturity date as the options' Expiration Date and with an expiration payoff equal to the options' Strike Price. Put-call parity is used for 2 purposes: 1. To value a call option relative to a put with identical terms. 2. To show how the Expiration Date payoffs on any one of these 4 securities can be replicated by taking appropriate positions in the other 3 securities (ie creating synthetic positions). 17 Contracts Options are traded in contracts, not as individual derivative units. Each contract represents a certain number units of the underlying asset. This number is different for different types of asset worldwide. Therefore, when you see a US Equity call option price of, say, $1.45, you will have to pay $1.45 * 100 for just 1 contract. 1 contract is the minimum amount you can trade and for US Equity Options 1 contract represents 100 individual shares. The following table outlines the amount of underlying securities that represent 1 contract for a few different markets where options are traded on an exchange: Underlying Asset Units per Options Contract US Equities 100 shares S&P Futures 250 units UK Equities 1,000 shares Therefore, when you trade a Covered Call you are only "covered" if you are trading the same number of units on each leg of the trade. For Example: If you are wanting to sell 3 contracts of MSFT $80 strike calls at $3.50, you will receive a premium (before commissions) of $1,050. But you will need to buy 300 MSFT shares in order to be "covered". This will be at a cost of 300 * the MSFT share price. Margin Margin is the mechanism by which you can borrow funds from your broker account but you are required to cover your potential risk liability with liquid assets in your account. This is particularly relevant to those traders who sell short, sell naked or trade net credit spreads. When you sell short, sell naked or trade a net credit spread, whilst money is deposited into your account, there is still (in most cases) a contingent liability risk which must be covered by sufficient funds in your account. These funds can either be represented in cash or "marginable securities". A marginable security is defined as an asset which is deemed by the brokerage to be secure enough to stand as collateral against your risk on the trade. A stock like MSFT may well be considered as a marginable security, whilst low priced stocks (under $10) with little trading history, low trading volumes, poor liquidity and high volatility may not be considered as acceptable collateral. Remember that in many cases of selling short and selling naked, your potential risk liability may be unlimited (or at least substantial). Using the Strategy Analyzers to determine your risk profile will help you to identify those situations where your risk potential is unacceptably high, depending on your own personal appetite for risk. 18 Placing your Order Trades can be placed either online of offline, depending on your broker account. Use the Strategy Guides to assist you in placing your spread orders over the telephone quickly, efficiently and accurately. By knowing what to say and how to say it clearly, concisely and correctly you will help save both your time, the broker's time and ensure that there are no misunderstandings. Make sure you fill in the right figures and have them in writing before picking up the phone to place your order. Then simply read out the order to the broker with your limit order prices. Because options prices are not always "clean", it is preferable to place a Limit Order, particularly on spreads. This will ensure that you will be filled at your specified price or not at all. By using the Limit Order function you can overwrite the market prices in order to base your calculations on your preferred limit order on any strategy and then see the results of your limit order risk profile. Trading Tips The most important things you need to know about any trade you ever do are: Your maximum risk on the trade Your maximum reward on the trade Your breakeven point(s) The Strategy Analyzers give you these crucial figures in both nominal and actual formats for over 60 different strategies. In addition, you also should know in advance: The maximum loss you will accept and when to get out of a loss making trade When to take your profits These are crucial money management criteria, which you must determine in your own mind before you start trading. There are wide parameters concerning money management techniques and much depends on your own appetite and respect for risk. Just keep in mind that it is generally a good thing to cut your losses short and to let your profits run. Expiration Figures courtesy of CBOE (www.cboe.com) Many people believe that 90% of options expire worthless (ie no Intrinsic Value at expiration). Figures from the CBOE indicate that in fact only 30% of actively options expire worthless in each monthly cycle. Only 10% of options are exercised during each monthly cycle. Usually this happens in the final week before the expiration date. (CBOE) Over 60% of all options positions are closed out in the market before expiration. In other words option buyers sell to close their positions and option writers (sellers) buy back to close their positions. (CBOE) 19 Exercise and Assignment Exercising Calls Means you buy the underlying stock at the Strike Price Exercising Puts Means you sell the