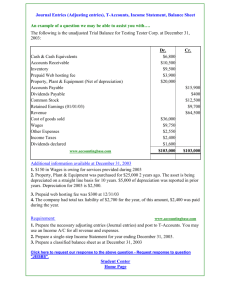

ch 9 adjusting entries and depreciation summary

advertisement

Chapter 9 - Adjusting Entries Summary Page Section 9.1 - Adjusting for supplies Office supplies are both an asset and an expense. Accordingly, the value of supplies that are physically used up over the course of the fiscal period must be allocated to an expense account at the end of each period. Don’t forget that a business purchases an asset but uses up or consumes an expense. As you know, the accounting entry for the initial (or additional) purchase of office supplies is as follows: 18 - Supplies (asset) - dr -100 ---------- Bank / A/P - cr - 100 Purchased supplies Now let’s assume that a business had $100 of supplies on hand at the start of the period, purchased an additional $50 of supplies over the course of the period, while a year-end physical inventory count determined $70 of supplies on hand as of the last day of the period. The adjusting entry is as follows: 31 - Supplies Expense - dr - 80 ---------- Supplies - cr - 80 Adjusting entry for supplies Adjusting for prepaid expenses Let’s assume that a business with a fiscal year-end of December 31 purchases a fully prepaid 12-month property insurance policy for $1200 on September 1. The initial purchase of the insurance policy on September 1 (an asset) appears as follows: 1 - Prepaid Insurance - dr - 1200 ---------- Bank/AP - cr - 1200 Purchased insurance A simple calculation reveals that the business has used up 4/12 (September 1 - December 31) or $400 of the $1200 insurance policy as of the last day of the fiscal period. Accordingly, the adjusting entry prepared on the last day of the period, indicating the amount of insurance that has expired during the period is as follows: 31 - Insurance Expense - dr - 400 ---------- Prepaid Insurance - cr - 400 Adjusting entry for insurance The same calculations and entries would be used for the initial purchase and year-end adjustment of rent (Prepaid Rent and Rent Expense) and licenses (Prepaid Licenses and License Expense). Adjusting for late-arriving purchase invoices Let’s assume that two purchase invoices (bills) arrive on January 3 representing advertising services and hydro usage incurred in the month of December for a business with a fiscal year end of December 31. The adjusting entry, backdated and recorded as of December 31, is as follows: 31 - Advertising Expense - dr - 400 Hydro Expense - dr - 200 ---------- Accounts Payable - cr - 600 Adjusting entry for late-arriving purchase invoices Section 9.5 - Adjusting for depreciation of fixed assets While not as obvious as the previous scenarios involving supplies and prepaid expenses, the year-end calculation of depreciation on certain fixed assets is also properly classified as an adjusting entry. Straight-line Method of Depreciation The straight-line method of depreciation is the easiest method for calculating the loss in value of depreciable assets over time. Using this method, the depreciation expense is identical from year to year (p. 346). The formula is as follows: annual depreciation expense using straight-line method = cost of asset - estimated residual value of asset estimated useful life of asset (in years) The cost of an asset is the original purchase price paid by the business for that asset. The estimated residual value of an asset is the predicted scrap (parts) or resale value of that asset once it is no longer operational at the end of its life. The estimated useful life of an asset is the predicted life of that asset (in years) before it is expected to break down and lose all functionality. Part-year depreciation Please note that under the straight-line method, depreciation of assets purchased midway through the fiscal period should be prorated (adjusted for time) in both year one and the final year of the asset’s life in order to take into account the precise loss in value and purchase date of the asset. Example of straight-line depreciation with part-year depreciation Let’s assume that an automobile is purchased on October 1 for $24,000 with an estimated residual value of $4000 and an estimated useful life of 10 years. The business uses a fiscal year end of December 31. Annual depreciation expense for the asset would normally be $2000 (24,000 - 4,000 / 10). The adjusting entry in year one, taking into account the precise date of purchase of the asset (part-year depreciation - see above), is as follows: 31 - Depreciation Expense - Automobile - dr - 500 (3/12 of $2,000) ---------- Accumulated Depreciation - Automobile - cr - 500 Adjusting entry for depreciation The adjusting entry in year two is as follows: 31 - Depreciation Expense - Automobile - dr - 2000 ---------- Accumulated Depreciation - Automobile - cr - 2000 Adjusting entry for depreciation Declining-balance Method of Depreciation For income tax purposes, the Canada Revenue Agency (CRA) prefers a somewhat more complicated method of calculating annual depreciation expense. This method is known as the declining-balance method of depreciation and results in declining annual depreciation expense figures for all depreciable assets. In other words, annual depreciation expense will be lower and lower from year to year under this method. The formula is as follows: annual depreciation expense using declining-balance method = net book value of asset x fixed rate of depreciation The net book value (NBV) of an asset represents the current or up-to-date or remaining or undepreciated value of the asset. Net book value can easily be calculated by subtracting the accumulated depreciation from the original purchase price. Net book value can also be calculated by subtracting the previous year's annual depreciation expense from the previous year's updated net book value. The fixed rate of depreciation to be employed under this method refers to the specific rate (percentage) of capital cost allowance or CCA (depreciation) established by the Canada Revenue Agency for each available class of fixed asset (p. 345). The 50% Rule You should also be aware that the CRA allows the use of something called the “50% Rule” under the declining-balance method for asset purchases carried out midway through the fiscal period (p. 347). This rule requires year one depreciation to be prorated by 50%, regardless of the actual date of purchase, so as to take into account the approximate loss of value of the asset in its first year of use. Sections 9.2 & 9.5 - Adjusting entries and the work sheet Don’t forget that all of the above adjusting entries must first be recorded on the work sheet (p. 317 & p. 342) and not in the general journal as one would expect. Summary of adjusting entries All adjusting entries (* other than late arriving purchase invoices) possess the following characteristics: 1. Each item involved is both an asset and an expense. 2. You buy the asset, you use up the expense. 3. In the adjusting entry you debit the expense, you credit the asset. 4. The amount used up over the course of the period is included in the adjusting entry. 5. Adjusting entries are always recorded as of the last day of the period. (*)