Número 10 - Pontificia Universidad Javeriana

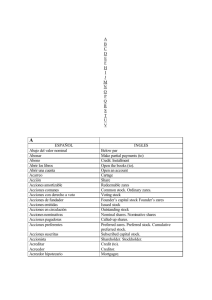

advertisement