underlying stock at the Strike Price The process for exercising your options is as follows: 1. notify your broker 2. your broker notifies the Options Clearing Corporation (OCC) 3. the OCC randomly chooses a brokerage firm with the appropriate short options in the same class and series 4. the brokerage firm randomly calls one of its customers with the relevant short options position and delivers an Assignment Notice informing them that the option owner has exercised their right to buy (call) or sell (put) 5. the stock transaction is processed Understanding Option Symbols Option Symbols Options have ticker symbols just like stocks do. The symbol accurately identifies the underlying, the expiration month, the strike price, and the type of option. A series of letters identify the option. They appear in the order of Root, Expiration month, and Strike price. The letter that is used for expiration month is also used to identify whether the option is a call or a put. The first letter or group of letters (up to 3) identify the underlying and is called the root. It is not the same as the stock symbol, although it can be. Microsoft has the stock symbol of MSFT. But since that's more than 3 letters, a root symbol is devised by the standardizing authority and a group of 3 letters is used. MSQ is the primary root for Microsoft. There can be others under certain conditions, but for now let's keep it simple. The root for Microsoft is MSQ. The next to the last letter in an option symbol indicates the expiration month. If the option is a call then the first half of the alphabet is used. If the option is a put then the last half of the alphabet is used. The table below illustrates the codes. 20 Expiration Month Codes Calls Puts Jan Feb A B M N Mar C O Apr D P May E Q Jun Jul Aug F G H R S T Sep I U Oct Nov J K V W Dec L X The last letter of the option symbol indicates the strike price. Again there are codes to decipher the strike price. Strike Price Codes A 5 105 205 305 N 70 170 270 370 B 10 110 210 310 O 75 175 275 375 C 15 115 215 315 P 80 180 280 380 Q 85 185 285 385 D 20 120 220 320 R 90 190 290 390 E 25 125 225 325 S 95 195 295 395 F 30 130 230 330 T 100 200 300 400 G 35 135 235 335 U 7.50 37.50 67.50 97.50 H 40 140 240 340 V 12.50 42.50 72.50 102.50 I 45 145 245 345 W 17.50 47.50 77.50 107.50 J 50 150 250 350 K 55 155 255 355 X 22.50 52.50 82.50 112.50 L 60 160 260 360 Y 27.50 57.50 87.50 117.50 M 65 165 265 365 Z 32.50 62.50 92.50 122.50 By using the above information we can decipher the option symbol MSQLM: The MSQ is the Root identifying Microsoft, the "L" is for the month of December and it also let's us know that the option is a call option. The last letter "M" tells us the option is for the 65 strike price. Don't worry about remembering or memorizing all the codes. They are readily available and easily obtained when you need them. One more example, let's examine the option symbol CAH: The last letter tells us the strike. You have an idea where a stock trades to know the strike. For instance, the letter "B" could be for the strike price of 40, 140, 240, 340, etc. In this case the letter "H" is for the strike price of 40. The letter "A" is for the month of January and indicates a call; And the letter "C" is the root symbol for the stock of Citicorp as well as the stock symbol. 21 Introduction Options "Greeks" are sensitivities of the option to various exposures of risk including time decay and volatility. The names are taken from the actual Greek names. Greek Delta Δ Gamma Γ Theta Θ Vega Κ Rho Ρ Zeta Ζ Sensitivity to Change in option price relative to change in underlying asset price (ie Speed) Change in option Delta relative to change in underlying asset price (ie Acceleration) Change in option price relative to change in time left to expiration (ie Time Decay) Change in option price relative to the change in the asset's volatility (ie Historical Volatility) Change in option price relative to changes in the Risk Free Interest Rate (ie Interest Rates) Percent change in option price per 1% change in implied volatility (ie Implied Volatility) Delta - Δ The Basics The option delta is the rate of change of the option price compared with the rate of change of the underlying asset price. In other words delta measures the speed of the option position compared with that of the underlying asset. Delta = rate of change in Option price rate of change in underlying asset price When the asset price is At the Money (ATM) the delta value will be around 0.5 (as a general rule). This means that for every $1 the stock moves, the option will move at a speed of around half of that. Obviously as the asset price deviates away from the ATM point, then the delta will change too, away from 0.5. ATM = +/- 50 deltas, ie moves at half the speed of the underlying asset Remember that 1 share has a delta of +/- 1, and 1 option contract represents 100 shares, therefore 1 ATM option will have a delta of +/- 50. You can think of delta as being the probability of the option expiring In the Money. So a delta of +/- 50 is saying the option has a 50/50 chance of expiring In the Money. Example If you buy 100 shares of AMZN (+100 deltas), you would need to buy 2 ATM Puts (-50 deltas each) for a Delta Neutral Position. 22 Delta Neutral Trading Remember that Delta means speed. The greater the leverage of your position, the greater potential exposure to speed. For example, if you buy a call option, the underlying stock may increase by 10% whilst your call option may increase by 100%. This leverage is great when it's in your favour, but not so good when it's against you. Taking the same example, if you buy a call and the underlying stock decreases by 10%, your call options may decrease in value by near 100%. This risk needs to be hedged. The term "hedge" is associated with the process of reducing risk. Delta Neutral Trading is a vast topic in itself, which will be covered in Special Article sessions within this site. It is a method of trading whereby your position delta on the totality of your spread trade is one where the sum of the deltas equals zero. The idea is that this conveys a "hedged" position, whereby the risk is reduced. Delta Neutral Traders do this on the basis that they can continually make profitable adjustments to their trade as the asset price fluctuates. The adjustments (usually selling part of the profitable side) bring the spread trade back to a delta neutral position (ie where the sum of the deltas for that position equals zero), whilst also capitalising on profitable side of the trade. A popular technique is to make the profitable adjustments back to delta neutral when the underlying asset has moved by 20% in either direction. Remember that Delta Neutral does NOT mean risk free! Deltas are NOT linear. Other points to remember Delta Neutral still requires you to manage the Time Decay. Longer term options will generally have lower deltas to shorter term options. Your position Delta on your trade is also known as your "Hedge Ratio". Delta is principally affected by Time left to expiration and Price of the underlying asset. Some futures Delta neutral trades can require no margin sometimes (and with certain brokers) With calls, Delta increases as the underlying asset price increases. Call deltas are always positive. Note that when you sell a call (naked) your position is delta negative. With puts, Delta decreases as the underlying asset price decreases. Put deltas are always negative. Note that when you sell a put (naked) your position is delta positive. 23 Delta Trading TRADE (US stock options) Buy 1 share Sell 1 share Buy ATM call Buy Call Sell ATM call Sell Call Buy ATM put Sell ATM put Buy Put Sell Put ATM Straddle ATM Strangle Bull spreads Bear spreads DELTA COMMENT (+ or -) +1 Buying a share has a delta of +1 -1 selling a share has a delta of -1 Why +50? Because 1 stock option contract represents 100 +50 shares. So 100 * 0.5 = +50 + A long call always has a positive delta Why -50? Because 1 stock option contract represents 100 -50 shares. So 100 * -0.5 = -50 A short call always has a negative delta Why -50? Because 1 stock option contract represents 100 -50 shares. So 100 * -0.5 = -50 Why +50? Because 1 stock option contract represents 100 +50 shares. So 100 * 0.5 = +50 A long put always has a negative delta + A short put always has a positive delta The long call delta and long put delta effectively cancel each 0 other out The long call delta and long put delta effectively cancel each 0 other out With a Bull Call Spread, the long call has a higher delta than the short call. With a Bull Put Spread, the short put has a + higher negative delta than the long put, but remember that because you're selling it, 2 minuses make a plus. With a Bear Call Spread, the short call has a higher delta than the long call, but the delta is negative because you're selling it. With a Bear Put Spread, the long put has a higher negative delta than the short put. Example: (Bull Call spread) XYZ = $100 Buy 10 Jan 100c Sell 10 Jan 105c Delta = +500 Delta = -470 (say) Hedge Ratio = +30 24 Why Does Speed Matter? Example You buy 100 shares of a stock. Each $1.00 your stock rises, you make $100 * $1.00 = $100. Each $1.00 your stock falls, you lose $100. Alternatively, by buying call options you could make $300 when your stock rises by $1.00? However, you can also lose $300 for every dollar the stock falls? This is the concept of leverage. You buy a stock at $50.00. Buying 100 shares costs you $5,000. Let's compare this to buying the equivalent in call options: 1 contract at $7.00 will cost you $700. (remember that 1 contract represents 100 shares for US stocks) For illustration purposes only , let's say that your Delta is 1, ie for every one point the stock moves, the call option you've bought also moves by 1 point. If the stock rises from $50 to $55: Your shares will increase by $5.00 per share and you'll make $500 in extra profit, a profit of 10%. Your calls will increase by $5.00 and you'll make $500 in profit, a profit of over 170%. If the stock falls from $50 to $45: Your shares will decrease by $5.00 per share and you'll lose $500, a loss of 10%. Out of the $5,000 you started with, you now have $4,500. Your options will decrease by $5.00 and you'll lose $500, a loss of over 70%. Out of the $700 you started with, you now only have $200. Can you now see why we might want to do something about the speed of the options price movements and why we might want to offset (or hedge) Delta? When we buy an option, we always want enough time to be right. We also want to make sure that modest swings in the stock price aren't causing uncomfortably fast and wild movements in our options position. This is why we want to hedge Delta, or in other words, slow down the speed of the percentage movement of our options position compared with that of the underlying asset. 25 Delta Picture Summary Figures assume trading 1 contract Gamma - Γ Gamma measures Delta's sensitivity to changes in the stock price, in other words "the speed of speed" or acceleration of the options position. Gamma = rate of change in Delta rate of change in underlying asset price By knowing the Gamma of an option, we know how quickly the Delta will change and how quickly we should adjust our position in advance of this. Gamma is significant because it helps the trader measure risk, particularly for Delta Neutral Traders. Gamma effectively shows us how quickly the odds change of the option expiring in the money. Gamma tends to be large when the option is Near the Money (NTM). This means that the Delta is highly sensitive (when the option is NTM) to changes in the stock price. In other words the odds of the option changing from being OTM to ITM or vice versa are high. Therefore, it is logical that ATM options have higher Gammas. When options are Deep In the Money (DITM), the Delta is close to 1 and is not too sensitive itself to changes in the underlying asset price. Therefore, the Gamma of DITM options is low. Similarly, Gamma is low for Deep Out of the Money (DOTM) options. The Gamma for puts and calls is always identical and can be positive or negative. Underlying Asset Price ATM NTM Deep ITM Deep OTM Delta Around 0.5 Around 0.5 Around 1 (high) Low Gamma High High Low Low 26 Gamma Picture Summary Theta - Θ Theta is the measure of how Time Decay affects the option premium. We already know that the shorter the time to expiration, the lower the Time Value of an option, therefore the lower the time value portion of the option price will be. 4 ways to combat Theta (Time) Decay 1. sell off any ATM or OTM options with 30 days left to expiration - do not hold options into the last month 2. sell options as an adjustment to existing positions 3. sell options you don't own as an adjustment to existing positions 4. buy short-term DITM options, which have plenty of Intrinsic Value and virtually no Time Value - if there is no Time Value, then it can't decay any further, can it?! 27 Theta Picture Summary Vega - Κ (also known as Kappa or Lambda) When you trade stocks, you must be aware of volatility. Volatility is also recognised as risk. Higher volatility is predicated by larger price fluctuations, which translates into greater risk. The greater the volatility and risk, the higher the options premiums will be. Volatility is expressed as a percentage, reflecting the average or expected price change (regardless of the direction). If a stock is currently priced at $100 and has a (Historical) Volatility of 20%, then that stock will be expected to trade within the range of $80 - $120. Vega measures an option's sensitivity to Historical Volatility (measured by standard deviation) of the underlying asset price. Vega is always positive and is identical for both calls and puts. 28 Implied and Historical Volatility There are two types of Volatility that you need to understand for options trading: Historical Volatility and Implied Volatility. Remember that there are 7 variables that affect an option's premium. Six of these variables are known with certainty: (1) stock price; (2) strike price; (3) type of option; (4) time to expiration; (5) interest rates; (6) dividends. The final variable is not known with certainty and is the expected volatility of the stock. This expected volatility figure is expressed as an annualised standard deviation and, working back from the option premium itself, is an "implied" figure, hence Implied Volatility. Historical Volatility is the annualized standard deviation of past price movements of the stock. We use Historical Volatility as a reference figure for calculating what the Fair Value of the option should be, given the stock's Historical Volatility. In the real world, option premiums frequently trade away from their fair values. Volatility Historical (or Statistical) Implied Look for Implied > Historical Historical > Implied Based on the underlying asset volatility over past (20-23 trading days is popular) Expressed as a % reflecting the average annual range (ie standard deviation) Based on the option's actual price (premium), expressed as a % and based on the perception of where market will be in the future This is the volatility figure derived from the Black-Scholes options pricing formula Comment Options prices could be overvalued as a result of higher implied volatility (look to sell options) Options prices could be undervalued, indicating good buying opportunities, particularly if you anticipate asset price movement Generally, Implied Volatility will veer towards Historical over the medium to longer term - this is known as the "Rubber Band Effect" Bollinger Bands are a good visual representation of volatility 29 About Volatility Q. What does Historical Volatility mean? A. It is a reflection of how the underlying asset has moved in the past (often 20-23 trading days) Example: XYZ = $200 and has Historical Volatility of 10% Volatility Smiles and Skews Volatility Smile A Volatility Smile occurs where the Near the Money options have lower Implied Volatility than the Deep ITM and Deep OTM options. When plotted on a chart, the Implied Volatility against strike price graph appears to be in the shape of a smile. It is not always clear why this occurs, but factors can include illiquidity leading to mispricing for Deep ITM and Deep OTM options. 30 Volatility Skew A Volatility Skew occurs where there is a difference in Implied Volatility between OTM calls and puts. The reasons for Volatility Skew are not always obvious, however, factors include market sentiment and supply and demand. Vega Picture Summary Rho - Ρ Rho is the measure of an option's sensitivity to a 1% move in the Risk Free Interest Rate. Call Rho is always positive (helpful) and Put Rho is always negative (unhelpful). Even large changes in interest rates have relatively little effect on options prices. Rho is generally considered to have the least impact of the options Greeks, particularly in a low interest rate environment. Rho Picture Summary 31 Stock Options Strategy Guides Stock Options Strategy Guide - Straddle Description Buy ATM put Buy ATM call Straddle Steps to trading a Straddle 1. Buy a put; 2. Buy a call with the same expiration date and same strike price. Steps In Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV) Actively seek chart patterns which appear like pennant formations, signifying a consolidating price pattern Try to concentrate on stocks with news events and earnings reports about to happen within 2 weeks Avoid stocks under $20.00 You need adequate space for a big move in either direction. Use the Analyzer to verify current market data and calculations Steps Out Manage your position according to the rules defined in your Trading Plan Exit either a few days after the news event occurs where there is no movement, or after the news event where there has been profitable movement. If the stock thrusts up, sell the call (making a profit for the entire position) and wait for a retracement to profit from the put If the stock thrusts down, sell the put (making a profit for the entire position) and wait for a retracement to profit from the call Never hold into the last month Your Outlook With Straddles, your outlook is direction neutral but you are looking for increasing volatility with the stock price moving explosively in either direction. Rationale To execute a neutral trade for a capital gain whilst expecting a surge in volatility. Ideally you are looking for a scenario where Implied Volatility is currently very low, giving you low option prices, but the stock is about to make an explosive move - you just don't know which direction. 32 Net Position This is a net debit trade. Your maximum risk on the trade itself is limited to the net debit of the bought calls and puts. Your maximum reward is potentially unlimited. Effect of Time Decay Time decay is harmful to your Straddle trade. Never keep a Straddle into the last month preceding expiration because this is the time when time decay accelerates the fastest. Appropriate Time Period to Trade You want to combine safety with prudence on cost. Therefore the optimum time period to trade straddles is with 3 months till expiration, but if the stock has not moved decisively sell your position when there is one month to expiration. NEVER HOLD A STRADDLE INTOTHE LAST MONTH. Selecting the Stock Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV) Actively seek chart patterns which appear like pennant formations, signifying a consolidating price pattern Try to concentrate on stocks with news events and earnings reports about to happen within 2 weeks Avoid stocks under $20.00 You need adequate space for a big move in either direction. Use the Analyzer to verify current market data and calculations Selecting the Option Choose options with adequate liquidity, open interest should be at least 100, preferably 500 Strike: ATM for call and put Expiration: preferably around 3 months. Same expiration for both legs. Maximum Risk Maximum Reward Breakeven to the Downside Breakeven to the Upside Limited to the net debit paid Uncapped strike price plus net debit strike price less net debit 33 The Greeks Expiration Today - 3 months Time(t) - 1 month Theta Time Decay is most harmful to the position at the strike where the position is unprofitable. Delta Vega Delta (speed) is at its greatest when the position is deep ITM on either side. The position is Delta Neutral around the strike price Volatility is most helpful to the position at the strike where the position is most unprofitable. Gamma Rho Gamma (acceleration) peaks at the strike price, illustrating the position's turning point and Higher interest rates are generally helpful to Delta's fastest rate of change. Gamma slows to the position when the underlying stock price zero when the position is deep ITM on either is above the strike price and vice versa. side. Exiting the Position With this strategy you can simply unravel the spread by selling your calls and puts. You can also exit just your profitable leg of the trade and hope that the stock retraces to favour the unprofitable side later on. For example if the share has moved decisively upwards, thus making the call profitable, you will sell the calls, make a profit on the entire trade, but you will be left with almost valueless puts. Having now sold the calls you will hope that the stock may retrace and enhance the value of the puts you are still holding, which you can then sell. Mitigating a loss Sell the position if you only have one month left to expiration. Do not hold on in hope because you risk losing your entire stake. Advantages Profit from a volatile stock moving in either direction Capped risk 34 Uncapped profit potential if the stock moves Disadvantages Expensive - you have to buy the ATM call and put Significant movement of the stock and option prices required to make a profit Bid / Ask Spread can adversely affect the quality of the trade Psychologically demanding strategy Notes It is preferable to enter Straddles shortly before earnings announcements In a perfect Straddle world you'll find options that are trading at lower than their average Implied Volatility levels but where you expect increasing volatility levels for the duration of your trade. Typically, we're looking for pennant formations or consolidation patterns on the daily charts, with the expectation that there will be a price breakout. 90 day rule: look for the cost of the Straddle to be less than half the difference between the highest high and lowest low during the last 3 trading months. Stock Options Strategy Guide - Strangle Description Buy OTM lower strike put Buy OTM higher strike call Strangle Steps to trading a Strangle 1. Buy a put; 2. Buy a call with the same expiration date but a HIGHER strike price. Steps In Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV) Actively seek chart patterns which appear like pennant formations, signifying a consolidating price pattern Try to concentrate on stocks with news events and earnings reports about to happen within 2 weeks Avoid stocks under $20.00 You need adequate space for a big move in either direction. Use the Analyzer to verify current market data and calculations Steps Out Manage your position according to the rules defined in your Trading Plan 35 Exit either a few days after the news event occurs where there is no movement, or after the news event where there has been profitable movement If the stock thrusts up, sell the call (making a profit for the entire position) and wait for a retracement to profit from the put If the stock thrusts down, sell the put (making a profit for the entire position) and wait for a retracement to profit from the call Never hold into the last month Your Outlook With strangles, your outlook is direction neutral but you are looking for increasing volatility with the stock price moving decisively in either direction. Rationale To execute a neutral trade for a capital gain whilst expecting a surge in volatility. Ideally you are looking for a scenario where Implied Volatility is currently very low, giving you low option prices, but where the stock is about to make an explosive move - you just don't know which direction. Strangles are cheaper than Straddles because you are buying OTM options on both sides, as opposed buying ATM options (as with Straddles). This also has the effect of widening your breakeven points. Net Position This is a net debit trade. Your maximum risk on the trade itself is limited to the net debit of the bought calls and puts. Your maximum reward is potentially unlimited. Effect of Time Decay Time decay is harmful to your Strangle trade. Never keep a Strangle into the last month preceding expiration because this is the time when time decay accelerates the fastest. Appropriate Time Period to Trade You want to combine safety with prudence on cost. Therefore the optimum time period to trade strangles is with 3 months till expiration, but if the stock has not moved decisively sell your position when there is one month to expiration. NEVER HOLD A STRANGLE INTO THE LAST MONTH. Selecting the Stock Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV) Actively seek chart patterns which appear like pennant formations, signifying a consolidating price pattern 36 Try to concentrate on stocks with news events and earnings reports about to happen within 2 weeks Avoid stocks under $20.00 You need adequate space for a big move in either direction. Use the Analyzer to verify current market data and calculations Selecting the Option Choose options with adequate liquidity, open interest should be at least 100, preferably 500 Put Strike: below the current stock price Call Strike: above the current stock price Expiration: preferably around 3 months. Same expiration for both legs. Maximum Risk Maximum Reward Breakeven to the Downside Breakeven to the Upside Limited to the net debit paid Uncapped Lower (put) strike less net debit paid Higher (call) strike plus net debit paid The Greeks Expiration Today - 3months Time(t) - 1 month Theta Time Decay is most harmful to the position between the strikes where the position is at its most unprofitable. Delta Vega Delta (speed) is at its greatest when the position is deep ITM on either side. The position is Delta Neutral between the strike prices Volatility is most helpful to the position between the strikes where the position is at its most unprofitable. Gamma Rho Gamma (acceleration) peaks around the Higher interest rates are generally helpful to 37 strikes, illustrating the position's turning area and Delta's fastest rate of change. Gamma slows to zero when the position is deep ITM on either side. the position when the underlying stock price is above the mid point between the strikes and vice versa. Exiting the Position With this strategy you can simply unravel the spread by selling your calls and puts. You can also exit just your profitable leg of the trade and hope that the stock retraces to favour the unprofitable side later on. For example if the share has moved decisively upwards, thus making the call profitable, you will sell the calls, make a profit on the entire trade, but you will be left with almost valueless puts. Having now sold the calls you will hope that the stock may retrace and enhance the value of the puts you are still holding, which you can now sell. Mitigating a loss Sell the position if you only have one month left to expiration. Do not hold on in hope because you risk losing your entire stake. Advantages Profit from a volatile stock moving in either direction Capped risk Uncapped profit potential if the stock moves Cheaper than a Straddle Disadvantages Significant movement of the stock and option prices required to make a profit Bid / Ask Spread can adversely affect the quality of the trade Psychologically demanding strategy Notes It is preferable to enter Strangles shortly before earnings announcements In a perfect Strangle world you'll find options that are trading at lower than their average Implied Volatility levels but where you expect increasing volatility for the duration of your trade. Typically, we're looking for pennant formations or consolidation patterns on the daily charts, with the expectation that there will be a price breakout. 38 Stock Options Strategy Guide - Long Call Description Steps to buying a call 1. Buy the call Remember that for option contracts in the US, one contract is for 100 shares. So when you see a price of $1.00 for a call, you will have to pay $100 for one contract. For option contracts in the UK, one contract is for 1,000 shares, so if the option price is $1.00 you will pay $1,000 for one contract. For S&P Futures options, one contract is for 250 futures, so if the option price is $1.00, you will pay $250 for one contract. Steps In Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV) Try to ensure that the trend is upward and identify a clear area of support Use the Analyzer to verify current market data and calculations Steps Out Manage your position according to the rules defined in your Trading Plan Do not keep the position into the final month before expiration If the stock falls below your stop loss, then exit by selling the calls. Your Outlook Bullish - you are expecting a rise in the stock price Rationale To make a better return than if you had simply bought the stock itself. Do ensure that you give yourself enough time to be right; this means you should go AT LEAST 6 months out, if not 1 or 2 year LEAPs. If you think these are expensive, then simply divide the price by the number of months left to expiration, and then compare that to shorter term option prices. You will see that LEAPs and longer term options are far better value per month and they give you more time to be right, thus improving your chances of success. Another method is to buy only deep ITM options. 39 Net Position This is a net debit trade because you are paying for the call option Your maximum risk is limited to the price you pay for the option Your maximum reward is unlimited Effect of Time Decay Time works against your bought option. So give yourself enough time to be right. Don't be fooled by the false economy that shorter options are cheaper. Compare a one month option to a 12 month option and divide the longer option price by 12. You will see that you are paying far less per month for the 12 month option. Give yourself time to be right; this means at least 3 months, preferably more. Appropriate Time Period to Trade 6 months minimum 12 months is better 24 months or more is the safest Selecting the Stock Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV) Try to ensure that the trend is upward and identify a clear area of support Use the Analyzer to verify current market data and calculations Selecting the Option Choose options with adequate liquidity, open interest should be at least 100, preferably 500 Strike: look for look for either the ATM or ITM (lower) strike below the current stock price Expiration: give yourself enough time to be right; remember that time decay accelerates exponentially in the last month before expiration, so give yourself a minimum of 3 months to be right, knowing you'll never hold into the last month. That gives you at least 2 months to be right, though preferably you'll choose over 6 months to expiration. Maximum Risk Maximum Reward Breakeven Limited to the amount you pay for the call option (premium) Uncapped The call exercise (strike) price plus the premium you paid for it 40 The Greeks Expiration Today - 6 months Time(t) - 1 month Theta Theta is negative, illustrating that Time Decay is harmful to the position. Notice how Theta Decay is at its most harmful when the position is ATM. Delta Vega Delta (speed) is positive and rises as the asset price rises above the strike price. Notice how Delta is zero when the position is Deep OTM, accelerates exponentially when the position is ATM, and stabilises to one (per contract) when the position is Deep ITM. Gamma Vega is positive, illustrating that volatility is helpful to the position. Notice how volatility is at its most helpful when the position is ATM. Rho Gamma (acceleration) is always positive with a Long Call and peaks when the position is ATM. Notice how Gamma is lower when the position is deep ITM or OTM. Rho is positive, illustrating that higher interest rates would be helpful to the position. Exiting the Position Sell the options you bought Mitigating a loss Use stop losses Advantages Cheaper than buying the stock outright Leverage of returns Flexibility of strikes and expirations Capped downside Disadvantages Potential 100% loss if badly chosen strike and expiration. Give yourself enough time to be right and do not buy OTM. High leverage can be dangerous if the stock falls 41 Stock Options Strategy Guide - Long Put Description Steps to buying a Put 1. Buy the put Remember that for option contracts in the US, one contract is 100 puts. So when you see a price of $1.00 for a put, you will have to pay $100 for one contract. For option contracts in the UK, one contract is for 1,000 shares, so if the option price is $1.00 you will pay $1,000 for one contract. For S&P Futures options, one contract is for 250 futures, so if the option price is $1.00, you will pay $250 for one contract. Steps In Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV) Try to ensure that the trend is downward and identify a clear area of resistance Use the Analyzer to verify current market data and calculations Steps Out Manage your position according to the rules defined in your Trading Plan Do not keep the position into the final month before expiration If the stock rises above your stop loss, then exit by selling the puts. Your Outlook Bearish - you are expecting a fall in the stock price Rationale To make a better return than if you had simply sold short the stock itself. Do ensure that you give yourself enough time to be right; this means you should go AT LEAST 6 months out, if not 1 or 2 year LEAPs. If you think these are expensive, then simply divide the price by the number of months left to expiration, and then compare that to shorter term put prices. You will see that LEAPs and longer term options are far better value per month and they give you more time to be right, thus improving your chances of success. Another method is to buy only deep ITM options. 42 Net Position This is a net debit trade because you are paying for the put option Your maximum risk is limited to the price you pay for the option Your maximum reward is unlimited until the stock falls to zero, whereupon your maximum reward is the strike price less the premium you paid for the put. Effect of Time Decay Time works against your bought option. So give yourself enough time to be right. Don't be fooled by the false economy that buying shorter dated options are cheaper. Compare a one month option to a 12 month option and divide the longer option price by 12. You will see that you are paying far less per month for the 12 month option. Give yourself time to be right; at least 3 months, preferably longer.. Appropriate Time Period to Trade 6 months minimum 12 months is better 24 months is the safest Selecting the Stock Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV) Try to ensure that the trend is downward and identify a clear area of resistance Use the Analyzer to verify current market data and calculations Selecting the Option Choose options with adequate liquidity, open interest should be at least 100, preferably 500 Strike: look for look for either the ATM or ITM (higher) strike above the current stock price Expiration: give yourself enough time to be right; remember that time decay accelerates exponentially in the last month before expiration, so give yourself a minimum of 3 months to be right, knowing you'll never hold into the last month. That gives you at least 2 months to be right. Maximum Risk Maximum Reward Breakeven Limited to the amount you pay for the put option (premium) Unlimited up to the strike price less the amount you paid for the put. Before expiration this could actually be more because of Time Value. The put exercise (strike) price less the premium you paid for it 43 The Greeks Expiration Today - 6 months Time(t) - 1 month Theta Theta is negative, illustrating that Time Decay is harmful to the position. Notice how Theta Decay is at its most harmful when the position is ATM. Delta Vega Delta (speed) is negative and falls as the asset price falls below the strike price. Notice how Delta is zero when the position is deep OTM, accelerates inversely exponentially when the position is ATM, and stabilises to minus one (per contract) when the position is deep ITM. Gamma Vega is positive, illustrating that volatility is helpful to the position. Notice how volatility is at its most helpful when the position is ATM. Rho Gamma (acceleration) is always positive with a Long Put and peaks when the position is ATM. Notice how Gamma approaches zero when the position is deep ITM or OTM. Rho is negative, illustrating that higher interest rates would be harmful to the position. Exiting the Position Sell the options you bought Mitigating a loss Use the underlying asset or stock to determine where your stop loss should be placed. Advantages Profit from declining stock prices Leverage of returns Flexibility of strikes and expirations Capped downside Disadvantages Potential 100% loss if badly chosen strike and expiration. Give yourself enough time to be right and do not buy OTM. High leverage can be dangerous if the stock rises 44